Author: Ritesh Jain

Reflexivity in Emerging Markets

Lewis Johnson writes ……….

Soros has specifically identified emerging market debts and currencies as reflexive. It’s easy to see why. The core of the problem revolves around the mismatch between local currency values and a country’s borrowings in foreign currencies, such as U.S. dollars. The act of loaning a growing amount of U.S. dollar debt to a country initially improves that country’s fundamentals. This “improvement” encourages more U.S. dollar lending, especially when interest rates are low back home and savers who are desperate for more income place their capital at unwise risks in peripheral economies.

This virtuous cycle can become a vicious one once incremental U.S. dollar lending dries up, such as after an inflection in credit quality back home (See “Markets Become Dangerous When Investors Become Gullible). Investors discover too late, as Soros notes, that their bonds’ collateral values were buoyed by abundant lending which collapse when credit decelerates. As debtors scramble to refinance, capital flight may depress local currencies relative to the dollar, raising local interest rates and lowering bond prices, which further depress collateral values and economic “fundamentals.” Often the local authorities may attempt to further raise interest rates, in the hope of stabilizing currency values and restarting investment, only to have higher rates hurt the economy.

In Conclusion

Lewis believe that the unfolding weakness in many emerging markets is one of those rare instances of reflexivity’s power. However, just because something can be reflexive, doesn’t mean that it will be reflexive. Frankly, most such potential occurrences abort before they reach the wildest stage of self-reinforcement. That’s why strongly reflexive markets are rare. Yes, they have small odds, but they also bring with them high severity which can drive powerful outcomes. These are often called “Black Swans” because they have low odds but a high expected value.

Investors should regard with caution any attempt by consensus, blind to reflexivity, to blithely dismiss the potential severity of unfolding emerging market weakness. After the crisis has passed, long term investors may prudently expect to find extraordinary values once these forces are spent. We are open to a marked deceleration in emerging market asset prices before a final, buyable low.

As Forex Reserves Slip, What Are India’s Options?

According to Nomura, the RBI has a host of options to protect the rupee and shore up reserves. These include:

Hiking rates and tightening liquidity.

Raising custom duties on imports and offering exports sops.

Announcing measures to boost capital inflows, such as liberalising foreign direct investment and external commercial borrowing norms.

Raising NRI or foreign-currency denominated bonds.

Curbing capital outflows by placing restrictions on outward remittances and investment.

Nomura believes that if the currency pressures persist, the RBI will likely hike rates before considering issuing any NRI bonds.

Interesting Articles this week

Week in Review

Summary

- Turkey continues to get crushed across the board with 10-year blowing out another 40

bps on the week to over 21 percent ….(they might have negative GDP growth next

year) - EM bond markets hammered….(India behaving well)

- Euro periphery spreads widening with Italy out to 282 bps over German bunds….(at

one point of time they were at par) - EM FX weaker led by South Africa….(this is next Turkey)

- The dollar index closed above crucial level….(imp level to watch)

- Global stocks weaker; (the U.S. closed higher on narrow breadth and thanks to Walmart)

- Fewer and fewer country ETFs are green on the year

- Lumber bouncing after vicious bear market….(lumber is a leading indicator of US

economy) - Crude weaker….(some reprieve)

- No shine for the metals with Dr copper now down 20 percent YTD….(not a good sign)

(Global Macro Monitor)

India Strategy and More

Some titbits for weekend reading

Kotak Institutional Equities

We see increased volatility and macro risks over the next few weeks from (1) potential escalation in US-China trade issues, (2) possible ‘hard’ sanctions on Iran leading to sharp decline in Iran oil exports and higher crude oil prices and (3) possible EM contagion given Turkey’s fragile macroeconomic situation and weak macroeconomic positions of several EMs. India’s delicate macroeconomic position will be hurt by higher oil prices given oil’s large influence over CAD/BoP (currency), GFD (bond yields) and inflation (interest rates).

MARKET VIEW: UNCERTAIN MACRO WITH PLENTIFUL RISKS

The performance of the market for the rest of the year will depend on (1) strength of economic recovery (cyclical versus structural recovery), (2) level of crude oil prices, which will shape India’s macro and (3) convergence or divergence of multiples between ‘growth’ and ‘value’ stocks. Politics will also become important by the end of the year. The Indian market trades at expensive multiples (19.8X 12-month forward P/E), pulled up by the very high multiples of ‘growth’ (‘quality’) stocks. In our view, valuations of several stocks could see a de-rating in case (1) India’s macroeconomic conditions were to deteriorate on the back of significantly higher crude oil prices (US$15/bbl or more from current levels) and/or (2) earnings were to disappoint. The market perhaps believes that India’s macroeconomic situation will improve over the next few months and/or earnings growth would be strong enough to offset any macro related concerns including higher interest rates/cost of capital.

Valuations are expensive for the market as a whole

We find the valuations of the Indian market to be rich and note the significant disconnect between high equity market valuations and weak macroeconomic outlook, as can be seen in the divergence between bond and equity yields

Much more in the attached PDF compiled by Abakkus Asset Manager LLP

https://blog.abakkusinvest.com/wp-content/uploads/2018/08/WWRR-Vol.2.007.pdf

Boom and Bust Cycle

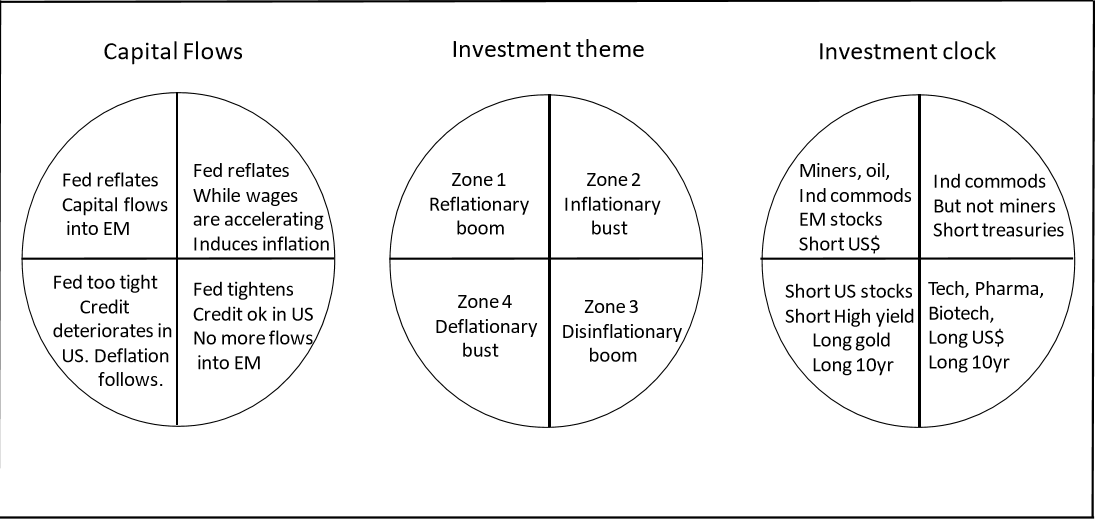

Capital flows determine the Investment Theme and that translate into Investment clock

Markets are still in bottom right quadrant and will be slowly transitioning to bottom left quadrant.

The world remains on US$ leash – Triffin paradox, forecasting & Turkey

Key points

1.The world remains on US$ standard; there are no alternatives.

2.US$ remains the key driver of most macro variables but it is unforecastable

3.We are concerned that declining liquidity, attempts to raise rates & China’s hesitancy is a recipe for stronger US$. Turkey might tip it over.

‘It is our currency but it is your problem’; It is everyone’s problem

Victor Shvets writes….The Triffin paradox (formulated in ‘60s) states that a country issuing reserve currency must run ever-increasing deficits, or find alternative ways of injecting sufficient liquidity to lubricate global interactions. This is in turn places such a country into a difficult position of constantly trying to balance conflicting domestic and global agenda. It is not only a problem for issuing country but it is also a major headache for the rest of the world. Keynes was right when he suggested creating ‘Bancor’ as an independent global currency. This was unacceptable to the US in 1940s and it is unacceptable today, as it requires ceding domestic sovereignty. Connally was wrong; US$ is a problem for all.

Today, there is no alternative to the US$. Recent small-scale barter deals are a drop in the bucket. US$ continues to dominate trade, finance and reserves. No other country can replace US$, because a reserve currency requires: (a) large and liquid pool of securities; (b) to be freely exchangeable, with minimum restrictions; & (c) an issuing country must run deficits to inject enough liquidity to lubricate the global economy. Today only the US$ satisfies all of these conditions. Alternatives like gold or cryptos are either not yet ready for prime time or cannot expand at a fast enough clip to facilitate global financialization.

But, alas, currencies are largely unforecastable

Hence, US$ remains the most important global driver of key macro variables, from liquidity and inflation to demand. It determines how fast global economy can expand and it distributes gains and losses to various countries and asset classes. In most cases, expanding global economy and trade requires stable-to-weak US$, with direction and intensity being important. However, rapidly rising US$ strangles liquidity, creates disinflation and reduces demand. That’s why more is written on US$ than on almost any other topic, with pages devoted to charts showing LT sweeping trends or variety of fundamental factors, from REER to deficits, growth rates to spreads, alas, to no avail. Currencies are far too complex to forecast. But getting US$ wrong is deadly.

If not well-managed, there is a risk of rapid US$ appreciation

With that proviso, how do we look at US$? We have very simple formulae: abundant liquidity + low volatility + rising reflation = low US$ and in reverse, declining global liquidity + rising volatilities + declining reflation = rising US$. There is of course a question of causation, as US$ is responsible for liquidity or reflation, while also magnifying their impact. However, as public sectors are now aggressively managing cycles, it is state policy choices & settings that determine final outcomes. Today, CBs are reducing liquidity, and China is uncertain as to how robust it should become in reflating demand while monetary policies are more divergent, driving higher volatilities. Plus, we can add social & political factors. How much would US$ appreciate, if Turkey were to introduce capital controls & some repudiation of US$0.5 trillion of its foreign debt? The risks are high, and it is far from clear whether Trump & ECB can stabilize Turkey, leading to a potentially much wider contagion.

In Back-and-Forth Between RBI and Uday Kotak, a Rs 15,000-Crore Lesson in Misgovernance

Hemindra Hazari always has an interesting point of view