IMF growth estimates

US growth estimate for 2019 revised up by 0.3% to 2.9%.

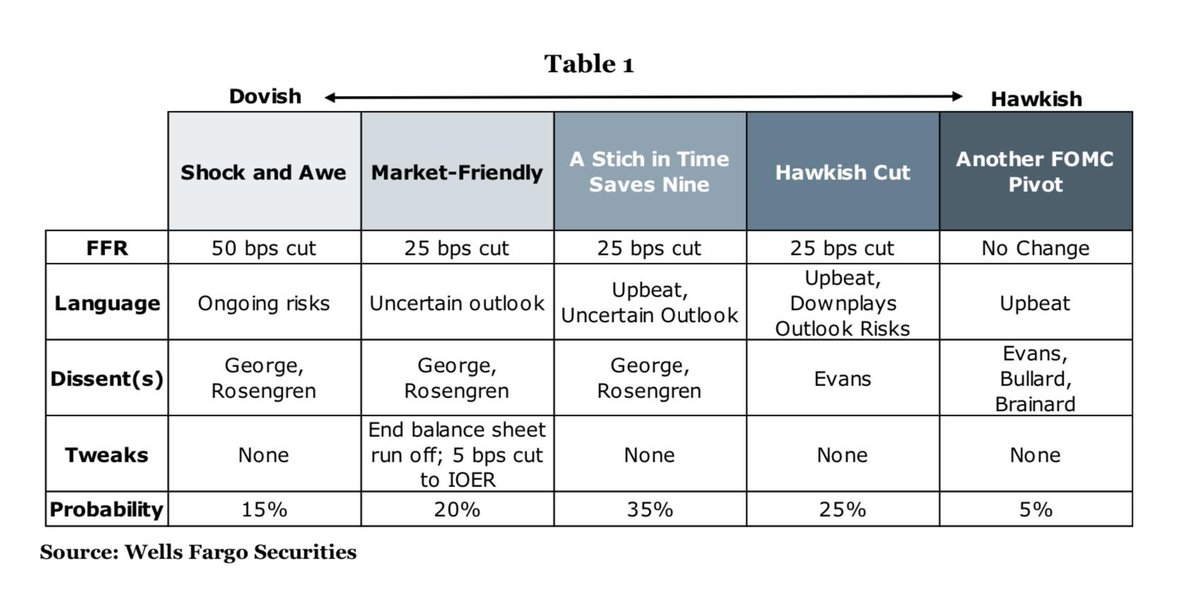

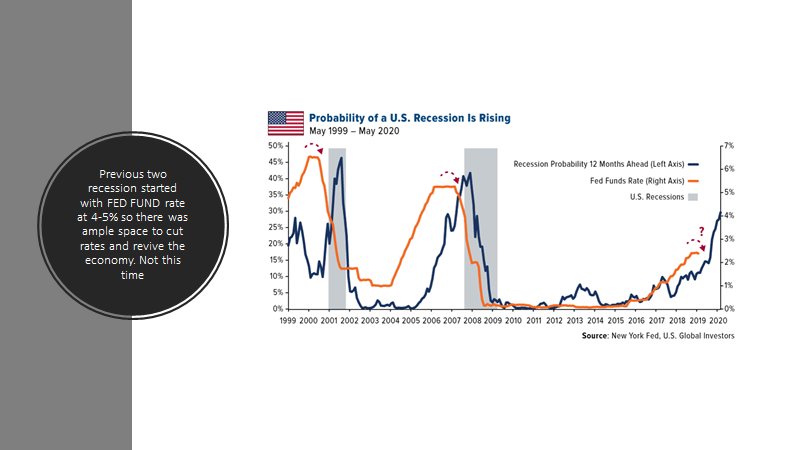

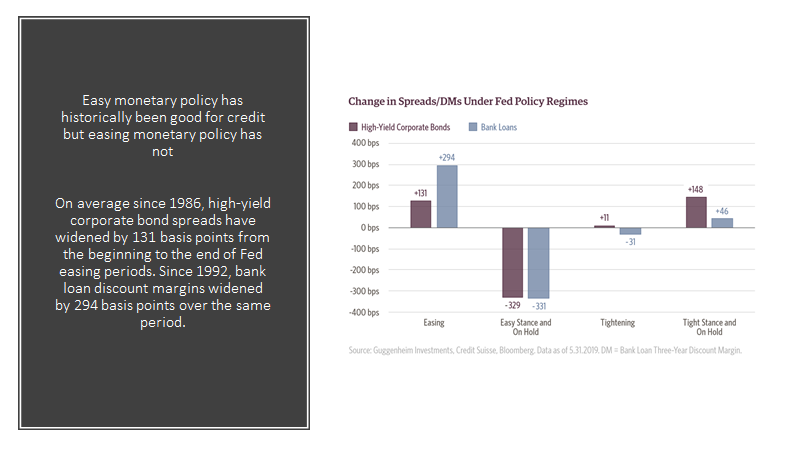

FED does not need to cut but a rate cut will stimulate the economy. If that were not enough President trump can now increase fiscal spending heading into election in 2020 as debt ceiling is now abolished till next US presidential election.

Lower Taxes+ Easing Monetary Policy+ Loose Fiscal policy=Higher GDP growth.

Our Brave new world:

Why Nestlé is a quality stock trading at a PE of 29 v. Daimler now trading in the “value” category with a PE of 8! (link: https://www.economist.com/finance-and-economics/2019/05/18/beneath-the-dull-surface-europes-stockmarket-is-a-place-of-extremes) economist.com/finance-and-ec…

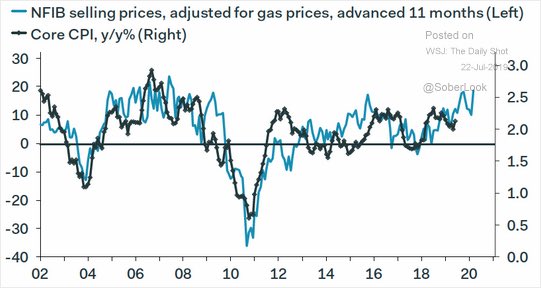

Price up, supply down.

Existing-home sales fell 1.7% to a seasonally adjusted annual pace of 5.27 million, the National Association of Realtors said Tuesday. Sales declined 2.2% compared with a year earlier, marking the 16th consecutive month of annual declines in sales.The spring selling season is crucial because about 40% of the year’s sales take place in March through June. Falling sales during most of this period have puzzled economists. They struggle to explain why the housing market has remained soft while the rest of the economy has been booming.

Borrowing rates have fallen to their lowest levels in two years, wages are rising and unemployment is at a 50-year low.

“It doesn’t make economic sense,” said Lawrence Yun, the NAR’s chief economist. – WSJ

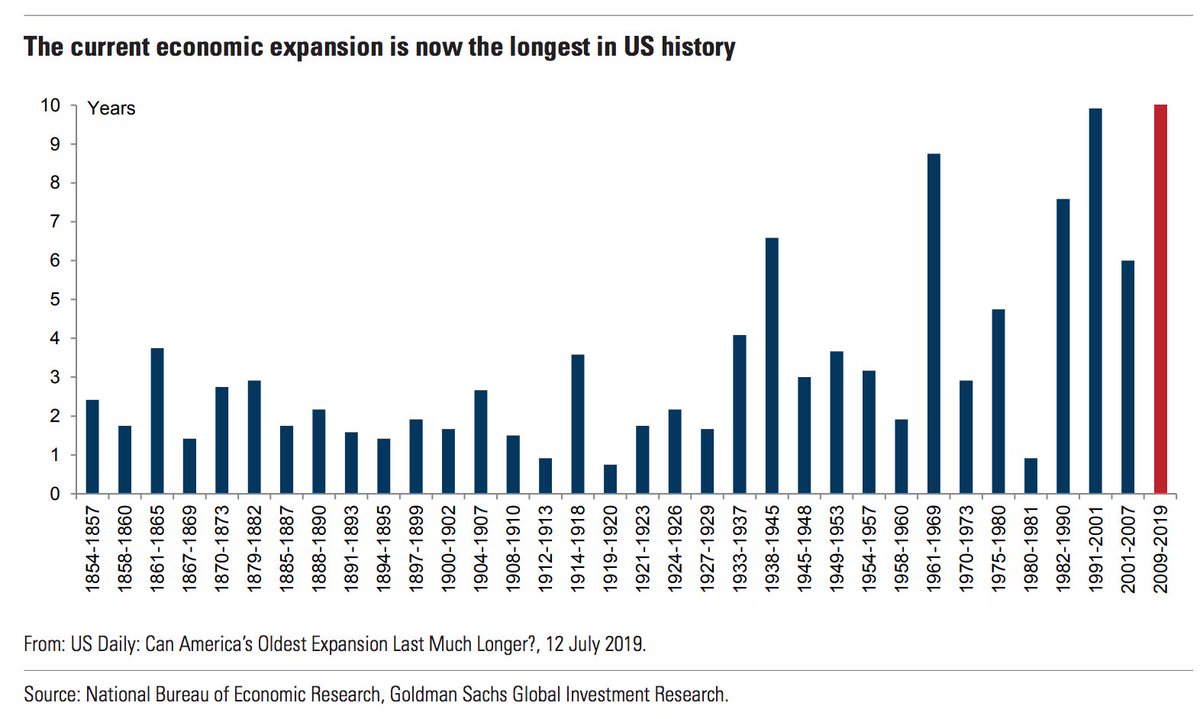

The Longest expansion just got longer

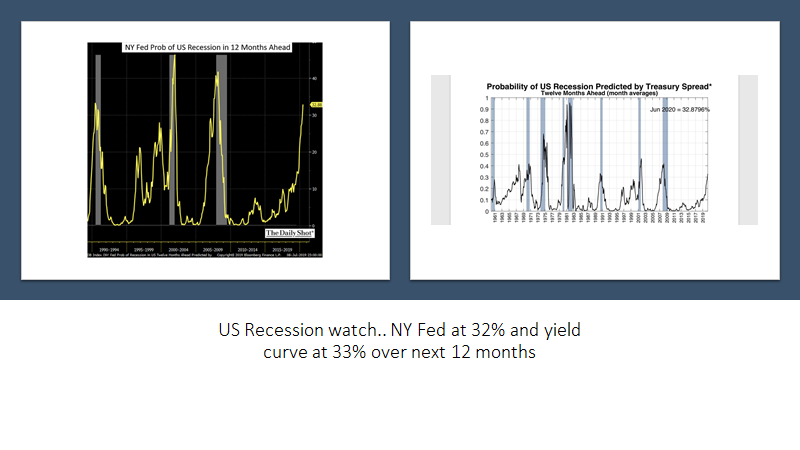

US has now reached longest econ expansion in history. 2 main triggers of past recessions—inflationary overheating & private sector imbalances—not flashing red, Goldman says. Even trade pol will not be major hit to growth. Goldman expects US to remain in solid shape after weakerQ2