NOURIEL ROUBINI

Although the global economy has been undergoing a sustained period of synchronized growth, it will inevitably lose steam as unsustainable fiscal policies in the US start to phase out. Come 2020, the stage will be set for another downturn – and, unlike in 2008, governments will lack the policy tools to manage it.

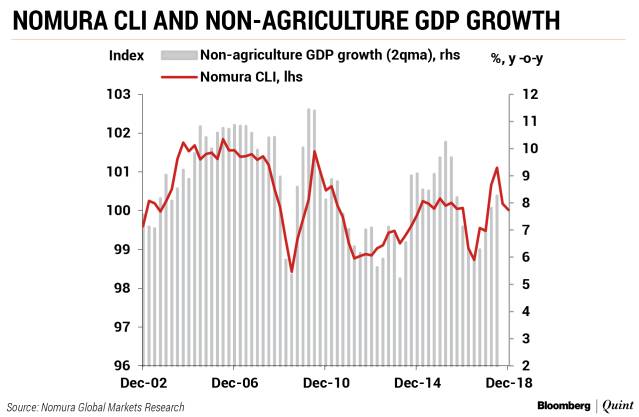

NEW YORK – As we mark the decennial of the collapse of Lehman Brothers, there are still ongoing debates about the causes and consequences of the financial crisis, and whether the lessons needed to prepare for the next one have been absorbed. But looking ahead, the more relevant question is what actually will trigger the next global recession and crisis, and when. The current global expansion will likely continue into next year, given that the US is running large fiscal deficits, China is pursuing loose fiscal and credit policies, and Europe remains on a recovery path. But by 2020, the conditions will be ripe for a financial crisis, followed by a global recession.

There are 10 reasons for this.

First, the fiscal-stimulus policies that are currently pushing the annual US growth rate above its 2% potential are

unsustainable. By 2020, the stimulus will run out, and a modest fiscal drag will pull growth from 3% to slightly below 2%. ( exactly because tax cuts is leading to buybacks not increase in capital creation. In case of India the fiscal stimulus is already over ,so called consumption is weakening and capex is not going happening. RBI can extend the cycle by expanding its balance sheet or we can go with a begging bowl to NRI’s)

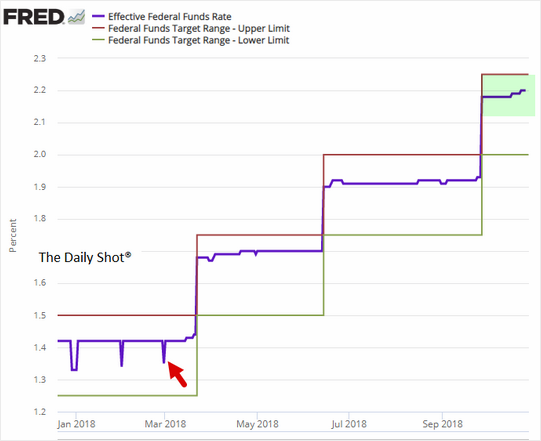

Second, because the stimulus was poorly timed, the US economy is now overheating, and inflation is rising above target. The US Federal Reserve will thus continue to raise the federal funds rate from its current 2% to at least 3.5% by 2020, and that will likely push up short- and long-term interest rates as well as the US dollar. Meanwhile , inflation is also increasing in other key economies, and rising oil prices are contributing additional inflationary pressures. That means the other major central banks will follow the Fed toward monetary-policy normalization, which will reduce global liquidity and put upward pressure on interest rates.(FED raising rates makes US assets more attractive vs other countries)

Third, the Trump administration’s trade disputes with China, Europe, Mexico, Canada, and others will almost certainly escalate, leading to slower growth and higher inflation.( they will not back down. An energy independent US doesn’t give DAMN to rest of the world)

Fourth, other US policies will continue to add stagflationary pressure, prompting the Fed to raise interest rates higher still. The administration is restricting inward/outward investment and technology transfers, which will disrupt supply chains. It is restricting the immigrants who are needed to maintain growth as the US population ages. It is discouraging investments in the green economy. And it has no infrastructure policy to address supply-side bottlenecks.(India will also see STAGFLATION simply because of rising input costs which cannot be passed on because consumer does not have buying capacity)

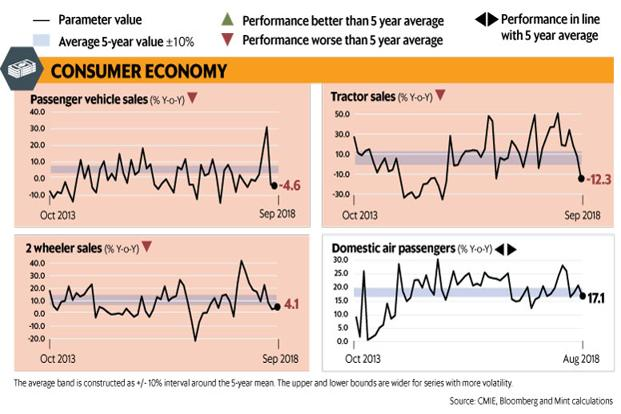

Fifth, growth in the rest of the world will likely slow down – more so as other countries will see fit to retaliate against US protectionism. China must slow its growth to deal with overcapacity and excessive leverage; otherwise a hard landing will be triggered. And already-fragile emerging markets will continue to feel the pinch from protectionism and tightening monetary conditions in the US.(Oh absolutely, free trade allows inefficiencies to be explored and used for everybody benefit and reverse is also true)

Sixth, Europe, too, will experience slower growth, owing to monetary-policy tightening and trade frictions. Moreover, populist policies in countries such as Italy may lead to an unsustainable debt dynamic within the eurozone. The

still-unresolved “doom loop” between governments and banks holding public debt will amplify the existential problems of an incomplete monetary union with inadequate risk-sharing. Under these conditions, another global downturn could prompt Italy and other countries to exit the eurozone altogether.(This is a big risk to the eurozone and it was good till lasted.The way a country needs a strong leader to unite , Europe also needs that leader. Angela merkel has got weakened by recent election losses and Macron’s popularity is fading … by mid 2019 it would be clear that Europe is on the verge of disintegration)

Seventh, US and global equity markets are frothy. Price-to-earnings ratios in the US are 50% above the historic average, private-equity valuations have become excessive, and government bonds are too expensive, given their low yields and negative term premia. And high-yield credit is also becoming increasingly expensive now that the

US corporate-leverage rate has reached historic highs.( and Powell prefers main street to wall (dalal) street, Market is underestimating the resolve of a different FED governor who wants to bring down the asset prices to reality)

Moreover, the leverage in many emerging markets and some advanced economies is clearly excessive. Commercial and residential real estate is far too expensive in many parts of the world. The emerging-market correction in equities, commodities, and fixed-income holdings will continue as global storm clouds gather. And as forward-looking investors start anticipating a growth slowdown in 2020, markets will reprice risky assets by 2019.(In India the central govt leverage is still low (debt/gdp) as compared to other EM. So Govt can still decide to spend more by borrowing from future but govt spending in India is only for revenue expenditure ( instant gratification) and not for income generating assets)

Eighth, once a correction occurs, the risk of illiquidity and fire sales/undershooting will become more severe. There are reduced market-making and warehousing activities by broker-dealers. Excessive high-frequency/algorithmic

trading will raise the likelihood of “flash crashes.” And fixed-income instruments have become more concentrated in open-ended exchange-traded and dedicated credit funds. and this will lead to higher volatility and lower forward returns).In the case of a risk-off, emerging markets and advanced-economy financial sectors with massive dollar-denominated liabilities will no longer have access to the Fed as a lender of last resort. With inflation rising and policy normalization underway, the backstop that central banks provided during the post-crisis years can no longer be counted on.

Ninth, Trump was already attacking the Fed when the growth rate was recently 4%.Just think about how he will behave in the 2020 election year, when growth likely will have fallen below 1% and job losses emerge. The temptation for Trump to “wag the dog” by manufacturing a foreign-policy crisis will be high, especially if the Democrats retake the House of Representatives this year.

Since Trump has already started a trade war with China and wouldn’t dare attack nuclear-armed North Korea, his last best target would be Iran. By provoking a military confrontation with that country,he would trigger a stag flationary geopolitical shock not unlike the oil-price spikes of 1973, 1979, and 1990. Needless to say, that would make the oncoming global recession even more severe.(of the top 5 weapons manufacturer in the world , 4 are from US and this will be US next big export)

Finally, once the perfect storm outlined above occurs, the policy tools for addressing it will be sorely lacking. The space for fiscal stimulus is already limited by massive public debt. The possibility for more unconventional monetary

policies will be limited by bloated balance sheets and the lack of headroom to cut policy rates. And financial-sector bailouts will be intolerable in countries with resurgent populist movements and near-insolvent governments.

In the US specifically, lawmakers have constrained the ability of the Fed to provide liquidity to non-bank and foreign financial institutions with dollar-denominated liabilities. And in Europe, the rise of populist parties is making it harder to pursue EU-level reforms and create the institutions necessary to combat the next financial crisis and downturn.

Unlike in 2008, when governments had the policy tools needed to prevent a free fall,the policymakers who must confront the next downturn will have their hands tied while overall debt levels are higher than during the previous crisis. When it comes,the next crisis and recession could be even more severe and prolonged than the last.