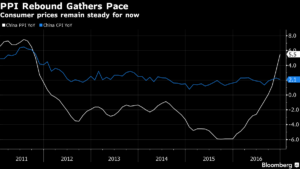

China quietly stopped being an exporter of deflation few months back when its factory gate price turned positive after a gap of five years. Portfolio managers who took this development seriously made a bounty in industrial metals stocks which outperformed the broader market since this news. Now we get one more jolt from china producer price index which also rose at the fastest pace in more than five years in December as the factory to the world swung to exporting inflation.

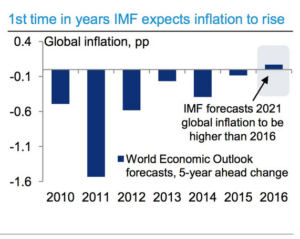

Now to be sure there are sceptics who point this as one off data but I think it is a start of a bigger trend. As Diana choleya writes China is more likely to be “exporting inflation” than “exporting price deflation” as it was in the period 2002-2006 because its economy and interaction with the world have changed .China used commodities and energy extremely inefficiently, but it also administered their domestic prices. Energy and commodity prices surged on world markets, but in China they hardly budged. Thus, global manufactured goods price deflation continued unabated until China reached its physical energy and transport supply limits. She further writes that gone are the days when Chinese exporters could rely on cheap and ample migrant labour to keep manufacturing prices low. Gone also are the days when China’s state-owned oil and gas producers could assume the burden of low administered energy tariffs, which also helped to hold down global prices of manufactured goods. Gone, too, are the days when public and overall debt were low enough for China not to care about shouldering the extra costs in order to achieve rapid industrialisation and to grab export market share and what you see is the risk in world today are hiding in plain sight in the form of unexpected higher inflation as the data highlights rise in both industrial metal and raw materials prices. All This adds to ongoing price pressures at Chinese factories, such as wage increases. They all raise input costs. With margins getting squeezed from the bottom up, producers will be trying to pass on these higher costs to the global supply chains via higher asking prices. And if they get those prices to stick, they’ll export inflation to the rest of the world. And that’ll be a sea change. Add a toxic mix of protectionism, the global markets will be surprised with health dose of inflation. Below is the chart where even IMF expects inflation to be in positive territory this year.

In my view mild return of inflation is already underway in India also as core inflation refuses to budge lower and input price inflation continues to march higher. The numbers are not alarming enough as is evident in bond market complacency and continued euphoria in equity markets to chase high P/E growth strategies even as bond yield refuse to go lower and value strategies have started outperforming. A major trend shift is underway ……Read the leaves the times they are changing

One thought on “The Gathering Inflation storm”