Doug Noland writes..

Let’s begin with the markets. Ten-year Treasury yields dropped eight bps this week to 2.39%, nearing the March 27th low (2.37%). Two-year yields fell seven bps to 2.20%, a 13-month low. German bund yields declined six bps to negative 0.10%, the low closing yield going back to September 2016. German two-year yields dipped another three bps to negative 0.65%. Swiss 10-year yields declined four bps to negative 0.40%, and Japanese 10-year yields slipped a basis point to negative 0.06%. Spanish 10-year yields at 0.88% and Portuguese yields at 1.05% make no sense whatsoever unless huge new ECB QE programs are in the offing. The market now prices a 75% probability of a Fed rate cut by December, up from the previous week’s 59%.

China’s renminbi dropped 1.38% versus the dollar this week to 6.9179, the low since November 30th (offshore renminbi at all-time lows). It’s worth noting that the renminbi is now only 1.2% from breaching the key psychological 7.00 level versus the dollar. Currencies were under pressure throughout Asia. The South Korean won declined 1.5%, the Singapore dollar 1.1%, the Taiwanese dollar 1.0%, the Philippine peso 1.0% and the Indonesian rupiah 0.9%. Weakness spread into EM more generally. The Brazilian real fell 3.5%, the South African ran 1.8%, the Hungarian forint 1.5%, the Chilean peso 1.5%, and the Colombian peso 1.0%.

For the most part, EM bond market calm endured. Problem child Lebanon saw local bond yields surged 24 bps to an almost five-month high 10.65%, with yields up 87 bps so far this month. More concerning, Brazil’s local (real) yields surged 31 bps to 9.09%, the highest level since March.

After somewhat stabilizing (courtesy of “national team” buying), Chinese equities this week resumed their descent. The Shanghai Composite dropped 1.9%, with the CSI Financials index down 2.7% and the ChiNext Index sinking 3.6%. Hong Kong’s Hang Seng Index declined 1.3%, led lower by a 2.1% drop in the Hang Seng China Financials index. Stocks were down 2.5% in South Korea, 6.2% in Indonesia, 3.1% in Taiwan, 2.5% in Thailand and 1.3% in the Philippines. Brazil’s Ibovespa index sank 4.5%.

Though major U.S. equities indices ended the week down less than 1%, there’s a story to tell. Monday trading saw the S&P500 sink 2.4% (DJIA down 617 pts). The President began the morning with a tweet: “China should not retaliate – will only get worse! I say openly to President Xi & all of my many friends in China that China will be hurt very badly if you don’t make a deal because companies will be forced to leave China for other countries.” Less than two hours later, Beijing announced retaliatory tariffs on $60 billion of U.S. goods.

Markets rallied on Tuesday, nerves calmed by the President’s comment that the trade war with China was a mere “little squabble;” “We have a good dialogue going. It will always continue.” “When the time is right we will make a deal with China. It will all happen, and much faster than people think!” A Chinese Foreign Ministry spokesperson said that China and the U.S. had agreed to continue “pursuing relevant discussions.” Treasury Secretary Mnuchin suggested he was planning for a trip to China to resume negotiations.

May 15 – Associated Press (Yanan Wang and Sam McNeil): “What do tilapia, Jane Austen and Chinese revolutionary poster art have in common? All have been used to rally public support around China’s position in its trade dispute with the U.S., as the ruling Communist Party takes a more aggressive approach — projecting stability and stirring up nationalistic sentiment in the process. ‘If you want to negotiate, the door is open,’ anchor Kang Hui said Monday on state broadcaster CCTV. ‘If you want a trade war,’ however, he added, ‘we’ll fight you until the end.’ ‘After 5,000 years of wind and rain, what hasn’t the Chinese nation weathered?’ Kang said. The toughly-worded monologue on the banner evening news program followed days of muted official responses to President Donald Trump’s decision to hike tariffs…”

May 14 – Bloomberg: “Chinese President Xi Jinping denounced as ‘foolish’ foreign efforts to reshape other nations as he pushes back against U.S. trade demands. ‘To think that one’s own race and civilization are superior to others, and to insist on transforming or even replacing other civilizations, is foolish in understanding and disastrous in practice,’ Xi said… at the opening ceremony of the Conference on Dialogue of Asian Civilizations in Beijing… ‘The Chinese people’s beliefs are united and their determination as strong as a rock to safeguard national unity and territorial integrity, and defend national interests and dignity,’ Xi said Tuesday when meeting with visiting Greek President Prokopis Pavlopoulos.”

By Wednesday morning, it was becoming increasingly clear that the “little squabble” was more than a little fib. China’s vice-premier Liu He had stated that China (negotiators and the Chinese people) would never “flinch” in the face of tariffs. After showing restraint over recent weeks, the Chinese media was unleashed. State media declared that China would “never surrender” to external pressure. And from the communist party’s People’s Daily: “At no time will China forfeit the country’s respect, and no one should expect China to swallow bitter fruit that harms its core interests.” CCTV’s “If you want a trade war, we’ll fight you until the end” video (from above) was quickly viewed more than 3.3 billion times.

U.S equities markets opened poorly Wednesday morning, quickly giving back much of Tuesday’s recovery. If Monday’s lows were to have been taken out, market technicals could have quickly turned problematic. Especially after the previous week’s instability, there were large quantities of put options outstanding in the marketplace. Had the markets weakened going into Friday’s expiration, there was a distinct possibility of intense self-reinforcing derivatives-related selling.

About 40 minutes after Wednesday’s open, Bloomberg reported that President Trump was preparing to offer the EU and Japan a six-month window to “limit or restrict” auto exports to the U.S. before imposing new tariffs. The S&P500 jumped as much as 1.4%, a rally that carried into Thursday’s session.

The auto tariff news came at a critical market juncture. Whether it was or wasn’t a coincidence hardly matters. At this point, markets have become quite enamored with the notion of Quadruple Puts – the Fed, Trump, Xi/Beijing and corporate buybacks. When historians look back at this period, they will surely be baffled by the markets’ capacity for disregarding major risks and negative developments. We’re at the stage of a historic – and especially protracted -cycle where it has repeatedly paid to ignore risk. Over time, the successful risk ignorers and dip buyers have ascended to the top. Risk-takers systematically rewarded; the cautious banished. And, once again, those that had recently purchased put options to hedge market risk were left unsatisfied.

The official announcement of the six-month delay in auto tariffs came Friday, along with news that the President was lifting tariffs on Canadian and Mexican steel and aluminum imports. The FT headline: “Trump Eases Trade Conflicts with US Allies.” Rallying markets were receptive to seemingly positive news – that is until a Friday afternoon report from CNBC (Kayla Tausche and Jacob Pramuk): “Negotiations between the U.S. and China appear to have stalled as both sides dig in after disagreements earlier this month. Scheduling for the next round of negotiations is ‘in flux’ because it is unclear what the two sides would negotiate…” One can assume the administration is now working to generate some positive news flow as it hunkers down for a tough fight with the Chinese.

The U.S./Chinese relationship was never going to end well. The lone superpower versus the rising superpower. Vastly different systems, cultures and values. And it would be such a different world these days if not for a decade (or three) of unprecedented global monetary stimulus – cheap (i.e. nearly free) finance that allowed the U.S. to run endless huge Current Account Deficits coupled with easy finance that bestowed upon the Chinese (the curse of) unlimited monetary resources for the most outrageous Credit and investment booms in history. I always expected markets would at some point put a kibosh to this perilous dynamic. It was instead the embittered U.S. electorate and the architect of “Make America Great Again.”

It sure appears as if the Rubicon has been crossed. Beijing has called out the dogs (i.e. state-controlled media) – and public anti-U.S. sentiments have been inflamed. I’ll assume they’re now executing a contingency plan some time in the making: Trump is the unreasonable and disrespectful bully. China will never again be disrespected and pushed around. President Xi – general secretary of the Communist Party, President of the People’s Republic of China, chairman of the Central Military Commission, China’s ‘Paramount Leader’ and revered ‘Core Leader’ – is precisely the great commander to confront the U.S. hegemon determined to repress China’s strength, advancement and rightful standing in the world.

It’s become difficult to envisage Trump and Xi exchanging pleasantries and doing beaming photo ops next month at the G-20 summit (June 28-29) in Osaka, Japan. President Trump has often touted his close personal relationship with China’s Xi, and the U.S. side seems to believe that a private meeting between the congenial leaders can get talks back on track (worked in Argentina!). Let’s ignore U.S. freedom of navigation voyages through the South China Sea; the administration cozying up with Taiwan; Secretary Pompeo meeting this Thursday with a pro-democracy leader in Hong Kong, etc. Let’s disregard the trail of condescending tweets. And Huawei.

May 16 – Bloomberg: “The Trump administration is pulling out the big guns in its push to slow China’s rise, with potentially devastating consequences for the rest of the world. The White House on Wednesday initiated a two-pronged assault on China: barring companies deemed a national security threat from selling to the U.S., and threatening to blacklist Huawei Technologies Co. from buying essential components. If it follows through, the move could cripple China’s largest technology company, depress the business of American chip giants from Qualcomm Inc. to Micron Technology Inc., and potentially disrupt the rollout of critical 5G wireless networks around the world.”

From CNBC: “Reacting to U.S actions on Huawei, China’s Commerce Ministry said in a statement, ‘We firmly oppose the act of any country to impose unilateral sanctions on Chinese entities based on its domestic laws, and to abuse export control measures while making ‘national security’ a catch-all phrase. We urge the US to stop its wrong practices.’”

My view is that China is adamantly opposed to the U.S.’s use of “unilateral sanctions.” The administration’s insistence on a sanction enforcement regime as integral to the trade deal was a red line the Chinese refused to cross. The U.S. doubled-down with sanctions on Huawei – and until proven otherwise I’ll assume both China’s and the U.S.’s positions have further hardened.

This is a critical juncture for China’s faltering Bubble. Fragilities are acute. The assumption is that China will now move aggressively with additional fiscal and monetary stimulus. Conversely, it’s not an inopportune time for Beijing to take some pain. They have a scapegoat – a villainous foreigner determined to contain China’s rising power. For Beijing, the greatest risk is that its population loses trust in the phenomenal communist party meritocracy.

As noted above, the Chinese renminbi dropped 1.4% this week versus the dollar – and is now just a little over 1% away from the key psychological 7.00 level. “China’s Central Bank Won’t Let Yuan Weaken Past 7 to the Dollar (Reuters’ Zheng Li and Kevin Yao): ’At present, rest assured they will certainly not let it break 7,’ a source told Reuters. A defense of the 7 level could help boost confidence in the currency and soothe investor fears about a sharp depreciation in the yuan… ‘Breaking 7 is beneficial to China because it can reduce some of the effects of tariff increases, but the impact on our renminbi confidence is negative and funds will flow out,’ the source said.”

“At present, rest assured…” Excluding its massive surplus with the U.S., China runs a significant trade deficit with the rest of the world. There’s a scenario where President Trump places hefty tariffs on all Chinese imports into the U.S., levies that over time would be expected to significantly reduce demand for Chinese goods. At the same time, a weakening renminbi would see China expend more for much of its imports. Keep in mind, as well, that Beijing’s current stimulus measures are further fueling its apartment Bubble and resulting consumption boom. It’s possible that China’s trade position is poised to radically deteriorate.

Let’s assume the PBOC does move to defend the 7.0 level (renminbi vs. $). Markets will instinctively test this support – while closely monitoring for indications of the scope of reserves (and forward contracts) expended in the process. And China (and the world) better hope reserves prove more resilient than back in 2015, when they proceeded to collapse by $580 billion over a twelve-month period. If China’s reserves begin to rapidly deplete, expect stringent capital control and other measures to stem outflows. And while everyone believes China will resort to fiscal and monetary stimulus until the cows come home, EM Crisis Dynamics invariably force authorities to tighten conditions to bolster currency and financial system stability.

Friday’s report on University of Michigan Consumer Confidence had consumer sentiment at a 15-year high. Consumer Expectations surged almost nine points to 96 (up from January’s 79.9), to the highest reading since January 2004 – and the second strongest reading going back to November 2000. With stock prices recently (May 1st) hitting record highs and the unemployment rate at 50-year lows, consumer optimism is not unreasonable.

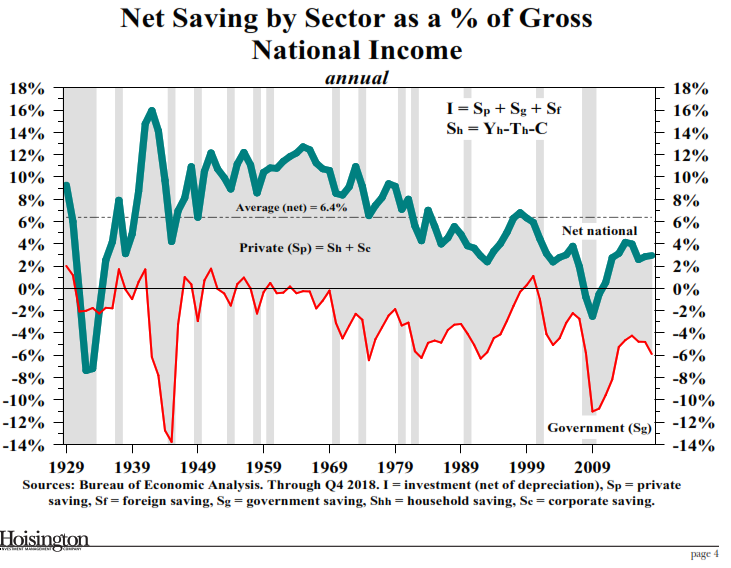

Increasingly, it appears as if the respite from Q4 global market instability has about run its course. As an economy – from governments to corporations to households – I can’t imagine a more poorly prepared system for the gathering storm. I know: fundamentals are “sound” and the banking system is “well capitalized.” Besides, there’s the Quadruple Puts – a deeply entrenched market misperception that really concerns me. Complacency is pervasive – epically so. Ignore fundamental developments, while placing faith in the power of politicians and central bankers (and corporations forever enjoying access to cheap finance to fund buybacks). Such a backdrop creates extraordinary risk for an abrupt change in perceptions and resulting crisis of confidence – in policymakers and the markets.

We started with the markets and will end with the markets. At this point, I don’t see great contradictions between the markets: Safe haven bonds and the risk markets are not actually telling wildly different stories. Seeing low market yields, loose financial conditions, seemingly great underlying U.S. economic fundamentals and Quadruple Puts, highly speculative (trend-following and performance-chasing) markets have been behaving about as one would expect near the end of a historic cycle: an intense, overarching short-term focus on speculative market gains. The safe havens, much less concerned with timing, see speculative Bubbles primed for bursting. Treasuries, bunds, JGBs, Swiss bonds, etc. see an acutely fragile global market structure.

May 14 – Bloomberg (Steve Matthews): “Federal Reserve Bank of Kansas City President Esther George said she’s opposed to cutting interest rates in order to raise inflation to the central bank’s 2% target, warning that could lead to asset-price bubbles and ultimately an economic downturn. ‘Lower interest rates might fuel asset price bubbles, create financial imbalances, and ultimately a recession,’ George… said… ‘In current circumstances, with an unemployment rate well below its projected longer-run level, I see little reason to be concerned about inflation running a bit below its longer-run objective.’”

Markets are not pricing in a 75% probability for a rate cut by December because of current Fed thinking. Chairman Powell is joined by sound thinkers including Esther George that recognize the risks associated with even looser monetary conditions. Markets are instead discerning the high probability of a market dislocation that would so significantly tighten financial conditions that the Fed and global central bankers will have no option other than cutting rates and resorting to more QE.

The breakdown in China/U.S. trade talks provides the initial catalyst. The 3.3% one-month decline in the renminbi (offshore renminbi down 3.9%) is indicative of acute vulnerability in the Chinese currency. And if PBOC support fails to stabilize the market, a crisis of confidence and run on Chinese assets cannot be ruled out. I don’t think one can overstate the financial, economic and geopolitical ramifications of China succumbing to Crisis Dynamics. The world becomes a much more uncertain place. Deleveraging in China would surely equate to global de-risking/deleveraging and highly destabilized global financial flows.

And for the crowd that these days harbors delusions of U.S. markets and economic activity largely immune to global issues, I pose the question: How do U.S. markets perform in the event of illiquidity and a “seizing up” of global markets? As I’ve posited before, the U.S. economy is extremely vulnerable to a dramatic market-induced tightening of financial conditions. What would markets look like if the marketplace turns against negative cash-flow enterprises? How would the U.S. economy function in the event of if debt market illiquidity?

The Powell U-turn granted markets four months of fun and games – and only greater systemic vulnerability. Now comes the downside, with a Fed that just might prove somewhat slower to come to the markets’ rescue than everyone presumes. This week marked the True Start to the U.S. vs. China Trade War. The degree of cluelessness is shocking.

read full post

http://creditbubblebulletin.blogspot.com/

.gif)