Armstrong economics explains it beautifully

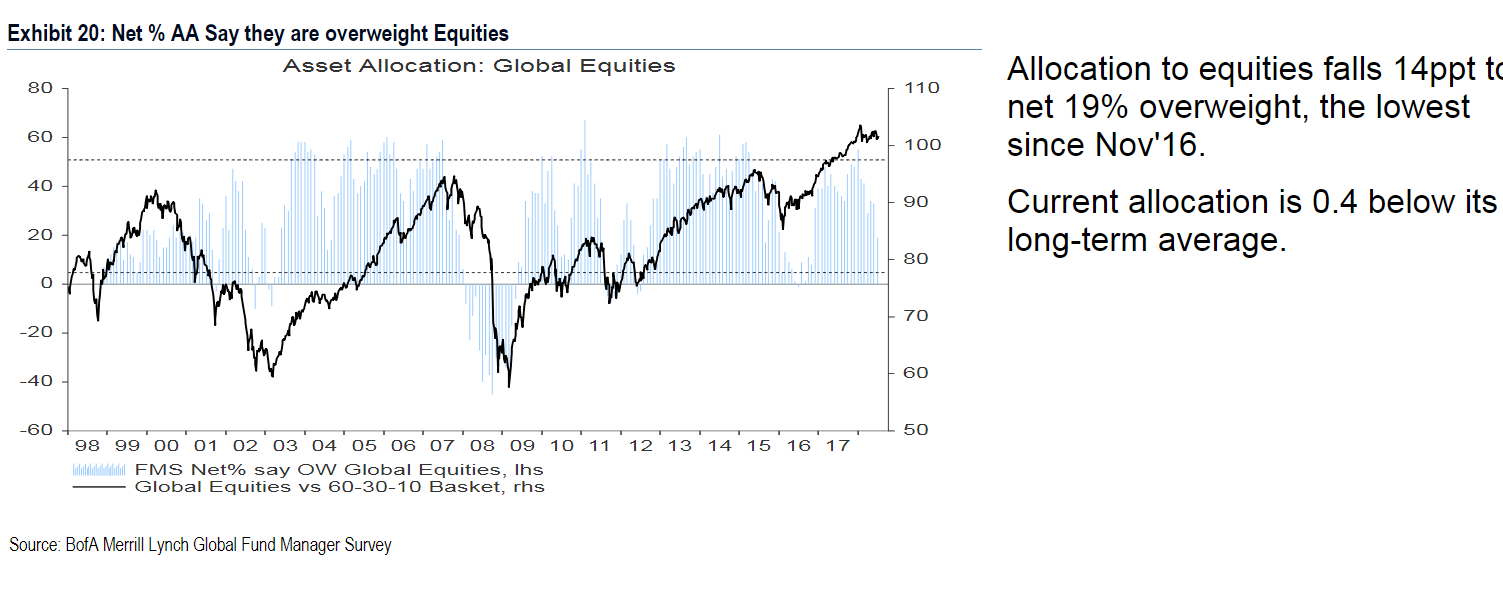

“The interesting fact is that the majority of fund managers today have reduced their equity allocation to their lowest level since November 2016 according to Reuters. The reason for this is their focus of trade and their assumption that the Great Depression was caused by a PROTECTIONISM. According to yet a recent monthly report by Bank of America Merrill Lynch (BAML) where they conducted a survey of fund managers, the majority, some 60%, now fear a trade war. Clearly, the biggest concern out there is a trade war poses the greatest risk to the stock market. Another 19% fear excessively higher interest rates by the Federal Reserve. These two perceptions are the dominant reason we see consolidation.”

Michael Harnett at BOFA writes “Investor sentiment is bearish this month, with survey respondents eyeing the risks from a possible trade war,” Within Equity Allocation Emerging market equity allocations were among the biggest casualties of the growing trade war fears. These suffered their biggest monthly drop in two years, taking the allocation down 23 percentage points to a net 1 percent underweight. (and you expect equities to fall?) yeah right

BAML further said this was the most crowded trade outright since “long U.S. dollar” in 2015. The allocation to tech stocks rebounded 10 percentage points to a net 33 percent overweight in July, making it the most favored sector of the month. (so everybody is long dollar hmmm )

Conclusion

I know they dont ring the bell at the top but “The sharp decline in asset allocation to equities has not been met with a collapse in market prices. so clearly market knows something and is not worried,this is a very interesting development for the majority NEVER manages to sell the high”.

Markets always inch upwards in the long-term. The same cannot be said about Gold and Real Estate which are primarily macro driven and based on supply and demand.

Markets are a function of earnings and earnings are a function of nominal GDP growth. Govt will do whatever is required to have positive nominal GDP and hence over a longer period of time equity should do well but starting point is also equally important. if u r buying markets which are already quite rich then you will have to endure time or price correction. i find rel estate as a proxy of inflation in india atleast and way of maintaining purchasing power. gold is a hedge against political stupidity.the more stupid political decision the more gold will rise in domestic currency

Correct, all of that is correct.

Yet, I see a bubble forming.