By BFI Capital

As we head deeper into a new decade, and after a memorably turbulent 2020, financial markets seem remarkably optimistic. They look forward to friendlier fundamentals, improved global economic growth, and the much-awaited mass vaccinations which are to improve consumer confidence and lead us back to a “normal life”. This all happens, of course, under the benevolent and sage guidance of governments and central banks that will competently lead us all to a robust recovery. Yet, I wonder: might this outlook be a little too optimistic?

I am not a big fan of economic and financial forecasts. The pretense of being able to foresee what will happen during the next year – or even decade – in a complex system such as the global economy should always be taken with a healthy dose of skepticism. Therefore, I’m sharing my own outlook for 2021 as food for thought, to be considered and added to, or weighed against, the reader’s own expectations and analyses.

While I do have my doubts about future predictions themselves, I am in fact a great fan of the PROCESS of forecasting – all the reading, learning and analysis involved, the discourse, and the estimation of what might lie ahead. That is fun and stimulating. It is one of the reasons I love what we do at BFI. And it is a necessary exercise for investment success. Smart investing is based on recognizing and understanding the driving forces, relevant trends, and global dynamics. That understanding lays the foundation for your strategic allocation. And, while nobody can model (at least for now) and foresee the future, an educated and informed guess is still better than throwing darts at the board without any knowledge at all – well, at least in my experience. So, here we go.

The Great Rebound – or The Great Awakening?

At some point, in school or some other type of Economics 101 class, we all learned that stock markets reflect the aggregate of effective and expected successes and/or failures of companies in an economy, which again reflect the overall strength or weakness of an economy. Therefore, with stock markets ending the nightmare year of 2020 at new record highs, that would leave us to believe the global economy is amazingly strong and robust. Right?

Well, unfortunately, it is not that simple. The world we live in has very little to do with the rules and theories that traditional economics were based on. When I graduated from university, I would not have been able to envision a world where interest rates are at zero, inflation is nowhere in sight, debt levels – both public and private – are at record highs, money supply is at record highs, money velocity and productivity are at record lows and, yet, the S&P 500 has just reached a new, all-time record after one of the worst recessions in modern history.

However, we have all been taught, sometimes painfully, that “markets are always right”. And they have priced in a great deal of positivity. Much of that optimism for 2021 is based on the belief that things can only get better after 2020. Once the coronavirus pandemic is in check with mass vaccinations underway, and once all that pent up demand comes back to life, how can things not get better from there?

So, the question is whether 2021 will provide us with a global economy that goes down in history as The Great 2021 Rebound, or whether we will instead encounter The Great 2021 Awakening. Personally, I think both scenarios have convincing arguments that would support each of them. And at BFI, we will be investing accordingly…; let me explain:

Key factors and considerations

Here’s a summary of some of the core factors and considerations for investing in 2021:

1) The hope of ending COVID. Vaccinations are being rolled out globally. Expectations are high that this will allow us to leave the pandemic behind and return to some form of normalcy in the coming months. In China and other parts of Asia, this already appears to be a reality. However, we should also expect logistical setbacks and delays. Moreover, this coronavirus, as so many in the past, will continue to evolve and mutate, while new viruses may also emerge. Therefore, based on the lessons we learn from this round of “pandemic management” and the future measures employed, we may expect to see more lockdowns and heavy-handed government interventions.

2) Split-world economy. The world economy remains somewhat decoupled. China, along with some other Asian economies, have normalized and are much less impacted by the pandemic and the respective government measures. On the other hand, America and Europe remain hard hit. Therefore, 2021 starts with weak and slowing economies in the Western world, while Asia is enjoying solid growth. Assuming we don’t experience any major pandemic setbacks, an economic rebound may occur in Europe and the US as well. However, this would go against the secular declining growth potential stemming from negative demographics, excessive debt, increasing regulation, and misguided policies.

3) Monetary and fiscal excess. Few things are certain in life beyond death and taxes, but it appears we may add a third item to the list: debt. The arrival of this new decade is paired with record peaks and growth rates of debt and deficits, both public and private, and pretty much everywhere. In response to COVID-19, and “thanks to it”, governments have been given the magic-money wand. And they are making ample use of it. As shown in the chart that follows, the fiscal response in 2020 alone dwarfs the response over the period of 2008-2010 during the last financial crisis. A similar picture, by the way, can be seen in monetary policy.

Fiscal Deficits 2020 as % of GDP

Source: Clocktower

This unprecedented expansion of monetary and fiscal support is being justified as a measure to help those who have lost their jobs and businesses. It is presented as relief and support spending. However, as can be seen particularly in Europe and the US, the pandemic has been highly politicized. And the so-called “relief packages” include numerous and large items that have little or nothing to do with relief and support in the context of the pandemic.

4) Big Government. With the unlimited power of “creating” money and debt, the share of government spending in most economies has reached levels that are highly concerning. Empirically, we know that government dollars spent are less productive – in other words they add less to growth – than dollars spent in the private economy.

Sheep spend their lifetimes afraid of a wolf and end up getting eaten by the shepherd. ~ Unknown

According to IMF estimates, published in October 2020, government spending as a share of GDP now accounts for more than half, at 50.5%. The Euro area is at 55.7%, while the United States is at 47.2%. The increased share of government influence on the economy (planned economics) is in the process of crowding out the more efficient, innovative and propulsive private sector. It is in essence killing off the benefits of a free-market economy.

Government Debt as % of GDP

Source: Refinitiv Datastream, ECR Research

A necessary condition for sustainable economic growth in the future is a reduction of debt levels. However, reducing the current debt levels would require politically unpopular measures (austerity, debt restructuring, defaults…). The way out that governments are currently working toward instead will involve a mix of inflation and financial repression (higher taxes), and the hope for growth.

5) Negative Real Interest Rates. Financial prudence and thriftiness have been largely thrown overboard, at least in the public sphere. Financing this kind of squander and profligacy, of course, is only possible in the context of rock-bottom interest rates. In fact, as depicted in the following diagram, financing costs (net government interest payments as a percentage of GDP) have been relatively flat, and in some cases, as in Italy or Germany, they have been decreasing over the past 20 years.

Cheap Financing – Net Government Interest Payments as % of GDP

Source: Refinitiv Datastream, ECR Research

This reduction in financing costs is counterintuitive. But it is a reflection of the past four decades – and particularly the last decade – of increasingly low interest rates. As we’ll touch on shortly, two primary deflationary forces (globalization and technology) have contributed to a very unique scenario: they have allowed (and continue to allow) governments and central banks to expand the monetary base beyond comprehension without inflation (in terms of CPI) rising and counterbalancing.

To be clear, we are coming to the end of a secular credit cycle. Sovereign bond yields around the world are in a secular bottoming process that may stretch out for a few more years, but we are, in effect, at the brink of transitioning into a new era.

At this point, with interest rates at rock-bottom, the trillion-dollar questions on the minds of economists and investors are: when will yields start rising? And how? Central banks will try to keep interest rates low, but how and for how long will they be able to resist market forces that will force yields up, particularly once inflation starts to rise?

6) CPI Inflation. Currently, CPI inflation is depressed in most economies, with outright deflationary situations in several European and Asian countries. Central banks have been communicating their intentions to raise inflation to around 2% for several years without much success. The deflationary forces were too strong. Fed Chairman Powell even expressed the intention to let inflation “run hot” (run higher, maybe 4%?).

It is impossible to say if and when inflation will rise in earnest, and how high it will go. The estimates of reputable economists are running all over the map. I personally don’t expect inflation to be a problem in 2021 (a ‘problem’ in a sense that it could trigger turbulence on the yields front). However, we do know from history that inflation can be quite unpredictable, with sudden spurts and eruptions that do have the potential of moving markets rapidly.

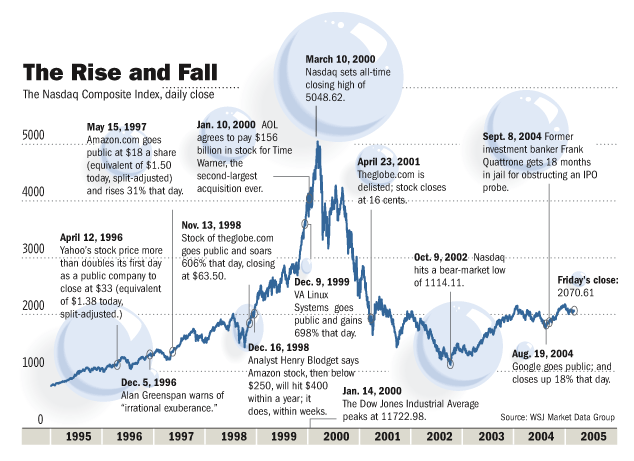

7) Equity Bubbles. There are some sectors in the equity market that look overvalued and (very) toppish. Equity markets have been the main beneficiaries of cheap money. The liquidity induced has lifted the prices of stocks higher and higher.

At BFI, we increasingly see the potential for a short-term correction in stock markets. However, based on an almost 100% certainty of continued monetary and fiscal stimulus, stock markets will continue to benefit. Therefore, we give 2021 the probability of another year with very attractive profits in stocks. The expected setbacks need to be considered and managed actively, however.

Major stock market bubbles since 1960; the FAANG stocks look, and smell, like another one

Source: BCA Research

8) Social Tensions. Wealth inequality in western economies is rising. To a large part, this is due to the monetary and fiscal policies discussed earlier: wealthy investors are able to reap profits on the back of rising financial markets, while the general economy does not allow for equal financial progress for the majority of society. This has led to growing dissatisfaction and growing potential for stark social unrest, as seen in the US last year. In my opinion, the polarization and social tensions in America will not go away under a Biden-Harris presidency.

And it is hardly surprising that the corona crisis has increased this inequality. A recent IMF study on inequality during and after five major pandemics this century found that inequality increased considerably in all cases in the five years following the outbreak, (both when focusing on the Gini coefficient and on the proportion of the total pie taken up by the 20% of households with the highest incomes). More social unrest is in the offing and studies suggest that inequality slows down economic growth.

Inequality on the Rise: Mean Household Income in the US

Source: Refinitiv Datastream / ECR Research

9) The Future is Faster than You Think. This is a title I am borrowing from another interesting book written by Peter H. Diamandis. It discusses how converging technologies are rapidly transforming business, industries, and our lives. I recommend reading this book to get a good overview of the manifold technological advances and the impact they have (and increasingly will have) on literally everything. A constellation of disruptive technologies – the internet of things, cloud computing, big data, 5G communication and, of course, artificial intelligence – is paving the way for a new form of global economy.

Unless you take good note of the (in some cases exponential) acceleration in technological progress as a result of the confluence of several different innovations, you will have a hard time understanding the power of de-monetization and deflation that the so-called Fourth Industrial Revolution (4IR) has. It is a force to be reckoned with in our economic and investment analysis. At this point, unfortunately, it is hard to determine whether the net impact will be positive or negative in the decade ahead. These technological advances are arriving at lightning speed and our current societal systems – and most of all, our governments – are not ready to cope efficiently and effectively with them. Therefore, while much good can come from all of this, we are also facing some formidable challenges.

Investment Strategy

Based on the current circumstances and trends, we all need to reevaluate and carefully consider our individual investment strategies. In the current context, I strongly recommend an investment approach that is PRUDENT, ACTIVE, AND SYSTEMATIC. I do NOT consider the current markets to be in a do-it-yourself environment and I think investors that are not financially sophisticated and experienced enough, with the necessary analytical tools and skills, should either mandate a professional investment firm or radically adjust and simplify their exposure to financial markets.

At BFI, and for our clients interested in a globally diversified portfolio structured to withstand the test of times, the strategic approach for 2021 in summary looks something like this:

- Equity: Stay invested with a strong exposure to selective sectors in equity markets, globally diversified, with increased weighting in emerging markets.

- Bonds: Strongly reduced exposure to bonds. Short-term government paper may serve for liquidity purposes. Very selective corporate exposure. Replacement of typical traditional allocation to bonds with alternatives, including gold, silver, and low-volatility hedge funds.

- Gold and silver: We have significant allocations to gold and silver, and we have started to add mining. Many of our wealthy clients hold physically allocated precious metals in segregated storage in Switzerland with Global Gold, in addition to their discretionarily managed portfolios with BFI Infinity.

- Alternatives: We have significant exposure to real estate, hedge funds and precious metals (physical and mining). We are also looking to increase our exposure to commodities, which are starting to come out of an extended bear market, and which might also profit from potentially increasing inflation expectations.

- Downside Protection: We actively employ downside protection tools, primarily put options, on the stock markets. This allows us to stay fully invested without the danger of stark losses in the expected corrections.

- Crypto Currencies: We invest in Bitcoin in small allocations via specialized strategies that also protect on the downside. For increased exposure to Crypto, we cooperate with business partners specialized in this field.

Conclusion

Effective vaccines, declining political risks, ongoing fiscal and monetary stimulus, and pent-up demand have created a jubilant mood among investors and analysts and a very bullish outlook for 2021. However, markets are ignoring several risks and rising long-term rates that could throw a wrench into the works in the course of this year.

Stoics like Epictetus, Seneca or Diogenes recognized the value of not allowing your emotions and passion to run out of control. In victory and success, as in defeat and pain, their objective was to prioritize reason, virtue and the discipline of Eudaimonia (striving to be the best version of yourself at all times) over emotional excess based in pleasure, fear or greed.

I believe that the principles of stoicism can provide a valuable compass for life. And, as we find closure with 2020, I think we are well advised to practice some stoicism as we continue our journey into the new decade. In other words, let us not be too pessimistic or too optimistic. Let us take a calm and reasoned look at what this new year might have to offer; and then, why don’t we settle for some cautious optimism.

https://www.bficapital.com/post/from-nightmare-to-fairy-tale-or-inflated-expectations-for-2021