All the major economies are over indebted with Japan being the most followed by Europe, U.K, China and the US. Japan particularly have found itself in adding debt since 1944 first when debt grew faster than income during pacific war, then the Japanese asset price bubble collapsed in late 1980s causing rapid increase in debt to GDP ratio and then Fukushima disaster of 2011 also had a negative impact on current account surplus of Japan.

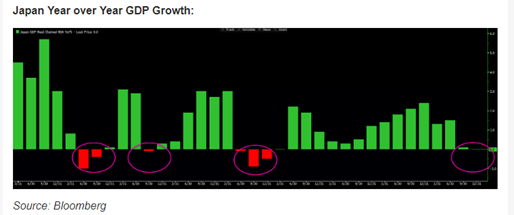

In past decade, Japan had four contractions YoY GDP growth. Each time economy is met with small spurt in growth, negative growth ensued. Raising the interest rates trims the economic growth even further proof of which lies in bubble collapse due to hike in lending rates by BoJ. Over indebtedness produces inherently weak aggregate demand which makes the economy subject to downturn without cyclical pressures.

There are four variables that affect monetary policy: interest rates, inflation, exchange rates and growth.

In Japan, while both net and gross debt increased over time, level of net debt is far lower than level of gross debt because Japanese government owns large amount of domestic and foreign financial assets in form of loans, bonds etc. Majority of Japanese bonds are purchased by BoJ which insulates it from changes in global bond market. Remainder of debt is financed by domestic creditors.

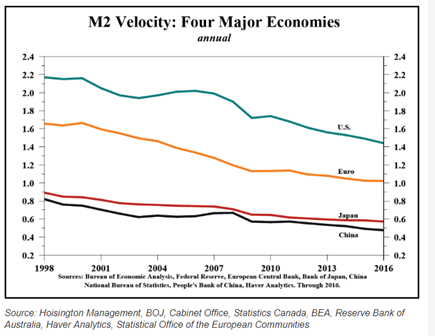

Central banks can control short term interest rates and size of their balance sheet but they cannot control money supply. As velocity of money declines, monetary policy is increasingly ineffective. As debt burden grows and productivity growth declines, velocity of money crashes.

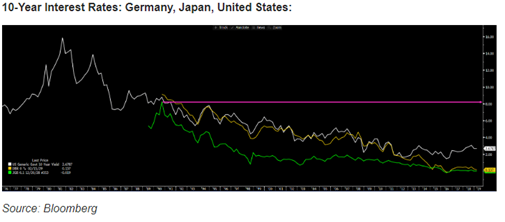

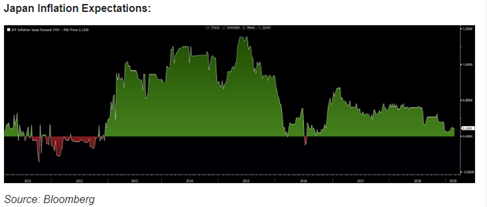

In Japan, long term rates are at 0%. Long term interest rates are built around the expectations of future inflation. Japan’s inflation expectations is also at 0% .

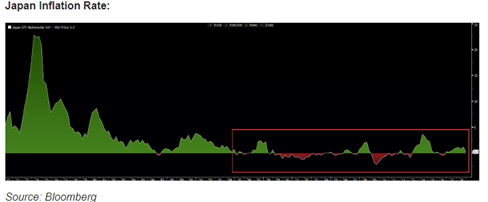

Economy that is over indebted can be seen in persistent disinflation or outright deflation. In Japan, deflation has arrived as the headline CPI rate has remained negative for many years. Yen is a great barometer of this deflation and I would be watching Yen weakness carefully to see any incipient signs of impending inflation.