Making sense out of Chaos

The most important question in the world right now is whether the 40-year trend of disinflation is ending. Is inflation coming?

Are you ready?

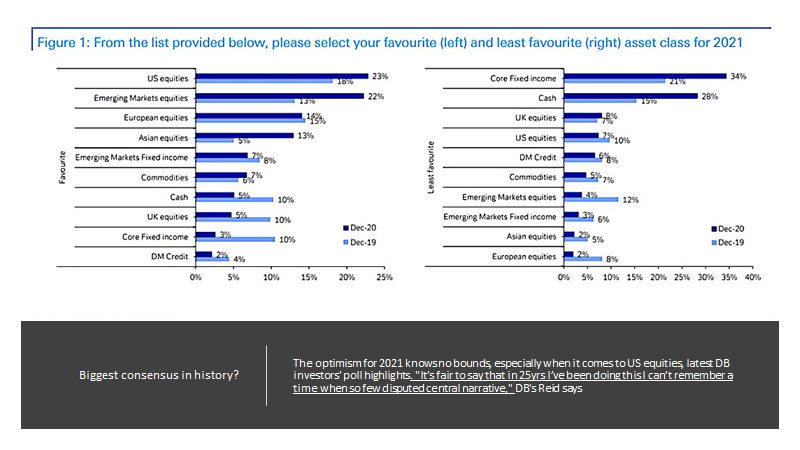

In this REALVISION interview, Kiril Sokoloff, Chairman and Founder of 13D Global Strategy & Research, talks with Mike Wilson, CIO, and Chief U.S. Equity Strategist of Morgan Stanley. He also chairs Morgan Stanley’s asset allocation committee of $3.5 trillion in assets. Wilson has had the hottest hand on Wall Street these past three years and nailed the bottom of the March lows to the very day. He believes a whole new investment paradigm has begun. The winners of the past decade of outperformance will fade and many new winners will dominate and outperform for the next several years.

why is inflation baked into our future?

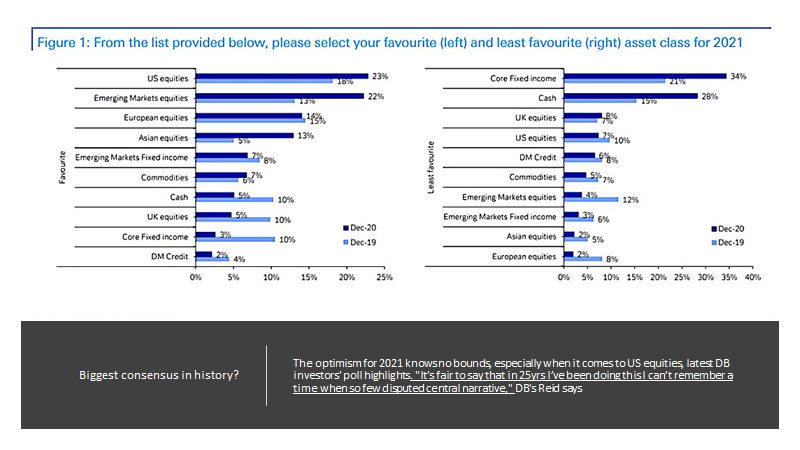

Markets always climb a wall of worry

Focus to shift from Capital to Labor

Technology outperformance getting over?

How is a $3.2 Trillion asset manager doing asset allocation?

Which countries look attractive?

Investing more art than science

https://www.home.saxo/content/articles/macro/chart-of-the-week-china-credit-impulse-08122020

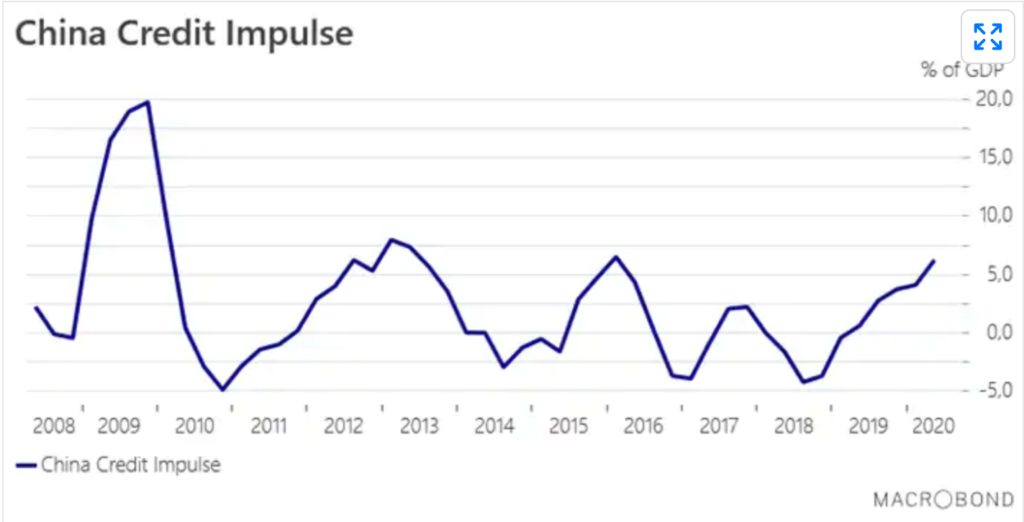

Here and there, we hear that the market is too optimistic about the recovery and that next year many challenges, from vaccine delivery to wave of bankruptcies, remain that could seriously jeopardize the exit from the pandemic era. At Saxo, we don’t think we are wearing red-colored glasses when we say that the year 2021 should be marked by a strong global recovery driven by central bank liquidity and positive growth impulse from China. The below chart represents the evolution of China credit impulse which is basically the change in the growth rate of aggregate credit as a percentage of gross domestic product. This is certainly one of the most important indicators for investors looking to know where the global economy is heading into next year. It is worth watching it as it leads the global economy by 9 to 12 months. For the first time since the 2015-yuan devaluation, China credit impulse is running above 5% of GDP. To be precise, it was standing at 6.2% of GDP in Q2 this year, at the time of the global lockdown. Even if credit impulse is close to a peak for the downturn phase of this mini-cycle, the flow of credit from the worst period of the health crisis will continue to support the global recovery at least until the end of Q1-Q2 next year. The strong improvement in China credit impulse is one of the two reasons, along with the sharp increase in global central bank liquidity since the outbreak, that makes us optimistic about the economic recovery next year. It will not be linear, and there will certainly be difficulties, but it is safe to say as this chaotic year is about to end that the worst is probably behind us. In terms of investment decision, the strong push in credit from China should be good for risky assets (notably emerging and frontier markets) and contribute to the reflation narrative.

Oil demand 102.5 million b/d in 2022, prices at $65/b end-2021

Energy transition to stimulate oil demand, EVs facing lithium shortfall

US stimulus to kick-start policy boost for demand globally

London — The world is entering a “long-lasting bull market” for commodities, with even oil set to benefit as recent underinvestment, dollar weakness, government spending and the energy transition boost demand across the board, Goldman Sachs’ global head of commodities research, Jeffrey Currie, said Dec. 8.

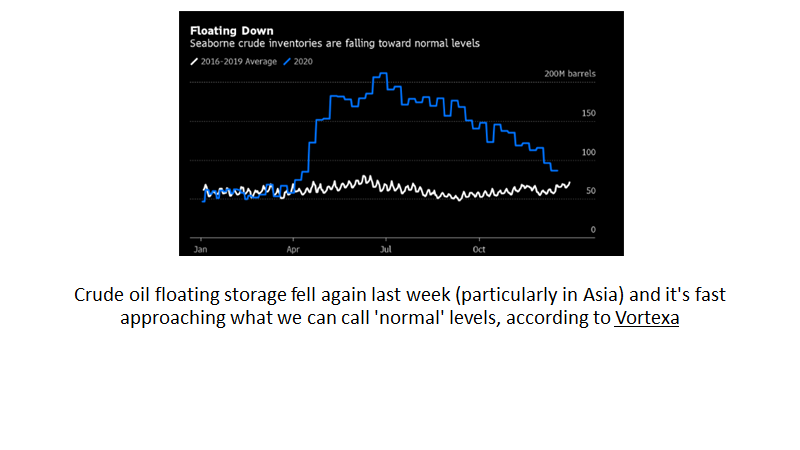

Speaking at an FT Live event, Currie said “every single commodity market with the exception of wheat is in a deficit today” and highlighted the example of oil, saying capital expenditure in the oil sector had fallen an unprecedented 40% in the first half of the year. He argued that even oil demand would be boosted by spending on the energy transition, due to the volume of oil consumed in the course of green energy infrastructure projects.

Goldman Sachs has a “target” price for oil of $65/b for the end of 2021 and is forecasting rapid demand recovery, with global demand set to reach 102.5 million b/d in 2022, he said, up from the International Energy Agency’s estimate that oil demand in 2019 was at 100.1 million b/d.

“It’s important to separate the vaccine, which is a tactical upside catalyst, from the pandemic itself, which is a structural catalyst to a longer-lasting bull market. As we look out to 2021 the vaccine creates that V-shaped recovery… but looking beyond that we believe it’s the beginning of a structural bull market not only in oil, but across the entire commodity complex,” Currie said.

Despite a reduction in oil demand for business travel, “we think the market’s going to be in substantial deficit throughout the end of next year and beyond into 2022… You have structural under-investment in supply — we call it the revenge of the old economy. It’s not just oil, it’s metals, mining, the entire old economy has shortages in investment,” he said.

“The second theme, policy, sits at the center of the demand story. The big catalyst that the pandemic shifted is that policy after 2008-9 was directed at market stability: whether it was OPEC, the [US Federal Reserve,] the Chinese five-year plan, everything was around financial stability. Now, all the policy is around social need, and social need creates a redistribution of wealth towards lower-income, income-constrained households that consume a lot more… Demand is relatively strong across the board.”

“We call it revving commodity demand — redistributional policies, environmental policies… and then there’s the versatility in supply chains” in the form of stockpiling of commodities by countries such as China, he said.

“Policy-driven demand is going to create a capex cycle that is bigger than the BRICS in the 2000s, not quite as big as the ’70s, but we’re talking about that kind of a bull market in commodities,” Currie said.

“It’s the same three legs everywhere — redistribution, Green, and then something to deal with the resilience of supply chains — all [governments] are focused on that, whether it’s the US, Europe or China,” he said, arguing the policy side of the new cycle would be kick-started by a potential $500 million stimulus likely to be approved by the US Congress in the coming days.

Currie went on to argue that a weakening US dollar was also providing “tailwinds” for the commodity sector, with the effect already evident in price rises in oil and commodities such as copper and iron ore, with iron ore prices hitting seven-year highs on Dec. 7. “This is not something we’re forecasting for the future — we’re inside it right now,” he said.

On the topic of energy transition, Currie played down some of the more optimistic forecasts by his fellow panelists on the pace of progress in battery technology, and the rise of electric vehicles, highlighting among other factors limitations in lithium availability.

“Right now Tesla and Apple consume 50% of the world’s lithium market. These metals markets cannot accommodate scaling up these battery technologies at the rates that are potentially anticipated here,” Currie said, going on to voice skepticism about the pace of improvement in battery technology.

Chief Executive, Gavekal

Hong Kong

Louis-Vincent Gave, CEO of Gavekal, is a go-to source for institutional investors trying to interpret global macro risks such as the financial implications of China’s rise. Gave, 46, was born in Paris, educated at Duke University, and based in Hong Kong before the pandemic. Gavekal provides independent research and manages $1.7 billion in Asian fixed-income and equities strategies, primarily for European institutions.

Barron’s: What investment trends will be most prominent after the pandemic?

Louis-Vincent Gave: If I ask what the most important development was in 2001, most people would say it was 9/11. With the benefit of hindsight, it was China joining the World Trade Organization, which changed the world for the following 20 years. If I ask about 2007, you’d say it was the start of the subprime crisis. With the benefit of hindsight, it was the launch of the smartphone.

With hindsight, what will people say about 2020?

So far, the Covid response in the U.S. has been a $12,800 increase in debt per capita; in the United Kingdom, it’s $7,000, and in Germany and France, $5,300. In China, it’s $1,200. The Western world responded with massive increases in budget deficits, which could constrain future policy options, while Asia, especially China, hasn’t.

Western policy makers have no choice but to embrace yield-curve controls; they can’t let interest rates go back up. You had Japan and Europe in the yield-curve control gang. The big change now is that the U.S. has joined them. Once the European Central Bank went down this [path], the euro tanked. Once we are on the other side of Covid-19 and it becomes clear the U.S. has no other choice, the dollar will collapse.

What will be the best investment opportunity post-Covid?

Investing in Asian fixed-income markets, in local currencies. Governments there have broadly been more efficient at dealing with Covid-19. Central-bank balance sheets and government spending haven’t grown out of control. Just as water flows downhill, capital is attracted to positive real [inflation adjusted] rates. Today, these are mostly found in Asia.

What is the most pressing public policy issue the U.S. will face?

How to fund runaway debt. For now, everyone’s answer is through modern monetary theory [which posits that governments that control their own currency can spend freely]. Once the debt is monetized by the central bank, there are no historical examples, outside of Japan, where that doesn’t lead to massive and very fast inflation, massive currency debasement, or both.

What does that mean for the dollar’s reserve-currency status?

I look at currencies like computer operating systems. Most Gavekal clients use Microsoft because everyone else uses it. The dollar is Microsoft. Go back to 2005-06, when Apple was trading at nine times earnings and viewed as making a niche product. In 2007, Apple said it would create a parallel system and went straight to the consumer, who took [Apple] not because it was cheaper but because it was easier.

So the renminbi is Apple.

We are seeing the rollout of Chinese fintech solutions across Southeast Asia, the Middle East, and Africa through WePay and Alipay. Then, tack on the digital renminbi and look forward to a future where an Indonesian businessman goes to Singapore and pays for his taxi with Alipay and the transaction isn’t settled through Swift or the dollar but through digital renminbi. The pushback I get is that no one is going to trust the digital RMB—or, who wants the Chinese government to know how and where you spend your money? That’s a big roadblock, but if you told me 10 years ago people would put Alexa in their homes voluntarily….

Aren’t you worried about China’s debt or social instability?

For the past 10 years, I’ve been told that Chinese debt was about to implode and there would be riots in the street. In the past 10 years, we have seen riots in France and the U.S—and in Hong Kong—but China has been remarkably stable. We have been told that the Chinese government would have no choice but to nationalize big parts of the economy and the renminbi would collapse. That scenario has unfolded in Europe and the U.S. [The U.S.] has increased debt by $4.2 trillion, three-quarters of which was funded by the Fed. Meanwhile, the renminbi has been the strongest currency year to date and over 10 years.

What is a key concern for Asia-based investors?

The decoupling of the U.S. and China is a massive change, and Taiwan is an important fault line. Taiwan wasn’t too much of an issue when the U.S. and China got along and all China produced were cheap plastic toys and bicycles. But this year, the market cap of the global semiconductor industry is above that of the energy sector. Taiwan Semiconductor Manufacturing [ticker: TSM] said it is already manufacturing a generation of chips that Intel [INTC] has said it won’t be able to fabricate until as late as 2023. If you think semiconductors matter more than energy, Taiwan Semi is one of the most important companies in the world.

What are the longer-term ramifications of President Xi’s crackdown in Hong Kong?

The core thesis is that Xi is a transformational president—the first imperialist president since the Ming Dynasty. If you are Xi and you hear your companies won’t have access [to U.S. markets], Hong Kong sounds like a great way to internationalize the renminbi and do a digital renminbi. Most Westerners saw the intervention as the death of Hong Kong, but China guaranteed Hong Kong would be China’s capital markets for the foreseeable future. [Xi] has no choice but to make it a success, which is why the Hong Kong dollar is stuck at the high end of its [trading] band.

Chinese internet stocks have been hit by increased regulatory scrutiny, including the scuttling of the oversubscribed planned public offering of Ant Group. Does this mark a turning point for these companies?

Since the [suspension] of the Ant IPO and new antitrust [guidelines], we also had a state-owned coal company default on one billion renminbi, or $150 million. One big issue for China has been a trade surplus of $60 billion and enormous inflows into China tech and bonds driving the renminbi higher.

In the Western world, we would raise rates [to deal with potential bubbles]. In China, they have regulatory weapons. They managed to cool the tech stocks in China and inflows into Chinese bonds. They got their message through.

You have been living in Vancouver during the pandemic. What is the one place on Earth that you’d most like to visit when the pandemic ends?

I have to get back to my Hong Kong and Beijing offices. I miss my colleagues and my friends there.

Thank you.

https://www.barrons.com/articles/renminbi-will-gain-wider-use-globally-gavekal-ceo-51607134576

By Leika Kihara, Tetsushi Kajimoto via reuters

TOKYO (Reuters) – Japan announced a fresh $708 billion economic stimulus package on Tuesday to speed up the recovery from the country’s deep coronavirus-driven slump, while targeting investment in new growth areas such as green and digital innovation.

The new package will include about 40 trillion yen ($384.54 billion) in direct fiscal spending and initiatives targeted at reducing carbon emissions and boosting adoption of digital technology.

Policymakers globally have unleashed a wall of monetary and fiscal stimulus to prevent a deep and prolonged recession as the coronavirus closed international borders and sent millions out of work. In the United States, a $908 billion coronavirus aid plan is currently under debate in Congress.

In Japan, the pandemic has forced the government to put its fiscal reform agenda on the backburner, despite holding the industrial world’s heaviest public debt burden, that is twice the size of its economy.

“We have compiled the new measures to maintain employment, sustain business and restore the economy and open a way to achieve new growth in green and digital areas, so as to protect people’s lives and livelihoods,” Prime Minister Yoshihide Suga told a meeting with ruling party executives.

The package, approved by cabinet on Tuesday, would bring the combined value of coronavirus-related stimulus to about $3 trillion – roughly two-third the size of Japan’s economy.

Suga said the fresh stimulus will boost Japan’s gross domestic product (GDP) by around 3.6%.

Japan’s economy, the world’s third-largest, rebounded in July-September from its worst postwar contraction in the second quarter, though many analysts expect a third wave of COVID-19 infections to keep any recovery modest.

Aside from direct fiscal spending, the package included credit guarantees and loan facilities for small firms facing funding strains caused by the pandemic. (this is important)

The new stimulus also featured steps underlining Suga’s policy priorities eyeing a post-pandemic world, contrary to two previous packages that focused on dealing with the immediate strain on households and business from the pandemic.

Examples include a 2-trillion yen fund to promote investment that helps achieve carbon neutrality by 2050, and 1 trillion yen to accelerate digital transformation.

Lacking, however, were details on how to fund the package.

The government will compile a 20-trillion-yen third extra budget for the current fiscal year, a source told Reuters. It is also seen setting aside money for the package under next year’s budget.

With tax revenues hit by slumping corporate profits blamed on COVID-19, some investors say the government may need to issue 15 trillion yen worth of new bonds to fund the third extra budget alone.

“Japan needs to make a plan for fiscal reform and shift to reconstructing public finance at some point. But now is the time to help firms and households hit by the pandemic,” said Yuichi Kodama, chief economist at Meiji Yasuda Research Institute.

($1 = 104.0200 yen)

Story time by Dinesh Sairam

1/ Our story begins with Mansa Musa or Musa I of Mali, an African king who consistently figures in the list of richest people in the world (Inflation-adjusted). One of his given names was ‘Lord of the (Gold) Mines of Wangara’. Lest we forget, Gold was the ‘Money’ in those days

2/ One fine day in 1324, Musa decided to go on a pilgrimage to Mecca. Of course, it was easier said than done. Mecca was ~8,500 Kms away from Timbuktu, Mali. Ultimately he did make that journey and it has been recorded in the script “The Chronicles of the Seeker” by Mahmud Kati.

3/ Famously, he took a ton of ‘money’ (Gold) with him to aid in his journey (Well in his defense, it was ~8,500 Kms). About 60,000 laborers and soldiers carried 2 Kgs each and their camels carried 13 Kgs each, bringing the tally to an estimated ~1,30,000 Kgs of Gold.

4/ Being a generous King, he donated Gold left and right to every poor person he saw on the way. Regions of Cairo, Medina and Mecca became instantly ‘rich’. The estimated donation is ~32,000 Kgs of Gold or ~$2 Billion in today’s estimate

5/ Do you think Musa’s kind-hearted generousness made Cairo, Medina and Mecca flourish? That would be the perfect fairy-tale ending, but Economics and the Law of Unintended Consequences beg to differ. Musa caused a severe hyperinflation in these parts.

6/ Since everyone became ‘rich’ overnight, they refused to work unless they’re paid a hefty salary. So business owners had no choice but to increase prices to support wages. Over a year of two, high prices drained people off their Gold and they became poorer than before

7/ As Musa returned from his pilgrimage, he saw the damage he’d caused. He tried to remedy the situation, but it was too late. Regions of Cairo, Medina and Mecca would continue to be devastated for years to come.

8/ If you think this story is unrealistic, history repeated itself as recently as in 2006-08. The Zimbabwean government printed gobs of money starting in 2005. This caused, you guessed it, a hyperinflation. At the peak, the inflation was 98%, meaning prices DOUBLED every day

9/ You might also be aware of the ridiculous denominations of currencies in Zimbabwe in 2008. At the same time this was being printed, meat for daily consumption was priced at ~Z$ 200 Million. Now these kinds of notes sell on eBay, in case you’re interested.

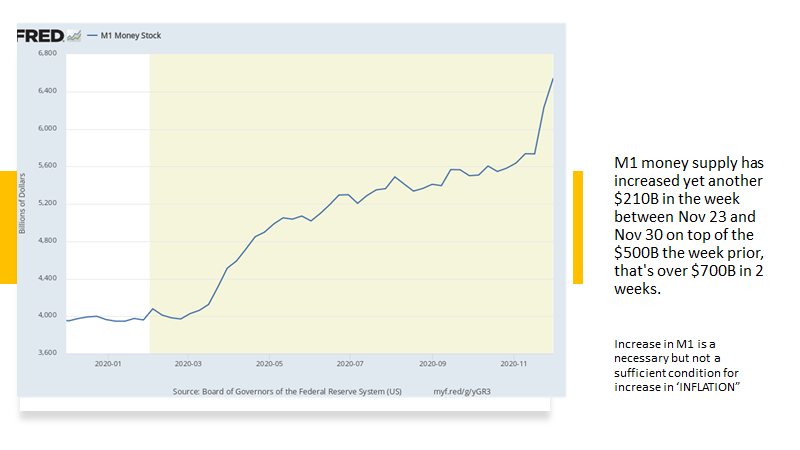

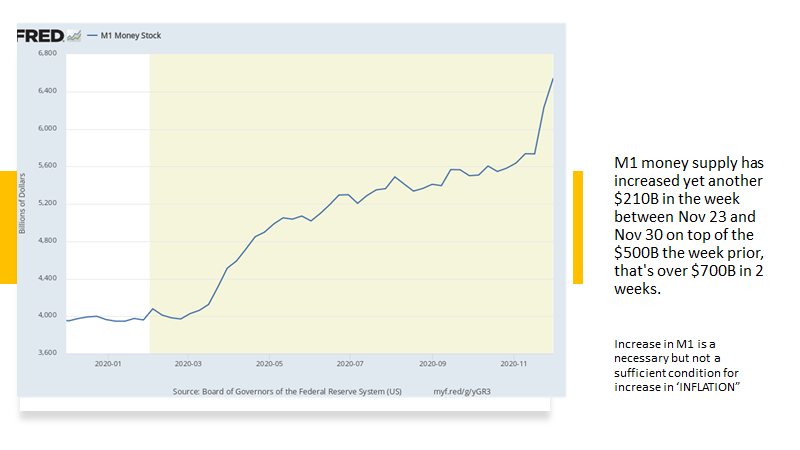

10-END/ George Gobel, the Standup Comedian, once said “If inflation continues to soar, you’re going to have to work like a dog just to live like one.” That’s Dark Humor, but we’re already in the midst of excess liquidity. What will follow this isn’t too difficult to guess.

Thread by @Dinesh_Sairam on Thread Reader App – Thread Reader App

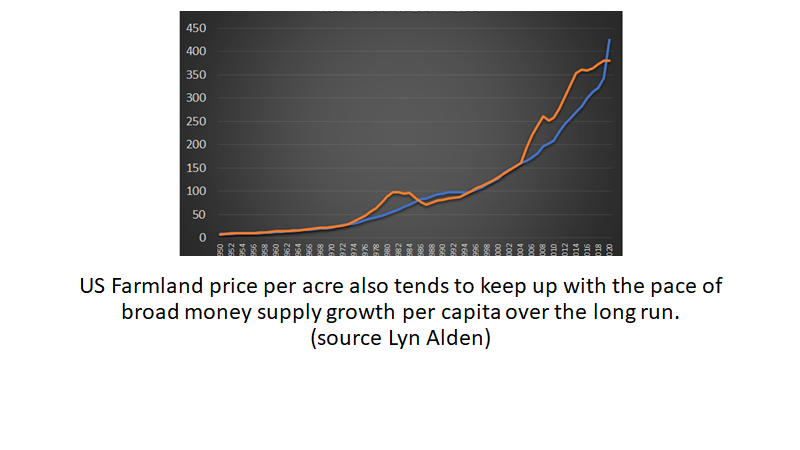

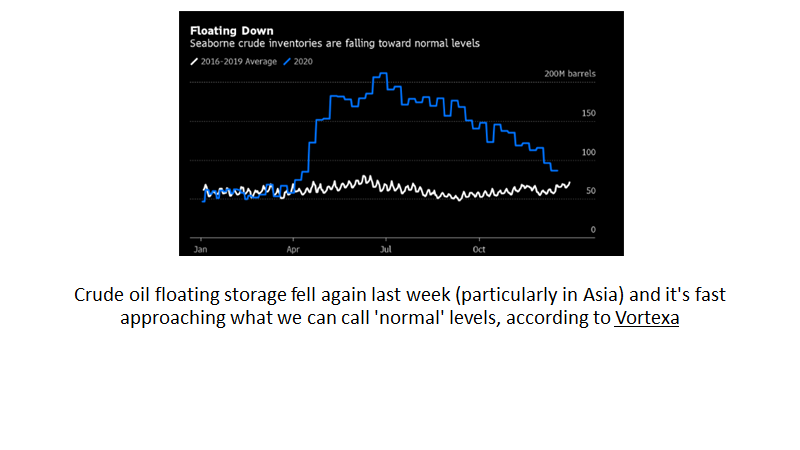

Luke Gromen of FFTT fame gives us a glimpse of some important charts that we need to understand and take into account as we head into 2021

First two charts

Next 2 charts

last 2 charts