FT writes “As India’s state-controlled banks were sucked into a crisis of non-performing corporate debt over the past four years, following a glut of lending to ill-fated projects in infrastructure and industry, an opportunity appeared for non-banking financial companies, or NBFCs. Thousands of shadow banks, which face broadly less rigorous regulation than formal banks, rapidly took market share, ramping up loans to customers from scooter buyers to construction companies”

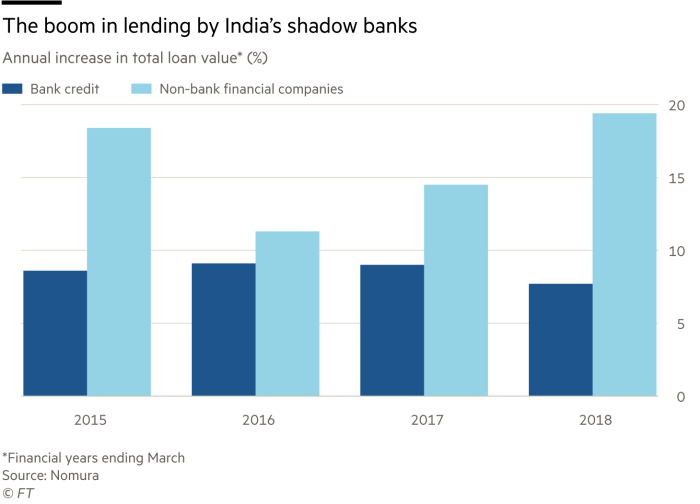

The chart below shows the extent of credit creation by shadow banks at the expense of commercial banking system

By the end of March 2018, the sector’s aggregate balance sheet had reached Rs22tn ($309bn), according to the latest figures available from the RBI.

But as always happens in an upward sloping yield curve, the long term assets of Housing Finance companies were increasingly getting financed by short term commercial paper . This was funded by Mutual funds who needed an outlet to deploy the unprecedented inflows due to demonetization. So it was the match made in heaven till ILFS collapsed and this funding was suddenly at the risk of rollover from now edgy mutual funds with some of them burnt badly with credit losses and bad press.

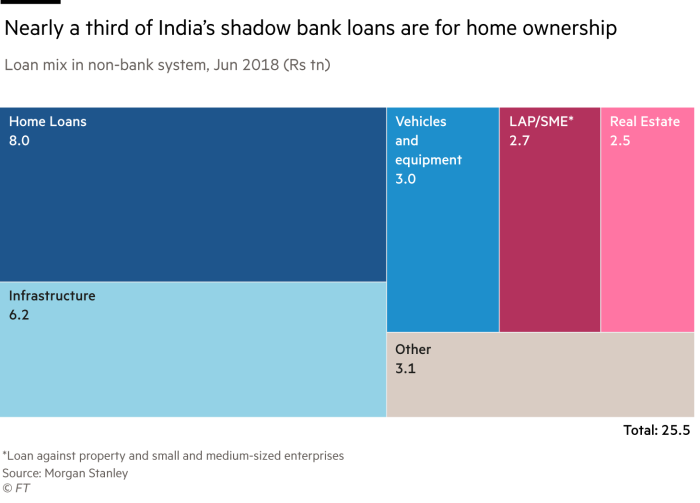

This is when spat between govt and RBI came out in open with govt wanting RBI to bail out the shadow banking system . The uneasy truce between central bank and govt (which is keen to have a higher credit/GDP growth in election year) has led to fragile calm in debt markets. But the final word goes to Morgan Stanley which notes Shadow banking loans to property developers, and similar assets, are worth about Rs4.6tn, ( USD 60 billion) with some estimates of inventory in following link https://www.livemint.com/Companies/j7PAiwiugpdE3MGlk0hHpL/Mumbais-new-luxury-flats-face-harsh-realty.html . It is easy and probably patriotic to bail out SME and MSME businesses whose funding from NBFC’s got cutoff in wake of ILFS fiasco.With developers facing a sales slowdown, there are fears that defaults from this sector ( which can only be bailed out by reducing the value of currency via higher inflation) could create new set of headaches for central bank and hit the credit boom responsible for India’s GDP in last 3 years.

Investors and people are being deluded by visions of great riches by the fund managers and thus made to part with their money; yet for the next few years this and other known problems shall continue to blow up like mines in a field. Any story that starts has its own life cycle. So at least for the next couple of years, three or four, expect deflation and defaults!