Adam writes….Where the OIL Sell-Off Has Left Us?

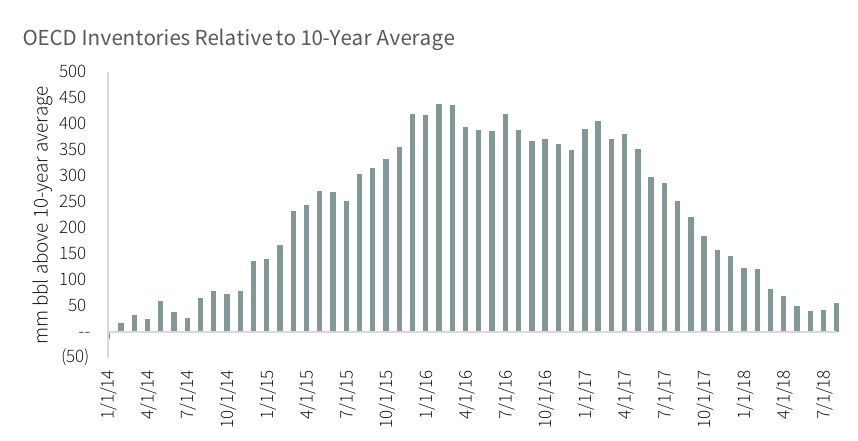

For those willing to do the work, we believe this sell-off has presented inventors with extreme value. After Tuesday’s 7% decline, WTI futures are now the most over-sold ever (14-day RSI) according to Capital One. Oil volatility meanwhile has picked up to levels not seen since the 2016 lows, according to Jeff DeGraff of Renaissance Macro.

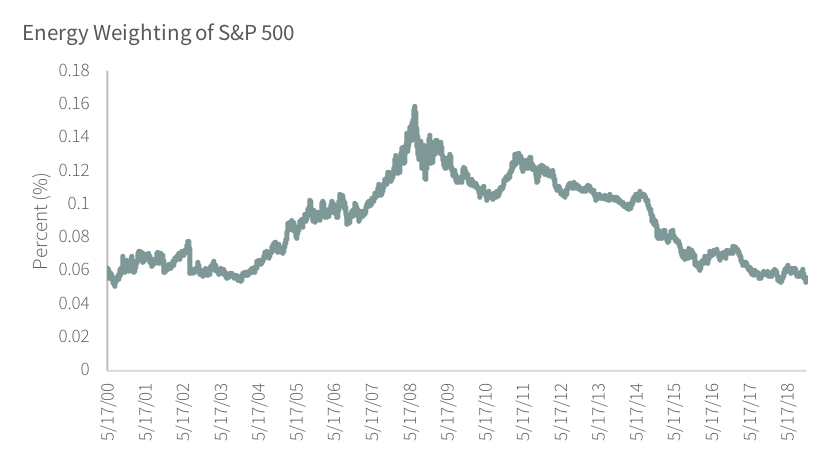

The equities also appear to be under massive liquidation. Many names we look at are approaching their lows made in 2016, despite the fact that oil prices have more than doubled. The energy weighting in the S&P 500 is now 5.3% — the lowest reading in eighteen years. This measure has been an excellent predictor of future energy-related equity performance and we would expect the same this time as well.

The sell-off has been indiscriminate and feels to us like a capitulation bottom. There have been reports that a large hedge-fund is unwinding its long-crude short-natural gas trade and that this has only exaggerated the move lower. Energy-related investments today represent the best value we have seen in over twenty years. Despite the steady improvement in fundamentals and oil prices, the relative valuation of energy stocks vs. the S&P 500 is now at an all-time low. The recent events in OPEC (perhaps exaggerated by fund liquidation as mentioned above) have all come together to create nearly unprecedented value. We have often said that we are contrarian investors that like to get involved in markets where investor sentiment is negative and yet fundamentals have turned positive. After the recent sell off, the energy related markets today offer the best value we have seen in nearly twenty years (if not ever).http://blog.gorozen.com/blog/interim-special-report-on-the-oil-sell-off?utm_campaign=Weekly%20Blog%20Notification&utm_source=hs_email&utm_medium=email&utm_content=67543970&_hsenc=p2ANqtz-8laxMLWy2upTbJdN-HXZEuyfL29FR0jrTUS5yXWfejxq3FeazYLh2V0zenZFGD2CYZo1ZkSMa3L4PqcUUePr4lXL1sWg&_hsmi=67543970