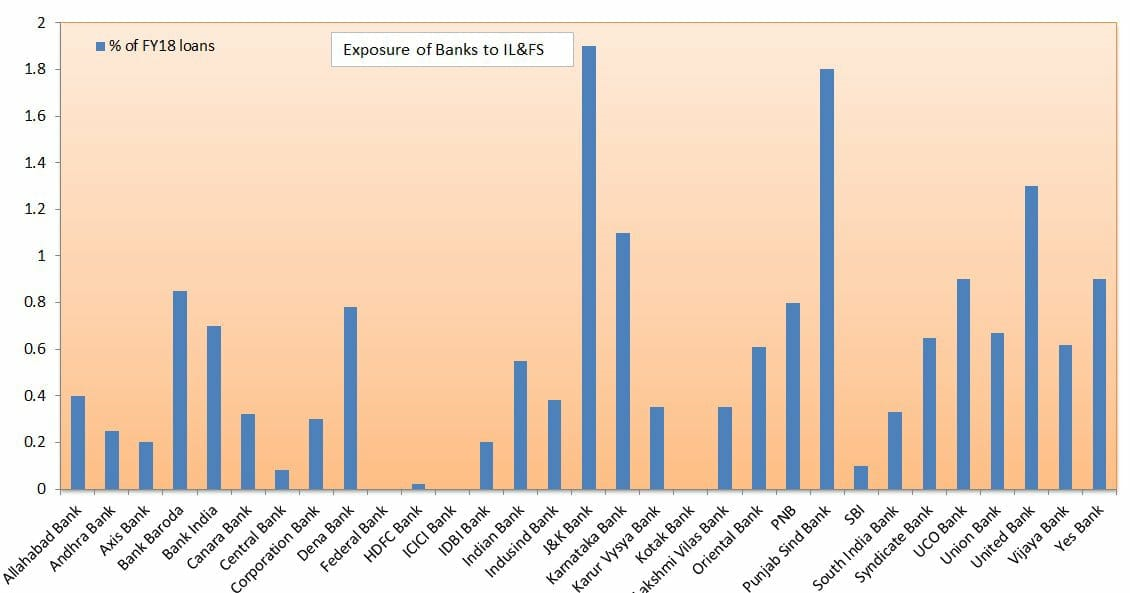

Sanjay Reddy an Economist at the New School for Social Research, New York writes on a very important which is not often analysed……India’s dependence on external financial confidence makes it fundamentally unlike China, as well as Korea, Taiwan, Singapore and other successful economies of east and southeast Asia. It makes it more akin to countries such as Brazil, Indonesia, South Africa or Turkey (collectively dubbed, with India, as the “Fragile Five” some years ago). China and other countries like it have pursued a policy that is export-oriented and manufacturing-centred, thereby generally covering their import bill and building up reserves over time In contrast, the fragile countries depend on the bets placed by foreign investors on their futures because they have failed to develop into successful exporting countries, at least on the required scale(that’s why our foreign exchange reserves can drain more quickly .Countries in this situation may grow but face continuous threats that a downturn in foreign confidence will halt their progress.

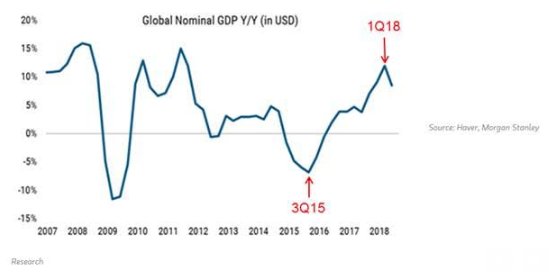

Efforts to please foreign investors with friendly policies, and robust economic growth based on domestic economic confidence can keep funds flowing in as long as the tide is favourable. Yet, these are not enough when the tide turns as a result of global factors. The most important such factor at present is the expected end of the “quantitative easing” policies that have caused cheap money to slosh around the globe, and financed much lending to and investment in the fast-growing emerging countries (of course, rising oil prices and other factors, including fears of increasing protectionism in the United States, also play a role). The export-oriented formula, “Make in India,” offers a correct prescription for India, as did Raghuram Rajan’s compatible import-substituting variant, “Make for India”. But the inadequate realisation of India’s productive potential is the ultimate basis of the ongoing vulnerability.

Conclusion

India’s failure to become a broad-based manufacturing exporter owes less to prices than to everything else that successful countries such as China do well and that India does not—adequate infrastructure, reliable and inexpensive power, an adequately healthy and educated workforce and many others. India’s remarkable success in global services exports masks this more basic failure of economic capabilities and social inclusion. Advice to the RBI and to the government to do nothing and allow the Rupee to slide confuses coping and cure. No one can predict if or when the fall of the Rupee will continue. What is clear is that it is the symptom and not the disease, and this must be not merely diagnosed but adequately treated.