Online banks are more technologically advanced, have less operating cost and hence are able to offer better deals to both borrowers and lenders

as WSJ writes “Many large banks have barely increased payouts to depositors since the Fed started raising rates in 2015. Standard savings accounts at Bank of America , for instance, yield 0.03% a year—and carry $8 monthly fees for deposits that fall under $500.

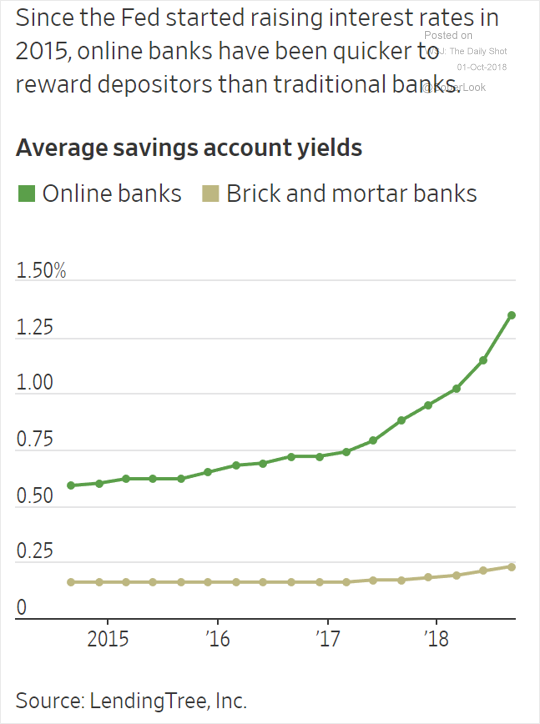

But more online banks offer better returns as they seek to build up lending businesses. Savings accounts at these banks pay an average of 1.35% per year, nearly six times the average of bricks-and-mortar banks, according to LendingTree.

Britain’s Revolut an online bank, has amassed nearly two million customers and was recently valued at $1.7 billion during its third round of funding thus making it the first ever digital-only bank to attain unicorn status. That’s nearly half as many accounts as those held by the country’s much bigger TSB Bank Plc.It is also the only British digital bank to operate across Europe so far. Strong growth in countries like France, Germany and Switzerland and the Nordic region helped drive its user base up by 50 percent in the last two months. Expansion plans are also underway in India, Brazil, South Africa and the UAE.

It is matter of time that we will see these online banks offering better value proposition in India also like DBS digibank which is offering 7% on saving bank but with limited banking options.

Hi Ritesh, maybe true for other industries but banking has a lot of risk- Knowing the customer is critical to assessing loan risks. knowing their sources of income, daily spending helps them to cross-sell financial products and, most importantly, to minimize bad debts.

Bad debts are the biggest variable cost in banking across the cycle and this helps to explain why disruption in financial services works differently to other industries. As a result, risk managers and regulators put the brakes on, giving the incumbent banks more time to respond. read this article https://www.platinum.com.au/Insights-Tools/The-Journal/Why-Fintechs-Find-Gobbling-up-Banks-Customers-Har

Thanks will have a look. I will give you my example. I have an account with X bank in Canada and they would be charging me for maintaining an account with them on the other hand there is an online bank which is not only going to not charge but also give me interest on balances. as of now I am splitting my money between these two accounts because frankly why do people with a little bit of tech knowledge need to go to a branch?