Doug Noland writes……. For the Week:

The S&P500 slipped 0.2% (up 6.3% y-t-d), while the Dow added 0.1% (up 6.0%). The Utilities increased 0.7% (up 0.6%). The Banks added 0.7% (up 14.5%), while the Broker/Dealers declined 1.5% (up 9.4%). The Transports slipped 0.9% (up 8.2%). The S&P 400 Midcaps (up 9.4%) and the small cap Russell 2000 (up 10.0%) were little changed for the week. The Nasdaq100 was about unchanged (up 7.2%). The Semiconductors surged 4.3% (up 10.9%). The Biotechs declined 0.6% (up 15.4%). With bullion jumping $21, the HUI gold index surged 5.2% (down 1.2%).

Three-month Treasury bill rates ended the week at 2.33%. Two-year government yields slipped a basis point to 2.61% (up 12bps y-t-d). Five-year T-note yields declined two bps to 2.60% (up 9bps). Ten-year Treasury yields fell three bps to 2.76% (up 7bps). Long bond yields declined three bps to 3.07% (up 5bps). Benchmark Fannie Mae MBS yields dipped one basis point to 3.56% (up 5bps).

Greek 10-year yields fell 11 bps to 4.06% (down 29bps y-t-d). Ten-year Portuguese yields declined eight bps to 1.65% (down 6bps). Italian 10-year yields fell eight bps to 2.65% (down 9bps). Spain’s 10-year yields dropped 12 bps to 1.23% (down 19bps). German bund yields fell seven bps to 0.19% (down 5bps). French yields declined six bps to 0.60% (down 11bps). The French to German 10-year bond spread widened one to 41 bps. U.K. 10-year gilt yields declined five bps to 1.31% (up 3bps). U.K.’s FTSE equities index % (up % y-t-d).

Japan’s Nikkei 225 equities index increased 0.5% (up 3.8% y-t-d). Japanese 10-year “JGB” yields declined two bps to 0.00% (down 1bp y-t-d). France’s CAC40 gained 1.0% (up 4.1% y-t-d). The German DAX equities index increased 0.7% (up 6.8%). Spain’s IBEX 35 equities index rose 1.3% (up 7.6%). Italy’s FTSE MIB index added 0.5% (up 8.1%). EM equities were mixed. Brazil’s Bovespa index gained 1.6% (up 11.1%), while Mexico’s Bolsa fell 1.4% (up 4.8%). South Korea’s Kospi index jumped 2.5% (up 6.7%). India’s Sensex equities index declined 1.0% (down 0.1%). China’s Shanghai Exchange added 0.2% (up 4.3%). Turkey’s Borsa Istanbul National 100 index surged 3.4% (up 11.5%). Russia’s MICEX equities index gained 1.0% (up 5.9%).

Investment-grade bond funds saw outflows of $158 million, and junk bond funds posted outflows of $264 million (from Lipper).

Freddie Mac 30-year fixed mortgage rates were unchanged at 4.45% (up 30bps y-o-y). Fifteen-year rates were unchanged at 3.88% (up 26bps). Five-year hybrid ARM rates increased three bps to 3.90% (up 38bps). Bankrate’s survey of jumbo mortgage borrowing costs had 30-yr fixed rates up six bps to a six-week high 4.48% (up 19bps).

Federal Reserve Credit last week declined $5.2bn to $4.011 TN. Over the past year, Fed Credit contracted $389bn, or 8.9%. Fed Credit inflated $1.200 TN, or 43%, over the past 324 weeks. Elsewhere, Fed holdings for foreign owners of Treasury, Agency Debt gained $5.2bn last week to $3.408 TN. “Custody holdings” rose $56.6bn y-o-y, or 1.7%.

M2 (narrow) “money” supply rose $15.2bn last week to $14.521 TN. “Narrow money” gained $684bn, or 4.9%, over the past year. For the week, Currency increased $2.2bn. Total Checkable Deposits jumped $30.0bn, while Savings Deposits dropped $25.5bn. Small Time Deposits gained $4.6bn. Retail Money Funds rose $4.0bn.

Total money market fund assets added $2.4bn to $3.052 TN. Money Funds gained $227bn y-o-y, or 8.0%.

Total Commercial Paper increased $3.0bn to $1.069 TN. CP declined $60bn y-o-y, or 5.3%.

Currency Watch:

The U.S. dollar index declined 0.6% to 95.794 (down 0.4% y-t-d). For the week on the upside, the British pound increased 2.5%, the South African rand 1.7%, the New Zealand dollar 1.4%, the Mexican peso 0.6%, the Norwegian krone 0.6%, the Singapore dollar 0.4%, the euro 0.4%, the Canadian dollar 0.3%, the Japanese yen 0.2%, the Australian dollar 0.2%, the Swiss franc 0.2% and the South Korean won 0.1%. For the week on the downside, the Swedish krona declined 0.2% and the Swedish krona slipped 0.2%. The Chinese renminbi increased 0.44% versus the dollar this week (up 1.93% y-t-d).

Commodities Watch:

January 25 – Bloomberg (Aibing Guo, Dan Murtaugh and Javier Blas): “China’s largest oil refiner said its trading unit lost almost $700 million last year after being wrong-footed by zigzagging markets, revealing one of the biggest losses by a commodity trader in the last decade. Sinopec blamed the losses at its Unipec unit in part on ‘inappropriate hedging techniques’ and said it closed its positions after discovering the problem. Oil plunged sharply in late November and December, prompting traders to speculate that Unipec may have contributed to the price drop… It marks a sharp reversal of fortunes for Unipec, which has grown over the last 25 years to become one of the largest and most aggressive oil traders.”

The Goldman Sachs Commodities Index declined 0.8% (up 9.4% y-t-d). Spot Gold rose 1.7% to $1,303 (up 1.6%). Silver jumped 1.9% to $15.699 (up 1.0%). Crude slipped 11 cents to $53.69 (up 18%). Gasoline dropped 4.4% (up 7%), and Natural Gas sank 8.7% (up 8%). Copper added 0.4% (up 4%). Wheat increased 0.4% (up 3%). Corn declined 0.4% (up 1%).

Market Dislocation Watch:

January 23 – Wall Street Journal (Ira Iosebashvili and Amrith Ramkumar): “Stocks, bond yields, commodities and other risky assets have continued moving in lockstep lately, raising hopes that this year’s nascent rebound will continue but also fueling worries momentum could once again reverse. Correlations across assets have hit their highest level in almost a year, with the S&P 500, the 10-year U.S. Treasury yield and U.S. crude oil moving in tandem in nine of the previous 12 sessions through Tuesday. A six-day run of declines for the asset classes earlier this month was the longest streak since June, according to Dow Jones Market Data.”

January 25 – Bloomberg (Gowri Gurumurthy): “This month’s new junk-bond deals are all trading up in the secondary, even after most of them were upsized and priced at the tight end of guidance. High-yield issuers returned this month, the busiest for bond sales since September 2018, following a slump in issuance during December…”

January 22 – Bloomberg (Christopher Maloney): “Mortgage returns are lagging those of investment-grade corporates to start 2019, and that gap may persist thanks to an OAS spread differential that’s near its widest in two years. The option-adjusted spread of the Bloomberg Barclays U.S. Aggregate Corporate index offered 106 bps more than seen in the U.S. MBS index as of Friday’s close. While this is down from the 121 bps seen at the beginning of the year, it’s still near the widest since the beginning of 2017.”

Trump Administration Watch:

January 25 – Reuters (Steve Holland and Richard Cowan): “President Donald Trump agreed under mounting pressure on Friday to end a 35-day-old partial U.S. government shutdown without getting the $5.7 billion he had demanded from Congress for a border wall, handing a political victory to Democrats. The three-week spending deal reached with congressional leaders, quickly passed by the Republican-led Senate and the Democratic-controlled House of Representatives without opposition and signed by Trump, paves the way for tough talks with lawmakers about how to address security along the U.S.-Mexican border.”

January 22 – Reuters (Jeff Mason): “As much as U.S. President Donald Trump wants to boost markets through a trade pact with China, he will not soften his position that Beijing must make real structural reforms, including how it handles intellectual property, to reach a deal, advisers say. Offering to buy more American goods is unlikely by itself to overcome an issue that has bedeviled talks between the two countries. Those talks are set to continue when Chinese Vice Premier Liu He visits Washington at the end of January. The United States accuses China of stealing intellectual property and forcing American companies to share technology when they do business in China. Beijing denies the accusations.”

January 24 – CNBC (Berkeley Lovelace Jr.): “Commerce Secretary Wilbur Ross said Thursday the U.S. is still ‘miles and miles’ from a trade deal with China. ‘Frankly, that shouldn’t be too surprising,’ Ross said… The U.S. and China have ‘lots and lots of issues,’ he continued, and the Trump administration will need to create ‘structural reforms’ and ‘penalties’ in order to resume normal trade relations with Beijing. ‘We would like to make a deal but it has to be a deal that will work for both parties,’ he said. ‘We’re miles and miles from getting a resolution.’ Ross listed the sticking points, starting with what he calls America’s ‘intolerably big trade deficit’ with China. That deficit ballooned to $323.3 billion in 2018… It’s the worst imbalance on record dating to 2006.”

January 24 – Bloomberg (Andrew Mayeda and Jenny Leonard): “Commerce Secretary Wilbur Ross said the U.S. and China are eager to end their trade war, but the outcome will hinge on whether Beijing will deepen economic reforms and further open up its markets. Ross said he expects that negotiators will release a statement on their progress after Chinese Vice Premier Liu He meets with U.S. Trade Representative Robert Lighthizer in Washington from Jan. 30-31. ‘The harder issues are the ones that deal with structural reforms, particularly intellectual property rights,’ said Ross…, adding that China is moving up the technology value chain and also has an interest in protecting its own IP. ‘The equal market access is another very big issue. The idea of forced technology transfers is a huge issue.’”

January 23 – CNBC (Tucker Higgins): “President Donald Trump’s outside advisor on China said… that he didn’t expect a breakthrough in trade talks in the ‘near term.’ Michael Pillsbury, director of the Center for Chinese Strategy at the Hudson Institute and a noted China hawk with the ear of the president, suggested that he expected a planned meeting between U.S. and Chinese negotiators scheduled for the end of the month to conclude without a trade deal. ‘Over the last 45 years, a lot of American presidents have negotiated with China,’ Pillsbury said… ‘And there are some patterns to what has gone on. One of them is that the Chinese prefer to make a last-minute deal, to get the best deal they can. So I am not among those who think there is going to be a breakthrough in the next few days.’”

January 24 – Bloomberg (Victoria Guida and Katy O’Donnell): “The White House will announce a plan by next month to end government control of Fannie Mae and Freddie Mac in a bid to resolve a long debate over the fate of the two companies that dominate the mortgage market, a top regulator said. Joseph Otting, acting director of the Federal Housing Finance Agency, told employees last week that the administration would not wait on Congress, where attempts to overhaul the housing finance system have repeatedly faltered in the years since Fannie and Freddie were rescued during the financial crisis, according to a recording of his remarks obtained by Politico. ‘In the next two to four weeks you’re going to be able to see some communication that comes out of the White House and Treasury that really sets a direction for what the future of housing will be in the U.S. and what the FHFA’s part of that will be,’ Otting said…”

January 21 – Reuters (Sijia Jiang, Michael Martina, Christian Shepherd and Rishika Chatterjee): “The United States will proceed with the formal extradition from Canada of Huawei executive Meng Wanzhou, Canada’s ambassador to the United States told the Globe and Mail, as Beijing vowed to respond to Washington’s actions.”

Federal Reserve Watch:

January 25 – Wall Street Journal (Nick Timiraos): “Federal Reserve officials are close to deciding they will maintain a larger portfolio of Treasury securities than they’d expected when they began shrinking those holdings two years ago, putting an end to the central bank’s portfolio wind-down closer into sight. Officials are still resolving details of their strategy and how to communicate it to the public… With interest rate increases on hold for now, planning for the bond portfolio could take center stage at a two-day policy meeting of the central bank’s Federal Open Market Committee next week.”

January 24 – Wall Street Journal (Paul Kiernan and Vivian Salama): “A top White House economic adviser said… President Trump will seek to fill two Federal Reserve Board vacancies with nominees who don’t believe a rapidly expanding economy has to fuel faster inflation. ‘The White House wants highly capable, competent people who understand that you can have strong economic growth without higher inflation,’ White House National Economic Council head Lawrence Kudlow told reporters. He said surges in the economy’s productive capacity mean that more people can work at higher wages without causing inflation to pick up. Mr. Trump has repeatedly criticized the Fed in recent months for raising interest rates.”

U.S. Bubble Watch:

January 23 – CNBC (Annie Nova): “Hundreds of thousands of people are living without a paycheck amid the longest government shutdown in history. As a result, federal employees and contractors are digging into their retirement savings, filing for unemployment, picking up other jobs and unable to meet their rent or mortgage payments. Most people would be in the same bind if they missed even one pay period. Just 40% of Americans are able to cover an unexpected $1,000 expense, such as an emergency room visit or car repair, with their savings, according to a survey from… Bankrate.”

January 24 – Reuters (Richard Leong): “J.P. Morgan economists reduced their outlook for U.S. economic growth in the first quarter to 1.75% from 2.00% as the partial U.S. government shutdown has stretched to a second month for the longest one ever, they said… ‘That estimate solely accounts for the reduction in government sector output and does not incorporate any potential spillover effects into private economic activity. Fortunately, so far those spillovers look contained,’ the banks’ economists wrote…”

January 22 – CNBC (Diana Olick): “Real estate brokers are trying to figure out why sales of existing homes plunged in December. The 6.4% monthly move was unusually large, regardless of direction. The tally from the National Association of Realtors generally moves in the very low single digits month to month. In fact, the shift was one of the largest that didn’t involve some sort of change in government policy, like the homebuyer tax credit. ‘The latest decline is harder to explain. Perhaps it is the decline in consumer confidence that’s been occurring in the latter half of 2018,’ said Lawrence Yun, chief economist for the Realtors. ‘The latest numbers do not reflect the lower, current mortgage rates compared to the November figures, so it’s really harder to explain.’”

January 23 – Bloomberg (Prashant Gopal): “After years of soaring U.S. home prices, cash-out refinancing is coming back in fashion, primarily among homeowners with government-backed loans who tend to have weaker credit and fewer other options. About 76% of refinancing deals last year for loans backed by the Federal Housing Administration, the departments of Agriculture and Veterans Affairs were used to tap equity, the highest share in 20 years of data, according to CoreLogic…”

January 25 – Bloomberg (Jesse Hamilton): “High-risk leveraged lending is still standing out as a danger in the financial system, though the overall risk has lessened in the wider $4.4 trillion portfolio of big loans tied to multiple lenders, according to an examination… by U.S. banking regulators. While leveraged loans are only a segment of the Shared National Credit Program review by the Federal Reserve and other agencies, that lending — often backing mergers and acquisitions of highly indebted companies — represent the bulk of loans rated at the lowest levels. ‘Risks associated with leveraged lending activities are building in contrast to the portfolio overall,’ the Fed, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. said… ‘A material downturn in the economy could result in a significant increase in classified exposures and higher losses.’”

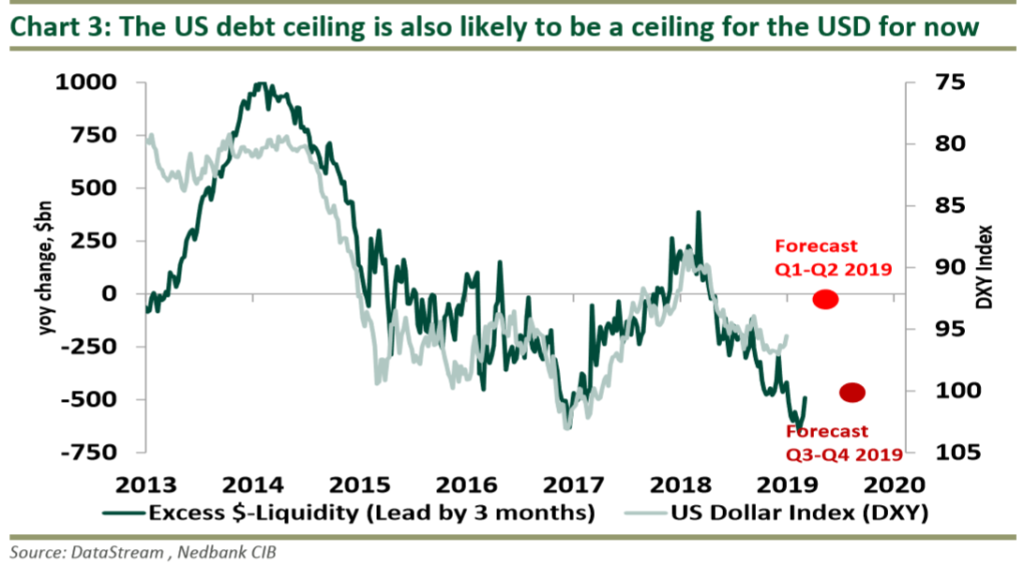

January 24 – Bloomberg (Emily Barrett and Misyrlena Egkolfopoulou): “The U.S. government shutdown risks putting a dent in both the dollar and Treasuries if it drags on. A quick resolution could do the same. A drawn-out spending battle may collide with the looming debate over America’s borrowing limit, potentially raising the odds of a U.S. credit rating downgrade, as occurred in 2011. But some observers reckon the market reaction this time around would be different: Instead of driving a haven trade into Treasuries, concerns about the U.S.’s growing debt burden could reverse that flow, pushing sovereign yields higher and the dollar lower.”

January 22 – Wall Street Journal (Rob Copeland): “Messaging startup Hustle projected the picture of Silicon Valley largess. The company spent millions of dollars raised from investors such as Alphabet Inc. on expensive new hires, on-tap kombucha, arcade games and a six-figure salary for its pedigreed chief executive. So it came as a shock to many employees earlier this month when co-founder and CEO Roddy Lindsay sent them an early-morning email announcing mass layoffs. Before the week was done, even the espresso machine was ripped out of the kitchen at Hustle’s San Francisco headquarters. Hustle is hardly the first startup to spend lavishly in an era of technology riches. What is new these days: The bill is coming due.”

January 22 – CNBC (Diana Olick): “After falling to record lows, the supply of homes on the market is finally rising. But a growing share of those homes are still out of reach to most buyers. In hot markets like Seattle, San Jose, California, Las Vegas and Portland, Oregon, the number of homes for sale rose last year. Even so, the share of affordable homes fell, thanks to rising home values and increasing mortgage interest rates. In Seattle, 58% of homes were considered affordable in 2017, but that share dropped to 46% last year, according to a survey from Redfin…”

January 25 – Wall Street Journal (Sam Goldfarb): “More companies with low credit ratings are limiting their borrowing to loans that would be repaid first in a bankruptcy, a trend that stands to undermine loans’ reputation as a safe investment. At the end of last year, roughly 27% of first-lien loans—the most senior type of debt that is typically held by investors—were backed by companies that didn’t have junior debt outstanding, according to LCD, a unit of S&P Global Market Intelligence. That was the largest share in records going back to 2007, up from 26% in 2017 and 18% in 2007… The presence of more junior debt is often referred to as a ‘debt cushion’ for investors in first-lien loans. Junior bonds and loans typically absorb losses first in a bankruptcy, while senior lenders typically get most or all of their money back.”

China Watch:

January 20 – CNBC (Huileng Tan): “China… announced that its official economic growth came in at 6.6% in 2018 — the slowest pace since 1990. That announcement was highly anticipated by many around the world amid Beijing’s ongoing trade dispute with the U.S., its largest trading partner. Economists polled by Reuters had predicted full-year GDP to come in at that pace, which was down from a revised 6.8% in 2017. Fourth quarter GDP growth was 6.4%, matching expectations.”

January 21 – Reuters (Yawen Chen and Ryan Woo): “Weakness in the service and farm sectors slowed China’s economic growth in the fourth quarter, despite a strong pickup in construction activity… Services grew 7.4% from a year earlier, slowing from 7.9% in the third quarter, while growth in agriculture slowed to 3.5% from 3.6%, the National Bureau of Statistics (NBS) said.”

January 20 – Reuters (Yawen Chen, Stella Qiu and Ryan Woo): “Growth in property investment in China cooled to the second slowest pace in 2018 in December, adding to signs of a further slackening in the real estate market in a blow to a key driver of economic growth. Real estate investment, which mainly focuses on the residential sector but includes commercial and office space, rose 8.2% in December from a year earlier, down from 9.3% in November…”

January 25 – Reuters (Kevin Yao): “China will take steps to spur growth amid a trade war with the United States, but there is limited room for aggressive stimulus in an economy already laden with massive debts and a property market prone to credit-driven spikes, policy insiders said. China’s deepening economic slowdown has fanned market expectations of a big spending binge, especially if the bruising tariff war with Washington escalates, intensifying pressure on Chinese jobs and threatening social stability. Such a move, plans for which have repeatedly been denied by China’s top leaders, would come at a price, however – similar moves in the past have quickly juiced growth rates but also buried the world’s No.2 economy under a mountain of debt. ‘The room for a strong stimulus is not big, and there are very big risks, because that will rely on a flood of cash and increased leverage in the economy,’ said a policy insider…”

January 20 – Reuters (Andrew Galbraith): “Encouraging China’s banks to actively increase support for the real economy, rather than relying on authorities’ orders to boost lending, is the key to improving the supply of credit in the economy, a central bank official said…”

January 21 – Bloomberg: “President Xi Jinping stressed the need to maintain political stability in an unusual meeting of China’s top leaders — a fresh sign the ruling party is growing concerned about the social implications of the slowing economy. Xi told a ‘seminar’ of top provincial leaders and ministers in Beijing… that the Communist Party needed greater efforts ‘to prevent and resolve major risks,’… He said areas of concern facing the leadership ranged from politics and ideology to the economy, environment and external situation. ‘The party is facing long-term and complex tests in terms of maintaining long-term rule, reform and opening-up, a market-driven economy, and within the external environment,’ Xi said… ‘The party is facing sharp and serious dangers of a slackness in spirit, lack of ability, distance from the people, and being passive and corrupt. This is an overall judgment based on the actual situation.’”

January 20 – CNBC (Edward White): “Defaults on Chinese corporate bonds rose to a record high last year, in a fresh sign of wobbles hitting the country’s financial markets as economic growth slows. Forty five Chinese corporates defaulted on 117 bonds with a principal amount of Rmb110.5bn ($16.3bn), according to Fitch… Both the number of issuers and principal value were all-time peaks. ‘The vast majority of onshore defaults were by non-[state-owned enterprises], which accounted for 86.7% of defaults by issuer count and 90% by principal amount,’ said Jenny Huang and Shuncheng Zhang, analysts at Fitch, also noting signs that ‘investor risk appetite has deteriorated on the surge in onshore defaults’.”

January 24 – Bloomberg: “Several Chinese provinces have unveiled sharply lower shantytown redevelopment targets for 2019, suggesting one key driver of home sales may be on the wane. From Sichuan to Shanxi, targets to replace older, rundown dwellings with new, affordable housing have fallen as much as 74% from 2018… UBS Group AG property analyst John Lam estimates the national target may this year be pared back by 14% to 5 million units. Beijing’s shantytown redevelopment drive, part of China’s fight to alleviate poverty, had been fueling robust demand for new residential properties over the past three years. People were often given cash handouts to buy new apartments on the private market, and such transactions may have contributed to more than one-fifth of home sales in 2017, China International Capital Corp. wrote…”

January 25 – CNBC (Evelyn Cheng): “Chinese authorities face an ever-growing list of challenges — be it an ongoing trade fight with the U.S. or headwinds in domestic demand — and it appears they don’t have many tools left to spur the economy amid a slowdown. The real estate market in China has traditionally played a major role in its economic development, household wealth and public sentiment and was used by Beijing to stimulate growth during previous downturns… But along with a Chinese penchant for investing in houses, persistent expectations of government support sent prices and the household debt burden soaring… Junheng Li, founder of China-focused equity research firm JL Warren Capital, estimates 61% of Chinese urban households live in homes less than 10 years old… ‘(Some) simple math shows that continuously building new homes to stimulate investments and meanwhile create the false impression of wealth effect coming with home price appreciation is about to hit the wall,’ she said… ‘Chinese policy makers are fully aware and highly alert not to send the wrong signal to the home buyers that home prices will continue to hike.’”

January 23 – Bloomberg: “Chinese companies challenged by policy makers’ determination to tamp down leverage in the country’s financial system have found some creative ways to secure funding. One of the least transparent mechanisms to emerge so far is a tactic where bond issuers are indirectly buying their own bond offerings, according to investors and credit analysts. The idea is to inflate issuance sizes, creating the image of greater access to capital than might otherwise be true — and leading to lower coupons in subsequent sales.”

Central Bank Watch:

January 24 – Financial Times (Claire Jones and Ben Hall): “The European Central Bank has sounded the alarm over the eurozone economy, warning a slowdown it thought would be temporary was showing signs of becoming long-lasting because of global trade tensions, Brexit and financial market volatility. The shift in outlook, which policymakers said had clearly ‘moved to the downside’, comes just six weeks after the ECB removed the most important element of its crisis-era stimulus, halting new purchases of bonds as part of its €2.6tn quantitative easing programme. ‘We were unanimous about acknowledging the weaker momentum and changing the balance of risk for growth,’ said Mario Draghi… The new guidance, which the ECB said had not yet trigger a change in monetary policy, came amid mounting signs of economic trouble across the eurozone. A monthly poll of purchasing managers, a key gauge of business activity, fell to its lowest levels since the eurozone debt crisis…”

January 22 – Reuters (Tetsushi Kajimoto and Daniel Leussink): “The Bank of Japan cut its inflation forecasts… but maintained its massive stimulus programme, with Governor Haruhiko Kuroda warning of growing risks to the economy from trade protectionism and faltering global demand.”

EM Watch:

January 22 – Wall Street Journal (Rob Copeland): “Reports of the death of the emerging market bond market appear to have been greatly exaggerated. A currency crisis in Turkey and Argentina and worries about rising US sanctions risk for Russia kept a lid on EM sovereign debt sales in 2018. But a spate of issuance since the start of the year is offering proof that all problems can be forgiven if the price is right. After dropping by a fifth in value last year, US dollar issuance from the developing world has bounced back to hit $14.1bn for the year to January 17, according to Dealogic. That makes it the third-best start on record after 2018 and 2014 as countries rush to take advantage of the window of opportunity opened up by diminishing expectations for further US interest rate rises this year.”

January 21 – Bloomberg (Aline Oyamada and Yakob Peterseil): “The longest weekly rally in emerging-market stocks in a year encouraged record inflows into at least one exchange-traded fund in the past two weeks. Investors piled more than $2 billion into the iShares Core MSCI Emerging Markets ETF, the second largest emerging-market ETF, in the two weeks through Jan. 18.”

Global Bubble Watch:

January 23 – Financial Times (Gideon Rachman): “Two questions come up repeatedly in the corridors of the World Economic Forum in Davos. First, what is going to happen in the US-China trade war? Second, what is going to happen with Brexit? There are considerable similarities between these two questions. In both cases, the only sensible answer is some variant of: ‘I don’t know’. In both cases, there is a strong possibility of a bad ‘no deal’ outcome that could create turmoil in the world economy. And, in both cases, the answer will be revealed in March. The Trump administration has set a deadline of March 2 for the US to reach a new trade deal with China. Without an agreement, the US has pledged to raise its import tariffs on $200bn worth of Chinese goods to 25%, from the current 10% level. The deadline for Britain to leave the EU is March 29. Without a deal, the default position is that there will be a ‘no deal Brexit’ — in which Britain will crash out of the EU, leading to the immediate imposition of tariffs, the lapse of existing legal agreements and a surge in red-tape and regulations.”

January 21 – Reuters (Leika Kihara and Silvia Aloisi): “The International Monetary Fund trimmed its global growth forecasts… and a survey showed increasing pessimism among business chiefs as trade tensions and uncertainty loomed over the world’s biggest annual gathering of the rich and powerful.”

January 22 – CNBC (Jeff Cox): “Governments are continuing to run up huge debt levels, with emerging countries helping push the total global IOU to 80% of gross domestic product. The worldwide tab through 2018 is now up to $66 trillion as measured in U.S. currency terms, about double where it was in 2007, just as the financial crisis was beginning to unfold, according to Fitch Ratings’ new Global Government Debt Chart Book… ‘Government debt levels are high, leaving many countries poorly positioned for financial tightening as global interest rates begin to move higher,’ James McCormack, Fitch’s global head of sovereign ratings, said…”

January 21 – Reuters (Marc Jones): “Credit ratings in the developing world look set to grind lower again this year as the world economy slows, with Latin America likely to be the center of the action… The year is already off to a gloomy start, with S&P Global warning last week that nearly a third of big bond issuers in emerging markets now have an unsustainable amount of debt. Ratings matter for sovereign borrowers because the more highly rated they are, the lower their funding costs tend to be. Fitch Ratings thinks there will be more downgrades than upgrades again this year and Moody’s… still has close to twice as many countries on downgrade warnings, at 19, than the 11 it sees as candidates for an upgrade.”

January 20 – Reuters (Tom Miles): “Global foreign direct investment (FDI) fell 19% last year to an estimated $1.2 trillion, largely caused by U.S. President Donald Trump’s tax reforms, the United Nations trade and development agency UNCTAD said…”

January 24 – Bloomberg (Chanyaporn Chanjaroen and Pooja Thakur Mahrotri): “Rising interest rates and the latest round of property curbs have put the brakes on mortgage demand at Singapore’s banks, potentially further dragging down the city’s housing market. Home-loan growth slowed to 1.9% in the first 11 months of 2018, less than half the 4.2% increase posted in 2017… Mortgage growth will stay stuck below 2% this year, according to Diksha Gera, an analyst at Bloomberg Intelligence.”

January 23 – Bloomberg (Cathy Chan and Crystal Tse): “First came a sweeping government crackdown and a surge in defaults and failures at thousands of China’s peer-to-peer lenders. Now, in another troubling sign for the industry, some of the biggest investment banks have stopped taking them public. Wall Street firms including Goldman Sachs… and Citigroup Inc. walked away from U.S. initial public offerings of Chinese P2P lenders in recent months, people with knowledge of the matter said.”

Europe Watch:

January 23 – Wall Street Journal (Stephen Fidler): “Europe seems stuck, its economic recovery running out of steam and its politics shaken by the growing strength of nationalist politicians in many European countries. The continent is still in shock from the effects of the financial crisis that started more than a decade ago. In its wake, it has left ‘polarization, reactionary populism and inequality,’ Spain’s new Prime Minister Pedro Sánchez told the World Economic Forum… As a result, politics is in a funk in many countries. Brexit, France’s street protests, and a reaction in Italy and countries of Eastern Europe against the policy prescriptions of the European Union and increased immigration have clouded the path forward, while also threatening to undermine the recovery. Many business and financial leaders prefer to seek action elsewhere.”

January 24 – Bloomberg (Fergal O’Brien): “Germany’s industrial slump worsened at the start of 2019, dragging the euro-area economy into its worst performance in more than five years. IHS Markit’s monthly index showed manufacturing in Germany shrank for the first time in four years. In the euro area it barely grew, and a broader measure of activity dropped to the weakest since 2013.”

January 22 – Financial Times (Valentina Romei): “Italian banks became more cautious about lending in the last quarter of 2018, tightening credit standards as well as terms and conditions on their loans, according to the European Central Bank’s latest bank lending survey. This is the second successive quarter of tightening in the Italian banking sector, ‘partly because they are charging higher interest margins on riskier loans’, said Jack Allen, an economist at Capital Economics.”

Brexit Watch:

January 22 – Reuters (Guy Faulconbridge and William James): “An attempt by British lawmakers to prevent a no-deal Brexit was gaining momentum on Wednesday after the opposition Labour Party said it was likely to throw its parliamentary weight behind that. The United Kingdom, facing the deepest political crisis since World War Two, is due to leave the European Union at 2300 GMT on March 29 but has no approved deal on how the divorce will take place.”

Japan Watch:

January 20 – Reuters (Tetsushi Kajimoto): “Confidence among Japanese manufacturers dropped for a third straight month in January to a two-year low, a Reuters monthly poll showed, as worries over the health of the global economy and trade tensions take a toll on the corporate sector.”

January 22 – Associated Press (Yuri Kageyama): “Japan’s exports fell 3.8% in December from a year earlier, hit by slowing demand in China, as the trade balance shifted back into deficit for the year… For the year, imports outpaced the rise in exports, leaving a trade deficit for the first time in three years…”

Fixed-Income Bubble Watch:

January 23 – CNBC (Jim Christie): “California power company PG&E Corp, which expects to soon file for bankruptcy, said… it would cost between $75 billion and $150 billion to fully comply with a judge’s order to inspect its power grid and remove or trim trees that could fall into power lines and trigger wildfires.”

Leveraged Speculation Watch:

January 23 – CNBC (Robert Frank): “Hedge fund billionaire Ken Griffin closed a deal to buy the most expensive home ever sold in the U.S., paying around $238 million for a New York penthouse… The deal is the largest in Griffin’s recent $700 million global real estate shopping spree, believed to be the largest ever for a U.S. billionaire. Over the past few years, the founder and CEO of Citadel has purchased the most expensive homes in Chicago, Miami and New York. He has spent more than $200 million to buy land in Palm Beach, Florida, for a home he plans to build there. And this week, news broke that he purchased a $122 million property in London, which was the most expensive sale in that city in a decade.”

Geopolitical Watch:

January 25 – CNBC (Sam Meredith): “Liberal billionaire George Soros… warned that the U.S. and China, the world’s two largest economies, are locked in a ‘cold war that could soon turn into a hot one.’ His comments come at a time when investors are increasingly concerned about a serious economic downturn, with a long-running U.S.-China trade war souring business and consumer sentiment. Referencing Trump’s decision to label China as a ‘strategic’ competitor in late 2017, Soros said this approach was ‘too simplistic.’ ‘An effective policy towards China can’t be reduced to a slogan. It needs to be far more sophisticated, detailed and practical; and it must include an American economic response to the Belt and Road Initiative,’ he said.”

January 23 – Reuters (Andrew Osborn and Robin Emmott): “Russia accused the United States on Thursday of trying to usurp power in Venezuela and warned against military intervention, putting it at odds with Washington and the EU which backed protests against one of Moscow’s closest allies. Venezuelan opposition leader Juan Guaido declared himself interim leader on Wednesday, winning the support of Washington and parts of Latin America. That prompted socialist President Nicolas Maduro… to sever diplomatic ties with the United States. The prospect of Maduro being ousted is a geopolitical and economic headache for Moscow which, alongside China, has become a creditor of last resort for Caracas”

January 25 – Reuters (Robin Emmott and Vladimir Soldatkin): “NATO and Russia failed on Friday to resolve a dispute over a new Russian missile that Western allies say is a threat to Europe, bringing closer Washington’s withdrawal from a landmark arms control treaty… Without a breakthrough, the United States is set to start the six-month process of pulling out of the 1987 Intermediate-range Nuclear Forces Treaty (INF), having notified it would do so in early December and accusing Moscow of breaching it.”

January 24 – Financial Times (Edward White and Nian Liu): “Taiwan’s foreign minister has called for international support after a Chinese publication sought to name and shame foreign companies that do not acknowledge Taiwan as part of China. A Chinese academic study of hundreds of the world’s largest companies operating in China named 66 companies that it said ‘misidentified’ Taiwan, in a move that threatens to reignite international tension over how global corporates refer to Taiwan. The publication’s list of companies — which included US tech giants Apple and Amazon as well as German industrial Siemens — has been reported by China’s state media and has prompted calls by a Communist party-linked news outlet for stronger oversight by Chinese authorities.”

January 24 – Bloomberg (Saijel Kishan, Katherine Burton and Melissa Karsh): “Billionaire George Soros warned of the ‘mortal danger’ of China’s use of artificial intelligence to repress its citizens under the leadership of Xi Jinping, who he called the most dangerous opponent of democracies. ‘The instruments of control developed by artificial intelligence give an inherent advantage of totalitarian regimes over open societies,’ the 88-year-old said… ‘China is not the only authoritarian regime in the world but it’s undoubtedly the wealthiest, strongest and most developed in machine learning and artificial intelligence.’”

January 21 – Reuters (Angus McDowall and Dan Williams): “Israel struck in Syria early on Monday, the latest salvo in its increasingly open assault on Iran’s presence there, shaking the night sky over Damascus with an hour of loud explosions in a second consecutive night of military action.”

http://creditbubblebulletin.blogspot.com/2019/01/weekly-commentary-just-facts-january-25.html