Doug Noland writes….When I began posting the CBB some twenty years ago, I made a commitment to readers: “I’ll call it as I see it – and let the chips fall where they will.” Over the years, I made a further commitment to myself: Don’t be concerned with reputation – stay diligently focused on analytical integrity.

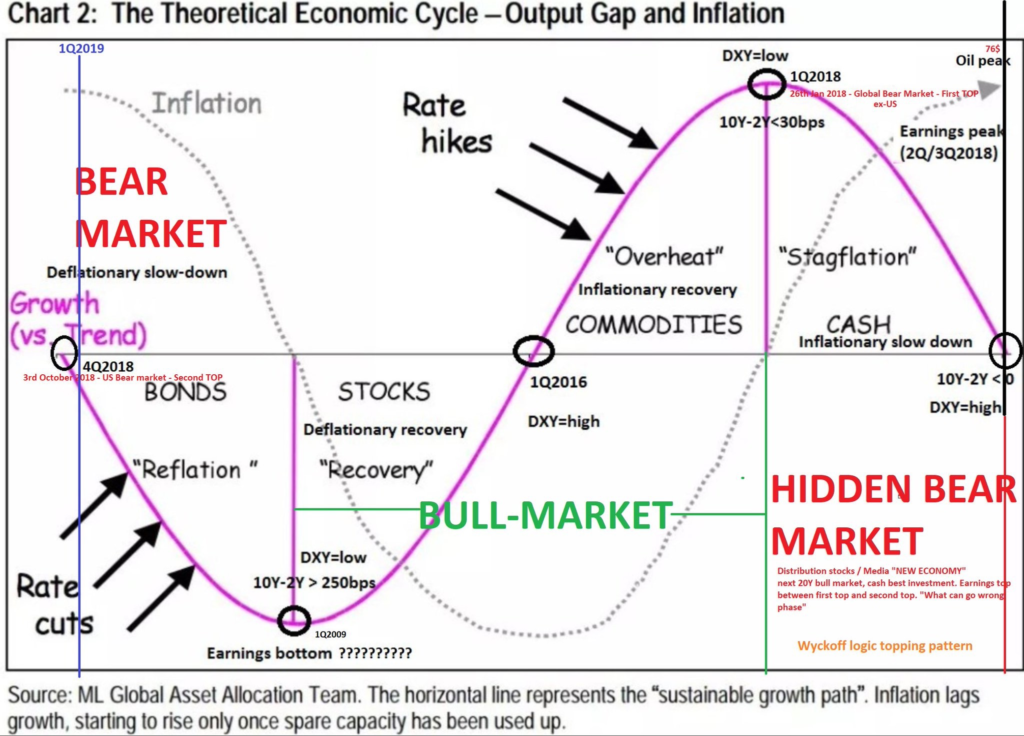

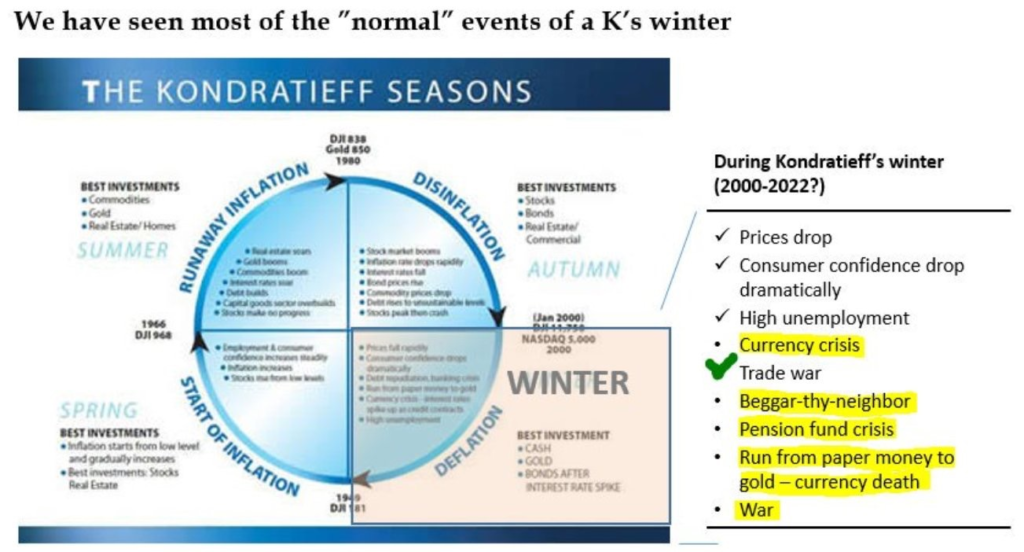

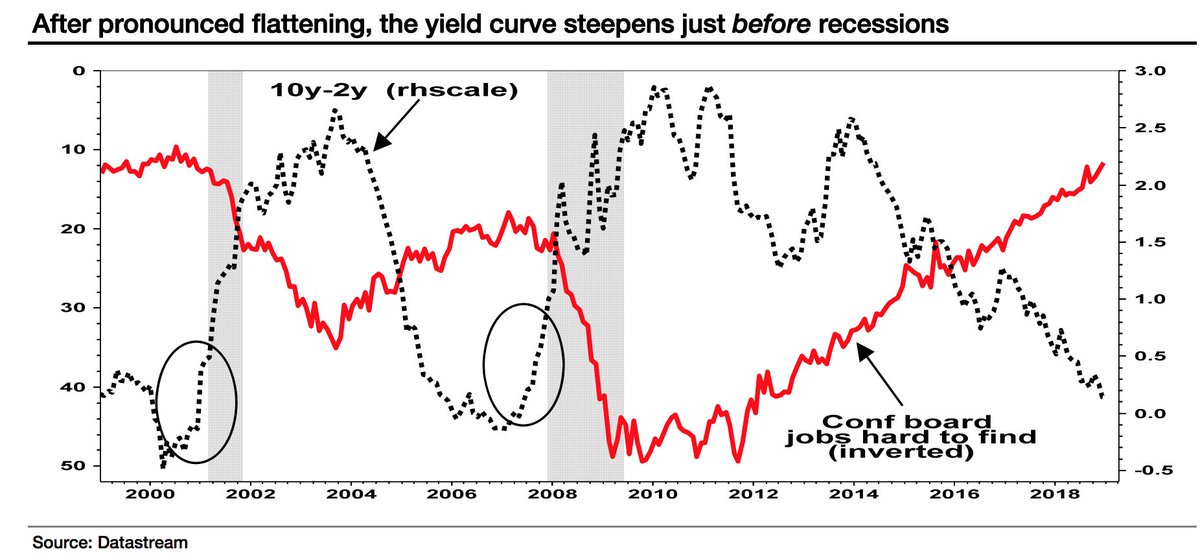

I attach this odd intro to “Issues 2019” recognizing this is a year where I could look quite foolish. I believe Global Financial Crisis is the Paramount Issue 2019. Last year saw the bursting of a historic global Bubble, Crisis Dynamics commencing with the blow-up of “short vol” strategies and attendant market instabilities. Crisis Dynamics proceeded to engulf the global “Periphery” (Argentina, Turkey, EM, more generally, and China). Receiving a transitory liquidity boost courtesy of the faltering “Periphery,” speculative Bubbles at “Core” U.S. securities markets succumbed to blow-off excess. Crisis Dynamics finally engulfed a vulnerable “Core” during 2018’s tumultuous fourth quarter.

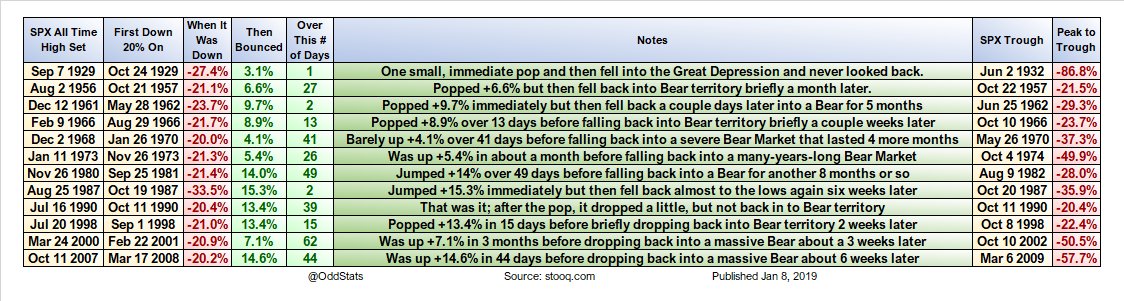

As we begin a new year, rallying risk markets engender optimism. The storm has passed, it is believed. Especially with the Fed’s early winding down of rate “normalization”, there’s no reason why the great bull market can’t be resuscitated and extended. The U.S. economy remains reasonably strong, while Beijing has China’s slowdown well under control. A trade deal would reduce uncertainty, creating a positive boost for markets and economies. With markets stabilized, the EM boom can get back on track. As always, upside volatility reenergizes market bullishness.

I titled Issues 2018, “Market Structure.” I fully anticipate Market Structure to remain a key Issue 2019. Trend-following strategies will continue to foment volatility and instability. U.S. securities markets rallied throughout the summer of 2018 in the face of a deteriorating fundamental backdrop. That rally, surely fueled by ETF flows and derivatives strategies, exacerbated fragilities. Speculative flows fueling the upside destabilization eventually reversed course – and market illiquidity soon followed. Yet short squeezes and the unwind of market hedges create the firepower for abrupt rallies and extreme shifts in market sentiment.

Market Illiquidity is a key Issue 2019. Its Wildness Lies in Wait. Rallying risk markets create their own liquidity, with speculative leverage and derivative strategies in particular generating self-reinforcing liquidity. Recovering stock prices ensure bouts of optimism, along with confidence that robust markets enjoy liquidity abundance. Problems arise with market downdrafts and De-Risking/Deleveraging Dynamics. Rally-induced optimism feeds unreasonable expectations and eventual disappointment.

Crisis Dynamics tend to be a process. There’s the manic phase followed by some type of shock. There is at least a partial recovery and a return of optimism – often bolstered by a dovish central bank response. It’s the second major leg down when things turn more serious – for sentiment, for market dynamics and illiquidity. Disappointment turns to disenchantment and, eventually, revulsion. It’s been a long time since market participants were tested by a prolonged, grinding bear market.

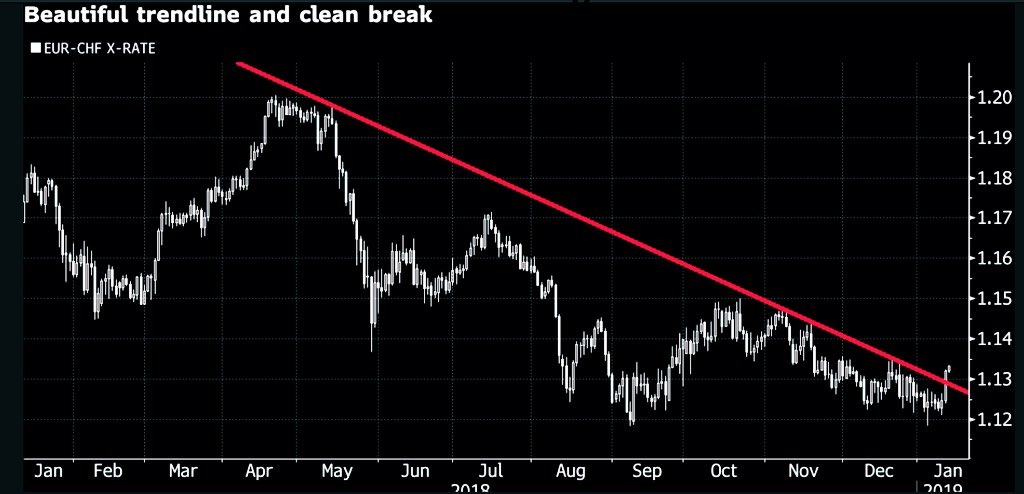

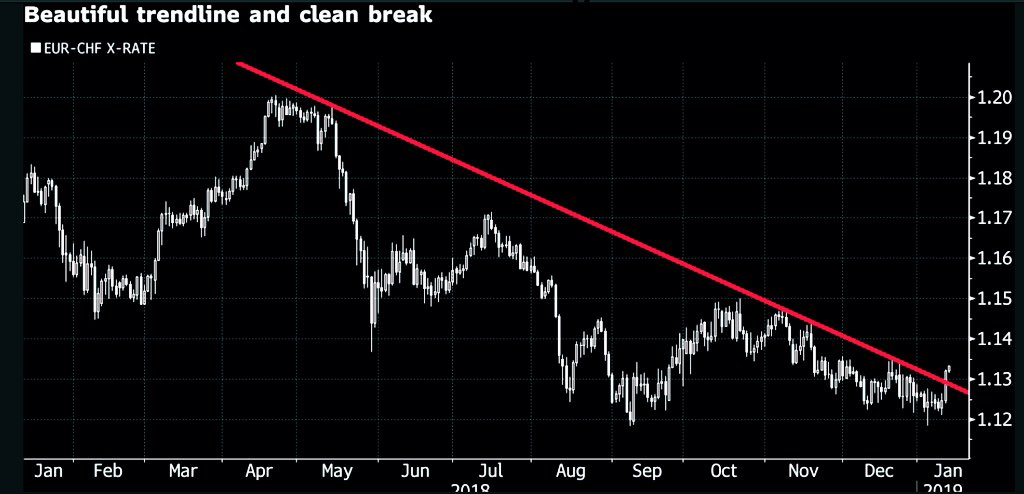

The February 2018 “short vol” blowup was a harbinger of trouble to come. I believe the January 3, 2019 “flash crash” portends serious Issues 2019 in global currency markets. An 8% intraday move in the yen vs. Australian dollar exposed problematic liquidity dynamics. Last year, the “short vol” market signal was initially dismissed then soon forgotten. The recent currency market “flash crash” is an ominous development of potentially momentous significance.

Our so-called “king dollar” is indicating some vulnerability to begin the new year. Newfound Fed dovishness has caught many traders too long the U.S. currency and short the yen, Canadian dollar, renminbi and EM currencies more generally. A clash among a band of fundamentally weak currencies is a critical Issue 2019. When the current currency market short squeeze runs its course, I see a marketplace that’s lost its bearings. A new global currency regime of extraordinary uncertainty, instability and volatility is an Issue 2019. This unsettled new regime is not conducive to speculative leverage.

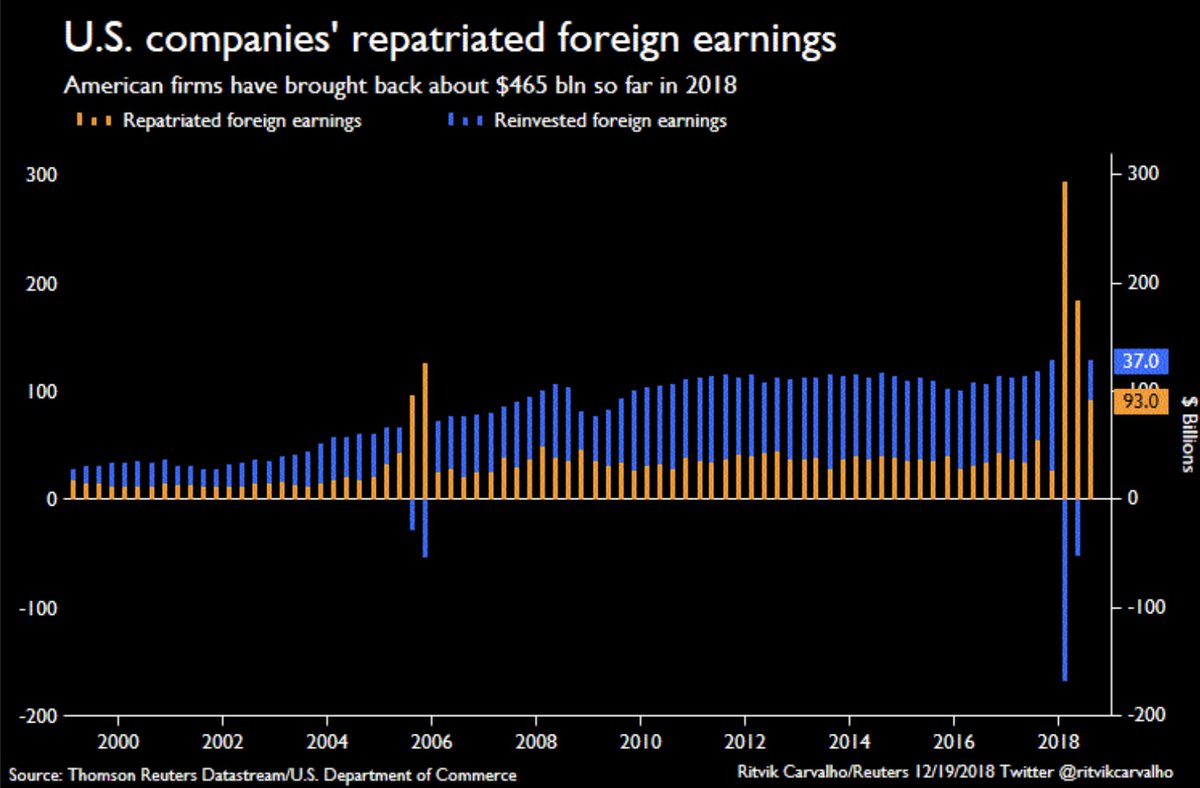

The U.S. dollar has serious fundamental issues: Trillion-dollar fiscal deficits; large structural Current Account Deficits; huge government, corporate and household debt loads; fragile securities markets; a maladjusted Bubble Economy; political dysfunction and, potentially, Washington chaos; and festering geopolitical risks.

The world’s reserve currency is fundamentally unsound. The dollar is also the nucleus for a financial apparatus financing much of the world’s levered speculative holdings. De-risking/Deleveraging Dynamics in 2018 saw waning liquidity and widening funding and hedging costs in the entangled world of dollar funding markets. With the likes of Goldman Sachs and Deutsche Bank seeing CDS prices rise significantly late in 2018, mounting systemic fragility would appear a serious Issue 2019.

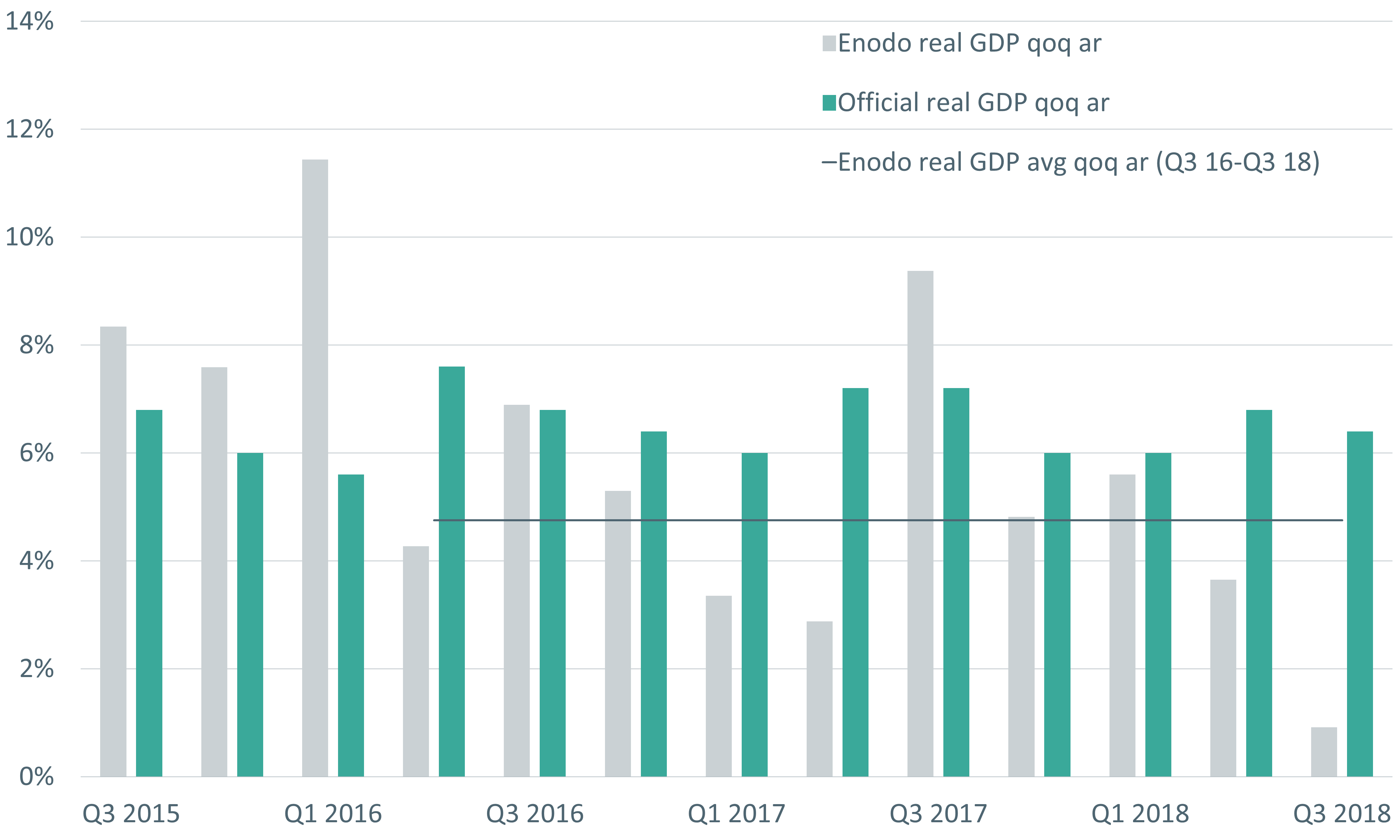

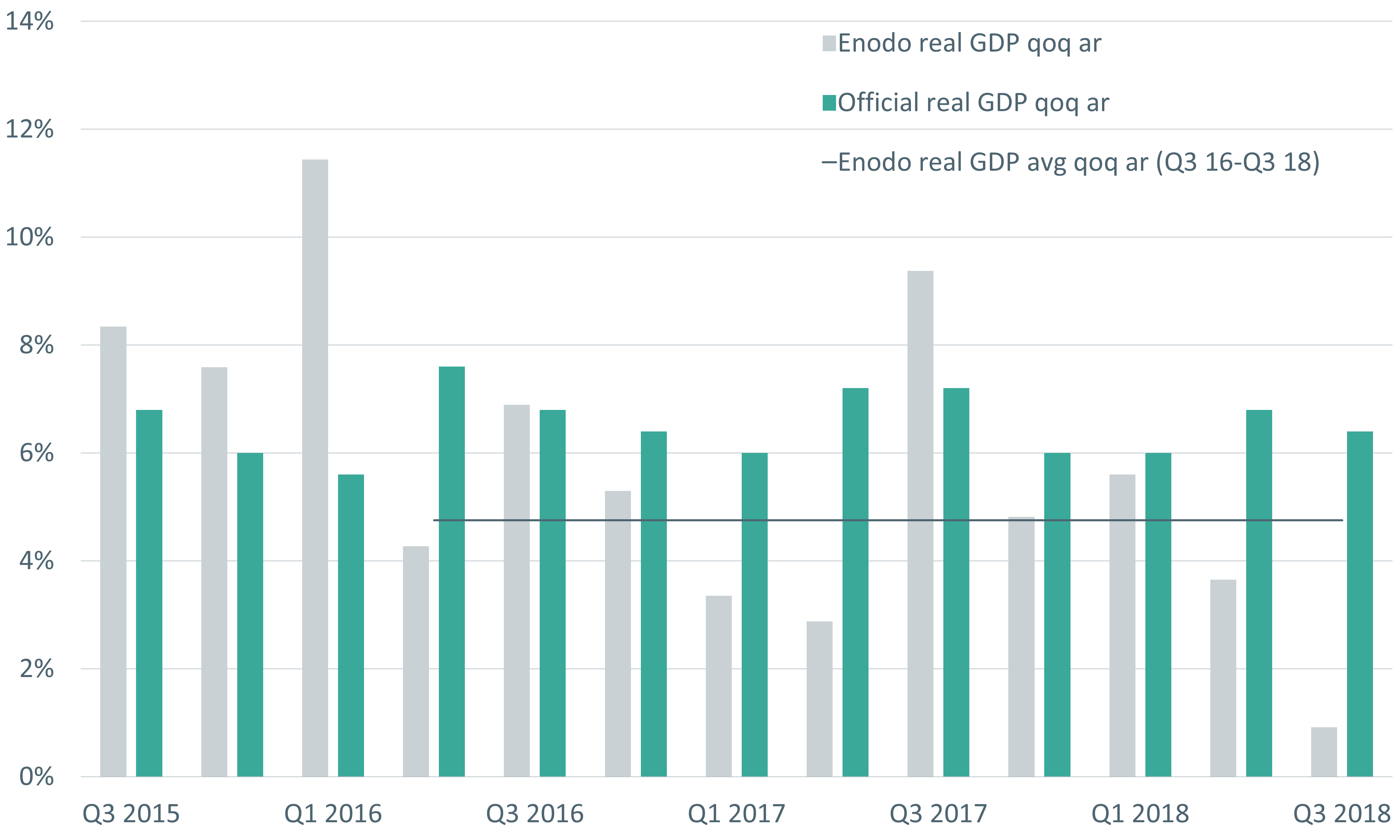

China’s currency has serious fundamental issues: A vulnerable banking system approaching $40 TN of assets (more than quadrupling since the crisis), with Trillions of potentially suspect loans; a troubled “shadow” banking apparatus; an historic housing Bubble with an estimated 65 million vacant units; a deeply maladjusted economic structure; Bubble economic and financial structures dependent upon ongoing loose financial conditions and rapid Credit expansion; huge financial and economic exposures to the emerging markets and the global economy more generally; a population with significantly elevated expectations prone to disappointment and dissatisfaction; and mounting geopolitical risks. In short, China’s historic Bubble is increasingly susceptible to a disorderly collapse.

Hong Kong’s Hang Seng China H-Financial Index dropped 18% in 2018, although China’s banks outperformed the 28% fall in Japan’s TOPIX Bank Index. I would tend to see Asian finance as especially vulnerable to the unfolding global Bubble collapse. Waning confidence in the region’s financial stability would portend acute currency market instability. China’s currency is especially vulnerable to capital flight and the imposition of draconian capital controls. The big unknown is how much “hot money” and leverage has accumulated in Chinese markets. The Indonesia rupiah remains vulnerable to tightening global finance. I worry about India’s banking system after years of Bubble excess. I have concerns for the region’s financial institutions generally. The stability of the perceived stable Hong Kong and Singapore dollars is on the list of Issues 2019.

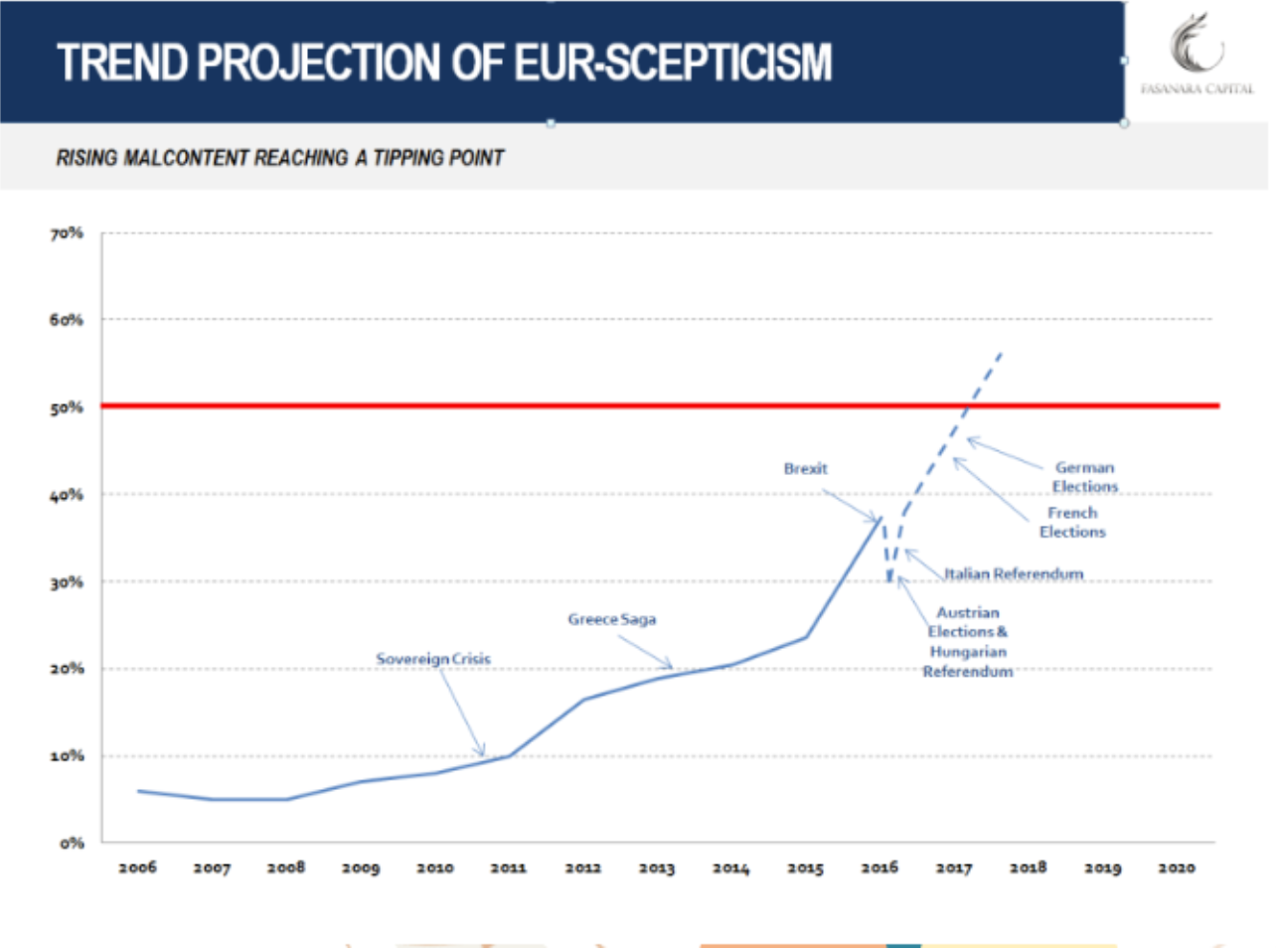

Fragile Asian finance has company. Italian banks sank 30% in 2018, slightly outperforming the 28% drop in European bank shares (STOXX 600). Italy’s 10-year yields traded to 3.72% in late-November, before ending 2018 at 2.74% (up 73bps in ’18). Italian – hence European – stability is an Issue 2019.

I believe a problematic crisis is likely to unfold in 2019, perhaps sparked by dislocation in Italian debt markets and the resulting crisis of confidence in Italy’s fragile banking system. Serious de-risking/deleveraging in Italian debt would surely see contagion in the vulnerable European periphery – including Greece, Spain and Portugal. Italy’s Target2 balances (liabilities to other eurozone central banks) almost reached $500 billion in 2018. Heightened social and political instability would appear a major Issue 2019, not coincidental with the end of ECB liquidity-creating operations. Draghi had kicked the can down the road. Markets, economies, politicians and protestors have about reached the can.

A crisis of confidence in Europe would ensure problematic currency market instability. Such a scenario would portent difficulties for vulnerable “developing” Eastern European markets and economies. Many economies would appear vulnerable to being locked out of global financing markets. A full-fledged financial crisis engulfing Turkey cannot be ruled out. Last year saw significant currency weakness also in the Russian ruble, Iceland krona, Hungarian forint and Polish zloty. I would see 2018 difficulties as a harbinger of much greater challenges ahead.

Bubbles are mechanism of wealth redistribution and destruction. This reality has been at the foundation of my ongoing deep worries for the consequences of history’s greatest global Bubble. We’ve witnessed the social angst, a deeply divided country and waning confidence in U.S. institutions following the collapse of the mortgage finance Bubble. I fear that the Bubble over the past decade has greatly increased the likelihood of geopolitical tensions and conflict. Aspects of this risk began to manifest in 2018, as fissures developed in the global Bubble. Geopolitical conflict is a critical Issue 2019. Trade relations are clearly front and center. Going forward, I don’t believe we can disregard escalating risks of military confrontation.

Bubbles inflate many things, including expectations. I worry that the protracted Chinese Bubble has so inflated expectations throughout China’s large population. With serious cracks in their Bubble, Beijing will continue to craft a strategy of casting blame on the U.S. (and the “west”). The administration’s hard line creates a convenient narrative: Trump and the U.S. are trying to hold back China’s advancement and ascendency to global superpower status. A faltering Bubble and deteriorating situation in China present Chinese leadership a not inconvenient time to confront the hostile U.S. The South China Sea and Taiwan could loom large as surprise flashpoint Issues 2019.

There are a number of potential geopolitical flashpoints. Without delving into detail, I would say generally that geopolitical risks will continue to rise rapidly in the post-Bubble backdrop. Issues easily disregarded during the Bubble expansion (i.e. the Middle East, Russia, Ukraine, Iran, etc.) may in total become more pressing Issues 2019. I can see a scenario where the U.S. is spending significantly more on national defense in the not too distant future.

“Chairman Powell ‘very worried’ about massive debt” was an early-2019 headline. I believe the U.S. Treasury market in 2018 hinted at a momentous change in Market Dynamics. And while a bout of “risk off” and a powerful short squeeze fueled a big year-end rally, there were times when the Treasury market’s traditional safe haven appeal seemed to have lost some luster. The unfolding bursting Bubble predicament turns even more problematic if ever Treasury yields rise concurrently with faltering risk markets. Such a scenario seemed more realistic in 2018. With huge and expanding deficits as far as the eye can see, the suspect dollar and mounting geopolitical tensions, the potential for a disorderly rise in Treasury yields is a potential surprise Issue 2019.

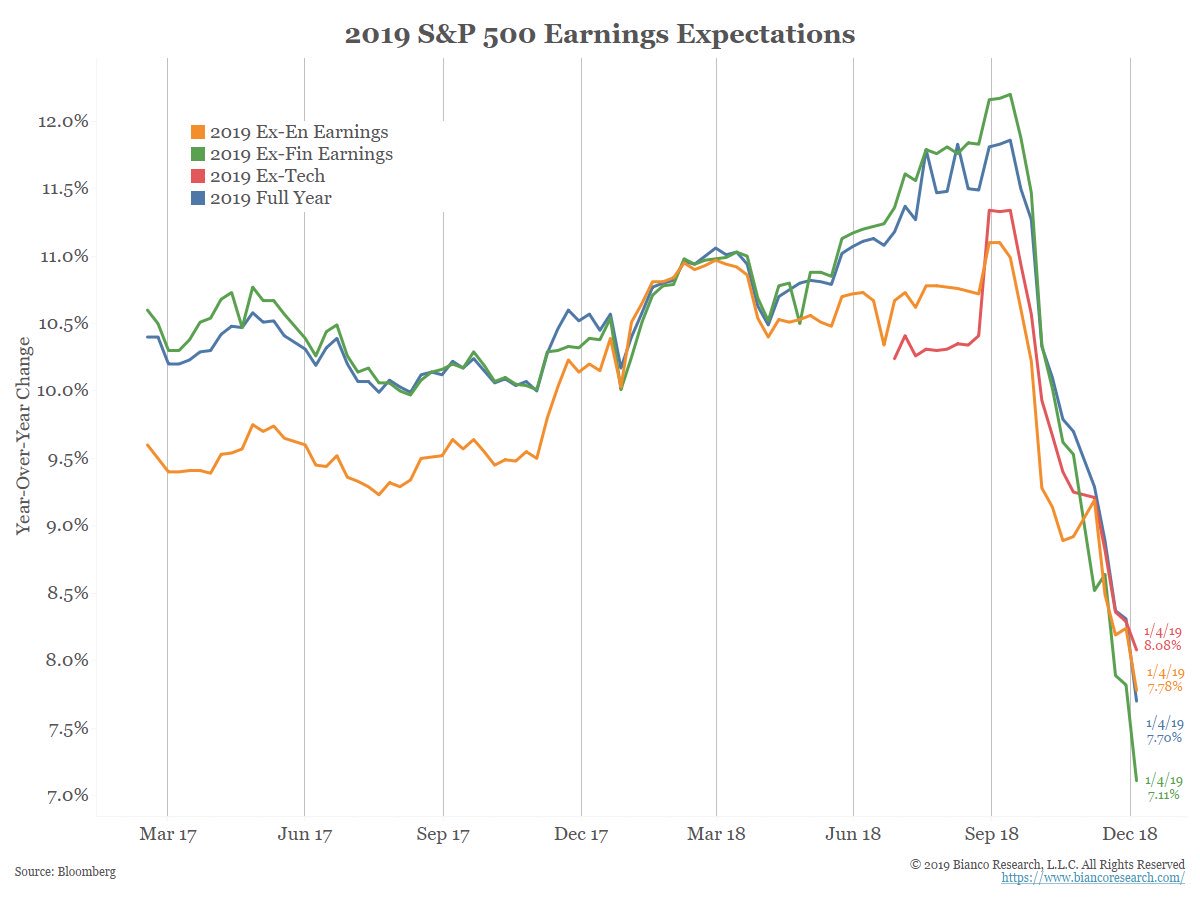

Whether Treasury yields surprise on the upside or fall further in an unfolding crisis backdrop, U.S. corporate Credit is a pressing Issue 2019. Thursday (Jan. 10) ended a 40-day drought in junk bond issuance (longest stretch since at least 1995). Both high-yield and investment-grade funds suffered major redemptions in late-2018, exposing how abruptly financial conditions can tighten throughout corporate finance. Fueling liquidity abundance throughout the boom, ETF flows were exposed as a critical market risk.

Flows for years have been dominated by trend-following and performance-chasing strategies on the upside. The reversal of bullish speculative flows was joined in late-2018 by speculative shorting and hedging-related selling. Liquidity abundance abruptly transformed into unmanageable selling pressure and acute illiquidity. Pernicious Market Structure was revealed and, outside of short squeezes and fleeting bouts of optimism, I believe putting the ETF humpty dumpty back together will prove difficult. The misperception of ETF “moneyness” is being cracked wide open.

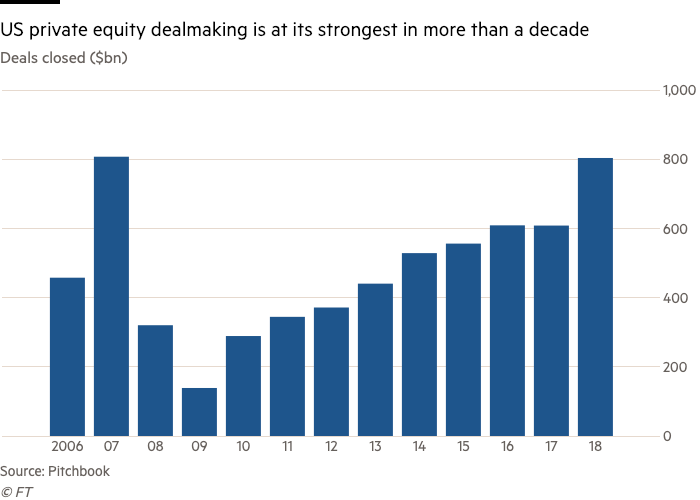

Enormous leverage has accumulated throughout corporate Credit over the past decade. This portends negative surprises and challenges in the unfolding backdrop. At this point, I’ll assume some type of trade agreement is cobbled together with the Chinese. This might provide near-term support for the markets and global economy. But I don’t believe a trade agreement would fundamentally change the backdrop of faltering global financial and economic Bubbles.

Expect ongoing global pressure on leveraged speculation. As an industry, the hedge funds did not experience huge redemptions in 2018. I expect redemptions and fund closures to be a significant issue following the next bout of serious de-risking/deleveraging. A similar dynamic should be expected for the ETF complex. Late-2018 outflows were likely just a warmup for the type of destabilizing flows possible in a panic environment.

In my view, an important interplay evolved during this protracted cycle between the ETF complex and a booming derivatives marketplace. Reliable inflows and abundant liquidity in the ETF universe created an advantageous backdrop for structuring and trading various derivatives strategies. This seemingly symbiotic relationship has run its course. The now highly uncertain ETF flow backdrop translates into a potentially problematic liquidity dynamic for derivative-related trading. ETF outflows pose risk to derivatives strategies, while a derivatives-induced market dislocation risks destroying investor faith in the liquidity and safety of ETF passive “investing.”

The possibility of a 1987-style “portfolio insurance” debacle except on a grander – global, multi-asset class – scale is an Issue 2019. The U.S. economy has vulnerabilities. Yet Unsound Finance is a predominant Issue 2019. Outside of possible dreadful geopolitical developments, I would argue that the key major risk for 2019 is the seizing up of global markets. Unprecedented amounts of risks have accumulated across markets around the globe. Consider a particularly problematic scenario: a major de-risking/deleveraging episode sparks upheaval and illiquidity across currencies, equities and fixed-income markets. Such a scenario might incite a crisis of confidence in major global financial institutions, including derivatives markets and counterparties. Central bankers better not disappoint.

Last week’s dovish turn by Chairman Powell broke the bearish spell and reversed markets higher, though this came weeks late in the eyes of most market participants. “We know that long periods of suppressed volatility can lead to the build-up of risks and to a disruptive ending, and the idea that monetary policy can ignore that and leave it to macroprudential tools just is not credible to me.” This prescient comment (released Friday) is extracted from 2013 Federal Reserve transcripts. Governor Powell at the time clearly had a firmer grasp of the risks associated with QE than chairman Bernanke and future chair Yellen.

It is my long-held view that the Fed (and the other major central banks) will see no alternative than to resort to QE when global markets “seize up.” Ten-year Treasury yields at 2.70%, German bund yields at 22 bps and JGBs at zero don’t seem inconsistent with this view. It’s been a decade (or three) of Monetary Disorder. Now come the consequences, commencing with acute market and price instability. I believe this instability will end in a serious and prolonged crisis. There will be policy interventions, of course. But it will become increasingly clear that flawed monetary doctrine and policies are more the problem than the solution. In an increasingly acrimonious world, how closely will policymakers coordinate crisis responses? Will central bankers stick with “whatever it takes”? How quickly will they react to the markets – and with how much firepower? Uncertainty associated with monetary policymaking in a global crisis environment is an Issue 2019.

http://creditbubblebulletin.blogspot.com/2019/01/market-commentary-issues-2019.html