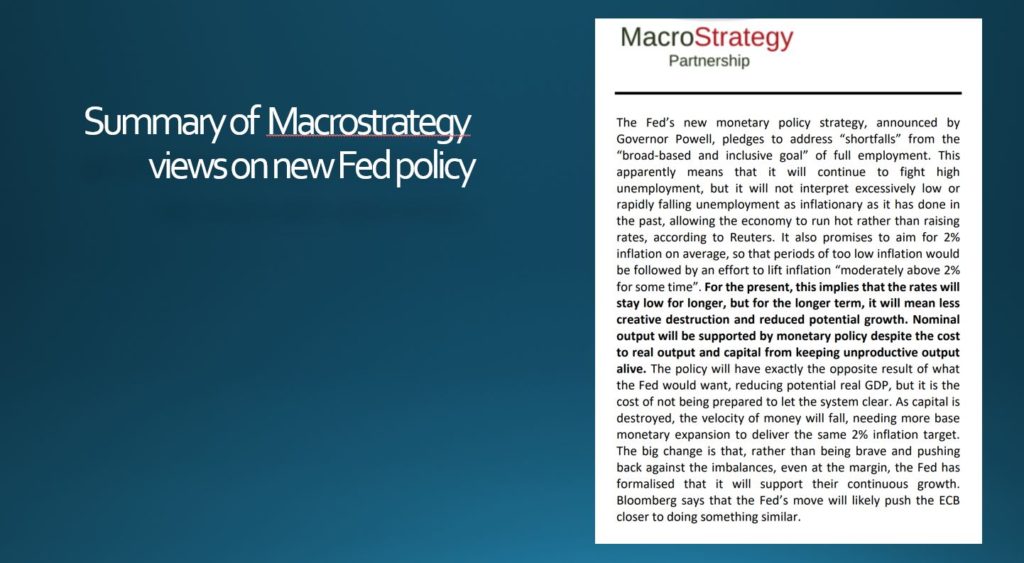

The Wall Street Journal referred to a “a milestone” – “a major shift in how [the Fed] sets interest rates by dropping its longstanding practice of preemptively lifting them to head off higher inflation.” The New York Times went with “a major shift in how the central bank guides the economy, signaling it will make job growth pre-eminent and will not raise interest rates to guard against coming inflation just because the unemployment rate is low.”

The Financial Times underscored a note from Evercore ISI economists: ‘They view the shift as ‘momentous and risk-friendly’, saying it ‘takes the world’s most important central bank beyond the inflation targeting framework that has dominated global monetary policy for a quarter of a century’.” “A revolutionary change to its monetary policy framework” that “could have profound consequences for the price of pretty much everything,” was how it was viewed by the Financial Review.

August 28 – Australian Financial Review (Christopher Joye): “On Thursday night the world’s most powerful central bank – the US Federal Reserve – ushered in a revolutionary change to its monetary policy framework because it believes it has consistently missed its core consumer price inflation target. This new regime, which will allow the Fed to keep borrowing rates lower for longer, and tolerate periods of what would have been unacceptably high inflation, could have profound consequences for the price of pretty much everything. It also reveals the central bankers’ essential conceit: that they don’t want markets to clear, or asset prices to gravitate to their natural levels, in the absence of extreme policymaking interference.”

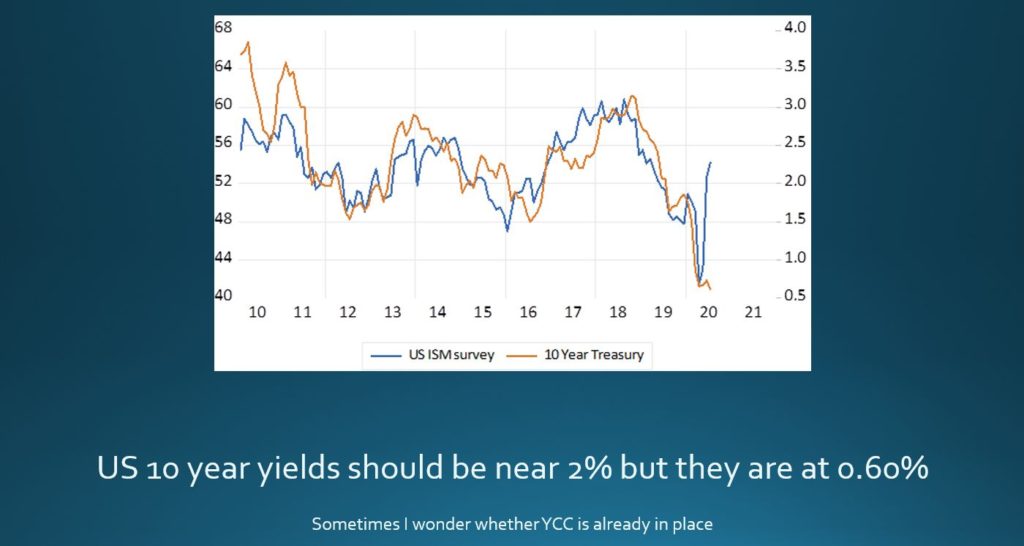

For the most part, equities took Powell’s Jackson Hole speech in stride. Stocks rose – but they pretty much rise whenever markets are trading. Understandably, bonds were a little edgy. Ten-year Treasury yields rose six bps on the announcement to 0.75%, a 10-week high. Investment-grade corporate debt was under notable pressure. The iShares Investment Grade Corporate Bond ETF declined 0.8%, trading to the low since July 1st (down 1.1% for the week).

There is certainly an element of “the emperor has no clothes” in all this. We know from experiences in Japan, the U.S. and elsewhere that central banks don’t control the inflation rate. The shift to an “inflation targeting” regime was ill-conceived from the start. Rather than admit to mistakes, the global central bank community will continue frantically digging ever deeper holes.

Can we at least admit that inflation dynamics have evolved momentously over recent decades? Could we accept that technology innovation has led to a proliferation of new types of products and related services – profoundly boosting supplies of high-tech, digitized and myriad online products? There has also been the seismic shift to services-based output, altering inflation dynamics throughout economies. Moreover, “globalization” – especially the capacity to manufacture endless low-cost technology components and products globally – has fundamentally changed the inflation axiom “too much money chasing too few goods.”

The above noted factors have placed downward pressure on many prices, altering traditional inflation dynamics and rendering conventional analysis invalid. This contemporary “supply” dynamic has worked to offset significant inflationary pressures in other price levels (i.e. healthcare, education, insurance, housing, and many things not easily produced in larger quantities) – putting some downward pressure on consumer price aggregates (i.e. CPI).

Moving beyond the obvious, can we contemplate that ultra-loose monetary policies work to exacerbate many of the dynamics placing downward pressure on consumer price aggregates? Clearly, the historic global technology arms race is a prime beneficiary – but cheap money-induced over-investment impacts many industries (i.e. shale, alternative energy, autonomous vehicles, etc.). I would further argue monetary-policy induced asset price Bubbles are a powerful wealth redistribution mechanism with far-reaching inflationary ramifications (CPI vs. price inflation for yachts, collectable art and such).

Let’s be reminded that central bank monetary management traditionally operated though the banking system, where subtle changes in overnight funding rates influenced lending along with Credit conditions more generally. Central bankers these days continue to expand this momentous policy experiment in using the financial markets as the primary mechanism for administering policy stimulus.

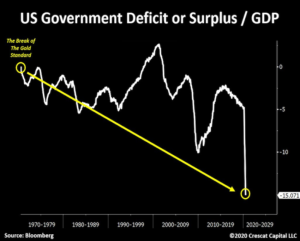

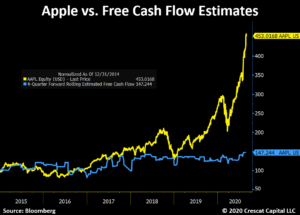

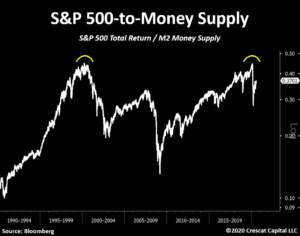

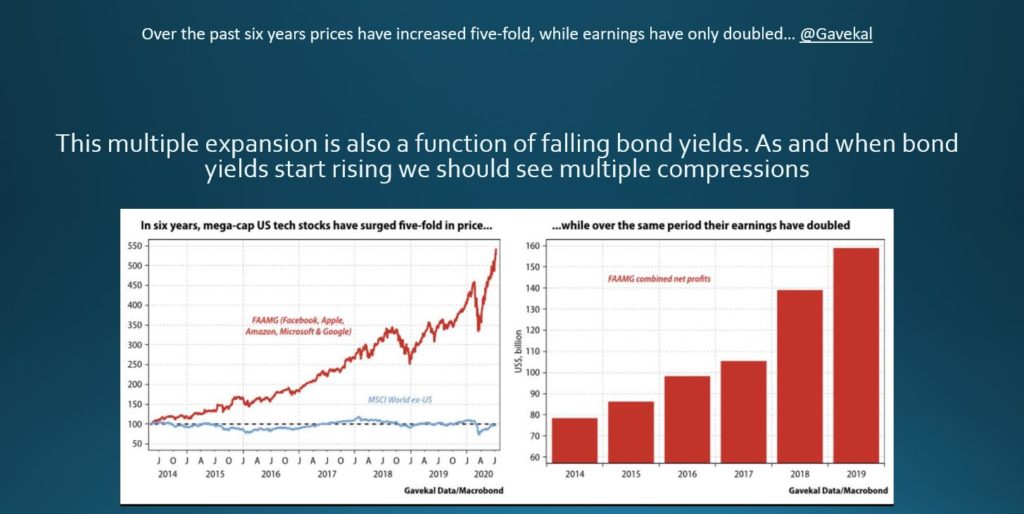

Why is it reasonable to believe that monetary policy specifically aiming to inflate securities markets will somehow simultaneously ensure a corresponding modest increase in consumer prices? It’s not. As we’ve witnessed for years now – and rather dramatically over recent months – such a policy course foremost fuels asset market speculative excess and price Bubbles.

There’s a strong case to be made that this dynamic pulls finance into the securities markets at the expense of more balanced investment spending throughout the general economy. Moreover, increasingly aggressive policy support (i.e. zero rates, QE and other emergency operations) over time exacerbates speculative excess and associated market distortions. As I posited last September when the Fed employed “insurance” rate cuts and QE with markets at all-time highs, it was throwing gas on a fire.

For now, damage wrought to Fed credibility is masked by record equities and bond prices. In the wanting eyes of the marketplace, the “inflation targeting” regime is mere pretense. Bernanke didn’t punt on the Fed’s “exit strategy” due to consumer prices. Below target CPI was not behind Yellen’s postponing policy normalization in the face of strengthening booms in both the markets and real economy. And Powell didn’t abruptly reverse course in December 2018 because of lagging consumer price pressure, just as CPI had nothing to do with last fall’s “insurance” stimulus measures.

Any lingering doubt the Federal Reserve has adopted a regime specifically targeting the securities markets was quashed with the $3 TN liquidity response to March’s downside market dislocation.

It’s tempting to write, “when future historians look back…” My ongoing commitment to weekly contemporaneous analysis of this is extraordinary period is fueled by the proclivity for historical revisionism (and the associated failure to learn from mistakes). Just this week a Financial Times article stated the Fed’s last September stimulus measures were in response to trade war worries – neglecting to mention the decisive role played by late-cycle “repo” market instability.

That said, I do believe skilled analysts will look back and point to the destabilizing impact of prolonged ultra-loose monetary policies stoking speculative finance, distorted asset price Bubbles, and general Monetary Disorder. The fixation on consumer price indices slightly below target in the face of such historic Bubbles will be a challenge to justify.

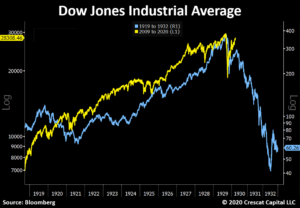

I have argued now for a long time that Bubbles and associated maladjustment are the prevailing risks – not deflation (as argued by conventional economists). And the greater Bubbles inflate the greater the risk of collapse unleashing deflationary outcomes.

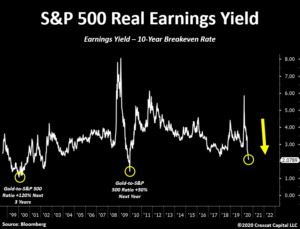

The Fed has been undertaking a policy review for the past year, with the outcome seemingly preordained. But to announce preference for higher prices and tolerance for persistent above-target inflation in the current backdrop is not without risk. At $7.0 TN, the Fed’s balance sheet has ballooned sevenfold in twelve years. A traditionally conservative central banker would never take a cavalier approach with inflation after an almost $3.0 TN six-month increase in M2 “money” supply.

I’m sticking with the view that we’re in the end game to these multi-decade experiments in finance and monetary management. I understand how $3.0 TN in Fed purchases buys some bond market tolerance. But multi-Trillion federal deficits will not be a one-year phenomenon. The Federal Reserve has accommodated a massive expansion of Treasury securities at ridiculously low yields. Does the Fed really believe it could then accommodate rising inflation without a market backlash? Do they appreciate how an unexpected inflationary surge would wreak absolute havoc in highly leveraged markets and economies?

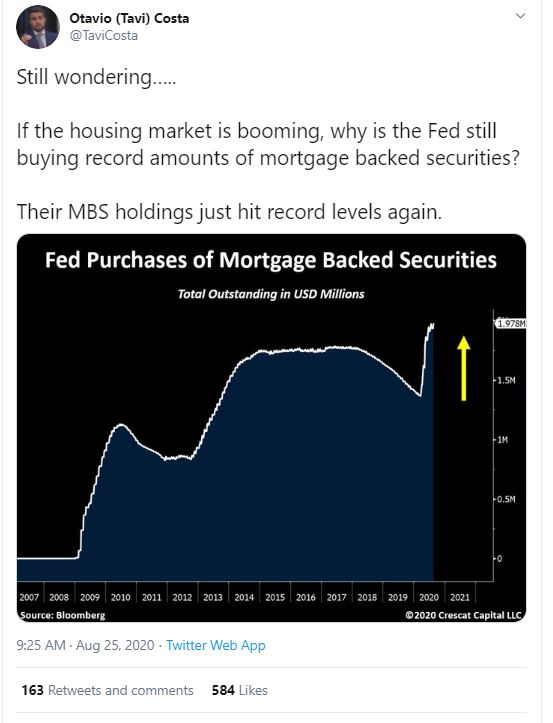

The Treasury yield curve steepened markedly this week. With 30-year Treasury yields jumping 18 bps to an 11-week high 1.50%, the spread to 3-month T-bill yields rose to 141 bps (wide since June 9th). Ten-year Treasury yields rose nine bps this week to 0.72%, with benchmark MBS yields gaining nine bps to 1.44% (6-wk high).

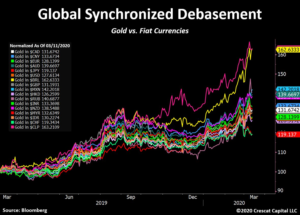

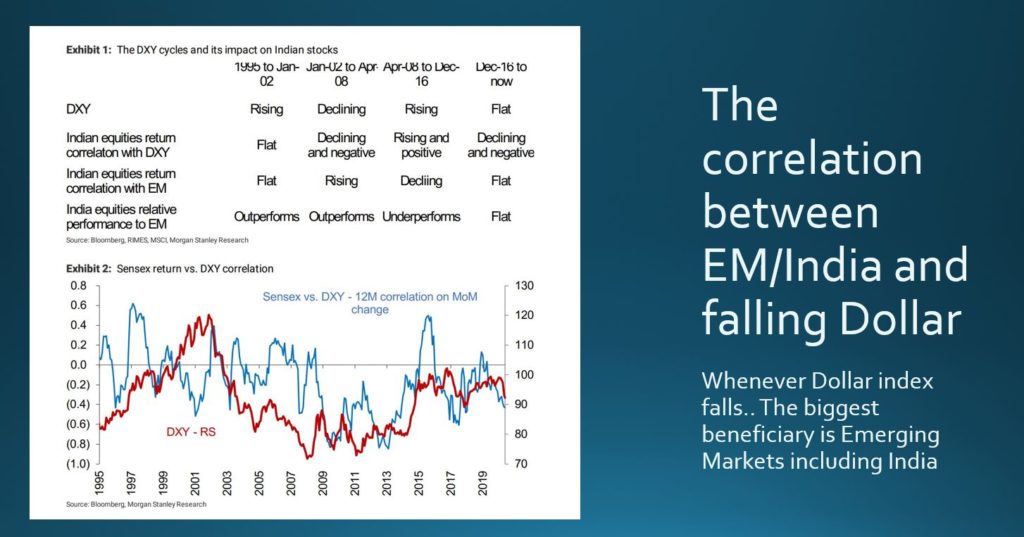

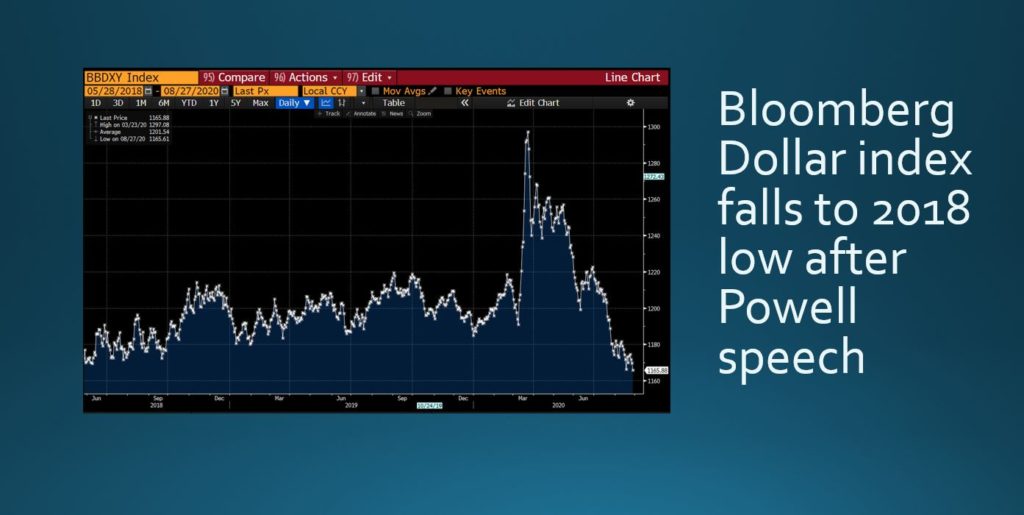

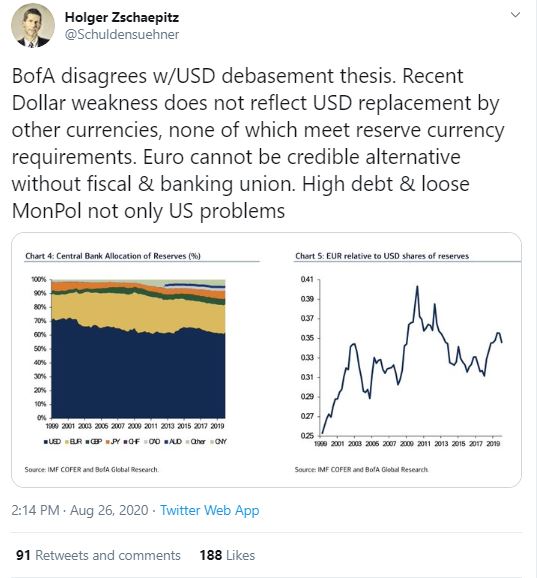

The dollar index declined 0.9%, nearing the low since May 2018. The Bloomberg Commodities Index jumped 2.3% to the highest level since March. Gold increased 1.3%, and Silver jumped 3.4%. Yet gains were notably broad-based. Copper rose 2.9%, Nickel 4.6%, Aluminum 2.0%, Coffee 5.8%, Corn 5.5%, and Wheat 2.6%. WTI Crude gained 1.5%, trading this week at the high since March.

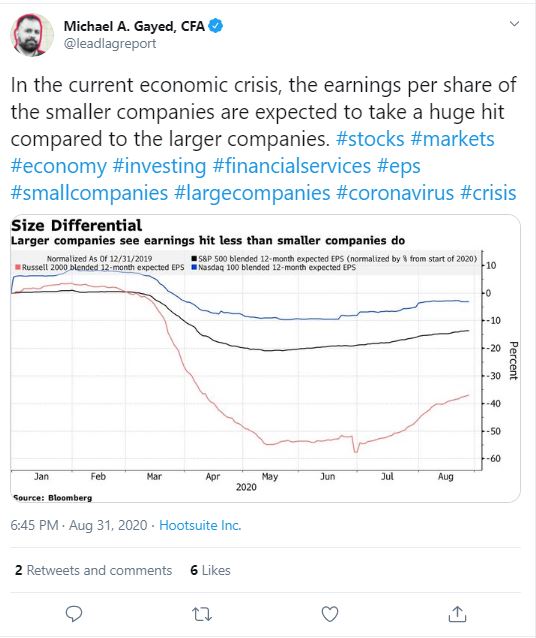

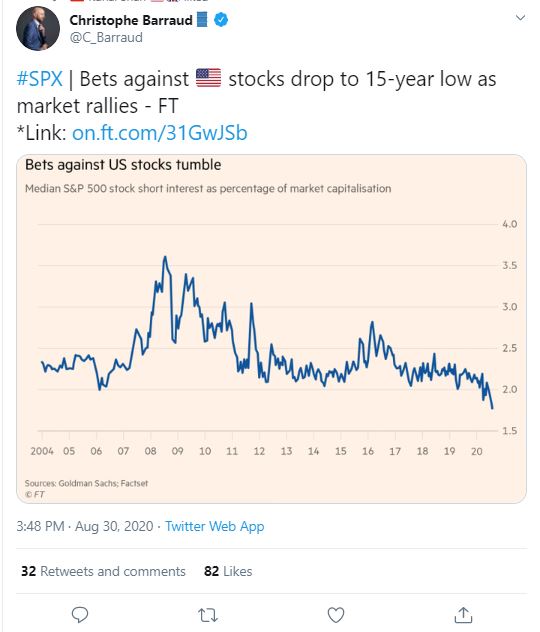

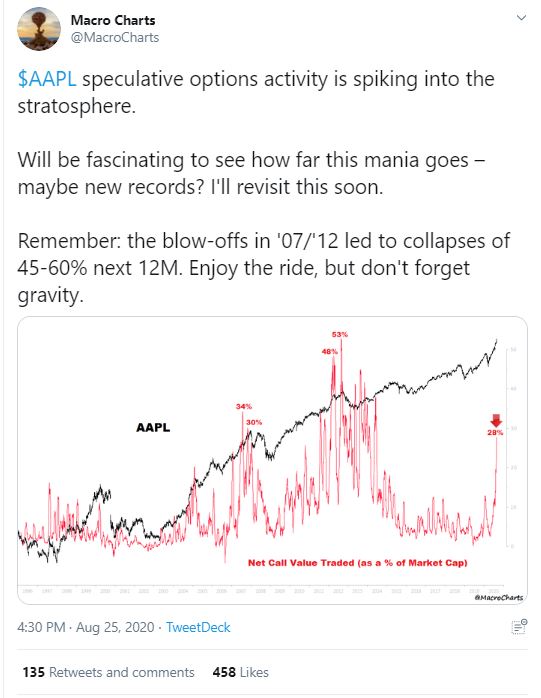

Equities continue to go nuts. The S&P500 gained 3.3% to an all-time high, increasing y-t-d gains to 8.6%. The Nasdaq100 jumped 3.8% to a new record, boosting 2020 gains to 37.4%. It was another brutal short squeeze week, with popularly shorted stocks again outperforming. The Bloomberg Americas Airlines Index surged 14%, and the J.P. Morgan U.S. Travel Index jumped 8.8%. The NYSE Financial Index rose 4.3%, and the NYSE Arca Computer Technology Index advanced 4.2%. Tesla surged another 8%, pushing its market capitalization to $412 billion.

Ludwig von Mises’ “Crack-up Boom.” The Fed’s new “regime” is major, profound, momentous and more. It’s not the least bit surprising – yet it is nonetheless almost unimaginable to actually witness. The Powell Fed has given up – thrown in the towel. They’ve spent a year essentially crafting rationalization and justification in anticipation of doing little more than executing “money printing” operations for years to come. I have argued they’re trapped – and they have apparently come to the same conclusion. Acute fragility associated with speculative Bubbles and egregious leverage now prohibit any effort to unwind recent extraordinary stimulus, not to mention raising rates or tightening monetary conditions in the foreseeable future.

It’s as sad as it is frightening. Despite the lip service, they’ve deserted the overarching financial stability mandate. Speculative Bubbles are free to run wilder. Leverage – speculative, corporate, federal and otherwise – Completely Unhinged.

Listening to Chairman Powell’s speech, my thoughts returned to Secretary of State James Baker approaching the podium to announce the beginning of the first Iraq war: “The war is about jobs, jobs, jobs.” How would the Bush Administration justify an expensive war in the distant Middle East (removing Saddam Hussein from Kuwait) to the American people? I viewed our government in different light from that moment on.

Chairman Powell: “This change reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities… The robust job market was delivering life-changing gains for many individuals, families, and communities, particularly at the lower end of the income spectrum.”

August 28 – Bloomberg (Devon Pendleton): “It’s been one of the most lucrative weeks in history for some of the world’s wealthiest people. The net worth of Amazon.com Inc. founder Jeff Bezos topped the once-unfathomable amount of $200 billion. …Elon Musk added the title of centibillionaire when his fortune soared past $100 billion fueled by Tesla Inc.’s ceaseless rally. And by Friday, the world’s 500 wealthiest people were $209 billion richer than a week ago. Musk’s surging wealth expanded the rarefied club of centibillionaires to four members. Facebook Inc. co-founder Mark Zuckerberg, the world’s third-richest person, joined Bezos and Bill Gates among the ranks of those possessing 12-figure fortunes earlier this month. Together, their wealth totals $540 billion…”

The Fed has capitulated on its financial stability mandate as well as the increasingly grave issue of rapidly widening inequality. The Federal Reserve’s culpability for deleterious wealth inequalities and attendant social strife has been exposed. Trapped by financial Bubbles, the Fed will pay only lip service. Actually, it’s worse: Going forward, the Fed will justify precariously loose monetary policies by pointing to its determination to assist the unfortunate.

The entire Federal Reserve system should carefully ponder Powell’s comments following his Jackson Hole speech: “Public faith in large institutions around the world is under pressure. Institutions like the Fed have to aggressively seek transparency and accountability to preserve our democratic legitimacy.”

Bloomberg’s Lisa Abramowicz: “We are getting inflation in certain areas… Certainly asset prices have gotten incredibly inflated and continue to do so on the promise that the Fed will keep rates low. How concerning is this? At what point does this have to make the Fed take stock and raise rates?”

Former New York Fed President Bill Dudley: “I think they are a little bit uncomfortable with the fact that asset prices are so buoyant. But remember that is partly by design. The Fed basically did what they did in March, April, May to try to make monetary policy easy and financial conditions accommodative. And they succeeded. Now as the stock market keeps going up and up and up, that will cause some anxiety about the Fed. But remember, stock markets go up – stock markets go down. The consequences for financial stability have historically actually been pretty modest. We had the stock market crash in 1987. Lots of economists anticipated there’d be a recession. There was no recession. So, I think buoyancy in the stock market is probably less risky to the economy because there’s not a lot of people that use a lot of leverage to own stocks.”

Earth to Dudley: We’re today confronting a deviant financial structure unrecognizable to that from 1987. Have you already forgotten March’s near global financial meltdown? Why did a panicked Fed expand its balance sheet by an unprecedented $3 TN? Why has it capitulated and basically signaled to highly speculative markets that they are committed to looking the other way and just letting things run their course?

I could, once again, invoke the timeworn punch bowl analogy (spiked and overflowing endlessly). It no longer does justice. I was thinking instead of late on Halloween evening when it’s easiest to just fill the big bowl with candies and leave distribution to the trick or treaters. Yet most kids act responsibility, snagging one treat (OK, maybe a couple) and leaving the rest for their fellow treaters. But the thought came to mind of offering a huge bowl filled to the brim with five-dollar bills, with the instruction “Only One Per Family.” It’s a superior metaphor for the Fed’s chosen course – but with the inviting note: “Help Yourself. First Come, First Serve – We’ll Fill the Bowl Whenever It’s Empty.”

For the Week:

The S&P500 jumped 3.3% (up 8.6% y-t-d), and the Dow rose 2.6% (up 0.4%). The Utilities declined 0.6% (down 7.8%). The Banks surged 5.6% (down 30.9%), and the Broker/Dealers gained 2.7% (up 2.3%). The Transports jumped 3.5% (up 3.9%). The S&P 400 Midcaps rose 1.9% (down 5.6%), and the small cap Russell 2000 gained 1.7% (down 5.4%). The Nasdaq100 advanced 3.8% (up 37.4%). The Semiconductors rose 3.0% (up 22.4%). The Biotechs slipped 0.4% (up 22.4%). With bullion rallying $24, the HUI gold index jumped 3.5% (up 44.1%).

Three-month Treasury bill rates ended the week at 0.095%. Two-year government yields declined two bps to 0.13% (down 144bps y-t-d). Five-year T-note yields added a basis point to 0.27% (down 142bps). Ten-year Treasury yields rose nine bps to 0.72% (down 119bps). Long bond yields surged 18 bps to 1.50% (down 89bps). Benchmark Fannie Mae MBS yields gained nine bps to 1.44% (down 128bps).

Greek 10-year yields increased a basis point to 1.09% (down 34bps y-t-d). Ten-year Portuguese yields rose seven bps to 0.40% (down 4bps). Italian 10-year yields jumped 10 bps to 1.04% (down 37bps). Spain’s 10-year yields gained eight bps to 0.38% (down 9bps). German bund yields jumped 10 bps to negative 0.41% (down 22bps). French yields gained nine bps to negative 0.11% (down 37bps). The French to German 10-year bond spread narrowed one to 30 bps. U.K. 10-year gilt yields jumped 11 bps to 0.31% (down 51bps). U.K.’s FTSE equities index slipped 0.6% (down 20.9%).

Japan’s Nikkei Equities Index dipped 0.2% (down 3.3% y-t-d). Japanese 10-year “JGB” yields gained three bps to 0.06% (up 7bps y-t-d). France’s CAC40 rose 2.2% (down 16.3%). The German DAX equities index gained 2.1% (down 1.6%). Spain’s IBEX 35 equities index advanced 2.2% (down 25.3%). Italy’s FTSE MIB index increased 0.7% (down 15.7%). EM equities were mixed. Brazil’s Bovespa index gained 0.6% (down 11.7%), while Mexico’s Bolsa declined 0.8% (down 13.2%). South Korea’s Kospi index rose 2.1% (up 7.1%). India’s Sensex equities index jumped 2.7% (down 4.3%). China’s Shanghai Exchange added 0.7% (up 11.6%). Turkey’s Borsa Istanbul National 100 index declined 0.8% (down 3.8%). Russia’s MICEX equities index dipped 0.5% (down 2.2%).

Investment-grade bond funds saw inflows of $6.029 billion, and junk bond funds posted positive flows of $1.392 billion (from Lipper).

Freddie Mac 30-year fixed mortgage rates dropped eight bps to 2.91% (down 67bps y-o-y). Fifteen-year rates fell eight bps to 2.46% (down 60bps). Five-year hybrid ARM rates were unchanged at 2.91% (down 40bps). Bankrate’s survey of jumbo mortgage borrowing costs had 30-year fixed rates up six bps to 3.11% (down 109bps).

Federal Reserve Credit last week expanded $10.0bn to $6.975 TN. Over the past year, Fed Credit expanded $3.251 TN, or 87%. Fed Credit inflated $4.164 Trillion, or 148%, over the past 407 weeks. Elsewhere, Fed holdings for foreign owners of Treasury, Agency Debt last week declined $4.1bn to $3.413 TN. “Custody holdings” were down $62.0bn, or 1.8%, y-o-y.

M2 (narrow) “money” supply jumped $46.6bn last week to a record $18.449 TN, with an unprecedented 25-week gain of $2.941 TN. “Narrow money” surged $3.533 TN, or 23.7%, over the past year. For the week, Currency increased $6.3bn. Total Checkable Deposits dropped $80.8bn, while Savings Deposits surged $126bn. Small Time Deposits fell $5.6bn. Retail Money Funds were little changed.

Total money market fund assets declined $4.1bn to $4.540 TN. Total money funds surged $1.176 TN y-o-y, or 35.0%.

Total Commercial Paper rose $4.9bn to $1.012 TN. CP was down $109bn, or 9.7% year-over-year.

Currency Watch:

For the week, the U.S. dollar index declined 0.9% to 92.371 (down 4.3% y-t-d). For the week on the upside, the Brazilian real increased 4.3%, the South African rand 3.4%, the New Zealand dollar 3.1%, the Australian dollar 2.9%, the British pound 2.0%, the Swedish krona 2.0%, the Norwegian krone 1.9%, the Singapore dollar 1.0%, the Mexican peso 1.0%, the euro 0.9%, the Swiss franc 0.8%, the Canadian dollar 0.6%, the Japanese yen 0.4% and the South Korean won 0.2%.

Commodities Watch:

The Bloomberg Commodities Index jumped 2.3% (down 9.6% y-t-d). Spot Gold rose 1.3% to $1,965 (up 29.4%). Silver surged 3.4% to $27.79 (up 55.1%). WTI crude gained 63 cents to $42.97 (down 30%). Gasoline rose 2.4% (down 22%), and Natural Gas surged 8.5% (up 21%). Copper jumped 2.9% (up 8%). Wheat rose 2.6% (down 2%). Corn surged 5.5% (down 7%).

Coronavirus Watch:

August 28 – Bloomberg (Riley Griffin and Jeannie Baumann): “A U.S. health official said Friday that hundreds of thousands of doses of coronavirus vaccines have already been manufactured in hopes that at least one of the candidates might succeed in clinical trials. The Trump administration’s ‘Operation Warp Speed’ program has reached agreements for eight coronavirus vaccine candidates that are in various stages of development, none of which have yet been approved or authorized for use.”

Market Instability Watch:

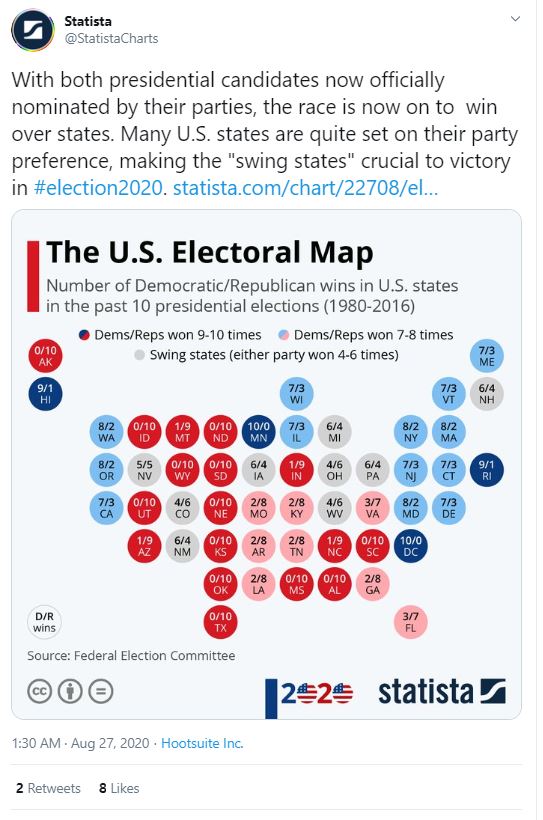

August 28 – Bloomberg (Katherine Greifeld and Liz McCormick): “Traders across major asset classes are sending the same message: Prepare for what could be the most-contentious U.S. presidential elections in decades. One measure of hedging in the stock market is higher than at any point in the past three presidential elections. In the interest-rates market, implied volatility is well above levels reached in 2016 or 2012. And three-month implied volatility in the dollar-yen pair — a classic haven trade — has risen above the two-month tenor by the most in two decades, signaling demand for protection from turbulence near Election Day. Trades protecting against election-induced volatility have been around all year, with ‘unprecedented’ levels of hedging seen as early as January.”

August 27 – Reuters (Tom Arnold and Karin Strohecker): “Reserves are running out for several emerging markets as governments from Belize to Zambia use up their financial firepower to fight the coronavirus crisis. The problem is particularly acute for those burning through reserves to tackle additional challenges, from sliding economies to a shortfall in commodity or oil revenues. Among the larger emerging markets, Turkey stands out, having seen its gross foreign exchange reserves nearly halve this year as it sought to defend its currency. But it is the smaller and riskier developing economies – so-called frontier markets – that are feeling the heat most…”

August 23 – Bloomberg (Marcus Wong and Livia Yap): “If the recent spike up in U.S. inflation numbers is a sign of things to come for global markets, that could prove especially bad news for investors in Indian, Russian and Mexican bonds. The fixed-income securities of the three countries appear the most vulnerable to any surge in consumer prices, according to a Bloomberg study of 10 emerging markets. Their real bond yields — those adjusted for inflation — are the lowest in the group versus their three-year average.”

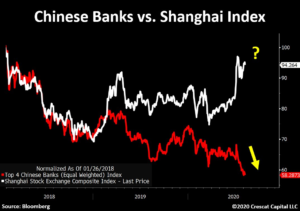

August 27 – Bloomberg: “As a wave of global liquidity pushes assets ever higher, in China the opposite is occurring. Borrowing costs in the world’s second-largest economy are spiking, driving down bonds and stocks, as the central bank holds back on aggressive easing. While the People’s Bank of China has stepped up actions to mitigate the liquidity shortage, injecting the most funds this month since January, that’s done little to alleviate the relative drought. A gauge of interbank borrowing costs is close to a six-month high and an indicator of liquidity tightness in the foreign-exchange market has touched its highest level since 2017. The yield on 10-year government debt is above 3%, approaching a record gap with Treasuries…”

August 24 – Bloomberg (Joanna Ossinger): “Investors can no longer rely on bonds to help mitigate equity risk because the relationship between assets has broken down, according to Credit Suisse… The 21-day correlation between the S&P 500 Index and 10-year Treasury yield turned negative on Aug. 21, after having been at nearly 0.80 in mid-July. ‘The breakdown in that correlation, alongside record low rate volatility, suggests bonds are no longer an effective diversifier of equity risk,’ Mandy Xu, derivatives strategist, wrote… ‘We recommend investors look at equity-specific hedges instead, especially with the normalization in equity volatility.’”

August 23 – Wall Street Journal (Paul Vigna): “The price/earnings ratio on the S&P 500, measured against the past 12 months of earnings, stands at 25.26, according to FactSet. That is the highest level since 2002. The forward P/E, measured against earnings expectations for the next year, is at 25.98—a mark last hit in September 2000. And the valuation of the median stock in the S&P 500, measured by forward P/E, is now in the 100th percentile of historical levels, according to Goldman Sachs…, going back four decades—the highest level possible. The index itself is trading at the 98th percentile.”

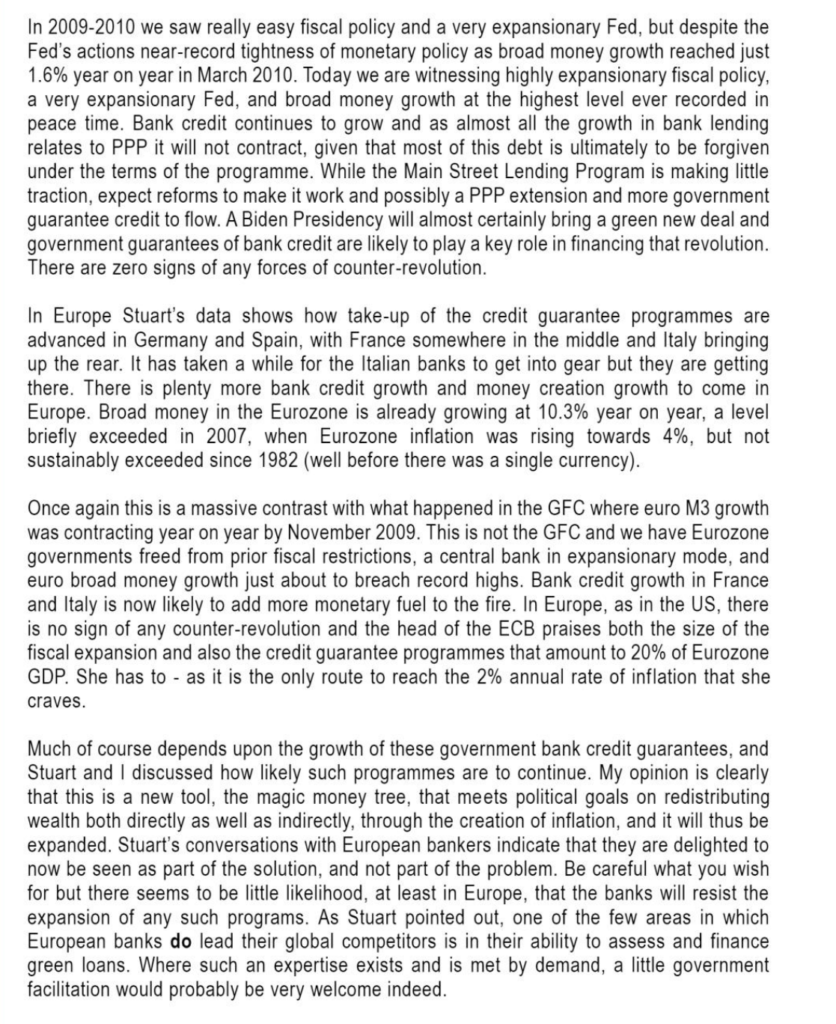

August 24 – Bloomberg (Alan Mirabella): “The Federal Reserve has created a speculative bubble that has pushed debt levels beyond what the U.S. economy can support, Leon Cooperman said. ‘They have created a real speculative environment,’ Cooperman said… ‘I am uncomfortable at the present time, not because of the virus, because I’m focused on something the market isn’t focused on. And that is the amount of debt that’s being created. Who pays for the party when the party is over?’ It took the U.S. ‘244 years to go from zero national debt to $21 trillion,’ he said. ‘We will probably end this year with $27 trillion. That’s a growth rate in debt far in excess of what the economy is growing at and I think that’s going to be a problem down the road.’”

Global Bubble Watch:

August 25 – Bloomberg (Zoe Schneeweiss): “Global trade surged in June as governments started to reopen their economies from strict lockdowns earlier in the year. There was growth in almost all countries, according to CPB World Trade Monitor, after huge declines in the previous three months. Even after the 7.6% jump in June, trade was down 12.5% in the second quarter, with the headline index at the lowest since 2014.”

August 26 – Bloomberg (Björn van Roye): “Economic activity fell faster and deeper in emerging markets than in advanced economies as the Covid-19 shock hit, and the recovery is proving slower and shallower. Activity in emerging markets excluding China remained 33% below the pre-virus level at the end of August, according to Bloomberg Economics gauges that integrate high-frequency data such as credit-card use, travel and location information. China, Russia, Turkey and Brazil have made the most progress, while the rate of recovery in major Latin American countries — particularly in Argentina and Colombia — has been much slower and has recently declined further.”

August 24 – Reuters (Scott Murdoch and Patturaja Murugaboopathy): “Companies raised the most funds in global equity and debt markets for the month of August in a decade as homebound bankers spend their summer fixing deals off the back of trillions of dollars of stimulus worldwide to fight the coronavirus pandemic. Companies have raised $65.5 billion through initial public offerings (IPOs) and high-yield bond issuances globally so far in August, the highest for that month in at least 10 years, according to Refinitiv… They raised $98.6 billion in July and $126.5 billion in June, which was the highest in 20 years. It comes as governments and central banks have made at least $15 trillion of stimulus available to help economies withstand the fallout of the coronavirus pandemic.”

August 23 – Reuters (Marc Jones): “The coronavirus crisis will see the world’s biggest firms slash dividend payouts between 17%-23% this year or what could be as much as $400 billion, a new report has shown, although sectors such as tech are fighting the trend. Global dividend payments plunged $108 billion to $382 billion in the second quarter of the year, fund manager Janus Henderson has calculated, equating to a 22% year-on-year drop which will be the worst since at least 2009.”

Trump Administration Watch:

August 26 – Reuters (Susan Heavey, Idrees Ali, Daphne Psaledakis, Raphael Satter and David Brunnstrom): “The United States… blacklisted 24 Chinese companies and targeted individuals it said were part of construction and military actions in the South China Sea, its first such sanctions move against Beijing over the disputed strategic waterway. The U.S. Commerce Department said the two dozen companies played a ‘role in helping the Chinese military construct and militarize the internationally condemned artificial islands in the South China Sea.’ Separately, the State Department said it would impose visa restrictions on Chinese individuals ‘responsible for, or complicit in,’ such action and those linked to China’s ‘use of coercion against Southeast Asian claimants to inhibit their access to offshore resources.’”

August 26 – Wall Street Journal (Kate O’Keeffe and Chun Han Wong): “The U.S. unveiled a set of visa and export restrictions targeting Chinese state-owned companies and their executives involved in advancing Beijing’s territorial claims in the contested South China Sea, a new challenge to China involving the strategic waters. Wednesday’s actions by the State and Commerce departments apply to a range of state-owned enterprises, including units of China Communications Construction Co., a leading contractor for Chinese leader Xi Jinping’s Belt and Road initiative to develop infrastructure and trade links across Asia, Africa and beyond. The U.S. added 24 Chinese companies active in the South China Sea… to a Commerce Department list that restricts American companies from supplying U.S.-origin technology to them without a license.”

August 26 – Reuters (Richard Cowan and Bhargav Acharya): “Republicans in the U.S. Congress are working on a narrow coronavirus stimulus bill that could be circulated to rank-and-file lawmakers as soon as this week… For weeks now, Republicans and Democrats have been deadlocked over the size and shape of a fifth coronavirus-response bill, on top of the approximately $3 trillion already enacted into law.”

August 24 – Bloomberg (James Clark): “As the U.S. Treasury Department’s Deputy Assistant Secretary for Federal Finance during the Obama administration, I spent a lot of time talking to the major buyers of our nation’s debt. When I left my job overseeing the government’s finances in 2017, the unpaid tab for the first 240 years of the ‘American Experiment’ was $20 trillion. In less than four years, that number has risen to $26.5 trillion, the result of essential outlays on pandemic relief and completely non-essential tax cuts for the wealthy.”

Federal Reserve Watch:

August 26 – Bloomberg (Steve Matthews): “Federal Reserve Bank of Kansas City President Esther George, who has been among the most hawkish Fed policy makers, doesn’t oppose some overshooting of the central bank’s 2% inflation target and sees more risk of price pressures being too weak than too strong. ‘I have never thought of 2% as a ceiling but to really stay focused on what anchors inflation expectations in the economy,’ George said… ‘From a communications standpoint, I think we will be talking about the kinds of things that help us do a better job of achieving our objectives.’”

August 26 – Wall Street Journal (Greg Ip): “In a much-anticipated speech this week, Federal Reserve Chairman Jerome Powell is expected to lay out a new framework for meeting its often-elusive goal of 2% inflation. When he’s done, he should keep his jacket on, because a proliferation of other missions await. Full employment and low inflation are no longer enough. In recent years the Fed has been asked to prevent financial crises, shrink the trade deficit, tackle climate change and, now, eliminate racial economic disparities. Mission creep poses real risks. The Fed is being asked to meet goals for which its tools are poorly suited and often in conflict.”

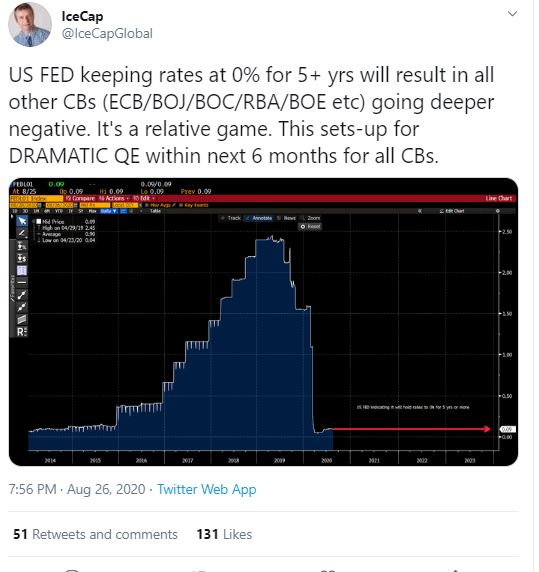

August 26 – Bloomberg (Rich Miller): “The Federal Reserve looks likely to keep short-term interest rates near zero for five years or possibly more after it adopts a new strategy for carrying out monetary policy. The new approach… is likely to result in policy makers taking a more relaxed view toward inflation, even to the point of welcoming a modest, temporary rise above their 2% target to make up for past shortfalls… ‘I wouldn’t be surprised if interest rates are still zero five years from now,’ said Jason Furman, a former chief White House economist and now Harvard University professor.”

U.S. Bubble Watch:

August 25 – Associated Press (Martin Crutsinger): “U.S. consumer confidence fell for the second consecutive month, sinking to the lowest levels in more than six years as a resurgence of COVID-19 infections in many parts of the country heightened pessimism. The Conference Board… reported… its Consumer Confidence Index declined to a reading of 84.8 in August, the lowest level since May 2014. The drop, which followed a July decline to 91.7, put the index 36% below its high point for the year reached in February… ‘Consumer confidence has now taken two steps back after one giant step forward in June,’ said Jim Baird, chief investment officer at Plante Moran Financial Adisors. ‘Initial hopes for a faster return to a pre-pandemic normal have faded.’”

August 27 – CNBC (Fred Imbert): “The number of Americans who filed for unemployment benefits for the first time came in above 1 million for the 22nd time in 23 weeks as the economy struggles to recover from the coronavirus pandemic… Initial U.S. jobless claims totaled just over 1 million for the week ending Aug. 22, down from 1.104 million in the previous week… Continuing claims… fell by 223,000 to 14.535 million for the week ending Aug. 15.”

August 25 – Bloomberg (Prashant Gopal): “New-home sales in the U.S. jumped to the highest level in almost 14 years in July as low mortgage rates helped fuel a suburban construction boom. Purchases of new single-family houses climbed 13.9% from June to a 901,000 annualized pace from an upwardly revised 791,000… The median forecast… called for a 790,000 rate of sales. The median selling price rose 7.2% from a year earlier to $330,600… ‘It has been a rocket ship up since May,’ said Rick Palacios, director of research at John Burns Real Estate Consulting… ‘Demand is insatiable right now.’”

August 25 – CNBC (Diana Olick): “Home prices rose 4.3% annually in June, unchanged from the gain seen in May, according to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index… The 10-City Composite increased 2.8% annually, down from 3% in the previous month. The 20-City Composite rose 3.5% year over year, down from 3.6% in the previous month.”

August 25 – CNBC (Kevin Stankiewicz): “Global investor Barry Sternlicht told CNBC… he believes masses of people are moving away from major U.S. cities in favor of the suburbs. ‘There’s hundreds of thousands of people looking for suburban homes, and I would say it’s not as driven by the Covid situation as it is safety and law and order, and that is now pervasive across the big cities of the United States, sadly,’ Sternlicht said…”

August 24 – Bloomberg (Ben Holland, Enda Curran, Vivien Lou Chen and Kyoungwha Kim): “There’s hardly any question that carries greater weight in economics right now, or divides the financial world more sharply, than whether inflation is on the way back. One camp is convinced that the no-expense-spared fight against Covid-19 has put developed economies on course for rising prices on a scale they haven’t seen in decades. The other one says the virus is exacerbating the conditions of the past dozen years or so — when deflation, rather than overheating, has been the big threat. The debate touches every area of policy, from trade rivalries to unemployment benefits, and everyone has an interest in the outcome. Governments and central banks may face pressure to curtail their pandemic relief efforts, already worth some $20 trillion according to Bank of America, if they trigger a spike in prices. Workers and consumers will see the impact in wage packets and household bills. More than $40 trillion of retirement savings is at risk of erosion if inflation returns.”

August 22 – Financial Times (Chris Flood): “Coronavirus, disappointing investment returns and declining interest rates, pose a triple threat to the health of the US public pension system, which is haemorrhaging cash and heading for a record funding shortfall. The total funding gap for the 143 largest US public pensions plans is on track to reach $1.62tn this year, significantly higher than the $1.16tn recorded in 2009 in the aftermath of the global financial crisis, according to Equable Institute… The weak financial condition of the US public pension systems poses severe risks for the living standards of millions of employees and retired workers.”

August 25 – Reuters (Pete Schroeder): “U.S. bank profits were down 70% from a year prior in the second quarter of 2020 on continued economic uncertainty driven by the coronavirus pandemic… Bank profits remained small as firms build up cushions to guard against future losses and business and consumer activity dropped, according to the Federal Deposit Insurance Corporation. Bank deposits climbed by over $1 trillion for the second straight quarter, and the regulator said the industry has ‘very strong” capital and liquidity levels.’”

August 26 – Reuters (Tom Wilson): “It sounds like a surefire bet. You lend money to a borrower who puts up collateral that exceeds the size of the loan, and then you earn interest of about 20%. What could possibly go wrong? That’s the proposition presented by ‘DeFi’, or decentralised finance, peer-to-peer cryptocurrency platforms that allow lenders and borrowers to transact without the traditional gatekeepers of loans: banks. And it has exploded during the COVID-19 crisis. Loans on such platforms have risen more than seven-fold since March to $3.7 billion…”

August 25 – Associated Press (Don Thompson and Haven Daley): “California’s firefighting agency is in talks with the National Guard and California Conservation Corps about providing reinforcements as an already devastating wildfire season threatens to get even worse… ‘Historically it’s September and October when we experience our largest and our most damaging wildfires. So to be in the middle of August and already have the second- and the third-largest wildfires in our state’s history is very concerning to us,’ Daniel Berlant, chief of wildfire planning and engineering at the California Department of Forestry and Fire Protection, said…”

August 23 – Wall Street Journal (Jimmy Vielkind and Katie Honan): “New York City faces a $9 billion deficit over the next two years, high levels of unemployment and the prospect of laying off 22,000 government workers if new revenue or savings aren’t found in the coming weeks. The growing economic crisis, brought on by the coronavirus pandemic, has alarmed New York Gov. Andrew Cuomo so much that he recently asserted greater control over a panel overseeing the finances of the nation’s largest city. Earlier this summer, Mr. Cuomo appointed three close allies to the New York State Financial Control Board. The board played a prominent role during the city’s last fiscal crisis in the 1970s, when it wielded broad legal power over the city’s budget and made difficult spending decisions.”

Fixed Income Watch:

August 24 – Bloomberg (John Gittelsohn): “Some of the largest real estate investors are walking away from debt on bad property deals, even as they raise billions of dollars for new opportunities borne of the pandemic. The willingness of Brookfield Property Partners LP, Starwood Capital Group, Colony Capital Inc. and Blackstone Group Inc. to skip payments on commercial mortgage-backed securities backed by hotels and malls illustrates how the economic fallout from the coronavirus has devalued some real estate while also creating new targets for these cash-loaded investors. ‘Just because a prior investment didn’t work out doesn’t necessarily mean that should tarnish the reputation for future endeavors,’ said Alan Todd, head of U.S. CMBS research for Bank of America Securities. ‘It’s not like something was done in bad faith.’”

August 26 – Bloomberg (John Gittelsohn): “U.S. commercial real estate prices are falling as the economic toll of the Covid-19 pandemic worsens — and the decline is just getting started. Indexes for office, retail and lodging properties all slipped year-over-year in July, data from… Real Capital Analytics Inc. show. Transaction volume plummeted to $14 billion across all sectors, down 69% from July 2019. ‘The worst is yet to come,’ Real Capital Senior Vice President Jim Costello said… ‘We’re not seeing the fallout yet of owners selling properties and taking a loss.’”

August 25 – Bloomberg (John Gittelsohn): “More than $54.3 billion in U.S. commercial mortgage backed securities have been transfered to loan workout specialists mostly because of payment delinquencies, a 320% increase since the start of the Covid-19 pandemic, according to Moody’s… Hotel and retail properties, the sectors hit hardest by restrictions on travel and public gatherings to reduce virus transmissions, make up the vast majority of the debt transferred to special servicers… The rate of severely delinquent loans — more than 121 days late — nearly tripled in August, jumping to 2.3% from 0.8% in July.”

China Watch:

August 25 – Reuters (Meg Shen, Ben Blanchard and Idrees Ali): “China has lodged ‘stern representations’ with the United States, accusing it of sending a U.S. U-2 reconnaissance plane into a no-fly zone over Chinese live-fire military drills…, further ratcheting up tensions between Beijing and Washington. China has long denounced U.S. surveillance activities, while the United States has complained of ‘unsafe’ intercepts by Chinese aircraft… China’s Defence Ministry said the U-2 flew without permission over a no-fly zone in the northern military region where live fire drills were taking place, ‘seriously interfering in normal exercise activities’.”

August 24 – Reuters (Roxanne Liu and Tony Munroe): “China said… it agreed with the United States to continue pushing forward the implementation of the bilateral Phase 1 trade deal reached earlier this year during a call between the two countries’ top trade negotiators. Vice Premier Liu He spoke with U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin… The two sides had constructive talks on the trade deal and strengthening macroeconomic policy coordination, the ministry said.”

August 23 – Bloomberg: “China’s fragile economic recovery is ushering in a dangerous new phase for the nation’s $4.1 trillion corporate bond market. With the economy now strong enough for policy makers to dial back financial support but still too weak to save the most distressed borrowers, some fund managers are bracing for defaults on domestic Chinese debt to hit record highs this year. Delinquencies have already started rising after a remarkably quiet second quarter, and pressure on borrowers is set to grow as 3.65 trillion yuan ($529bn) of notes mature by year-end.”

August 25 – Financial Times (Christian Shepherd): “An intensifying purge of disloyal Chinese Communist party law and order officials is setting the stage for President Xi Jinping to become party chairman and hold on to power beyond his second term, experts have warned. The anti-corruption campaign launched last month to target the party’s legal and domestic security apparatus kicked into a higher gear last week when the Central Commission for Discipline Inspection announced a probe into Gong Daoan, the Shanghai police chief and the highest-ranking official to fall since Mr Xi’s second term began in 2017. Officials have signalled the importance of the campaign by insisting it must channel the spirit of the ‘Yan’an rectification movement’ launched by Mao Zedong in 1941, the first big purge in the party’s history. “

August 24 – Wall Street Journal (Xie Yu and Mike Bird): “Financial stress at an upmarket developer is rattling Chinese families who paid big deposits for unbuilt homes—showing the risks in presales, one of the sector’s favorite funding tools in China. China’s real-estate firms have grown more reliant on customer down-payments as authorities have curbed access to other kinds of credit. In many cases, clients pay the full price for their home before it is built, handing over a lump sum and borrowing the rest from the bank, and the developer uses the cash as general funding for operations.”

August 24 – Bloomberg (Manuel Baigorri): “Chinese buyers have not only stopped snapping up iconic overseas assets, the coronavirus pandemic is ravaging the targets of deals that defined a headier era. Whereas some prolific acquirers such as HNA Group Co. and Anbang Insurance Group Co. began falling into disarray before the recent crisis, the impact on investments in sectors hit hardest by the outbreak means healthier owners are now feeling the pain. Conglomerate Fosun International Ltd. could soon see its 2015 investment in Cirque du Soleil Entertainment Group wiped out… Baggage handler Swissport International AG is also negotiating with investors over a rescue that could see HNA exit the cash-strapped firm it bought in 2015… At $15.1 billion, the volume of Chinese outbound M&A so far this year represents a 25% drop from a year earlier and a far cry from the peak in 2016…”

August 24 – Bloomberg: “China’s mega banks are ramping up their recruitment of fresh graduates as a record number enter the labor market, joining other state-owned firms in boosting employment even as lenders deal with plunging earnings and ballooning bad debt.”

EM Watch:

August 26 – Reuters (Anthony Esposito and Miguel Angel Gutierrez): “Mexico’s economy could contract by almost 13% this year, the central bank warned…, after GDP data showed the pandemic lockdown had thrown the country into the deepest slump since the Great Depression… Gross domestic product fell 17.1% in seasonally adjusted terms in the April-June period from the prior quarter…”

August 27 – Financial Times (Bryan Harris): “Brazil’s government is under increasing pressure to loosen or lift a constitutionally mandated spending cap, alarming investors who fear a sharp deterioration in the country’s fiscal position. Since its creation in 2016, the spending cap has been a fiscal anchor for Latin America’s largest economy. But it is under attack from forces both inside and outside the government, which want to spend in order to boost the economy, or Mr Bolsonaro’s popularity. The debate has spooked the country’s business community, which fears a looming fiscal crisis would trigger an exodus from Brazilian assets, weaken the exchange rate, spur inflation and generate instability.”

August 24 – Financial Times (Michael Stott): “Brazil and Mexico are leading Latin America out of a deep coronavirus-induced slump but chronic economic weaknesses will keep the region as the worst performer in the developing world. Latin America has been the global epicentre of the pandemic since early June, accounting for more than 40% of the world’s new Covid-19 deaths despite having only 8% of the population. The scale of the crisis has dealt a huge blow to already sickly economies. While Brazil and Mexico took a more laissez-faire approach to coronavirus, most of Latin America’s other economies were crippled by strict lockdowns lasting far longer than those in Europe or Asia.”

August 26 – Financial Times (Jonathan Wheatley): “Just like other risky assets around the world, emerging market bond and equity prices have snapped back into shape since the huge crisis-fighting injection of liquidity from the US and eurozone central banks in March. EM economies are likely to be hardest hit by the pandemic, but on aggregate, asset prices are close to the levels they held before the panic selling set in. ‘If you look at the fundamentals of many EMs and then look at the yields, you have to say something doesn’t add up,’ said Claudio Irigoyen, economist and fixed-income strategist at Bank of America… ‘For that to make sense, you have to add in that the [US Federal Reserve] and the European Central Bank are the buyers of last resort of all risky assets and [rely on] the perception that nothing can go wrong.’”

August 26 – Bloomberg (Dana Khraiche): “Lebanon suffered another dramatic inflation surge in July as the country’s financial meltdown continued with no end in sight. Consumer prices rose an annual 112.4%, compared with just under 90% in June… The cost of food and non-alcoholic beverages rose just over 336% compared with last year. Prices of housing, water, electricity, gas and other fuels rose only an annual 11.6% because the government has maintained subsidies for petroleum products.”

Europe Watch:

August 24 – Financial Times (Tommy Stubbington): “Banks in the eurozone are so awash with cheap cash from the European Central Bank that they no longer want to borrow from each other, in a striking reversal of the signs of stress in money markets in the spring. Three-month Euribor… has sunk to an all-time low of minus 0.49% in recent days. The plunge in borrowing rates comes after eurozone lenders took more than €1.3tn in cheap loans from the ECB in June… ‘You have a central bank that’s absolutely relentless in providing cheap liquidity,’ said Peter Schaffrik, a strategist at RBC Capital Markets. ‘That drives down lending rates across the board.’”

August 27 – Reuters (Balazs Koranyi): “Euro zone companies continued to tap bank credit in July, although lending growth slowed since the height of the coronavirus crisis… Lending growth to non-financial corporations in the 19-country euro zone expanded by 7.0% in July compared with a year earlier…”

Japan Watch:

August 28 – Bloomberg (Isabel Reynolds and Lily Nonomiy): “Japanese Prime Minister Shinzo Abe said he would resign to undergo treatment for a chronic illness, ending his run as the country’s longest serving premier in an announcement that surprised some members of his party. Abe confirmed reports that he was dealing with ulcerative colitis, a chronic digestive condition that also forced him to step down as premier in 2007. He said he would stay on until leaders of his Liberal Democratic Party hold an internal vote to pick a successor…”

Leveraged Speculation Watch:

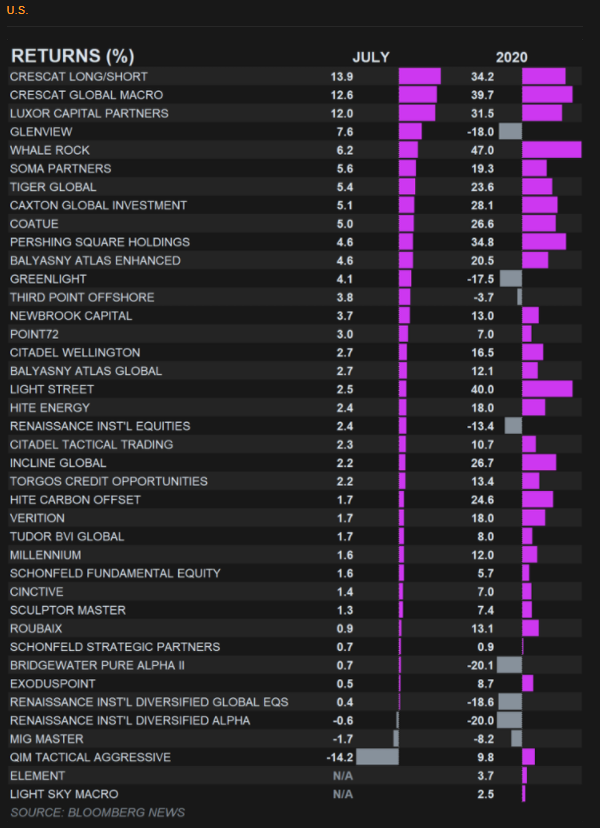

August 25 – Financial Times (Laurence Fletcher and Richard Henderson): “Hedge funds that bet on market volatility have turned out to be some of the biggest losers from the financial turmoil that struck in March. Volatility hedge funds, which buy and sell derivatives to try and profit from the volatility of stocks, bonds and currencies, lost 2.4% this year to July… That compares with an average 0.3% loss among hedge funds more broadly, and a 2.4% return from the S&P 500 index. The stumble shows how painful it can be to assume a long period of calm will continue. Betting against flare-ups in markets, or shorting volatility, as many of these funds had done, can prove costly in a shock.”

Geopolitical Watch:

August 27 – Reuters (Ben Blanchard): “The risk of accidental conflict is rising because of tension in the South China Sea and around Taiwan and communication must be maintained to reduce the risk of miscalculation, Taiwan President Tsai Ing-wen said… ‘The risk of conflict requires careful management by all the parties concerned. We expect and hope that Beijing will continue to exercise restraint consistent with their obligations as a major regional power,’ Tsai told a forum…”

August 26 – Reuters (Ben Blanchard and Yew Lun Tian): “Numerous Chinese and U.S. military exercises, Taiwan missiles tracking Chinese fighters and plummeting China-U.S. ties make for a heady cocktail of tension that is raising fears of conflict touched off by a crisis over Taiwan. In the last three weeks, China has announced four separate exercises along its coast, from the Bohai Gulf in the north to the East and Yellow Seas and South China Sea, along with other exercises it said were aimed at ‘the current security situation across the Taiwan Strait’. Meanwhile Taiwan, claimed by China as its ‘sacred’ territory, said its surface-to-air missiles had tracked approaching Chinese fighters – details Taiwan does not normally give – as U.S. Health Secretary Alex Azar was visiting the island this month.”

August 24 – Financial Times (Zhou Bo): “The relationship between China and the US is in freefall. That is dangerous. US defence secretary Mark Esper has said he wants to visit China this year, which shows the Pentagon is worried. That Wei Fenghe, China’s defence minister, spoke at length with Mr Esper in August shows that Beijing is worried too. Both men have agreed to keep communications open and to work to reduce risks as they arise. The crucial question is: how? In July, US secretary of state Mike Pompeo inverted a famous line of Ronald Reagan’s about the Soviet Union and applied it to China: ‘trust but verify’ became ‘distrust but verify’. Washington suspects that an increasingly coercive China wants to drive the US out of the Indo-Pacific. Beijing meanwhile believes that the US, worried about its global primacy, has fully abandoned its supposed neutrality on the South China Sea. Haunted by economic recession and the pandemic, and desperate for re-election, President Donald Trump has also made confronting China his last-straw strategy to beat his opponent, Joe Biden. The risk of a mistake is therefore high.”

August 26 – Bloomberg: “China’s latest volley of missile launches into the world’s most hotly contested body of water served as a warning to two key U.S. targets: aircraft carriers and regional bases. The missiles launched into the South China Sea… included the DF-21D and DF-26B, the South China Morning Post reported, citing a person close to the People’s Liberation Army. Those weapons are central to China’s strategy of deterring any military action off its eastern coast by threatening to destroy the major sources of U.S. power projection in the region.”

August 26 – South China Morning Post (Kristin Huang): “China launched two missiles, including an ‘aircraft-carrier killer’, into the South China Sea on Wednesday morning, a source close to the Chinese military said, sending a clear warning to the United States. The move came one day after China said a US U-2 spy plane entered a no-fly zone without permission during a Chinese live-fire naval drill in the Bohai Sea off its north coast. One of the missiles, a DF-26B, was launched from the northwestern province of Qinghai, while the other, a DF-21D, lifted off from Zhejiang province in the east.”

August 27 – Financial Times (Kathrin Hille, Christian Shepherd and Emma Zhou): “Military tension between Washington and Beijing is surging after China launched missiles capable of hitting US warships and military bases into the disputed South China Sea. The People’s Liberation Army on Wednesday ‘fired four medium-range missiles into [an] area between Hainan and the Paracel Islands,’ said a US military official… Another US military official said the launch included a Dongfeng-21D, an anti-ship missile built to threaten US aircraft carriers, and several Dongfeng-26B medium-range missiles, known as the ‘Guam express’ because they can reach air force and naval bases in the US Pacific territory.”

August 26 – Reuters (Idrees Ali and Phil Stewart): “U.S. troops in Syria were wounded this week when a Russian military patrol slammed into their vehicle, U.S. officials said…, as Washington condemned the incident as a violation of safety protocols agreed with Moscow. Two officials, speaking on condition of anonymity, said several U.S. troops suffered concussive symptoms following the incident.”

August 24 – Reuters (Ezgi Erkoyun and Tuvan Gumrukcu): “President Tayyip Erdogan said… Turkey’s navy will not back down as Greece ‘sows chaos’ in the eastern Mediterranean Sea, where the countries have deployed frigates in an escalating rhetorical confrontation over overlapping resource claims. ‘The ones who throw Greece in front of the Turkish navy will not stand behind them,’ Erdogan said…”

August 26 – Financial Times (Laura Pitel): “Turkey will make no concessions in the eastern Mediterranean, President Recep Tayyip Erdogan declared as France announced that it would join naval exercises in the region amid a mounting stand-off over hydrocarbons. …Mr Erdogan warned that Turkey would do ‘whatever is politically, economically and militarily necessary’ to protect its rights. Turkey ‘will take whatever it is entitled to’ in the Mediterranean and other maritime regions, he said, adding: ‘Just as we do not covet anyone else’s territory, sovereignty or interests, we will never make concessions on what belongs to us.’”

August 27 – Financial Times (Henry Foy and James Shotter): “Russia has created a reserve police force for use in neighbouring Belarus on the request of its embattled strongman leader, President Vladimir Putin said, warning that he would deploy it across the border if protests in the country turn violent. The show of support for President Alexander Lukashenko came with a reiterated warning from Mr Putin that western countries should refrain from attempting to influence the situation in Belarus. It is almost three weeks since mass protests against Mr Lukashenko’s 26-year regime erupted after he was declared the winner of his sixth consecutive presidential election…”

“I like to reinvent myself — it’s part of my job.”

“I like to reinvent myself — it’s part of my job.” Interestingly, the FOMC seems to be a bit bullish on the speed of the return to full employment, but the lack of flexibility (having to get there before pivoting policy) is important. In the past, the Fed would “see emerging inflation pressures” or “robust labor market” and decide to tighten its policy stance. That has not worked out well in recent years, and the Fed has abandoned that policy. It is now a wait until it actually comes about- not could or should or might.

Interestingly, the FOMC seems to be a bit bullish on the speed of the return to full employment, but the lack of flexibility (having to get there before pivoting policy) is important. In the past, the Fed would “see emerging inflation pressures” or “robust labor market” and decide to tighten its policy stance. That has not worked out well in recent years, and the Fed has abandoned that policy. It is now a wait until it actually comes about- not could or should or might.  Instead of worry about what the Fed thinks will come about (which was paramount a year ago), markets can assess the labor market for themselves and judge the duration and extent of monetary accommodation the Fed will provide. If the labor market recovery slows or accelerates, the duration of low rates and QE will change.

Instead of worry about what the Fed thinks will come about (which was paramount a year ago), markets can assess the labor market for themselves and judge the duration and extent of monetary accommodation the Fed will provide. If the labor market recovery slows or accelerates, the duration of low rates and QE will change.