Doug Noland writes…..

In the People’s Bank of China’s (PBOC) Monday daily currency value “fixing,” the yuan/renminbi was set 0.33% weaker (vs. dollar) at 6.9225. Market reaction was immediate and intense. The Chinese currency quickly traded to 7.03 and then ended Monday’s disorderly session at an 11-year low 7.0602 (largest daily decline since August ’15). While still within the PBOC’s 2% trading band, it was a 1.56% decline for the day (offshore renminbi down 1.73%). A weaker-than-expected fix coupled with the lack of PBOC intervention (as the renminbi blew through the key 7.0 level) rattled already skittish global markets.

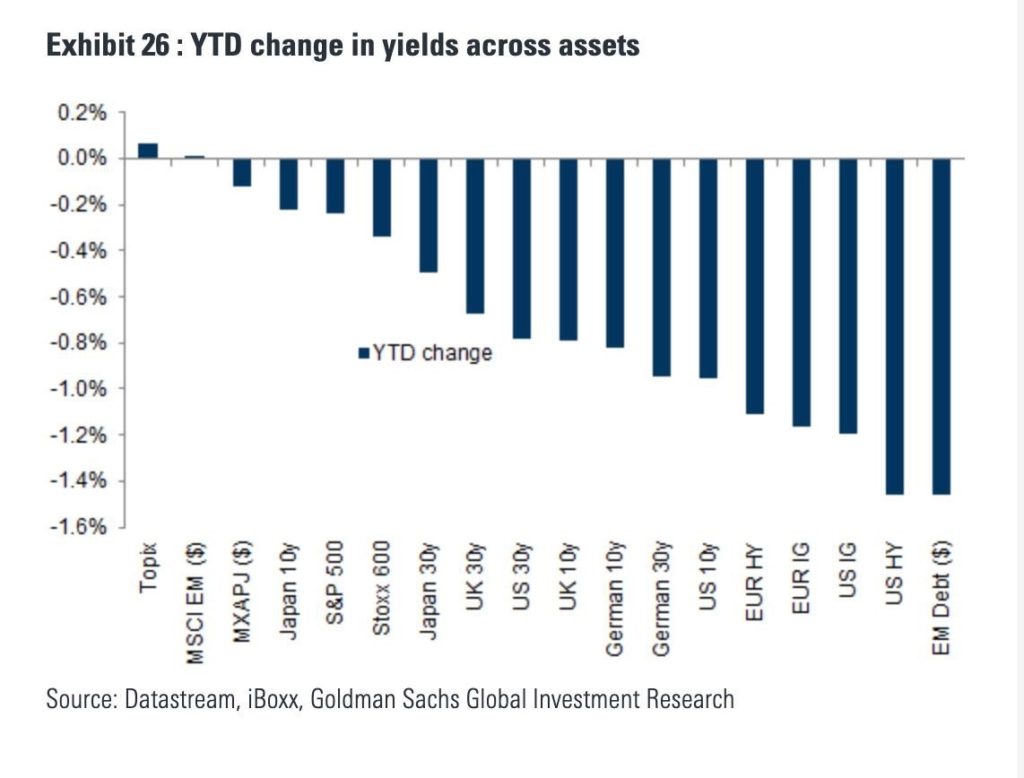

Safe haven assets were bought aggressively. Gold surged $23, or 1.6%, Monday to $1,441, the high going back to 2013 (trading to all-time highs in Indian rupees, British pounds, Australian dollars and Canadian dollar). The Swiss franc gained 0.9%, and the Japanese yen increased 0.6%. Treasury yields sank a notable 14 bps to 1.71%, the low going back to October 2016. Intraday Monday, 10-year yields traded as much as 32 bps below three-month T-bills, “the most extreme yield-curve inversion” since 2007 (from Bloomberg). German bund yields declined another two bps to a then record low negative 0.52% (ending the week at negative 0.58%). Swiss 10-year yields fell two bps to negative 0.88% (ending the week at negative 0.98%). Australian yields dropped below 1.0% for the first time.

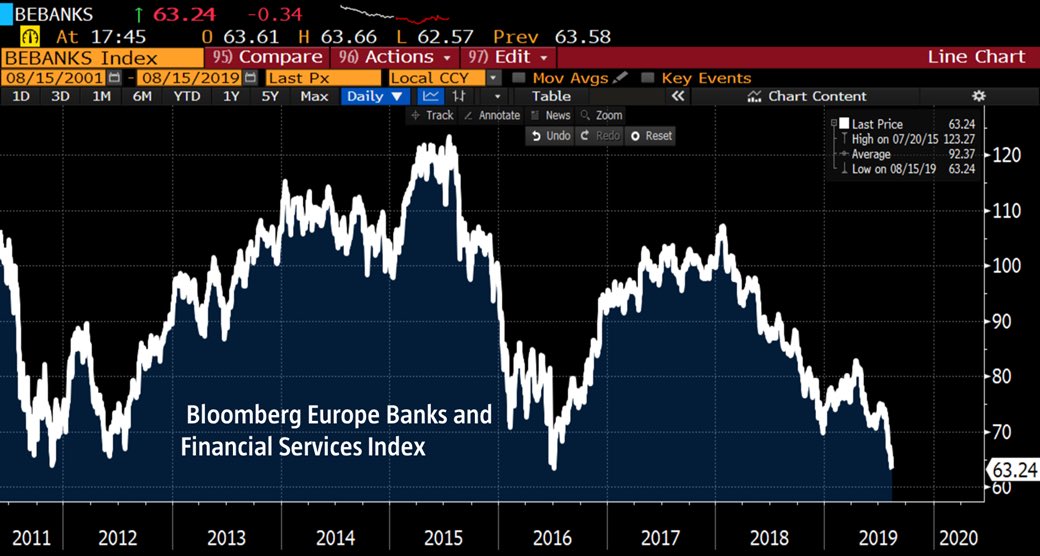

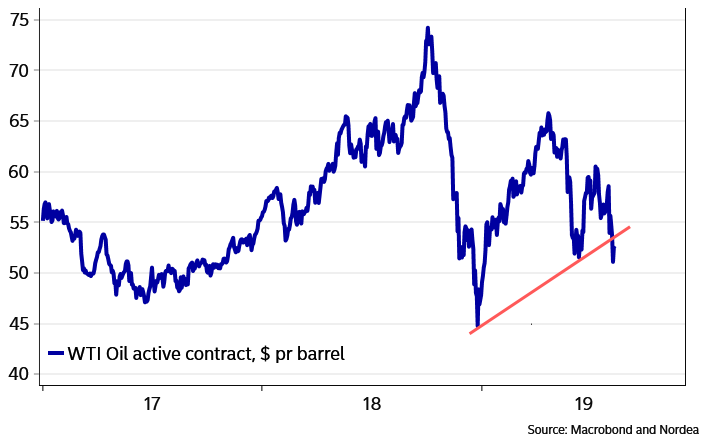

It’s worth noting the Japanese yen traded Monday at the strongest level versus the dollar since the January 3rd market dislocation (that set the stage for the Powell’s January 4th “U-turn). “Risk off” saw EM currencies under liquidation – with the more vulnerable under notable selling pressure. The Brazilian real dropped 2.2%, the Colombian peso 2.1%, the Argentine peso 1.8%, the Indian rupee 1.6% and the South Korean won 1.4%. Crude fell 1.7% in Monday trading. Hong Kong’s China Financials Index dropped 2.5%, with the index down 4.4% for the week to the lowest level since January. European bank stocks dropped 4.1%, trading to the low since July 2016.

A Monday Bloomberg headline: “China Retaliation ‘11’ on Scale of 1-10, Wall Street Warns.” Global markets were shocked Beijing would interject the renminbi into tit-for-tat trade retaliation. Trade war morphing into currency war? The White House was not impressed.

August 5 – Reuters (Susan Heavey and Dan Burns): “U.S. President Donald Trump slammed China’s decision to let its yuan currency breach the key seven-per-dollar level for the first time in more than a decade, calling it ‘a major violation’ and jabbing the U.S. central bank. ‘China dropped the price of their currency to an almost a historic low. It’s called ‘currency manipulation.’ Are you listening Federal Reserve? This is a major violation which will greatly weaken China over time!’ Trump tweeted.

The U.S. market selloff intensified after President Trump’s tweet, with the S&P500 ending the session down 3.0% – 2019’s biggest one-day decline. The Nasdaq100 dropped 3.6%, with the Semiconductors slammed 4.4%. The Bank index was hit 3.6%. Junk bond spreads widened 40 bps in Monday trading to 437 bps, trading near the highest level since January – weighed down by the energy sector. Investment-grade corporate and bank CDS rose, though not the dramatic moves suffered in high-yield.

Tuesday morning from PBOC Governor Yi Gang: “As a responsible big country, China will abide by the spirit of the G20 leaders’ summit on the exchange rate issue, adhere to the market-determined exchange rate system, not engage in competitive devaluation, and not use the exchange rate for competitive purposes and not use the exchange rate as a tool to deal with external disturbances such as trade disputes.” Yi’s statement along with the PBOC’s Tuesday “fix” at 6.9683 – a smaller decline versus the dollar than markets had expected – helped calm fears of a destabilizing devaluation.

By Thursday, fear of renminbi dislocation becoming a catalyst for global “risk off” had subsided. The renminbi gained 0.21% against the dollar in Thursday trading, as Asian and EM currencies posted modest gains. The Shanghai Composite recovered almost 1%. European stocks rallied sharply, with Germany’s DAX gaining 1.7% and France’s CAC40 jumping 2.3%. The S&P500 rallied 1.9%, with the Nasdaq100 up 2.3%.

Curiously, the safe havens were happy to disregard bouncing risk markets. Treasury yields declined two bps Thursday to 1.72%, while the yen and Swiss franc both posted small gains. Gold gave back hardly anything.

The VIX surged to 24.81 during Monday trading, the high since January 3rd. By Thursday’s close, the VIX was back down to 17. Option players were betting that the worst of the selling was likely over for the near-term – the critical time horizon for option traders. It has been a recurring pattern: a spell of “risk off” trading spurs hedging and put option buying. And after a flurry of put option purchases, the game then becomes getting to option expiration with as little value as possible left in these instruments.

Large quantities of outstanding put options (and other hedges) create the potential for a self-reinforcing self-off, where the writers of hedges are forced into the marketplace to aggressively sell futures and ETFs to offset mounting losses on the options they had previously sold. Yet market players have been conditioned to believe policymakers are keenly attuned to derivatives meltdown risk. After Monday’s scare, the bet is both President Trump and Beijing will avoid rocking the markets next week (U.S. options expiration Friday).

And while the VIX closed the week below 18 (17.97), Friday’s session was not without its share of drama. The S&P500 traded down 1.3% in early-Friday trading. After stating “We’re not going to be doing business with Huawei,” the President’s comments were later clarified. The U.S. will be moving ahead with its special licensing process for Huawei’s U.S. suppliers. The S&P500 traded back to little changed on the day, before reversing lower into the close.

The collapse of Italian bond yields has been one of the more dramatic global market moves. After trading to almost 3.60% last October, Italian 10-year yields ended Wednesday trading at 1.42%. For a country so hopelessly over-indebted ($3 TN plus), Italian bond prices are arguably one of the more distorted assets in a world of distorted asset markets. Italian yields reversed sharply higher at the end of the week, rising 12 bps Thursday and a notable 27 bps on Friday – on political instability after Deputy Prime Minister Matteo Salvini called for early elections (breaking with its Five Star Movement coalition partner). Italian stocks were hit 2.5% in Friday trading, ending the week down 3.4%. Global “risk off” could prove an especially challenging backdrop for vulnerable Italian assets.

August 9 – Bloomberg (Sophie Caronello): “Britain’s pound ended the week at its lowest closing level versus the greenback since Margaret Thatcher was ensconced in No. 10 Downing Street. Sterling posted a fourth straight-weekly decline, sliding 1.1% to $1.2033 in a five-day period that witnessed mounting concern over the country’s exit from the European Union and a report indicating that the British economy shrank for the first time in six years.”

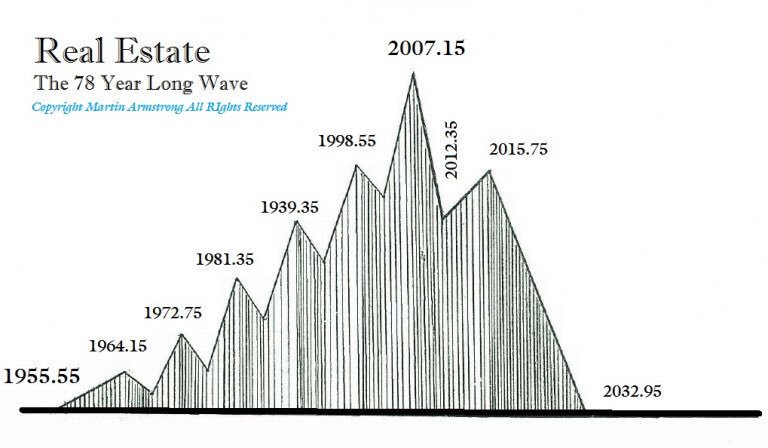

Italy, the U.K., China, India, Brazil and many others… Global central bank-induced liquidity excess has kept numerous remarkably leaky boats afloat in recent years. There will be systemic hell to pay when the dam finally breaks.

I’ll assume Monday’s global market convulsions will have the U.S. administration and Beijing treading cautiously next week. Yet I expect it will prove more difficult this time to squeeze the genie back into the bottle. To see such high cross asset correlations around the globe is disconcerting. And we saw Monday how critical a stable renminbi has become to global finance. It’s not a stretch to say this global party comes to rapid conclusion the moment markets fear a disorderly Chinese currency devaluation.

August 6 – Bloomberg (Michelle Jamrisko, Anirban Nag, and Karlis Salna): “It used to be that a buildup in foreign reserves was seen as a bulwark against currency shocks and swift turns in investor sentiment. Those days seem far away — and that defense less robust — as the trade conflict between the U.S. and China evolves into a full-blown currency war that’s threatening emerging markets globally. Reserves of central banks in developing Asian nations, which have risen to almost $5 trillion this year, will now be put to the test as currencies slide. ‘The key lesson from 2008 is that you can never have too much reserves,’ said Taimur Baig, chief economist at DBS Group… ‘But they were for fighting a fire in a conventional world,’ noting that today’s environment is quite unconventional.”

China’s $3.0 TN of reserves are less imposing than in the past. Indeed, reserves throughout EM will likely become a market focus. My sense is analysts have little grasp of potential capital flight risk, for China or EM more generally. How much “carry trade” leverage (borrow in low-yielding currencies to fund purchases in higher-yielding instruments) has accumulated during this most-protracted of speculative cycles? What other “hot money” vulnerability lurks (i.e. ETF outflows, derivatives…). Such issues garner little notice when “risk on” is bubbling and liquidity is flowing abundantly. But we were reminded Monday how abruptly “risk off” de-risking/deleveraging can erupt – and how quickly fears of illiquidity and dislocation can take hold.

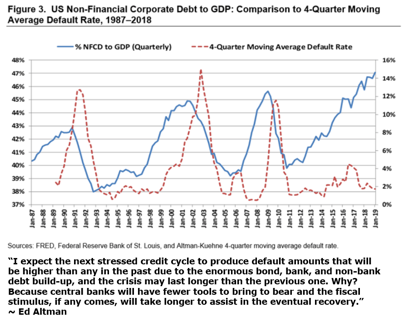

I’ll stick with the analysis that global markets are moving toward a very problematic scenario. Having witnessed previous EM crises (i.e. Mexico in ‘94/’95, Southeast Asian ’97, Russia ’98 and Brazil ‘01/’02), it’s worth recalling how currency market dislocations become instrumental in systemic crises. Rapid drawdowns in international reserve holdings stoke fears of illiquidity, leading to a destabilizing “hot money” exodus. Rapidly shrinking reserve holdings then force central banks to raise interest rates to support domestic currencies, with the resulting rapidly tightened financial conditions bursting fragile financial and economic Bubbles.

EM central bankers learned from past predicaments. Over this cycle, it became increasingly common for central bankers to support their currencies in the derivatives marketplace, a mechanism whereby vulnerable currencies could be bolstered without resorting to precious international reserve holdings. Central bank derivative operations successfully stabilized currencies during previous fleeting bouts of “risk off”. The repeated rapid recovery of global liquidity abundance reassured – policymakers along with the markets – that these derivative trades could be unwound with little notice. Recurrent EM resilience emboldened the view that large reserve stockpiles had fundamentally upgraded EM risk profiles.

Like so many aspects of this long boom, it works miraculously – until it doesn’t. At this point, the key analysis is that reserve holdings surely overstate resources available for countries to combat a more enduring period of “risk off” capital flight. Moreover, the perception of EM resilience has ensured unprecedented Credit and speculative excess throughout a systemic EM Bubble.

August 6 – Reuters (Winni Zhou and Andrew Galbraith): “China’s major state-owned banks have been active in the yuan forwards markets this week, sources said, using swaps to curb greenback supply as authorities sought to slow the currency’s decline after its break past the key 7 to the dollar threshold… Four sources with knowledge of the matter told Reuters that state banks were seen swapping yuan for dollars in onshore forwards market to support the Chinese unit. ‘Yesterday big banks were all selling one-year onshore forward swaps, then in the afternoon the spot dollar-yuan fell,’ said a trader… in Shanghai.”

China’s major state-owned backs can support the renminbi through clandestine derivatives trading, while supporting the faltering small bank sector with liquidity and capital injections along with bolstering the faltering Chinese Bubble with aggressive Credit growth. This, as well, is an ostensible miracle – until it all blows up. To repeat: How large is the “carry trade” in higher-yielding Chinese securities? Add to this: How large are the big Chinese banks’ derivatives positions in support of the renminbi?

I am clearly not alone in the view that Beijing took a huge gamble in moving to devalue the Chinese currency this week. They today have a large international reserve position. Over the coming weeks and months, I expect analysts to increasingly question the adequacy of these reserves in light of extraordinary financial and economic vulnerabilities.

The key take-away from another critical week: As the marginal provider of global liquidity and economic growth, Chinese finance has become the epicenter of crisis dynamics. Global markets are highly correlated; speculative dynamics remain extraordinarily synchronized. At this point, a bet on global risk markets is a bet on China – a bet on the ongoing inflation of China’s historic Bubble. Developments – market, policy, economic and geopolitical – are corroborating the analysis that it’s very late in the game. I’ll assume the flow of “Hot Money” away from global risk markets has commenced.

http://creditbubblebulletin.blogspot.com/2019/08/weekly-commentary-hot-money-watch.html