By Ritesh Jain

Fiat system goes critical with the dawn of the new decade, the world will become increasingly interventionist. In keeping with the motto “Once your worldly reputation is in tatters, the opinion of others hardly matters”, all the barriers to new debt are now being breached. Debt no longer plays a role, and zero interest rates and money supply expansion remain the order of the day as far as the eye can see.

What was obvious from writing this report was that, the main result of the fiscal and policy response globally to the virus, through monetary and fiscal policy and regulations, will be a structural shift to much bigger government, whatever political flag it is under. This will change the whole nature of society, perhaps best highlighted by Bloomberg which said German Chancellor Merkel’s stimulus package will result in the biggest re-engineering of the economy since post-war construction, installing the kind of state “capitalism” in Germany that borrows heavily from France or China. This is not the result of some devious plot as many assume, but rather the cost of sustaining the existing imbalances. Nevertheless, with the imbalances and costs so high, the changes to the shape of the economy and industry, both domestically and internationally, and the makeup of that industry in terms of competition and ownership etc, including passive vs active (the only game in town will be base money & fiscal spending) – will be massive.

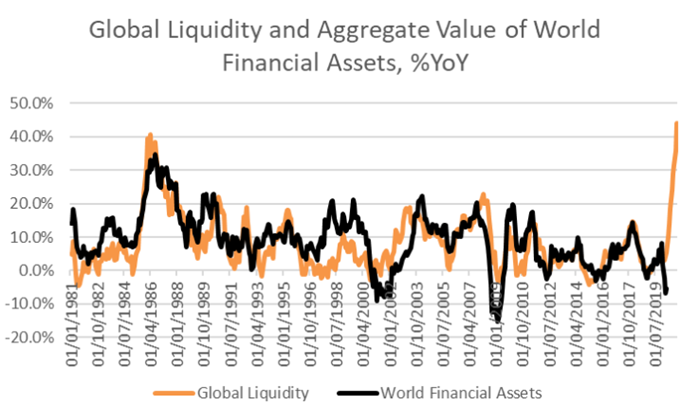

The only chart that matters

I know cash flows and valuation matters for the patient long term investors but even warren Buffett has started complaining about lack of market opportunities due to heavy intervention by central bankers and famed investor Jeremy Grantham has reduced his equity allocation in his flagship GMO fund from 35% to 25% and was quoted in FT saying stock markets are “lost in one sided optimism”. It seems that now you need to take LIQUIDITY as granted and then use your skills to find the direction in which this LIQUIDITY is flowing. This kind of LIQUIDITY just makes the system more vulnerable as poorly run companies are also able to find money to continue operations and this brings down the productivity for the entire system.

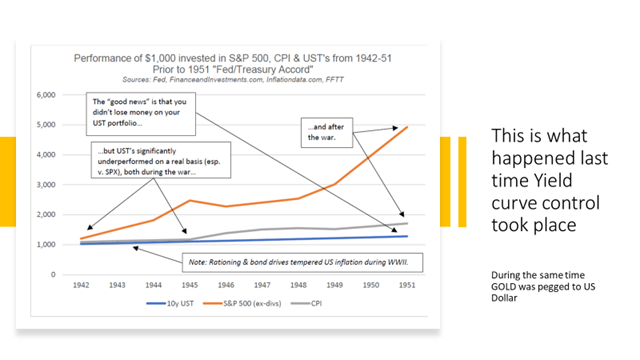

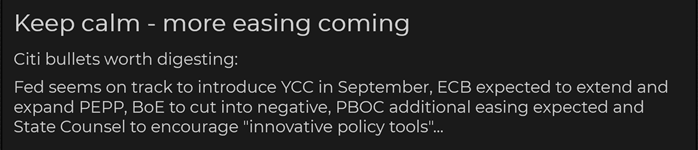

if you are worried about whether this Tsunami of LIQUIDITY is creating distortions in asset prices wait till US Fed decides to CAP the bond yields. I believe the only way US can get back to its Trend growth growth is by reducing the value of US Dollar. The best way is to Cap the bond yields and let the inflation run hot. Lat time it happened was after second world war during 1942-1951 period and US was able to get back to fast growth lane by nominally defaulting on its debt.

Goldman turns optimistic based on what Higher Prices?? Goldman turned optimistic on U.S. Stocks. Strategists rolled back a prediction that the S&P 500 will slump to 2400- 21% below Fridays 3044 Close – and now see the downside risks capped at 2750.It may even rally further to 3200.Policy support limits the downside to roughly 10%, they said.

What lays ahead for the Federal Reserve free money printing institution of the world

The United States’ Federal reserve’s balance sheet increased by USD441bn in May to USD7.06trn. Over the last 5 and 10 weeks, M2 money supply has grown at an annualised pace of 106% and 111% respectively. The growth is set to continue. The inert Treasury General Account soared to USD1.364trn, indicating that, to meet its own goal of it being down to USD800bn by the end of June and September, the Treasury must inject USD564bn into the economy, equivalent to over 3% of money supply in just over 4 weeks. Also, Boston Fed President Eric Rosengren said he expects companies to begin receiving money through the central bank’s Main Street Lending programme within 2 weeks, which the Boston Fed will be administering. The general message was of greater monetary and fiscal stimulus to come.

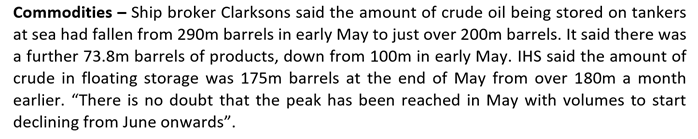

Have oil prices finally turned?

Looking into the Mirror is not helpful in investing

The first 20 years of the 21st century can be divided into two halves. The first half was the reflation trade, which was characterised by rising commodity prices, a weak US dollar, and strong growth. The second half has been the opposite, with falling commodity prices, weak growth and a strong dollar. Perhaps nothing shows this more clearly, that the relative performance of emerging markets, which greatly outperformed the S&P 500 in 2000s, and then gave back all that relative outperformance in 2010s.

Collapsing yields and commodities have forced investors into a variety of “safety trades”. Growth stocks over value stocks, gold over silver, and long dated bonds. All have remarkably similar performance, particularly in recent years.

( chart courtesy: Horseman Capital)

The tale of two halves

2000-2010: Capital moves from Developed Markets TO Emerging Markets

2010-2020: Capital moves back from Emerging Markets TO Developed Markets

( chart courtesy: Horseman Capital)

Macro Outlook

2020-?

Changing underlying trends in oil, government spending and Chinese exports suggest that the macro trend of the 2010s will not be the same as the 2020s.

If the experience of changing macro trends from 2000s to 2010s are repeated, then the winners of last decade, will under perform the losers of last decade