Weekly Commentary: Q3 2018 Z.1 and THE Cycle Peak

Some important Pointers

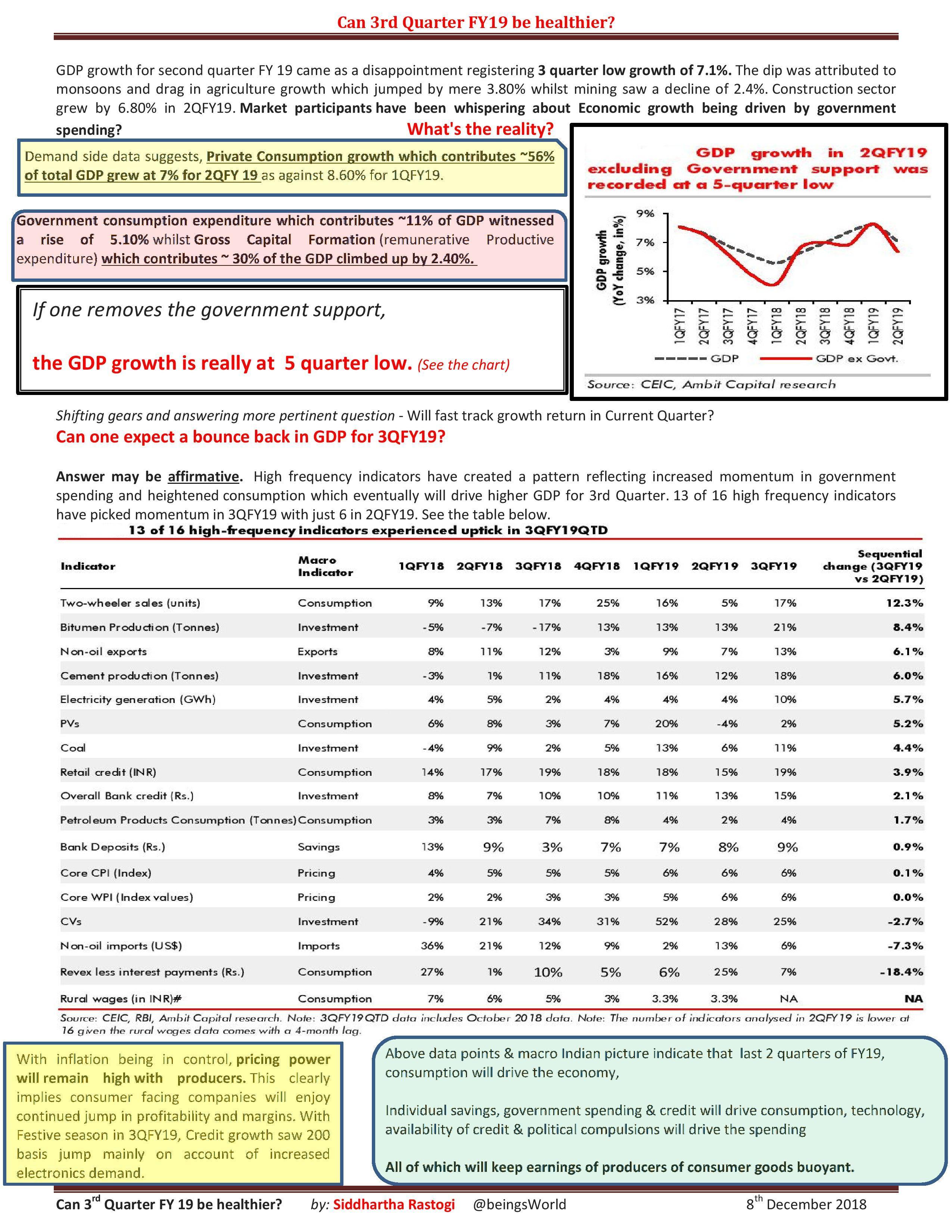

Evidence of tighter financial conditions, Total Business borrowings slowed markedly. After Q2’s 6.9% rate (strongest since Q1 ’16), Total Business debt growth slowed to 3.9%. The expansion of Corporate borrowings slowed markedly, from 7.2% to 4.1%. State & Local government debt contracted at a 1.4% pace (Q2 -0.38%). Winning the Piggy Borrower contest, perennially, was our federal government. Federal borrowings expanded at a 6.8% pace, down slightly from Q2.

Yet percentage growth rates don’t do justice late in a Credit Cycle. Outstanding Treasuries expanded $1.187 TN over the past four quarters (7.3%) and $1.774 TN over eight quarters (11.3%). On a seasonally-adjusted and annualized rate basis (SAAR), federal borrowings expanded $1.180 TN, almost the same as Q2.

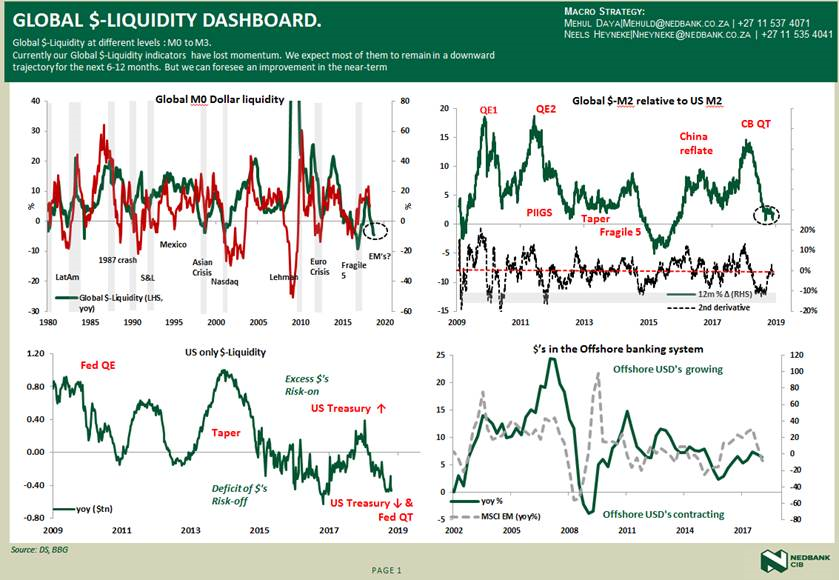

So far in 2018, federal debt has expanded the most since 2010.( they are the ones sucking LIQUIDITY)

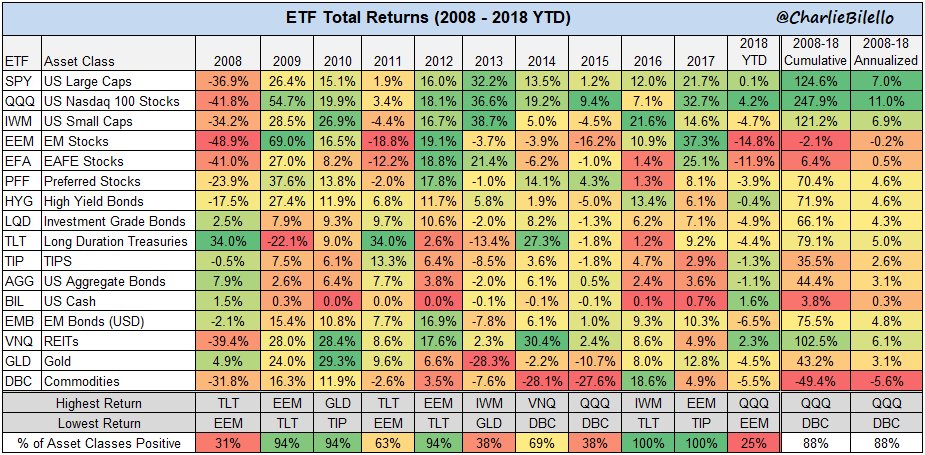

Total (Debt and Equities) Securities increased nominal $2.701 TN during Q3, and $7.344 TN in four quarters, to a record $95.057 TN. Total Securities ended the quarter at a record 460% of GDP. This compares to previous cycle peaks 379% (Q3 ’07) and 359% (Q1 ’00).

Securities market inflation continued to inflate Household Assets during the quarter, while the Bubble in Household Net Worth remains fundamental to the U.S. Bubble Economy.

Household Net Worth ended the quarter at a record 528% of GDP, up from the year ago 514% and Q3 2016’s 498%. Household Net Worth to GDP set previous cycle peaks at 484% (Q1 ‘07) and 435% (Q4 ‘99). (NOW YOU KNOW WHERE SPENDING IS COMING FROM)

Still, most would dismissively ask, where’s the Bubble? Well, Household Net Worth has inflated $50 TN (85%) since the end of 2008, which certainly has supported elevated confidence, spending and economic activity. And it’s clear that booming securities markets have been integral to the record expansion in Household perceived wealth. So, what have been the driving forces behind bubbling markets?

Rest of World (ROW) holdings of U.S. Financial Assets jumped nominal $558 billion during Q3 to a record $28.087 TN. ROW holdings were up $1.598 TN over the past year and $3.830 TN over seven quarters. ROW holdings increased to a record 136% of GDP, up from 100% ($14.646 TN) to end 2007 and 57% ($5.639 TN) to conclude 1999. Where in the world has all this “money” been coming from? Sustainable? Reversible?

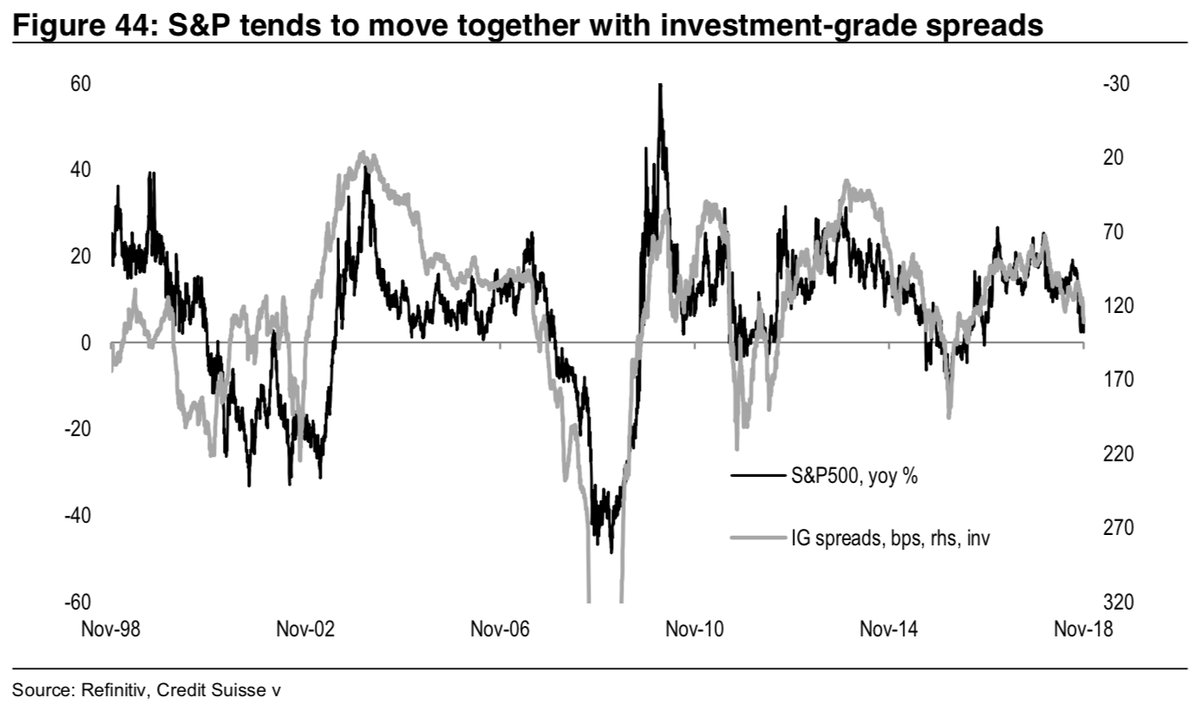

The jump in Equities holdings masks a pivotal slowdown in ROW purchases of U.S. Debt Securities. Though purchases were positive during Q3, ROW holdings of U.S. Debt Securities actually contracted nominal $190 billion during the first three quarters of 2018. This contraction in ROW U.S. Debt Securities holdings ( corporate bonds) is in stark contrast to 2017’s gain of $747 billion and the $324 billion increase in 2016.

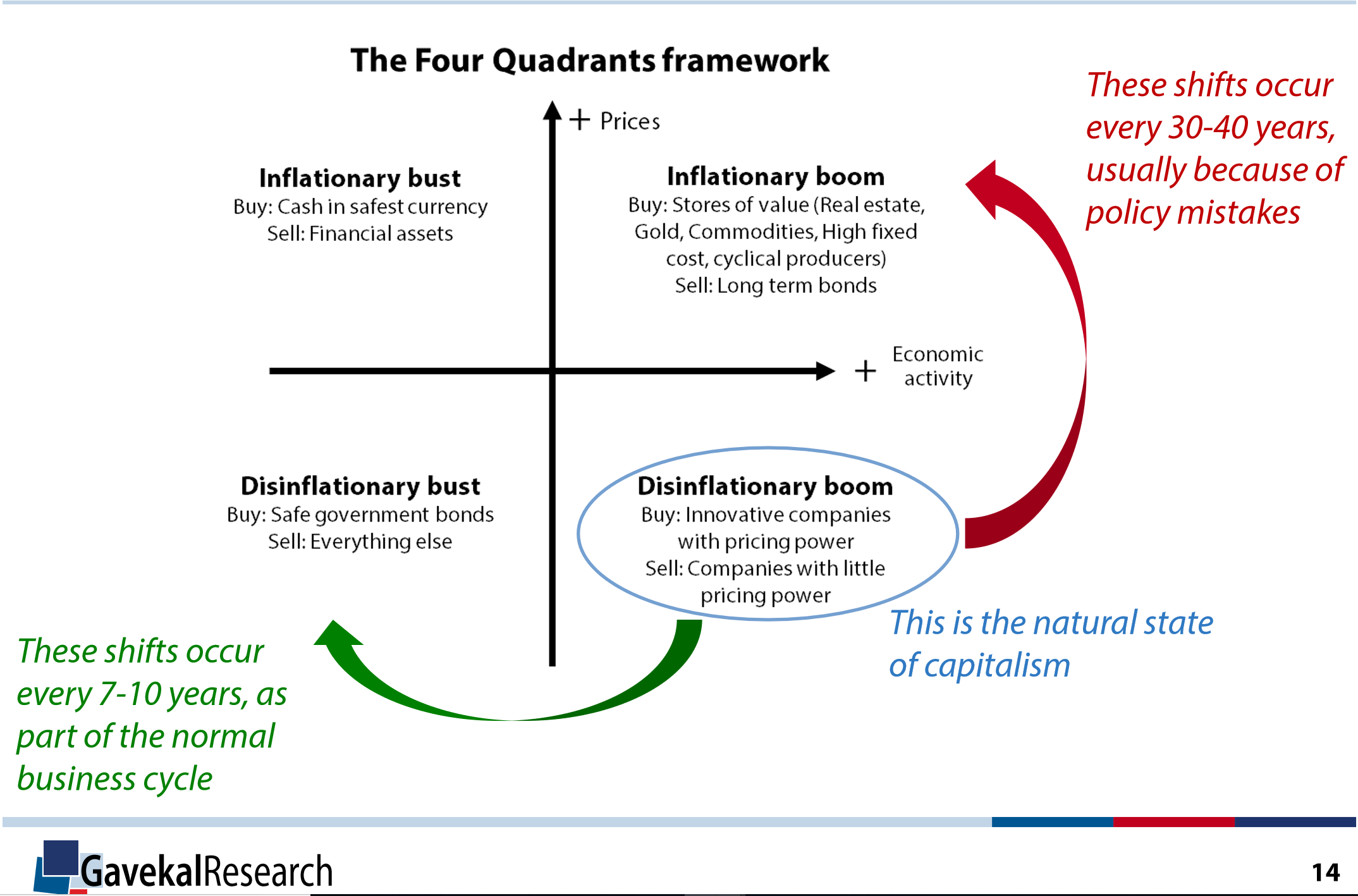

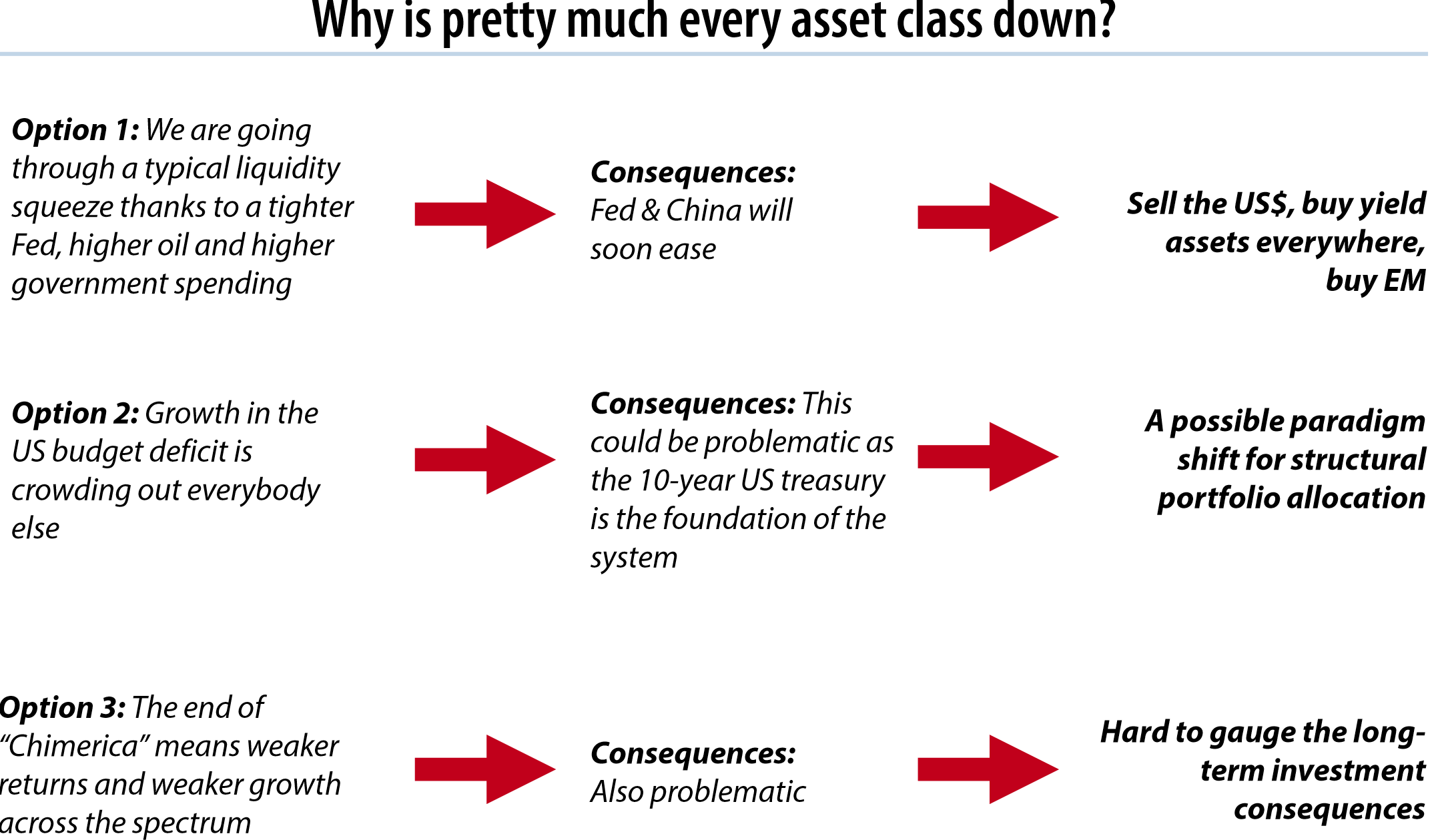

I would posit that tightening global finance – in particular, the de-risking/deleveraging dynamic that took hold in the speculator community – contributed to waning international demand for U.S. Corporate Bonds. At the same time, EM outflows and pressure on EM central banks to support faltering currencies led to sharply lower international demand for Treasuries (not to mention geopolitical frictions). Overall, it points to an important inflection point in international financial flows into U.S. securities markets. For much of the year, major flows into outperforming U.S. equities helped to conceal adverse repercussions. With U.S. equities succumbing to de-risking/deleveraging, markets generally will now confront momentous changes in the liquidity backdrop.

The confluence of the powerful global tightening of financial conditions, a significant decline in ROW debt purchases, the slowdown in bank lending and the now tenuous backdrop in the equities marketplace creates an extraordinarily fragile backdrop. Moreover, the current quarter has experienced a sharp slowdown in junk bond issuance and leveraged lending. What’s more, significant deleveraging has commenced in U.S. equities. Overall, it points to a troubling liquidity backdrop for both the markets and the U.S. economy, more generally.

I’ll add that “Periphery to Core Crisis Dynamics” are coming home to roost. Keep in mind that the initial faltering Global Bubble phase – de-risking/deleveraging at the “Periphery” – worked to exacerbated flows to – and speculative excess at – the “Core.” The huge increase in ROW Equities holdings is emblematic of speculative “blow-off” dynamics right in the face of rapidly deteriorating fundamental prospects. It recalls heightened systemic fragilities created by dysfunctional market dynamics in early-2000 and, even more so, in the second-half of 2007.

At this point, I’ll posit a (not unlikely) possible scenario. De-risking/deleveraging exposes problematic underlying speculative leverage in both equities and corporate Credit. A sharp tightening of corporate Credit conditions weighs on debt issuance and business borrowing more generally. Tighter finance and sinking equities prices engender some reassessment regarding the rationale for aggressive stock buyback programs. Further weighing on inflated market valuations, the rapidly deteriorating backdrop will also provoke some overdue rethink on the M&A front.

Meanwhile, the vast chasm between elevated consumer confidence and fading economic prospects will have to narrow. Household Net Worth has inflated $20 TN, or about 100% of GDP, in just the past three years ($50 TN since the end of ’08!). This surge in perceived wealth spurred consumption and boosted auto and home purchases (along with boats, campers, timeshares, cruises, etc.) After stoking discretionary and luxury spending, it’s reasonable to begin anticipating a problematic change in spending patterns.

There are many aspects of the unfolding downturn that go unappreciated. I worry about deep economic structural maladjustment. How many thousands of uneconomic enterprises have propagated from all the easy finance and surging asset prices? I have deep concern for Silicon Valley. If the unfolding trade and cold war with China wasn’t enough, they’re about to get the rug pulled out from under them by the financial markets. How much perceived wealth could be lost in a bursting Bubble of inflated technology shares and private business equity, compounded by a deflating Bubble in wildly inflated real estate prices surrounding the tech hubs? I fear a complete lack of understanding and preparation.

It’s difficult not to see the arrest of a top Huawei executive on the same day as the Trump/Xi summit as an ominous development. The CFO and daughter of the founder of one of China’s most powerful international technology conglomerates faces fraud charges and possible extradition to the U.S. In China, outrage. Sure, there was a weird level of ambiguity regarding the true gains from Saturday’s U.S./China trade meeting. But to see global markets convulse on the arrest of a Chinese executive rather starkly illuminates the acute fragilities the world now confronts.

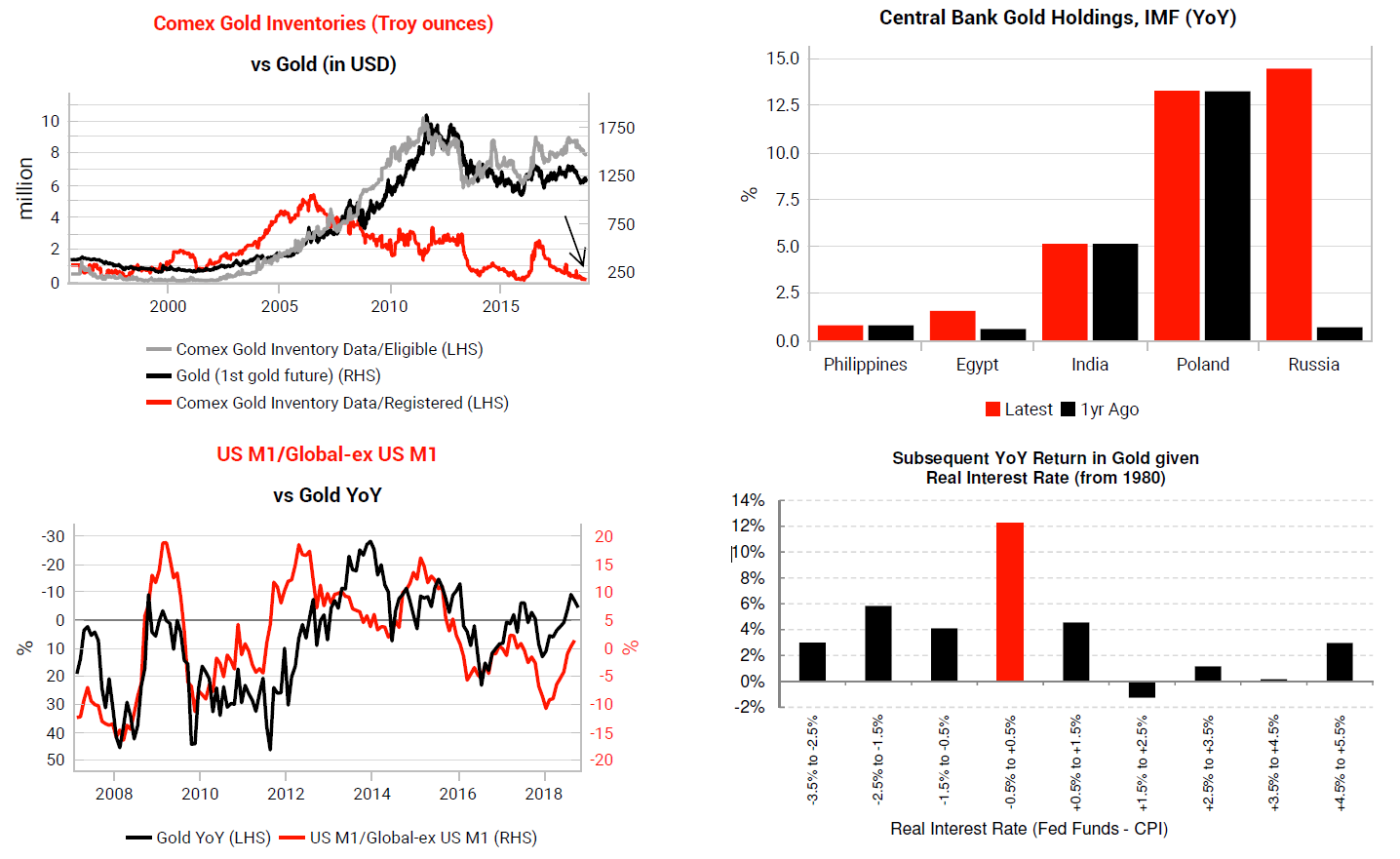

Ten-year Treasury yields dropped 14 bps this week to 2.85%. German bund yields fell six bps to 0.25%. Not to be outdone, 10-year Japanese JGB yields declined three bps to 0.06%. No signs of confidence in the soundness of the global financial system from those three. Safe havens showed a pulse this week. Gold jumped $26 to an almost five-month high $1,248. The Japanese yen gained 0.8% and the Swiss franc increased 0.6%.

It was curious to see the U.S. dollar under some selling pressure (dollar index down 0.7% this week). But, then again… If our asset markets (i.e. stocks, fixed-income, real estate…) are as vulnerable as I believe and the American economy as maladjusted, there’s a credible bear case against the U.S. currency to ponder. We’ve certainly done our level best to swamp the world with dollars over recent decades.

A dollar break would really catch the speculator community (and investors) positioned poorly. It’s reached the point that NOTHING can be taken for granted in these chaotic financial markets. Which portends something really important: ongoing pressure to de-risk and deleverage. Why do I have the feeling I’ll be using Q3 2018 Z.1 data for Household Net Worth (along with both Equities and Total Securities to GDP, etc.) as THE Cycle Peak for years (decades?) to come?

http://creditbubblebulletin.blogspot.com/