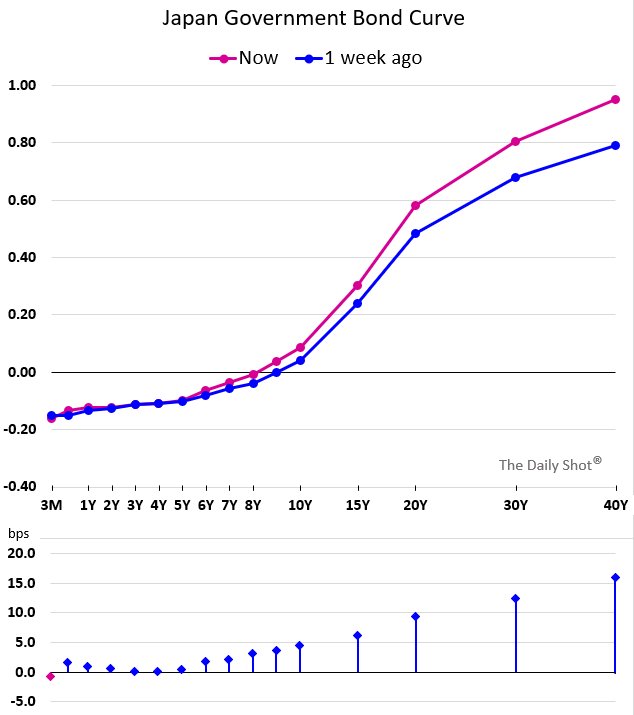

The Mumbai Ahmedabad bullet train deal done six months ago with 88000 cr loan from Japan was done in their base currency which is JPY, but at a nominal interest rate of 0.1% for 50 years. The exchange rate was 57 paisa for 1 JPY at the time of signing the deal. The deal emphasised more on the nominal interest rate which India would be paying and not on exchange rate .

In pure economics the interest rate differential takes into account the inflation differential which should be reflected in exchange rate . So if india inflation is 7% and Japan at Zero then theoretically, INR should depreciate by 7% against JPY.

This is exactly what has happened .On Wednesday (July 25), the going rate for 1 Japanese yen was 61 paise, as per forex market data.In less than a year, the project’s loan burden has jumped by Rs 6,160 crore, or 7% of the loan amount, due to depreciation of the Indian rupee against the Japanese yen.

I have seen during last twenty years of my career, lot of corporates treasuries going for the lure of borrowing money in JPY or swapping their Indian rupee loan into JPY (at the advice of their BANKS) and ending up paying more than what they would have paid had the loan been in INR.

Leave it to Japanese to make Bullet train but be aware it will be an additional burden on India’s finances.