Shiv Kumar (ex chairman and ceo PepsiCo India) gave a fantastic presentation at Kotak Consumer Forum.

The Topic was Wake up call for FMCG

below is the PPT

https://www.slideshare.net/ShivShivakumar1/presentation-kotak-consumer-forum

Making sense out of Chaos

Shiv Kumar (ex chairman and ceo PepsiCo India) gave a fantastic presentation at Kotak Consumer Forum.

The Topic was Wake up call for FMCG

below is the PPT

https://www.slideshare.net/ShivShivakumar1/presentation-kotak-consumer-forum

Northman Trader writes “It’s coming. And don’t kid yourself into believing it won’t. It happens in every cycle. The economy comes out of a recession, things recover (these days with the help of central banks) and the cycle ultimately morphs into unrealistic positive expectations about the future and optimism reigns supreme as unemployment drops to cycle lows and corporate profits look great.

We just had this phase in 2018 on the heels of tax cuts and the official unemployment rate dropping to 3.7% with record earnings and over 20% profit growth thanks to tax cuts.

But then something happens at the end of each cycle. Corporations have a harder and harder time keeping pace with the high expectations. It’s called peak profit growth. One can squeeze only so much profit growth out of each cycle. And now, in this cycle, the artificially induced profit growth results in 2018 are not sustainable into 2019.

So what, you might ask, will companies do to maximize their profit growth in a challenging comparison environment, an environment where they are facing higher costs and margin pressures due to a myriad of reasons? Think rising rates, trade wars, difficulty to find new talent, etc.

You already know the answer: It’s called rightsizing, operational efficiency and a number of other clever guises designed to avoid the term layoffs. And no it doesn’t suddenly happen in size. It starts small, but it begins nevertheless. You just have to look for the signs.

Here’s one current example:

“Starbucks Corp., on a mission to boost profit and appease apprehensive investors, is dismissing about 5 percent of its non-restaurant workers.

The company said it’s laying off about 350 corporate employees, most of whom work in its Seattle headquarters. Starbucks had said in September that an unspecified number of job cuts were coming. The coffee chain is restructuring to speed innovation and pump slowing sales.”

And you get the talk of “oh how difficult it is, but we have no choice” blah blah blah:

“Today will be a difficult day for all of us,” Chief Executive Officer Kevin Johnson said in an internal email to employees viewed by Bloomberg News. “As we continue evolving our core areas of marketing, creative, product, technology and store development, we are making some significant changes to these areas, as well as other functions across our global business.”

We just have to do it right? Can’t afford those salaries of these people right?

Bullshit. These 350 people are losing their jobs in the face of this:

“Starbucks is raising its dividend and increasing its share buyback program to return $10 billion more to shareholders by 2020 than previously promised, CEO Kevin Johnson told analysts on a conference call Thursday.

In November, the company announced it would return $15 billion to shareholders through buybacks and dividends through fiscal year 2020″.

Right. Oh yea, the writing is on the wall and it’s already beginning.

I humbly submit that nobody knows how this will play out, but I do know one thing: Corporations will do what’s best for them and their primary purpose is not to guarantee you a job.

Rather it’s maximzing shareholder value. And whether you like it or not it’s buybacks and dividends while streamlining and finding ways to maximize margins.

And that may or may not impact you. Some of these changes coming will be positive and fascinating, but these changes will also impact real people with real jobs and the I think it’s fair to say the transition will be far from smooth for many.

But let there be no doubt: It’s coming. And then the cycle repeats itself.”

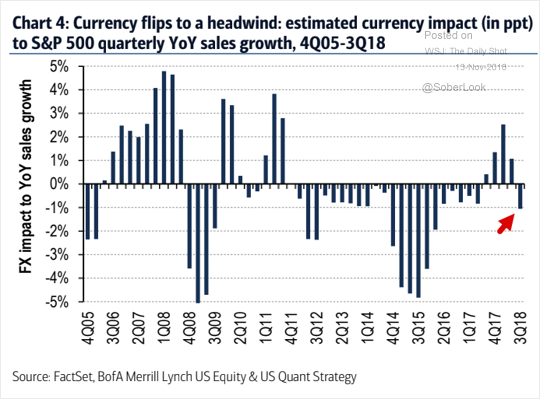

The dollar continues to climb and finally it’s becoming a headwind for corporate earnings.

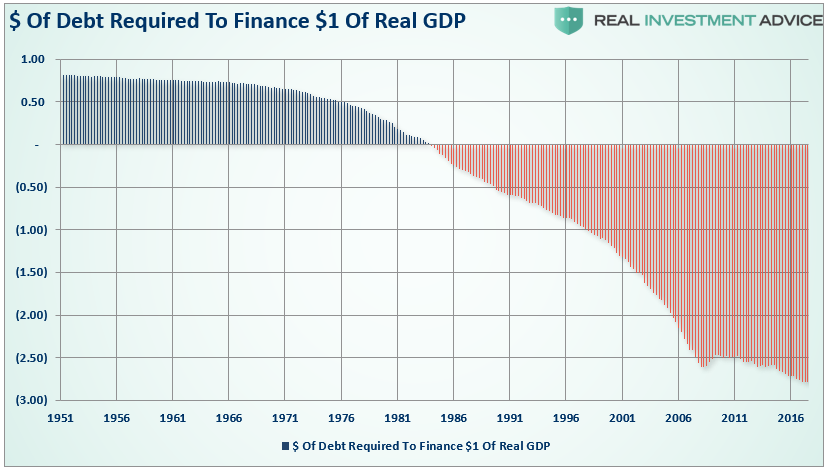

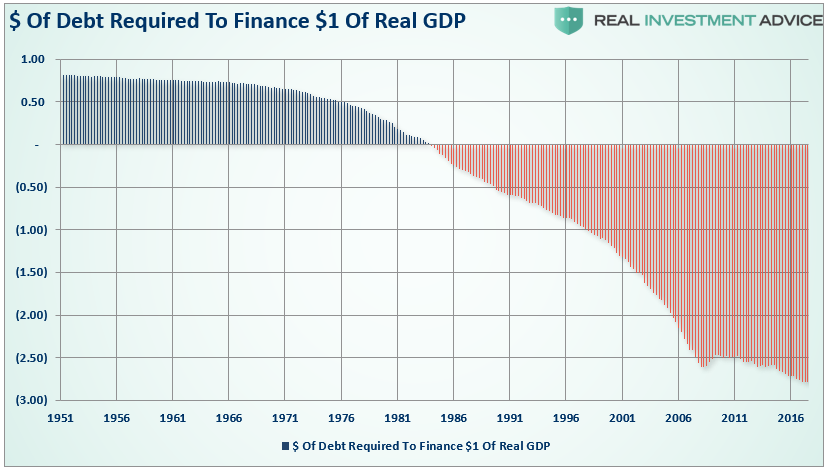

How Empires fall……Three dollars of debt for one dollar of growth …. that is not sustainable

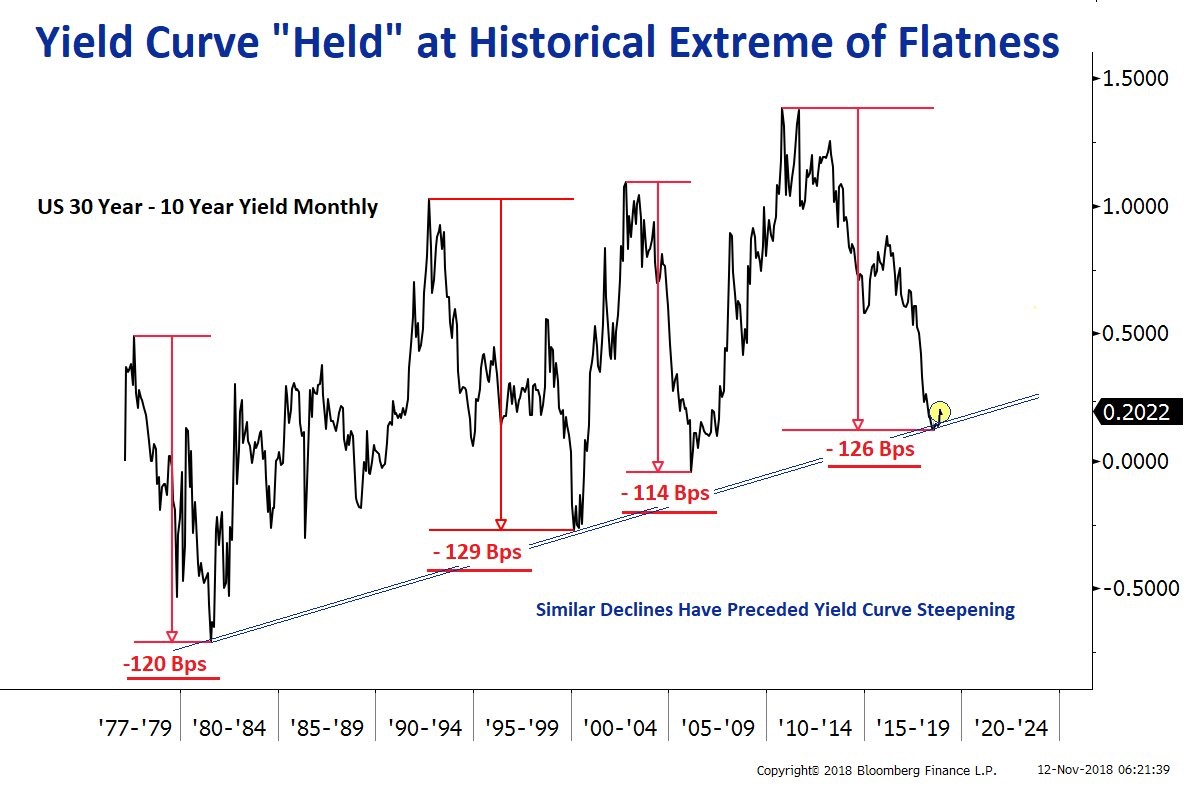

Yield curve becoming flat (signs of slowdown)and if one chart which would make FED stop in its track from raising rates ,then this is the one.

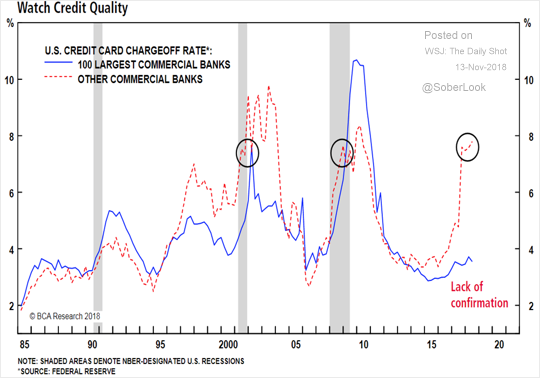

Small US banks are experiencing high levels of credit card delinquencies (which is partially why credit card rates have risen so much

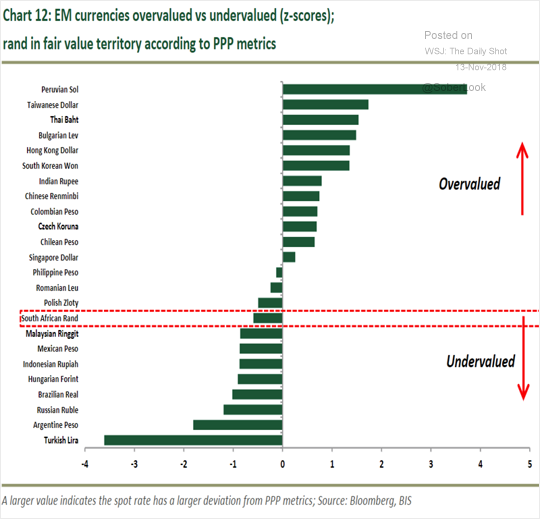

On PPP basis Indian Rupee is overvalued

Lance Roberts writes……Debt Doesn’t Create Real Growth

The massive indulgence in debt has simply created a “credit-induced boom” which has now reached its inevitable conclusion. While the Federal Reserve believed that creating a “wealth effect” by suppressing interest rates to allow cheaper debt creation would repair the economic ills of the “Great Recession,” it only succeeded in creating an even bigger “debt bubble” a decade later.

This unsustainable credit-sourced boom led to artificially stimulated borrowing which pushed money into diminishing investment opportunities and widespread mal-investments. In 2007, we clearly saw it play out “real-time” in everything from sub-prime mortgages to derivative instruments which were only for the purpose of milking the system of every potential penny regardless of the apparent underlying risk. Today, we see it again in accelerated stock buybacks, low-quality debt issuance, debt-funded dividends, and speculative investments.

When credit creation can no longer be sustained, the markets must clear the excesses before the next cycle can begin. It is only then, and must be allowed to happen, can resources be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. Those fiscal and monetary policies, from TARP and QE, to tax cuts, only delay the clearing process. Ultimately, that delay only deepens the process when it begins.https://realinvestmentadvice.com/the-economic-consequences-of-debt/

The biggest risk in the coming recession is the potential depth of that clearing process. With the economy currently requiring roughly $3 of debt to create $1 of economic growth. A reversion to a structurally manageable level of debt would involve a nearly $40 Trillion reduction of total credit market debt from current levels.

Scott Minerd of Guggenheim’s speaks his mind and following is the summary of his views at Reuters Global Investment 2019 Outlook Summit.

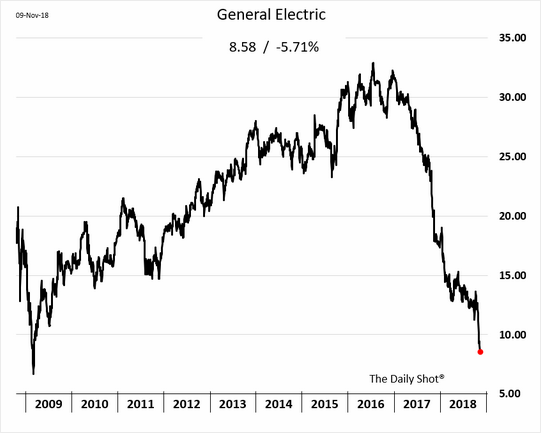

“Corporate credit is clearly the big excess that needs to be flushed out of the system,” and General Electric Co is just one example of a broader problem.(corporates have bought back their own stock with debt and it will lead to weaker credit profile )

Guggenheim expects $1 trillion of investment debt will be downgraded to junk status as the Fed raises rates and the economy slows over the next two years.( Junk rated bonds are a big short in my view but timing is important)

U.S. economy is on a collision course due to excessive corporate debt and he has prepared by buying higher credit-quality investments.( same thing will happen in EM including India, spreads will just blow out and investors holding credit funds will see NAV losses)

“We’re in the process of slowly killing the expansion,”. “Any attempt to rein in credit is ultimately going to blow up.”

(if everybody knows it then why is FED raising the rates……well it is to fund their underfunded pension plans and getting ready with enough ammunition for next recession)

A recession may not materialize until 2020,and the Fed may hike rates up to five times until the end of 2019 unless oil price declines or another factor cause them to scrap such plans.( if Scott is right then 2 year US treasury will be close to 3% , and that is a very good reason to sell EM and invest in US )

The rate hikes will keep the U.S. dollar strong as higher yields attract capital and put more pressure on emerging markets struggling to repay debts in dollars.( probably the most important view for investors looking to invest in emerging markets like India)

Global Macro Monitor sums up “CROWDING OUT” mainly, the changing supply and demand dynamics in the Treasury market. The sharp increase in new Treasury supply this year and the coming years, and the declining demand, mainly, what was once “free money” from: 1) foreign central banks; 2) U.S. government trust funds, such as Social Security which is now in deficit; and 3) The Fed, which is now a net seller of Treasury securities as quantitative tightening is full steam of head, forcing the Treasury to issue an additional maximum of $30 billion into the market to refinance the FED’s maturing Treasury portfolio.https://macromon.wordpress.com/2018/11/12/mr-markets-biggest-headwind/

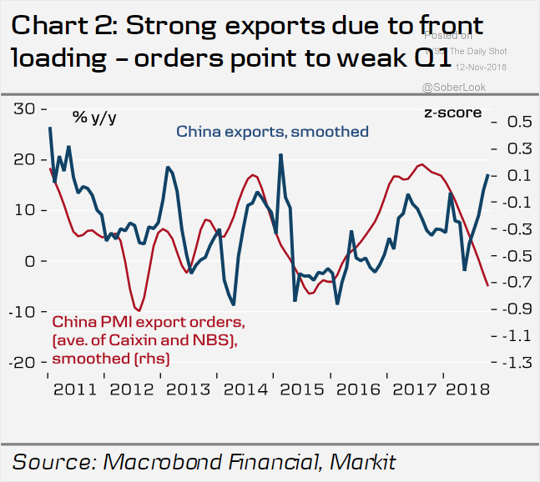

The latest increase in China’s exports was driven by US firms “frontloading” orders ahead of tariffs giving false picture of higher US trade deficit against china

Global shipping indicators point to weakening demand.

• The Baltic Dry Index: Everyone is frontloading INVENTORIES.

The fall and rise of Iconic company. GE shares plunge to recession are low of $8, after CEO Culp says he feels the “urgency” and will sell assets to raise cash

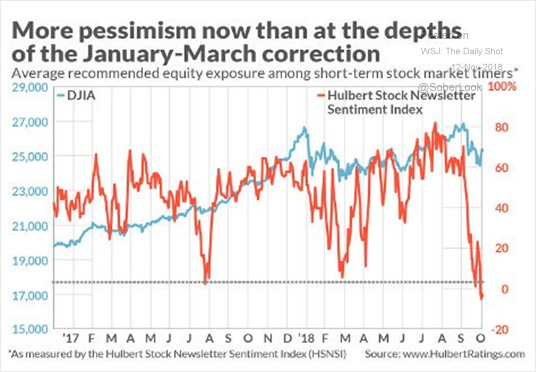

Market timers have become extremely pessimistic . I am a contrarian to the core and this kind of market positioning makes me uncomfortable.

Martin Armstrong writes “In the USA the result of a federal budget and debt means that each state is on its own. Their budget is of no interest to Washington. In the case of the EU, each member state prints its own Euros – not the ECB. That means the EU Commission acts like a dictator applying the same rules to everyone regardless of the local social needs. This is why the Euro will fail. It is NOT a structure remotely similar to the USA despite they pretended it would reap the same benefit by just a single currency.

Eventually, Italy will be forced to choose between its people and the dictatorship of Brussels. That will be another whole level of political chaos next year.

Eurozone is finally going to be without its charismatic leader Angela Merkel who will step down from as CDU party leader in dec and as chancellor by 2021.

Shane Parrish of FARNAM STREET has become an unlikely guru for Wall Street. His self-improvement strategies appeal to his overachieving audience in elite finance, Silicon Valley and professional sports.

Some titbits from his interesting interview https://www.nytimes.com/2018/11/11/business/intelligence-expert-wall-street.html

“Today, information is just another commodity. And the edge belongs to algorithms, data sets and funds that track indexes and countless other investment themes. This has been devastating for hedge fund and mutual fund managers who make their living trying to outsmart the stock market.With their business models under attack, they are searching for answers. there is a simple solution: reading, reflection and lifelong learning.

“These days, if you are not getting better you are falling behind,” said Mr. Parrish, who is reading “The Laws of Human Nature,” an examination of human behavior that draws on examples of historical figures by Robert Greene. “Reading is a way to consume people’s experiences, to learn something timeless and then apply it to your life.”

Chuck Royce, the founder and former chief executive officer of Royce mutual funds, who oversees $4 billion in investments, says he has embraced Mr. Parrish’s core principles. He gets up at 5:30 every morning to do his daily reading, which currently includes “Thinking in Bets: Making Smarter Bets When you Don’t Have All the Cards” by Annie Duke, a former poker champion — and a big favorite among investors these days. At the office, Mr. Royce works from a couch strewn with papers. His Bloomberg terminal is in another room. (my own experience with Bloomberg was same, if it is not in front of you then you read a lot and think clearly)

He concludes “Every world-class investor is questioning right now how they can improve,” So, in a machine-driven age where everything is driven by speed, perhaps the edge is judgment, time and perspective.”

Nirmal Bang writes …CPI inflation stood at 3.3% in October 2018, down from 3.7% in the previous month.It was below our estimate of 3.70% and Bloomberg consensus estimate of 3.60%. The lower than expected reading was because of deflation in the food and beverage segment. Food and beverage inflation stood at -0.1% YoY in October 2018, down from 1% in the previous month. Prices of vegetables, dairy products and pulses declined over the month. Core inflation on the other hand accelerated to 6.2% YoY from 5.8% in the previous month on the back of higher than expected inflation in the heath, household goods and personal care segment. Higher goods and services inflation reflects the pass-through of higher input costs including rupee depreciation and higher import duties. With CPI inflation below the RBI’s 4% forecast , an extended pause is likely. However, the increase in core CPI warrants vigilance

IIP growth came in at 4.5% in September 2018, a tad lower than the revised 4.7% in the previous month. However, it was better than our estimate of 4% and Bloomberg consensus estimate of 4.3%. Manufacturing sector growth slowed to 4.6% from 5.1% in the previous month. Nevertheless, growth was largely stable with 16 of 23 manufacturing sectors registering positive growth, same as in the previous month. Export oriented sectors particularly textiles continued to reap benefits from a weaker Indian rupee and relatively robust global demand. On the other hand, capital goods production is seeing signs of a slowdown after a good run over the past 12-15 months. Electricity production rose 8.2% YoY, while mining grew 0.2%YoY.Manufacturing sector growth is likely to slow from November onwards due to tighter credit conditions, consumer uncertainty and slowdown in capital spending by the government to meet the fiscal deficit target and by the private sector ahead of elections.

My two cents

Lower Agri commodity prices and higher input price inflation are here to stay. The situation gets tricky because large part of rural India’s income is a derivative of Agri commodity prices. On the other hand rising input prices are already showing up in core inflation which cannot be passed on to the final buyer because debt fueled household consumption is slowing down and corporate profitability will be dented in coming quarters. Lower inflation should then at least be positive for Govt bonds, no not really because market is wary of depreciating rupee and it is a matter of time that we breach 8% on ten year bond.