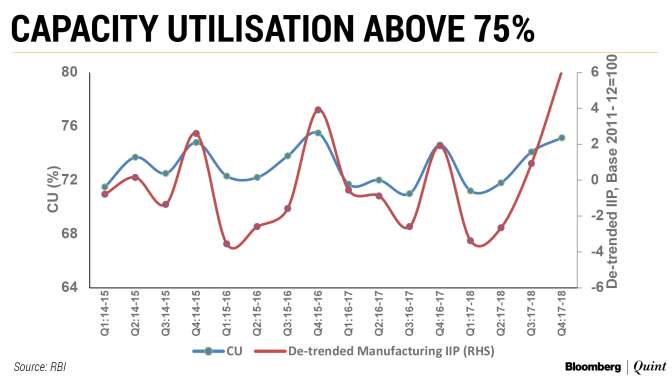

1.Capacity utilisation crosses 75%. Probably the most important piece of data for Indian economy ……….why?

Till now govt spending and household consumption has kept the economy growing but both C ( consumption) and G (governement spending) cannot give a long term boost to the economy. It has to come from Private Capex (I) and

once capacity utilisation reaches around 80% I expect Private sector to start putting new capacities and the baton of lifting GDP growth can be passed on to the Private sector which is more sustainable

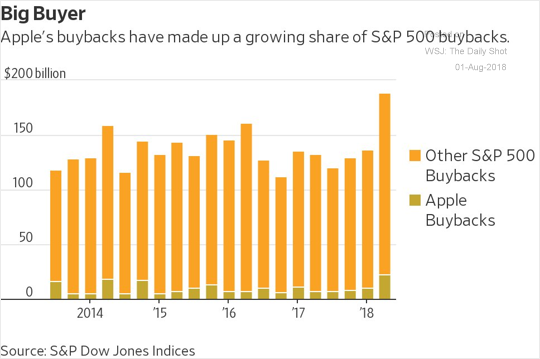

2.Financial engineering (stock buybacks) have been adding support to the share price of Apple but as Andy Kessler at WSJ writes “Smartphones are now like radial tyres. Everyone has one and they don’t wear out. Phone franchises are fickle. Ask Motorola and Nokia, if you can find them.One near- term sign of distress, Marketing tech products with splashy colours, as steve jobs did with tangerine IMacs is almost over.Apple hopes to make it up in services, but google leads in Maps, Netflix in video, and UBER in transportation. Apple is falling behind in most other growth segments. The company’s destructive seed is its desperate need for a new product category. it won’s be watches”

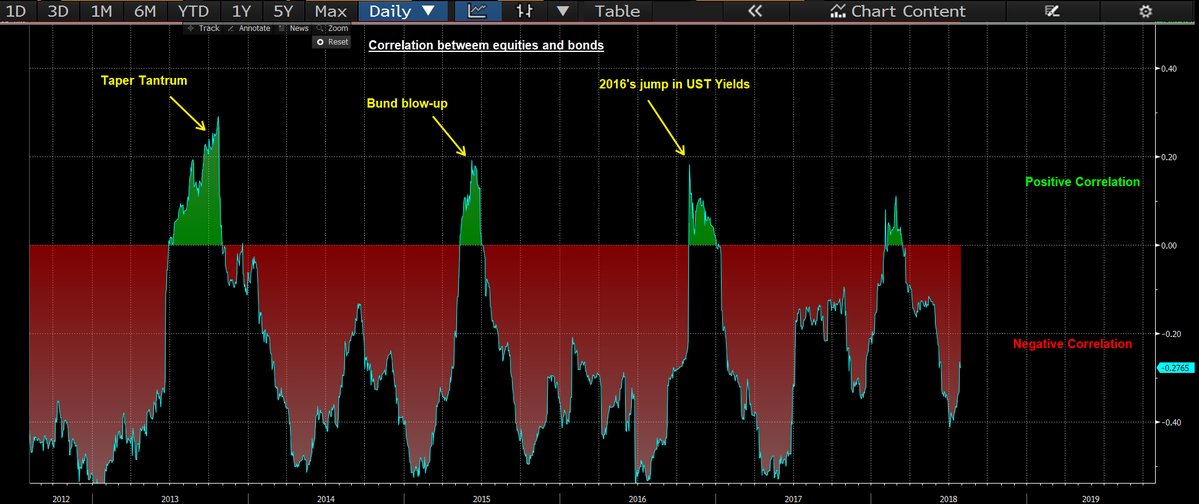

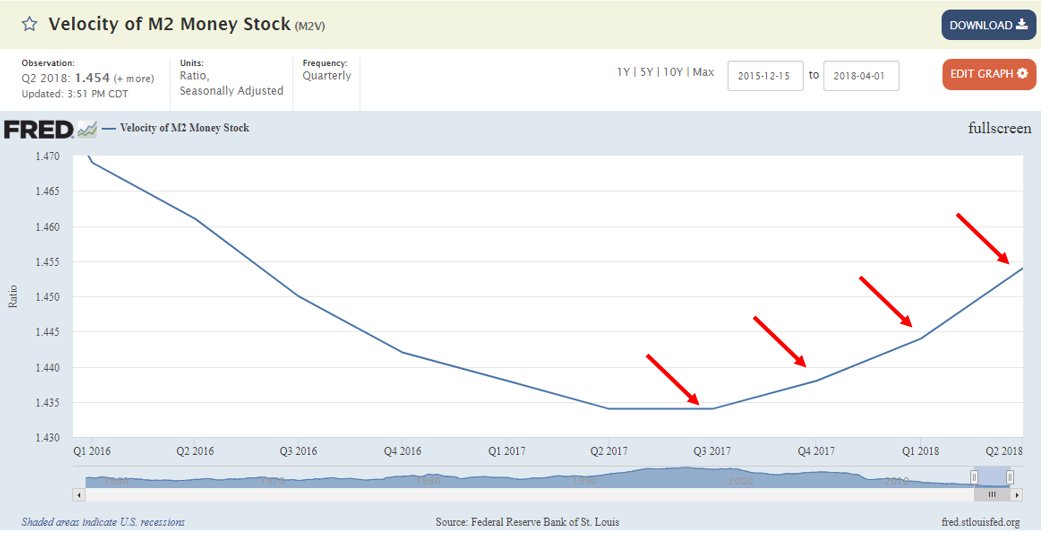

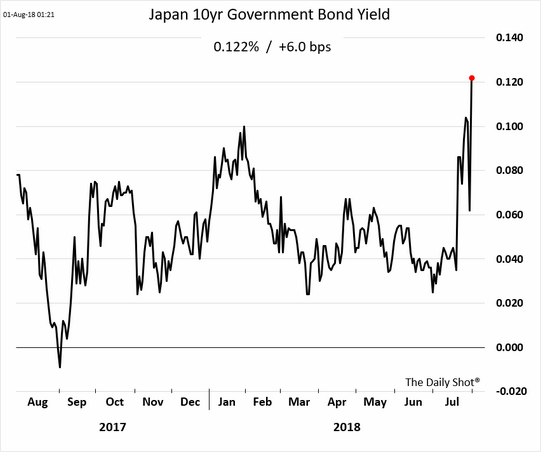

3.Japan Bond market finally revolted against its central bank resolve and forgot that there is a lid on bond yields.

Japan 10 year bond yield yesterday rose 100% in one day…….. yes it went from 0.06% to 0.12% .

Now with JGB yield rising (It’s frightening how US yields have been pinned down by foreign buying) ,US yields have also picked up. If 3.25% goes in 30yr yields watch out for spill over to other markets including EM bonds.

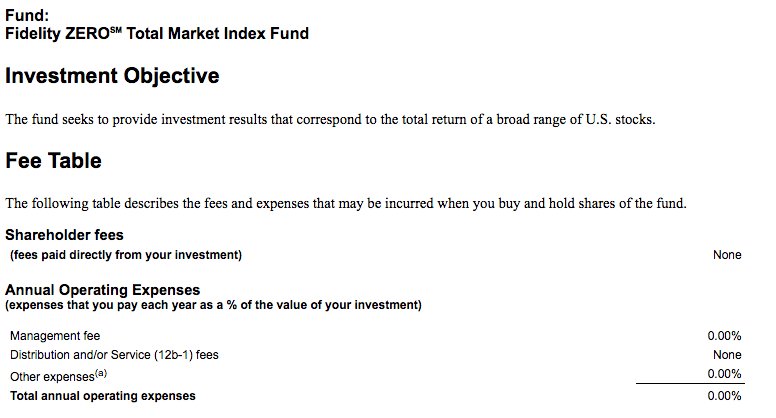

4.Fidelity went to zero fees on their ETF . I mean WOW. I guess they would be making money from SLB ( securities lending and Borrowing). It is a matter of time we will see plethora of low cost ETF in India .