Let me explain why Indian markets continue to be on a tear

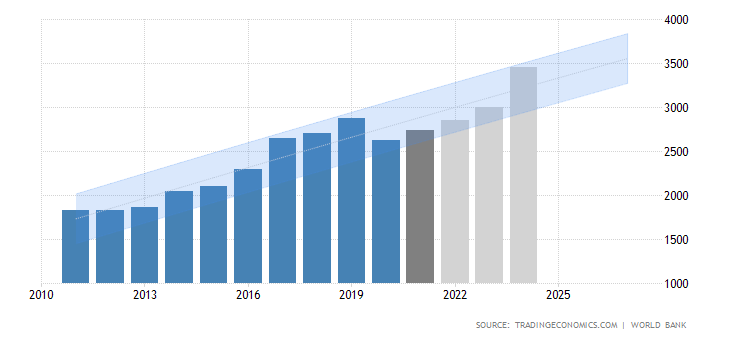

India’s GDP (trend growth) has bounced back in 2021 after covid bump of 2020. This economy will fully recover by 2023.

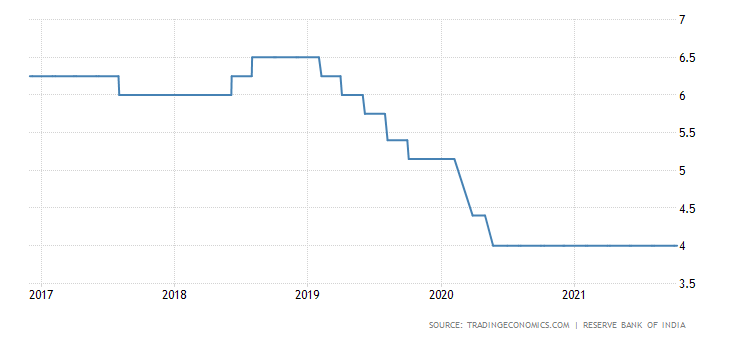

But look at the RBI repo rate. RBI cut repo rate by 100 bp last year and has not started reversing any of the emergency rate cuts.

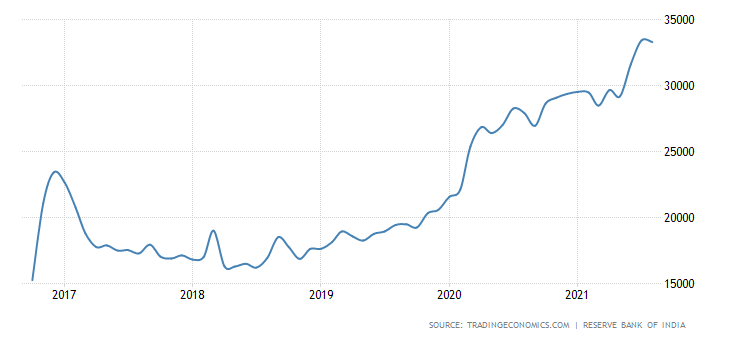

Also look at the RBI balance sheet. RBI not only cut the rates but increased its B/S by 75% in last 12-18 months. This is RBI effectively funding govt deficit and keeping an artificial lid on interest rates which govt should pay on its borrowing. This is effectively increasing the liquidity in the banking system without any addition to the productivity of the Indian economy.

This ( excess liquidity) money can either go for business activity or it can go to where it can find instant gratification i.e Stock markets. No surprise that this money went into equity markets. Foreign inflows were also positive during this time and more so after china crackdown on its tech sector. Some of this foreign money left china and came to India.

but bond market ( which is the first one to revolt against excessive money printing) is already saying enough is enough and threatening to raise the interest rates for you, me and govt. Indian 10 year bond yield touched 1 year high this week.

Indian currency INR is also now getting annoyed at this excess liquidity in the system lately. The chart below is only of last 3 months.

Conclusion

Indian Central Bank was instrumental in creating this liquidity which as I mentioned above did not go in creating jobs or increasing productivity. It went into the asset markets which is threatening to get out of control if RBI does not immediately increase the cost of money.

As chuck prince once said “As long as the music is playing, you’ve got to get up and dance.”…I would only suggest that dance near the door.

Thank you

Isn’t this all the central banks are doing ? What is RBI doing different ?

other CB have started withdrawing stimulus and other some EM CB are even raising interest rates

Can you please explain how does this printed money make its way into the stock market?

It was my understanding that central banks’ money printing creates reserves that in itself are not that useful unless the banks can find someone to give loans to. Correct me if I’m wrong but a lot of this liquidity is being parked at the RBI via reverse repo, right? So how is this money making its way into the market?

Also, since bonds are falling, what is to prevent RBI from printing money and buying bonds from the open market to push yields lower?

excess liquidity brings down the equilibriam interest rates below what should generally exist. also excess liquidity is complemented with cutting rates. if this leads to negative real rates ( only china has positive real rates) it makes deposits unattractive and enhances appeal of risk assets ( you can read online articles on huge inflows in china bond markets).now RBI has started tightening liquidity from october end and also taking back some liquidity from bond market. this is leading to 20 months high in 10 year bond yield and a struggling equity markets.