1. Be cautious of Normal Distributions and models that the economists show and use in their forecasts. While data is handy for decision making – don’t put all your faith in it.

2. Markets are relatively near-sighted and only remember the immediate past – if things have been good lately, investors will expect that trend to continue. And if things are bad lately, they’ll expect the future to be lousy.

Don’t be fooled by this. Like Minsky taught us, the calmer things are – the bigger spike of turbulence there will be. . .

3. Markets are rational most of the time – like 90% – but there’s that 10% of the time markets get irrational and mis-price assets significantly (like during bubbles or brutal bear markets for example).

Finding that 10% period and betting against it can be very lucrative. . .

4. Just because markets are going up and they have been for a while doesn’t mean they will continue indefinitely.

Just like the Turkey that got used to his daily life – the risks were piling up all around him.

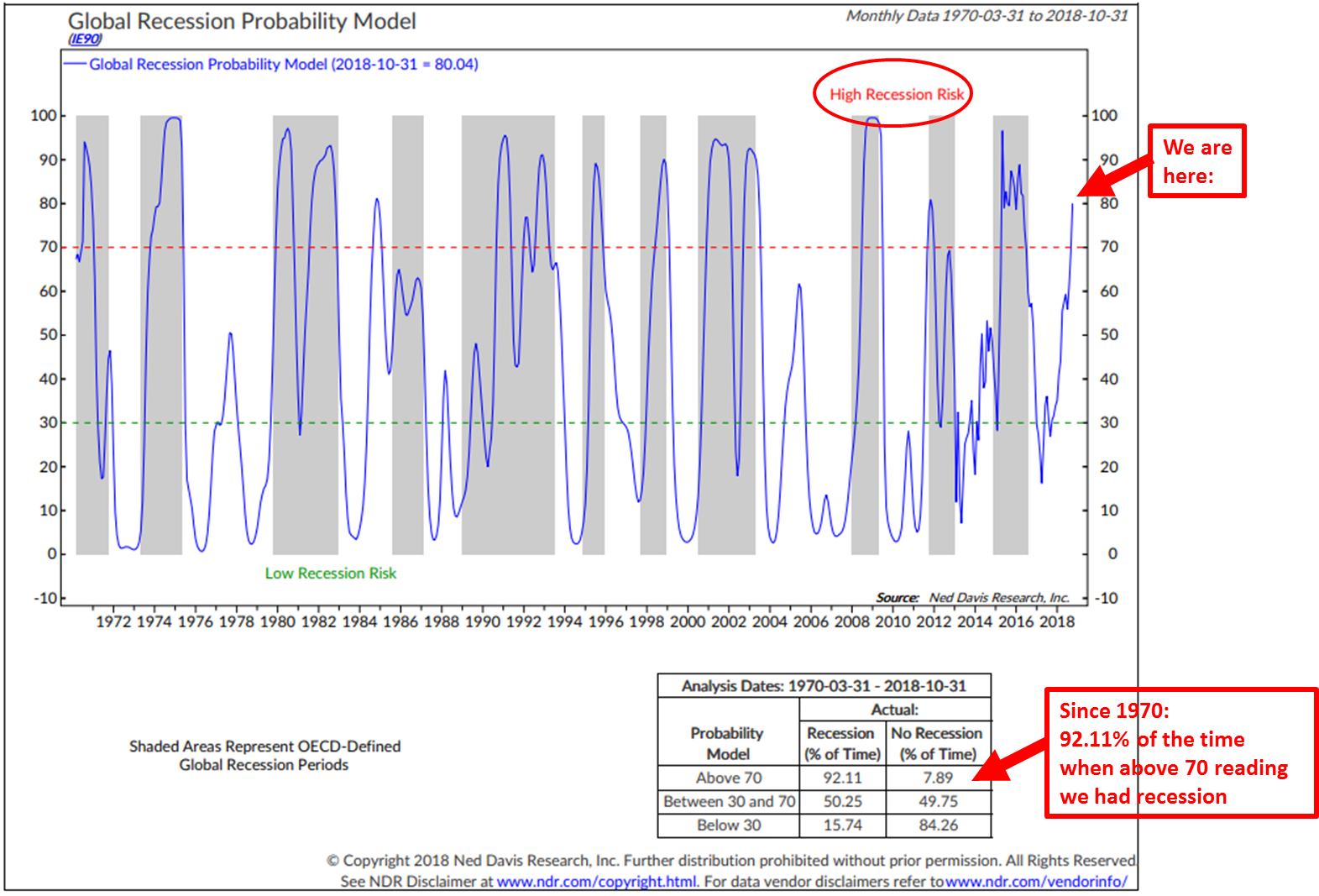

High Probability of Global recession

Ned Davis research writes ….note the red arrow at the top right. Readings above 70 have found us in recession 92.11% of the time (1970 to present). Several months ago, the model score stood at 61.3. It has just moved to 80.04. Expect a global recession. It either has begun or will begin shortly. Though no guarantee, as 7.89% of the time since 1970 when the global economic indicators that make up this model were above 70, a recession did not occur.

Conclusion

China,Europe and Emerging markets economic growth is already topping and if US continues to raise rates into the year end, we might see even US growth taking a hit by first quarter of next year.

This is when I think the chances of global economy enters into recession

The Markets Are a Jungle. Good Thing Felix Zulauf Is Your Guide

Some smart investors rarely give interviews and I am always on lookout for Felix Zulauf views on market. Below is summary of his latest interview……Via CMG wealth

Article by Lauren R. Rublin, October 5, 2018

Felix Zulauf was a member of the Barron’s Roundtable for about 30 years, until relinquishing his seat at our annual investment gathering in 2017. While his predictions were more right than wrong, it was the breadth of his knowledge and the depth of his analysis of global markets that won him devoted fans among his Roundtable peers, the crew at Barron’s, and beyond. Simply put, Felix, president of Zulauf Asset Management in Baar, Switzerland, always knew—and still knows—better than most how to connect the dots among central bankers’ actions, fiscal policies, currency gyrations, geopolitics, and the price of assets, hard and soft.

With interest rates rising, governments in flux, and the world’s two biggest economies facing off over trade, it seemed the right time to ask him how today’s turmoil will impact investors in the year ahead. Ever gracious, he shared his thoughts and best investment bets in an interview this past week.

Following is a selection of what I feel are the most important takeaways from the interview.

Zulauf believes we have left the world of free markets and entered the world of managed economies and said this is a major change in in his lifetime.

Central banks took over the running of economic policy after the financial crisis and run the show to this day.

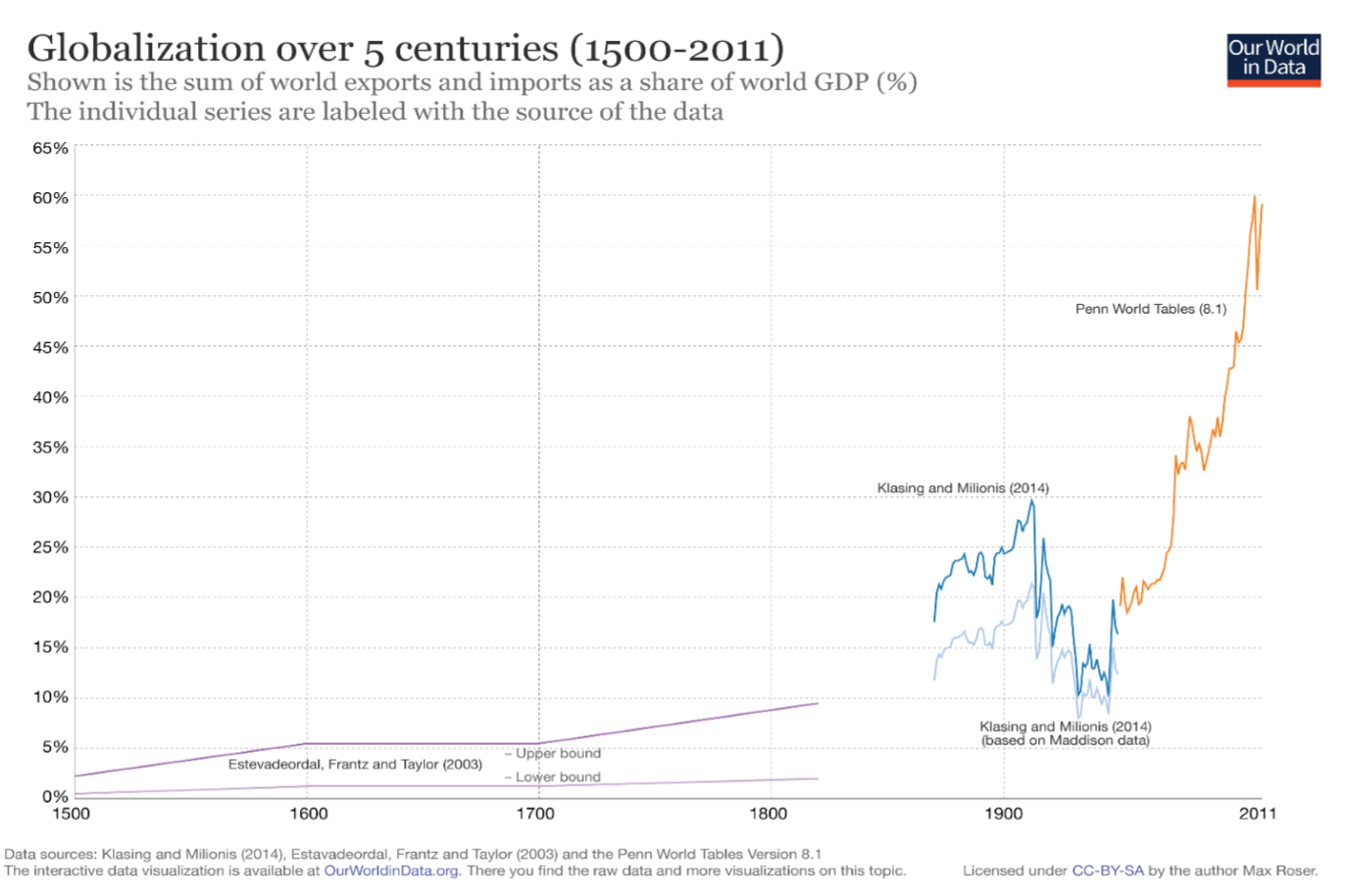

He also said the move to globalization is now moving backwards and moving to regional economic and trade partnerships, which could create problems for multinational companies.

The past 30 years saw the biggest globalization process ever, with the integration of China into the world economy. With today’s trade conflict, that is changing.

He believes, the Northeast Asia economic model isn’t compatible with the Western model.

In the West, corporations are run for profit. In Northeast Asia, exports have been used to increase employment, income, and market share. In China, average export prices have been unchanged in U.S. dollar terms for the past 15 years, whereas the average wage has gone up six times. A company with such statistics goes bankrupt, but China has escaped that outcome through the use of debt.

He believes the World Trade Organization should have sanctioned China for applying unfair trade practices, but didn’t. And added, Presidents Clinton, Bush, and Obama, and the Europeans, were asleep. President Trump has taken up the issue, as he was elected to do. Middle-class incomes in the U.S. and many European countries have been unchanged or down for the past 30 years in purchasing-power terms, while middle-class incomes in China and its satellite economies have risen tremendously.

He expects the China trade conflict to continue. 25% tariffs on everything within 12 months. Concluding, the Chinese will lose a few trade battles, but eventually win the war.

Investment picks: He favors oil and the U.S. dollar against certain currencies. He is short Emerging Markets. And also likes going long Japan via a currency hedged ETF and short the S&P 500 as a pair trade.

More on China:

China will build up its strategic partnerships around Asia, keep expanding in Africa, and try to convince Europe to join its trading bloc. If the U.S. continues to take an aggressive stance, it runs the risk of becoming isolated.

He’s looking out next six or seven years. A trade war might protect U.S. industries for a while, but protectionism weakens industries and economies.

He said, at present, the world economy is desynchronized.

The U.S. economy is on steroids due to tax cuts and government spending and growing above trend.

China is in a pronounced slowdown that could continue until the middle of next year, at least. The Chinese agenda is to have a strong economy in 2021, the 100th anniversary of the founding of the Communist Party of China, and 2022, the year of the next National Congress.

That is why China started to address major problems, such as pollution and financial excesses, in 2017. Cleaning things up led to a slowdown that could intensify in coming months as U.S. tariffs increase.

This totally got my attention:

China will launch another fiscal stimulus program, supported by monetary stimulus.

When it does, the currency will fall 15% or 20%. The Chinese will let the currency go because they know they can’t please President Trump on trade. They aren’t prepared to do what he’s asking for.

We’ll also see fiscal stimulus applied in emerging markets, which are largely dependent on China, and in Europe and maybe the U.S., where President Trump will launch a spending program to boost the economy ahead of the 2020 election.

Bad for bonds – a decisive bear market in bonds

Global fiscal stimulus initiatives are poison for bond markets. Bond yields are rising around the world. After major new fiscal stimulus programs are announced, perhaps from mid-2019 onward, yields will rise quickly, resulting in a decisive bear market in bonds.

Treasury Bond – $1.3 trillion in Treasury paper must be issued in the next 12 months (to finance U.S. spending deficits) – More supply = higher interest rates

The U.S. economy is growing above trend, capacity utilization is high, and the intensifying trade conflict with China suggests disruption in some supply chains, which leads to higher prices.

The Federal Reserve is selling $50 billion of Treasurys per month, and the U.S. Treasury must issue $1.3 trillion of paper over the next 12 months. All these factors are pushing yields up.

On the Euro – Right on point! Watch the banks!

Introducing the euro led to forced centralization of the political organization, as imbalances created by the monetary union must be rebalanced through a centralized system. As nations have different needs, the people are revolting; established parties are in decisive decline, and anti-establishment organizations are rising.

The risk of a hard Brexit is high. Italy doesn’t listen to Brussels any longer. The March election brought anti-establishment parties to power that proposed a budget with a 2.4% deficit target. Eventually it will be closer to 4%. The Italian banking system holds €350 billion of government bonds. If 10-year government-bond yields hit 4%, banks’ equity capital will just about equal their nonperforming loans.

By the middle of next year, you’ll see more fiscal stimulation in Germany, Italy, France, and possibly Spain. Governments will not care about the EU’s directives. The EU will have to change, giving more sovereignty to individual nations. If Brussels remains dogmatic, the EU eventually will break apart.

The European Central Bank

ECB quantitative easing ends by the end of this year. The economy has been doing well, the inflation rate has risen, and yet the ECB has continued with aggressive monetary easing, primarily financing the weak governments. This is nonsense.

They are the worst-run central bank in the world. I expect the euro to weaken further, possibly to $1.06 from a current $1.15.

The U.S. Fed

The Federal Reserve is draining liquidity from the financial system [by not buying new bonds to replace maturing paper]. It will remove another $600 billion from the market in the next year.

The Treasury will issue $1.3 trillion of Treasury paper to finance the budget deficit.

All of this means a lot of liquidity is being withdrawn from the market, which is bearish for financial assets.

He expects U.S. stocks to slide into the middle of next year, falling maybe 25% to 30% from the top, taking nearly all other markets down with them.

Zulauf concludes:

When the declines are big enough, the central planners will come in. Central banks will ease monetary policy, buying assets if necessary.

You won’t earn a lot owning equities over the next 10 years, especially if you’re a passive investor in index funds.

It will be a much better time for traders and active investors who pick stocks and sectors and do exactly what hasn’t worked for the past 10 years.

Credit Suisse- Credit growth could fall to single digit

The imminent slowdown in credit growth of non-banking financial companies (NBFCs) could lead to a credit crunch in India, with overall system credit growth falling to less than 10%, Credit Suisse said in a report.

“NBFC/housing finance companies (HFCs) have played a major role in credit supply in recent years, accounting for 25-35% of incremental overall credit. Even as bank credit growth in the last two years has averaged at 7%, a strong 20%+ growth in NBFC credit aided overall credit expansion beyond 10%,” said Credit Suisse.

Over the last few years, NBFCs/ HFCs have seen strong supply of funds from banks (43% year-on-year growth as of August 2018) and mutual funds (around 35% of debt assets under management), making this asset class among the largest exposures for these fund suppliers, said the report.

Mint article below

The (ominous) problem with global liquidity

Without trust, nothing grows- quarterly client letter,Prerequisite capital

Whether it be a marriage, a business partnership, or an economic system – without trust nothing grows, rather, things fall apart.

One of the most underappreciated dynamics of the last 12 years pertains to the chart below… it shows world trade as a percentage of global GDP for the last 500 years:

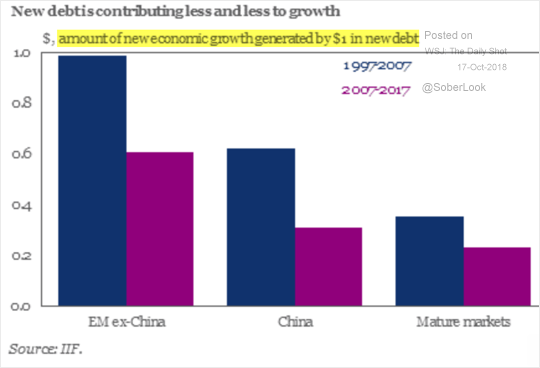

The productivity of debt is sharply down

The problem is not debt, it is the productivity of debt and if you see the chart below from IIF things are going in wrong direction. On top of that it is the govt which has accumulated debt as it has expanded its tentacles in different parts of the economy. Now,Government deficits are not saving, but dissaving, reducing the total saving available for investment. The US govt debt/GDP has crossed 100%(India we are still closer to manageable 60%). It is important to note that the projected increase in US federal debt from $21.4 to $28.9 trillion will, all other things being equal, further reduce net national saving from approximately 3% to 2% or possibly even zero. Thus, investment would be forced downward, continuing to erode productivity, unless, of course, consumer saving were to rise. But, if consumer saving were to rise, this would reduce consumer spending and economic growth, undermining the incentive for more investment.This is a recipe for semi-recessionary economic conditions, regardless of monetary mistakes.

Lacy hunt , at Hoisington asset management believes that accumulation of more debt unless accompanied by very high inflation only leads to lower yields….and he concludes” The response by policy makers to this eventuality is a guess, but a higher interest rate policy does not appear to be an option. From the standpoint of an investment firm that started in 1980, when 30-year bond yields were close to 15%, the current 30-year treasury rate at 3% seems ridiculously low. In the near future, at 1.5%, the 3% yield will seem generous”.

Crash in 2019 and US recession in 2020

Scott Minerd’s of Guggenheim’s Partners is one of the smartest guy in investment . Below is his interview transcript

Marina Grushin: What makes you confident that the US economy will enter recession in early 2020?

Scott Minerd: Confidence in our recession call stems from what we’ve observed in past business cycles. Most pre-recessionary periods share a common set of characteristics. They start with an economy growing above potential, putting downward pressure on unemployment. The Fed then raises interest rates—eventually into restrictive territory—to try to limit the growth of imbalances. This is the key recession trigger. Evidence that policy is getting tighter can be seen in the flattening of the Treasury yield curve(absolutely). Economic activity doesn’t typically slow until a few quarters prior to recession; in fact, growth in the second-to-last year of the expansion is usually fairly strong. We see all of these things playing out right now. The fact that the fiscal impulse is set to fade in 2020 and policy uncertainty will rise heading into the presidential election only adds to my confidence.

Marina Grushin: What assumptions are you making about inflation and interest rates?

Scott Minerd: We’re expecting core PCE inflation to rise over the next couple of years to around 2.25%, partly as a result of cyclical consumer pressures. Tariffs will also have more impact than people think. Not only will imported goods prices increase but competing producers will pad their profit margins by raising prices on domestically produced goods, just as we saw with the 20% increase in washing machine prices earlier this year.

In the face of inflationary pressures and low unemployment, the Fed will have no choice but to forge ahead into restrictive territory. Even former doves like Governor Lael Brainard are now arguing that the short-run neutral rate may be rising, and that policy will eventually need to become restrictive relative to that. In fact, all Fed officials forecast that the terminal rate will be above their respective forecasts of neutral. So restrictive policy is coming in 2019. We therefore see the Fed raising the target range to 3.25-3.50% next year. This will put three-month Libor somewhat above 3.75%. Long-term Treasury yields will likely top out near 3.50%( agree completely), and the yield curve will invert once it’s clear the Fed is done hiking (I expect it in next 3 months). We expect a Fed easing cycle to begin in 2020, which will put to rest questions about whether the 35-year bull market in bonds is over. It isn’t.

Marina Grushin: Does the recent steepening give you pause?

Scott Minerd: I wouldn’t draw conclusions based on a few trading days. Sure, the curve has steepened recently, but it’s been flattening for the last three years! As I said, longer-dated yields are getting closer to our expected terminal rate and there’s still more room for short-end yields to increase.

Marina Grushin: You’ve expressed concern about corporate debt. What are the risks?

Scott Minerd: The last recession featured overleveraged consumers and banks; the next one will feature overleveraged companies and non-bank investors that have taken on too much risk in the era of low rates and QE. As the Fed raises rates, it will choke off corporate free cash flow. Leverage among IG companies, which has already increased a lot in this cycle, will rise further when earnings roll over. This will help lead to a big wave of rating downgrades, thanks to the dramatic growth of the BBB segment of the corporate bond market. BBB-rated bonds now account for almost half of the Bloomberg Barclays Corporate IG index, yet many of their issuers have leverage ratios that were historically associated with BB securities. Passive bond funds have not only aided the buildup of these risks but may also exacerbate their impact when they eventually need to sell downgraded positions into an illiquid market. If the scale of downgrades is on par with prior cycles, the migration of “fallen angels” from BBB to BB could amount to about $1tn of debt, overwhelming the HY market. That will tighten financial conditions and hurt the economy.(time to short high yield bond etf)

Marina Grushin: Haven’t corporate borrowers mitigated these risks by locking in low rates at longer maturities?

Scott Minerd: Actually, a lot of corporate America appears more sensitive to changes in interest rates today, and that lot exists in the riskiest segment—issuers rated below investment-grade (IG). Floating-rate liabilities currently make up a larger piece of the high-yield (HY) corporate debt pie than at any time in the past; and if not this year, then next year, there will be more floating-rate bank loans than fixed-rate HY bonds outstanding. The companies that have locked in rates are typically IG, and won’t be the most vulnerable in a recession.

Marina Grushin: Does the growth of non-bank lending worry you?

Scott Minerd: It’s a risk we’re watching in the HY market. Fifteen years ago, around 80% of all syndicated loans remained on bank balance sheets through a “pro-rata” tranche that was a revolving credit line or an amortizing term loan; now, 70-80% of syndicated bank loans are outside of the banking system, meaning that the pro-rata tranche is much smaller in comparison to the institutional loan tranche that is distributed among non-bank lenders. We’ve also seen estimates that the private debt market has grown to around $400bn to $700bn in size—larger than the size of the bank loan market in 2007. That has made it harder to trace credit risk and maintain credit standards. Meanwhile, innovations like bank loan ETFs have moved credit risk into the hands of retail investors. That’s something we didn’t have to worry about in the last major crisis in corporate credit, in 2001/02. We’re in uncharted territory.

Marina Grushin: Putting this all together, how severe do you think the next recession will be?

Scott Minerd: The next recession may not be any more severe than average in part because policymakers are likely to act quickly knowing that they have limited policy options. But that lack of policy space worries me. In the US we’ll be entering the downturn with the largest peacetime budget deficit we’ve had outside of a recession, and the Fed is likely to be constrained by the zero bound once again, making this the recession when unconventional policies become conventional; we expect the Fed to cut rates to zero, employ aggressive forward guidance, and resurrect QE. Whether these tools will be as effective as the Fed claims they were in the last cycle remains to be seen. Keep in mind that achieving the equivalent of a 2% rate reduction—the difference between our 3.5% forecast for the terminal rate and the roughly 5.5pp of rate cuts in a typical easing cycle—would be worth several trillion dollars of QE. Put differently, we think the Fed will probably wish they had more powerful tools when the time comes to use them (this is why they are raising the rates)

Outside of the US, the lack of policy space is even more concerning. Markets will force belt-tightening measures in Southern Europe, but the ECB will have minimal ability to cushion the downturn. Will the political systems in Italy, Spain, Portugal and Greece be able to deliver the fiscal tightening that markets will demand? If not, then we’ll have big problems. The BOJ will have limited options to fight a sharp appreciation of the yen, and China will be choking on bad debt after an epic debt binge over the last decade. These factors could make the next recession more severe than our models suggest.

Marina Grushin: What looks mispriced today?

Scott Minerd: Not surprisingly, we think credit spreads are too tight right now. For example, after adjusting for expected credit losses, HY bonds offer minimal value over Treasuries. While carry is reasonably attractive and trailing defaults are modest, a credit investor should not take for granted the ability to liquidate a position when the value proposition changes. The door is always smaller on the way out.

More broadly, turmoil in the credit markets will almost certainly spill over into the equity markets. In a scenario similar to 2001/02, we think HY spreads could widen by about 800bp or more, which corresponds to a roughly 40% decline in stocks— effectively a retracement to prior technical support levels, the S&P 500 highs of 2007 and 2000. While I don’t think the equity bull market is over yet, an eventual decline of that magnitude looks justifiable to me on a technical and a fundamental basis.

Marina Grushin: How soon should investors reduce risk?

Scott Minerd: Corporate credit spreads tend to start widening roughly one year before a recession begins, which would correspond to the first half of next year. But with spreads as tight as they are you aren’t giving up much by starting to reduce risk now. Besides, it takes time to turn a ship around.

Equities will probably peak a bit later in 2019, not least because the because the Nov-April period tends to be seasonally strong for stocks, especially after midterm elections. That will be the rally to sell. By the end of Q2 next year, I expect risk-off everywhere.(I agree)

Marina Grushin: What should investors buy/sell today?

Scott Minerd: We’re underweight duration in our core fixed income funds to position for a rise in rates toward 3.5%. We expect the yield curve to continue flattening and recommend a barbell of high-quality, longer-duration bonds and floating-rate credit. We are upgrading credit quality and reducing our credit beta in anticipation of spread widening beginning next year.

Marina Grushin: What would have to happen for you to change your call for a recession in 2020?

Scott Minerd: We’d likely have to see faster supply-side growth, which would allow us to sustain this pace of economic growth without putting pressure on resource utilization. That would entail better productivity growth but also more rapid increases in labor supply. Despite some observers’ optimism that tax cuts will achieve the former, we don’t expect to see major productivity gains. As for the latter, Washington is unfortunately pursuing a self-defeating immigration policy. At a time when we should be welcoming new foreign workers who can fill the void left by retiring baby boomers, we’re instead looking for ways to restrict immigration.

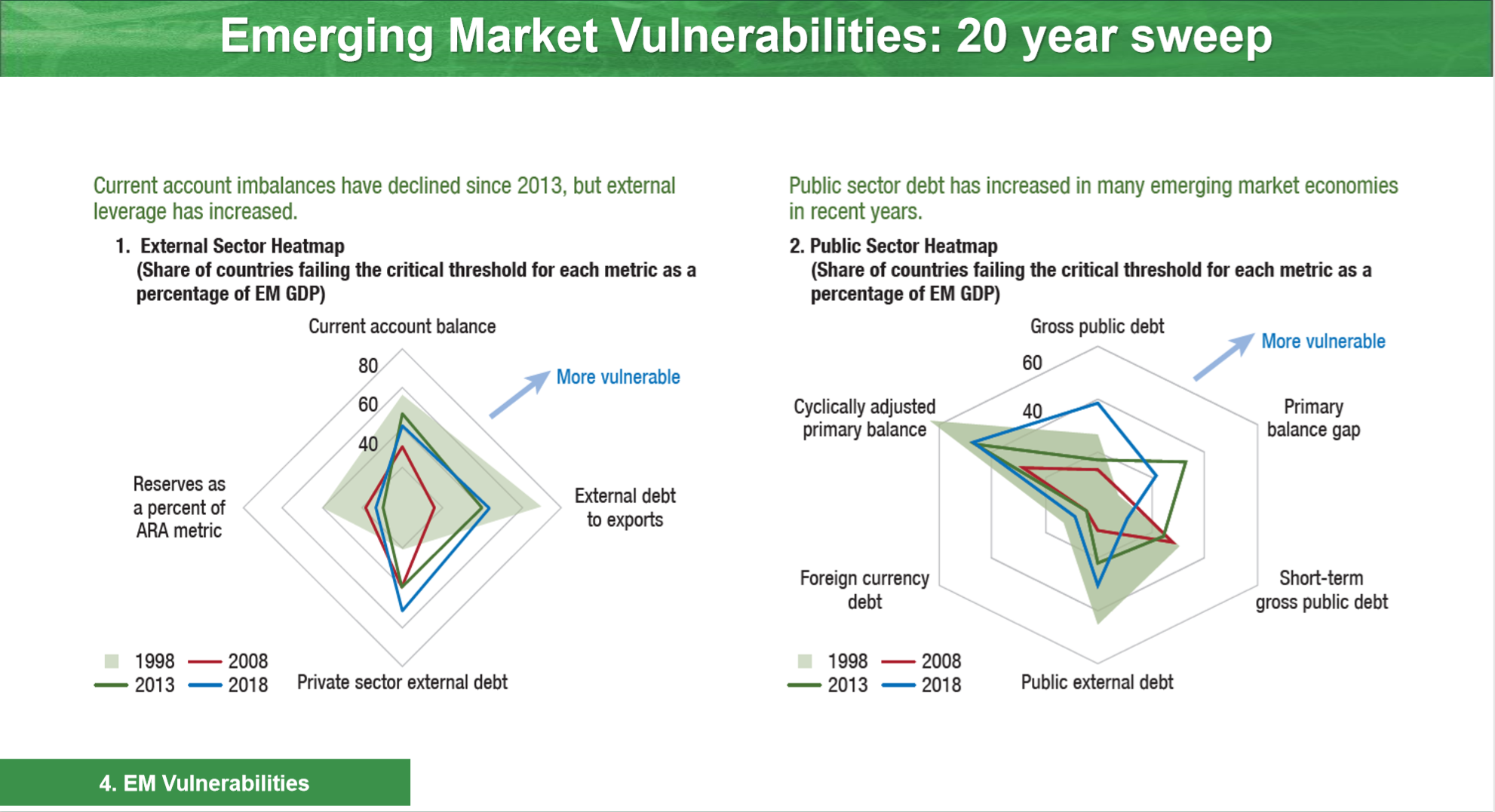

Global Financial Stability Report- IMF

‘Global Financial Stability Report’, by IMF has a key focus on the global financial stability assessment, and the fragilities in Emerging and Frontier Markets.

Summary

Financial Conditions have tightened in EMs ex China, reflected through outflows and asset market pressures

Investor differentiation however remains high with performance driven by fundamentals and idiosyncratic factors. Furthermore, spillovers within EMs have risen but remain below historical highs

A new model on Capital Flows at Risk suggests that medium term downside risks have increased. Portfolio flows are expected to remain subdued given the external backdrop.

Within EM vulnerabilities, high leverage, external connectedness and potential FX liquidity needs remain key.

Investor base dynamics across both sovereign and corporate bonds add another leg of vulnerability; Furthermore, while bond markets have grown sharply, financial deepening varies significantly across EMs.

Full Report below

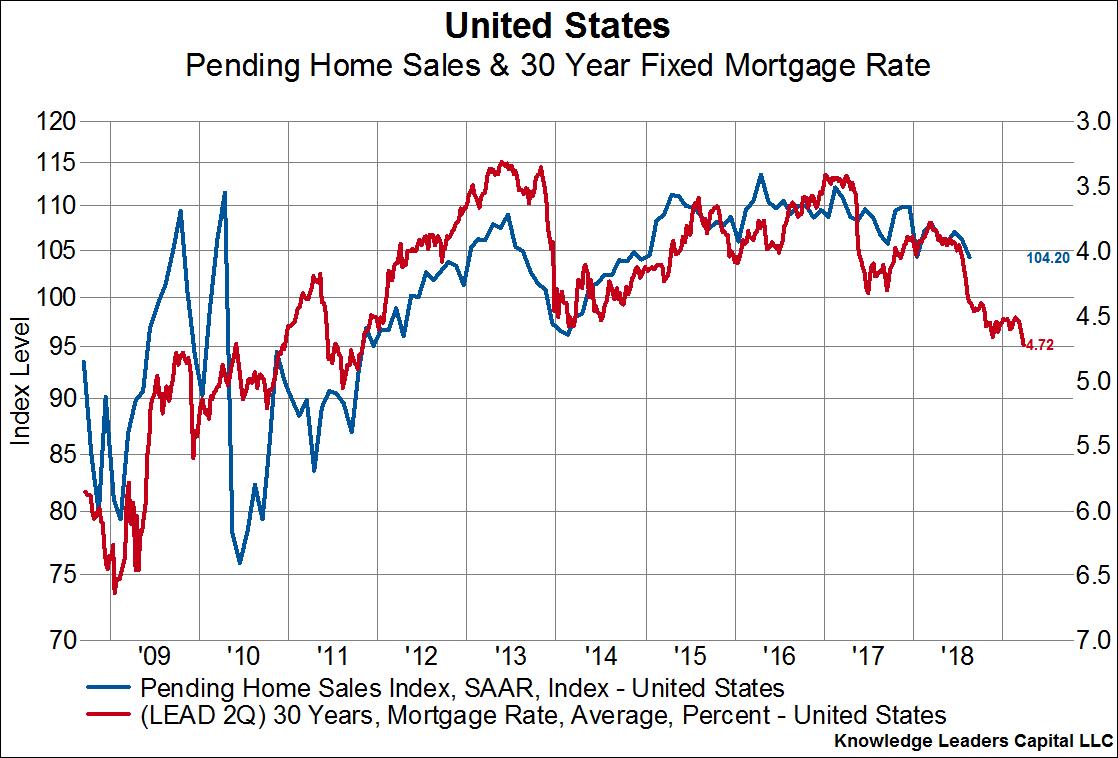

Higher Mortgage Rates are Starting to Bite the Housing Market

Knowledge Leaders write…The effects of higher long-term interest rates in US are starting to be squarely felt in the housing space. Pending sales, mortgage applications and new construction have all been weak and look set to get even weaker in the quarters to come as the lagged effects of higher mortgage rates set in. Home prices have yet to respond since inventory levels are still moderate, but inventories aren’t the support they were just two years ago. Meanwhile, affordability levels are no longer very supportive. All this suggests that the housing sector, which has been a bright spot of this recovery over the last five or six years, may not be the same source of wealth accumulation and growth over the next few years, or as long as higher mortgage rates continue to take the juice out of this sector.

This is one reason I believe that yields have still not bottomed out and we might still see a final low in 30 year US bond yield possibly with inverted yield curve.