Ray Dalio has a net worth estimated at $18 billion, according to Forbes, largely gained from building and running Bridgewater Associates, the largest and—by some metrics—most successful hedge fund in the world

Main points from article/interview in BARRON’s

Capitalism is basically not working for the majority of people (sorry guys if you have not made your moolah by now the time is up… cycle is over)

“Economics and markets are my day job,” said Dalio ( he tells people how to manage their business)

Jonathan Tepper and Denise Hearn’s forthcoming book, The Myth of Capitalism, argues that the current U.S. system is so dominated by monopolies that it isn’t true capitalism ( ask us Indians,we have closed 5 telecom companies with million jobs lost). There’s also Anand Giridharadas’ Winners Take All, published in August, which posits that the efforts by the global elite to save the world through philanthropy serves to preserve the status quo that benefits them—and to mask their own participation in creating the crises they’re purported to fix

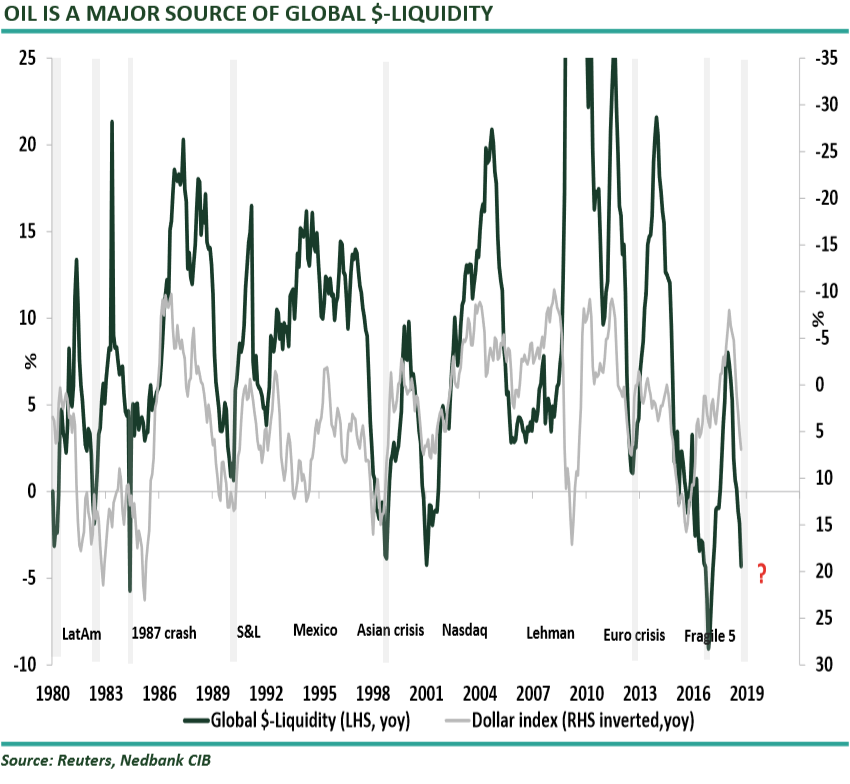

Dalio has spoken about the pressing problem of inequality for years—and has warned that artificial intelligence will help to worsen it. (I can only tell the Indian policy makers to WAKEUP AND SMELL THE COFFEE… there is no more demographic dividend guys)

DALIO cited a Federal Reserve survey statistic that 40% of U.S. households could not raise $400 in case of emergency without selling something. “We might not have contact with those people, but that is a reality,” Dalio told the crowd, who paid thousands of dollars to sit on the Palace Theater’s velvet seats and hear him speak.

The current polarization—both politically and socially—is most analogous to the 1930s, he argued. “It has to be dealt with,” Dalio said, saying if he were running things, he’d declare the wealth gap and opportunity gap a “national emergency.”( can we do that in India, if not ,get ready for social chaos)