It’s the end of the Age of Reagan, but it’s much more than that

“If the formula doesn’t work, you change the formula.” — Arin Hanson

“The era of ‘big government is over’ is over.” — James Medlock

I know this post has a very Vox-like title, but in fact I’m not going to go through Biden’s new infrastructure plan point by point and tell you what’s in it. if you want that, you can check out the actual Vox explainer, or the always-excellent writeup by the WaPo’s Jeff Stein et al. You can also check out Brad DeLong’s thoughts and David Roberts’ deep dive into the climate aspects. I’m sure there will be more in the days to come, and I’ll have plenty of thoughts on the specific provisions as well.

What I want to do in this post, however, is try to figure out what it all means. By now I think everyone has realized that something is changing in American economic policy. The tenor, pace, and scope of Biden’s economic programs proposals, and the muted nature of the ideological opposition, suggest that we’ve entered a new policy paradigm — much as when FDR took office in 1933 or Ronald Reagan in 1981. Every President comes in with a laundry list of initiatives, but once every few decades a President comes in with a new philosophy for what policy should look like. And that is happening now. The fact that a $1.9 trillion COVID relief bill was passed with relatively little fuss, and was really just the warm-up to an even bigger infrastructure bill, and that other “big” policies like student debt cancellation are being pursued on the side as an afterthought, should make it clear that Biden is blitzing.

But what’s the unifying philosophy here? What is Bidenomics? I have some thoughts. First, we need to talk a bit about why the old paradigm wasn’t working.

Why we needed a new paradigm

The last economic policy paradigm, bequeathed to us by Ronald Reagan (and Paul Volcker), was based around tax cuts, deregulation, welfare cuts, and tight monetary policy. These were intended as remedies for the two main economic problems of the 1970s — slow growth and inflation, together known as “stagflation”. The idea that tax cuts boost growth comes from basic economic theory; in almost any model, taxes distort the economy (except for things like carbon taxes), so if you cut taxes it should make the economy more efficient, thus increasing growth at least temporarily. The idea that deregulation boosts growth was more of an article of faith — since “regulation” means a ton of different things, there’s no economic model that can capture it in a general sense (actually deregulation really started under Carter, who arguably did more than Reagan). Welfare cuts were partly based on economic theory — means-tested welfare programs are a form of implicit taxation, which theoretically discourages people from working — and part dogma about a “culture of dependence”. As for tight monetary policy — or more accurately, an anti-inflationary bias at the Fed — that was obviously just a response to inflation.

We can argue back and forth about whether the Reagan paradigm ever boosted growth; in fact, I don’t know the answer. The late 80s and 90s were good years for American incomes and the 90s and early 00s were good years for productivity. How much tax cuts and deregulation had to do with that is up for debate, and how much the country benefitted from reduced inflation is also arguable.

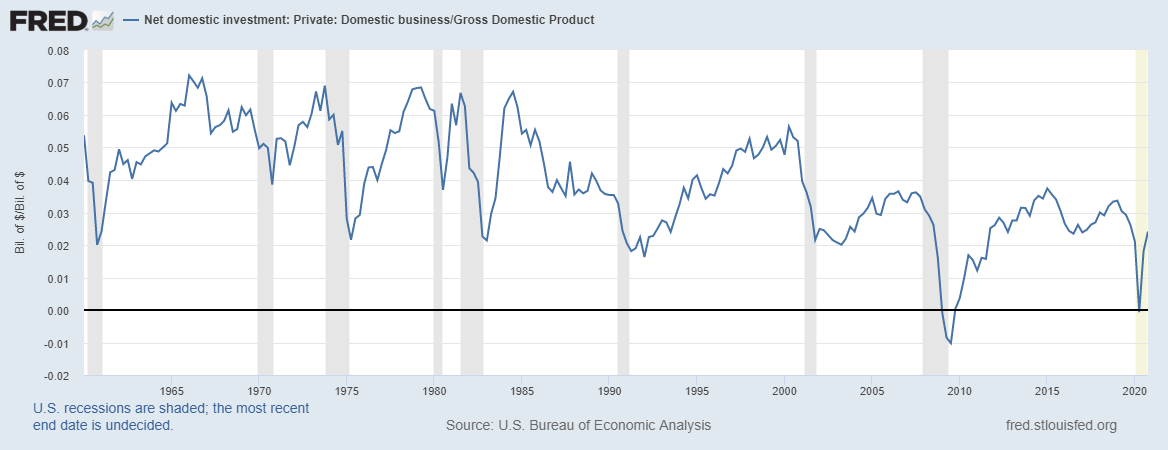

But it’s clear that by the 2000s and 2010s, the Reaganite paradigm wasn’t doing what it was supposed to do. Bush cut taxes for investors, but as Danny Yagan — who is not working in the Biden administration — showed, this didn’t boost business investment at all. In fact, tax cuts in general failed to stem the overall drop in private business investment during 1980-2020:

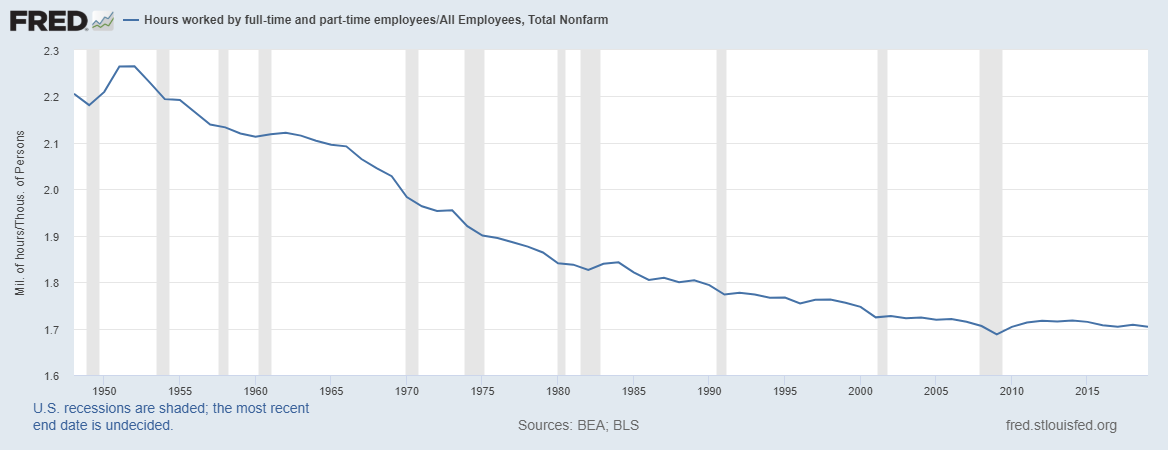

And if income tax cuts made people work more, it certainly isn’t apparent in the aggregate data:

As for productivity, by 2005 the computer boom was over and we were back to slow growth. That came coupled with weak competitiveness, as industrial activity fled to China.

The one really enduring economic success of the Reagan age was that inflation stayed low, but there’s a good argument to be made that in the aftermath of the Great Recession it was too low; if the Fed had allowed inflation to rise more, it might have helped speed the recovery of the 2010s (not just through macroeconomic effects, but by hastening deleveraging).

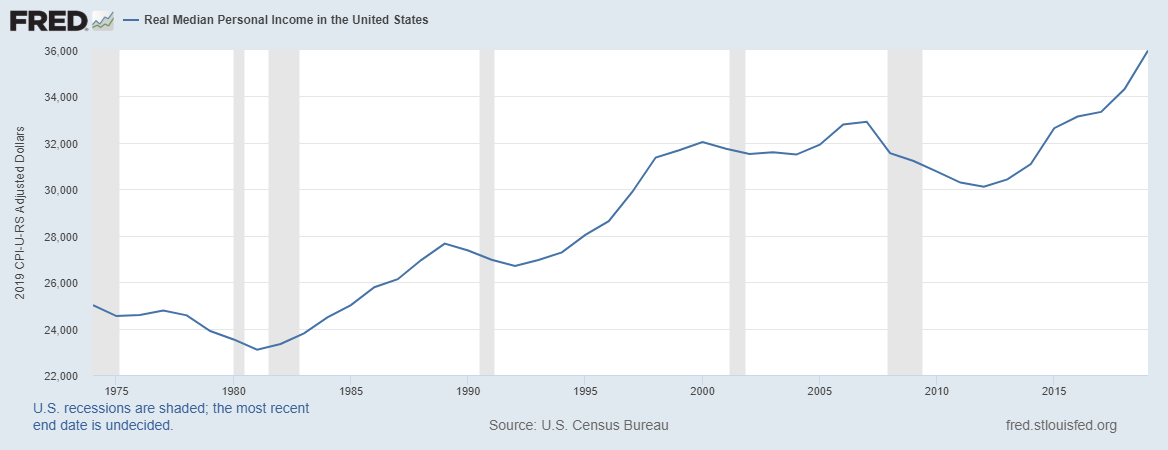

So growth slowed and investment slowed; the Reagan program wasn’t fixing those problems. Meanwhile inequality soared during the years after 1980. Slowing growth and soaring inequality combined to produce a stagnation in median incomes after 2000.

There was an encouraging rise in the late 2010s, but not enough to shake the perception that progress for the average American had stalled. Americans were no longer doing better than their parents. Meanwhile, increased risk from the country’s broken health care system, a rise in evictions, the unemployment and house price declines of the Great Recession, and the vicissitudes of 401(k) programs meant that true standards of living performed even worse than the above graph suggests.

Thus it was clear that the Reagan policy program of tax cuts, deregulation, and welfare cuts wasn’t working. So we needed to come up with a new paradigm. We should have come up with one in the Great Recession, but we didn’t. Instead, it took COVID and the insanity of the Trump administration to push us over the edge and make us realize big changes were needed.

Well, we finally woke up, and here we are. The big changes are Bidenomics.

Cash benefits, care jobs, and investment

The Biden program is multifaceted — it includes things like support for unions, environmental protection, student debt cancellation, immigration, and a bunch of other stuff. But it would be wrong to characterize his program as merely a grab bag of long-time Democratic policy priorities. Three approaches stand out above the maelstrom:

- Cash benefits

- Care jobs

- Investment

Cash benefits were at the center of the COVID relief bill that already passed. In addition to the standard COVID relief items (quasi-universal $1400 checks, special unemployment benefits, housing and medical assistance, etc.) there was a very big program that is officially temporary but which will probably be made permanent: A child allowance. It’s very big in size — $3000 to $3600 per child. There’s no time limit and no work requirement. It’s basically a pilot universal basic income program for families.

The second pillar of Bidenomics is care jobs. The new “infrastructure” bill includes tens of billions of dollars a year for long-term in-home care for disabled and elderly people. Biden has made it explicit since early on that he intends to make caregiving jobs a pillar of his strategy for mass employment.

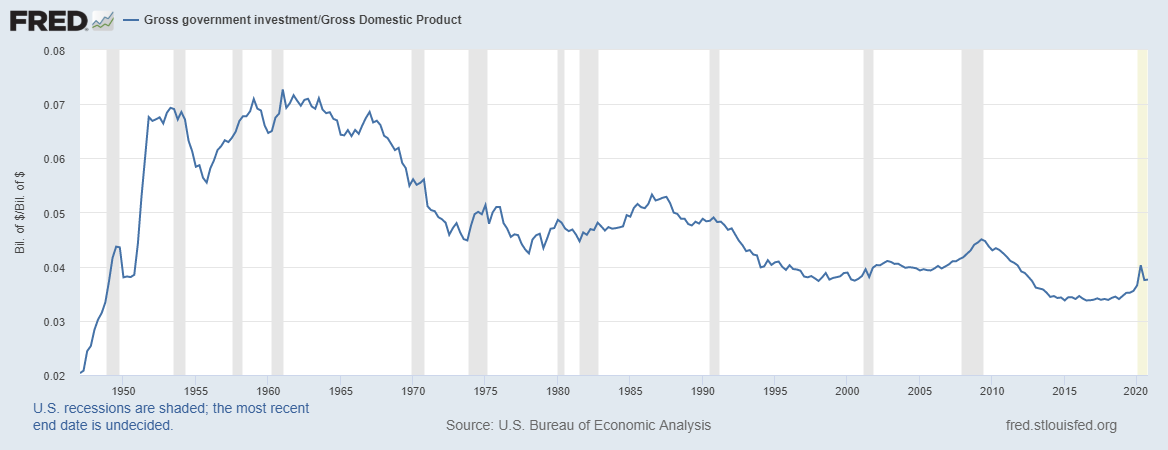

The third pillar of Bidenomics is investment — government investment, and measures to encourage private investment. The former includes tens of billions a year in new research spending, massive construction of new green energy infrastructure like electrical grids and charging stations, retrofits of existing infrastructure (e.g. lead removal from pipes), and repair of existing infrastructure like roads and bridges. This will help restore government investment as a fraction of GDP, which has been drifting downward for decades:

In other words, if private businesses aren’t investing enough, have government plug the hole. But in fact it’s not just about plugging the hole, since things like a modernized electrical grid, a network of charging stations, and lead removal are not things the private sector is likely to do (or do enough of) on its own.

But the administration isn’t relying entirely on direct government action to lift investment — not by a long shot. First of all, infrastructure is a complement to private investment; repair roads, and private businesses will buy vehicles to take advantage of those roads. Government research is also complementary to private investment — there’s a clear pipeline from government-funded labs to privately-funded product innovation and the investment that goes with it. And finally, Biden’s clean electricity standard for the power sector, which will force all U.S. electricity to be carbon-free by 2035, will require huge private investment — in solar, wind, storage, hydro, and nuclear.

Note how little of this investment program relies on indirect investment incentives like capital gains tax cuts or depreciation allowances. Bidenomics doesn’t just turn the knobs and hope that useful investment comes out — it actively directs investment into particular sectors (green energy) and particular activities (science).

Together, these three things — cash benefits, care jobs, and investment — are the pillars of the new approach that’s going to replace Reaganomics. It’s not a direct one-for-one substitute, any more than Reaganomics was a direct repudiation of the New Deal. Instead, while there are some reversals, much of it is orthogonal to the old paradigm, because it’s focused on addressing the problems of today.

Bidenomics: Creating a two-track economy

Before I go on to discuss the justification for this new paradigm, I’d like to sum up all these “pillars” into one more-or-less cohesive vision of where I think Bidenomics is taking us. I think it’s aiming to create a two-track economy — a dynamic, internationally competitive innovation sector, and a domestically focused engine of mass employment and distributed prosperity.

I basically get this notion from Japan. In the 1970s and 1980s, Japan cultivated a world-beating export sector, based around all the companies you’ve heard of (Toyota, Panasonic, etc.). But this was only perhaps 20% of its economy, and the rest was a domestic-focused sector. Although some domestic-focused industries were highly productive (health care!), much of the domestic-focused sector — retail, finance, agriculture, utilities, and a few non-competitive manufacturing industries — was not very productive compared to the U.S. But those sectors did manage to employ a huge number of people; Japan has traditionally had very low unemployment, and that has not changed with the mass entry of women into the workforce since 2012. Japan in many ways built the most effective corporate welfare state in the world.

Biden and his people, I’m sure, do not want the domestic-focused sectors of the economy to be unproductive. But they want those sectors to do the heavy lifting in terms of giving most Americans a job, as they did in Japan. Those domestic sectors include the care economy, where Biden’s team believes much of future employment will come from.

This is partly a story about technology — automation, the end of mass manufacturing employment, etc. With even retail jobs commonly believed to be at risk from new technologies, many people look to care work as the last thing we know we want humans to do. But it’s also a story about globalization, and the shift of global economic activity from the U.S. to Asia. With Asia becoming the workshop of the world, the U.S., with its low population density and relatively remote location, has been forced to become something else — the world’s research park.

The U.S. still has the world’s best research universities, and an enormous concentration of talent from around the world. If we can sustain both those things, we’re well-positioned to continue to be the world’s idea factory; innovation is our comparative advantage. And as long as we do that, we will maintain highly competitive knowledge industries whose specialty is continuous innovation that’s downstream from government science — software, high-tech manufacturing, and pharma/biotech. That’s an assembly line even China may never be able to match.

But while this sector will generate a lot of productivity and a lot of export revenue, it is not going to employ most Americans. Instead, most Americans will work in less competitive, domestically focused sectors — selling houses to each other, pulling each other’s wisdom teeth, preparing each other’s food, bagging each other’s groceries, taking care of each other in their old age. That vast domestic sector will distribute the income generated by the highly competitive knowledge sectors (in fact, this is exactly how an agglomeration model of the economy works, as you can read in Paul Krugman’s book with Masahisa Fujita and Anthony Venables).

And that distribution of income via domestic industries is supplemented by active government redistribution of income — taking a bit of money from the Elon Musks of the world and using it to make sure the mass of people have a claim to food and houses and schools and medical care.

So I think Bidenomics, with its dual focus on research/investment/immigration and care jobs + cash benefits, is an attempt to boost both sectors of the economy at once — to make the export sector more productive while making the domestic sector better at spreading the wealth around. If there’s one unified characterization of the vision Bidenomics is creating for our future, I think that’s it.

Bidenomics and economics research

As with Reaganomics, Bidenomics is based on multiple sources of inspiration — economics research, political imperatives, gut instinct, wishful thinking, and so on. I’ll talk here about the economics part, since that’s the part I know the most about.

The idea that the U.S. needs more research spending probably comes from the work of Paul Romer. Romer was a pioneer of endogenous growth models, which said that the generation of new ideas is key to growth (he won a Nobel for this in 2018). That theory implies that if you spend more on research you get faster growth, and Romer has been vocal in promoting this idea. Also important is the recent research of Bloom et al. and especially of Charles Jones; these researchers suggest that we need to pour more resources into science to keep innovation going. John Van Reenen has done a lot of important work in this area as well; see his call for “innovation policy to restore American prosperity”. See also the work of Daniel Gross and Bhaven Sampat, as well as that of Jonathan Gruber and Simon Johnson, who show how the “spend more money on research” approach worked for us before.

The idea of cash benefits — without work requirements or time cutoffs — owes much to the work of Hilary Hoynes, who keeps a low profile but is incredibly influential. The child allowance is directly from a 2018 paper by Hoynes and Diane Schanzenbach. Heather Boushey, who works in the Biden administration, has been deeply influenced by this literature. Meanwhile, an increasing amount of empirical research is showing that unconditional benefits usually don’t stop people from working. See the famous paper on the Alaska Permanent Fund payouts, by Damon Jones and Ioana Marinescu. And see Marinescu’s 2018 literature review on unconditional benefits, showing that they don’t have much of a deleterious effect on work output, if any. That research basically debunks the “culture of dependency” argument, at least as far as unconditional cash benefits are concerned. Then see Henrik Kleven’s research on the EITC, showing that it was probably the cash benefit aspect, rather than the work incentive, that accomplished most of that program’s much-lauded poverty reduction.

As for Biden’s environmental focus, much of it comes from research outside the field of economics, but Martin Weitzman’s research on the risks of climate change deserves a mention.

This is an impressive body of research. It doesn’t constitute a slam-dunk case — nothing ever will — but it’s a heck of a lot better than a graph on a cocktail napkin.

Bold, persistent experimentation

There are some elements of the Biden plan I didn’t mention, because numerically they’re not very big. One of these is the industrial policy part of the infrastructure bill, which would create a new office in the Commerce department that would actively try to relocate certain industries and their supply chains in the U.S. This aspect of the bill is certain to cause the greatest howls of rage from various people who have decided that industrial policy is bad bad scary-bad.

There is little solid reason to believe that industrial policy is bad bad scary-bad. The case against it has always been far more based in dogma than in evidence; like regulation, industrial policies are so multifarious and complex that it’s not really possible to conclude that it “works” or “doesn’t work”. There is some research suggesting that it’s important — Ricardo Hausmann’s work on economic complexity, various research by Dani Rodrik, a few exploratory papers by the IMF, scattered studies on export subsidies, and so on. This literature is nowhere near conclusive; it doesn’t even agree on what constitutes industrial policy.

But that’s how policy actually works, in real life. There are things that experts think won’t work, based on theoretical grounds; until some bold policy entrepreneur or wild-eyed nutcase actually goes and tries these things, we won’t really know if they work or not.

A great example is the minimum wage. Back in the 1970s, economists almost all believed that minimum wages hurt employment a lot. But they had been getting too high on their own textbook models — when the evidence started rolling in, it turned out that minimum wage was a lot less harmful to employment than Econ 101 had suggested. That prompted people to dust off old theories like monopsony power to explain the newly realized facts. The pipeline here was 1) policy entrepreneurship —> 2) empirical studies —> better theory. Not the other way around.

I expect Bidenomics to contain a lot of stuff like that. Union policy. Subsidies for care jobs. Various new types of infrastructure. Industrial policies. Competitiveness policies vis-a-vis China. And so on. The three basic pillars I described above are the starting point, but they won’t be the whole thing.

That’s going to make a lot of people at the Cato Institute and the Heritage Foundation and the Manhattan Institute and other think tanks that still believe in the old Reagan orthodoxy pull their hair out. It’s going to ruffle the feathers of some economists who still think theory comes first. It’s going to worry older Democratic policy advisors who came up during the Age of Reagan and who still instinctively believe in technocratic knob-turning rather than in directly mucking about in the bowels of the economy.

And that’s OK. It’s good to have a “loyal opposition” that watches and critiques the new paradigm. Sometimes that opposition will be right; like every policy paradigm before it, Bidenomics is going to make some mistakes. That is the price of progress.

The key will be making sure the mistakes don’t get too big.

How Bidenomics could go wrong

Obviously I’m pretty excited about Bidenomics — I don’t agree with everything Biden is doing, but overall this has the general contours of the change I’ve long thought needed to happen. Still, there are some ways the program could fail, and I think it’s important to keep an eye on these as we push ahead. The main ones I can think of are:

1) Debt constraints. Biden has shown a much greater willingness than previous Democratic Presidents to borrow and spend, and the exigencies of COVID caused a big bump in government debt. Some people (mostly online meme warriors) believe there’s no constraint on government borrowing, and others believe there are constraints but we’re nowhere near them. I tend to think it’s not much of a problem right now, but I also recognize that the effects of government debt are not well-understood. If bond investors get nervous and long-term interest rates spike, the Fed will have to decide whether to push those rates down. If it does (perhaps concerned that failing to do so would cause government interest costs to spiral out of control), the result could be accelerating inflation. Or not. I don’t know, since I don’t understand the relationship between monetary policy, fiscal policy, and inflation, and I don’t think anyone yet does. But it bears keeping an eye on.

2) Ruinous costs. The U.S. has an excess cost problem in two big industries — health care (plus child care), and construction. Care work and construction are exactly the two biggest sectors that Biden wants to pump money into. Remember how when we poured all that money into California’s high-speed rail program and it became a giant boondoggle and lots of it got wasted and we didn’t actually get high-speed rail? If that happens with Biden’s new electrical grid etc., we’re in trouble. And if pumping money into long-term care just makes the cost spiral out of control, it will waste labor and add to our overall health cost problem. Either of those outcomes would depress productivity and growth, leaving a smaller pie to be distributed to the nation’s masses. Thus, in order to make sure we actually get bang for our buck, Biden and his team should focus on identifying and mitigating the sources of excess costs in construction and care, rather than just assuming that throwing more money at these things is enough.

There are other dangers, such as higher consumer prices from some of Biden’s less-well-thought-out industrial policies, but I think they’re really second-order compared to these big two. Of the two, I’m much more worried about the second one; excess costs are the big millstone around the neck of the U.S. economy, a looming problem that so far I haven’t seen either Biden or his Republican opposition talk or think much about.

But anyway, I don’t want to end on a negative note. Always remember that America needed a new paradigm. Our old one wasn’t working, and economic research and basic data analysis both suggested clear directions for change. There will be missteps and mistakes on the way to change. Many people will resist the changes, some for better reasons than others. But when it comes time to turn the ship, you must turn the ship, and that is what Biden is doing. Let’s see where it goes.