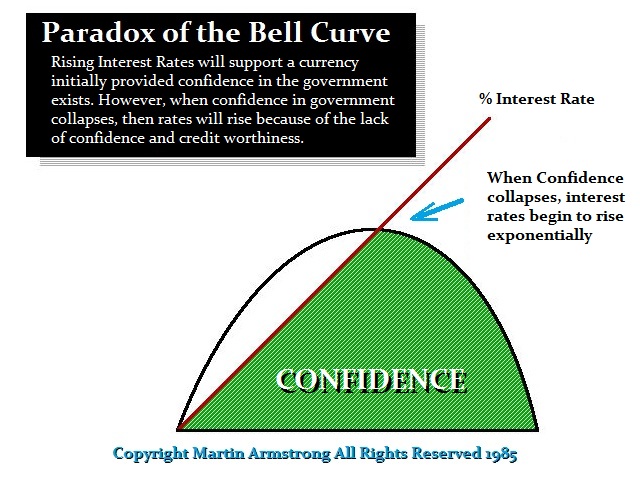

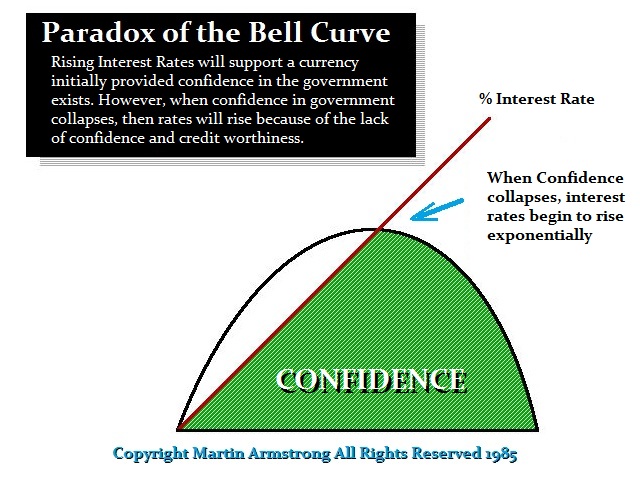

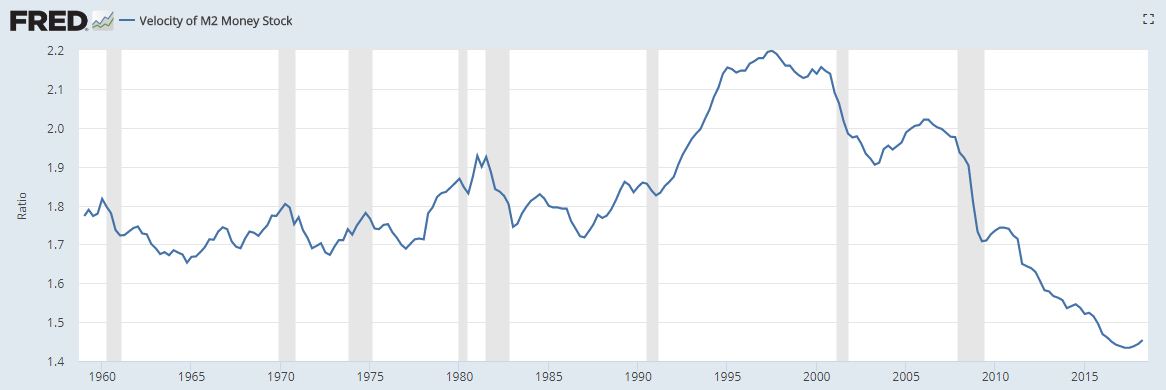

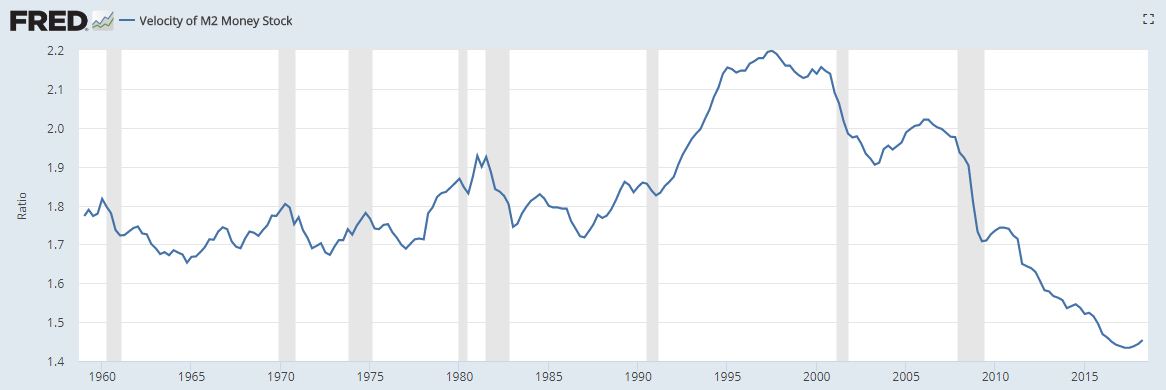

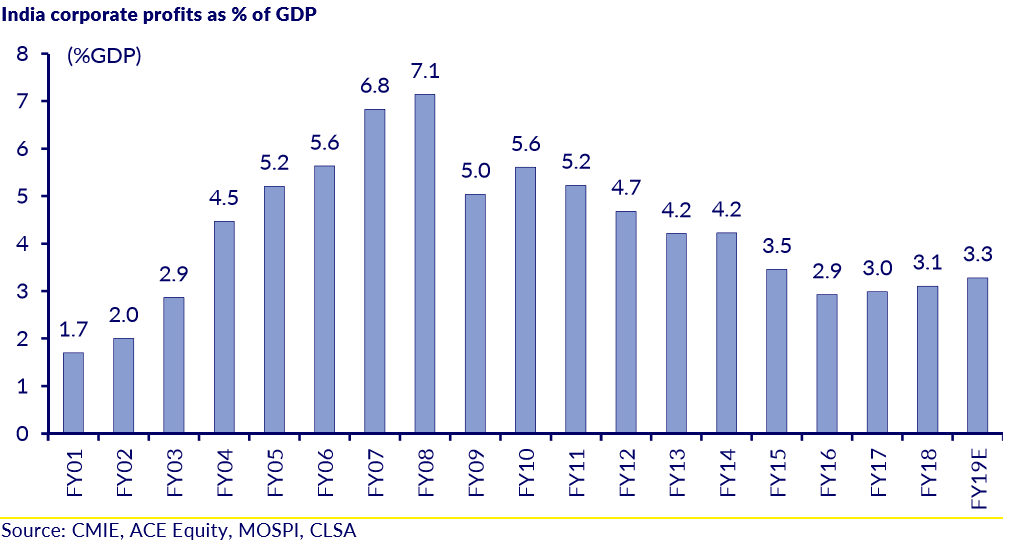

Andrew Lee at Macrostrategy writes….Can governments and central banks continue to avoid the essential clearing process in the next downturn? As productivity growth has slowed, the real economy multiplier on further monetary easing has become increasingly marginal, but as productivity starts to fall and capital stock decline, the real economy multiplier on more QE would turn negative.

As it does so, “populism” will grow, and public anger intensify. Every election since Brexit has moved away from the status quo. Far from demanding the system clear of its imbalances however, the public is demanding more imbalances. The identity to the falling productivity and loss of tangible capital is the loss of intangible capital and values. Rather than prevent monetary stimulus, populism will effectively demand more.

Although capital overall will become less productive, it appears a lot of the reason for that decline will be due to the breakdown of international relationships, which are obviously “cheap” sacrifices for politicians trying to win domestic votes. The international economic and even security architecture is therefore at risk.

Wherever you look, political capital is being lost. Whilst you would expect a growing anger from the public, as their values and expectations are part of these losses, society is often unable to recognise the deterioration. Values, expectations and aspirations are becoming less productive; the intangible identity to the physical capital being lost or degraded. The cost of not letting the system clear is this continued loss of capital. A recent example in the U.K. is in law and order where the head of the U.K. Police Federation warned that, with budgets under pressure, the police will not be able to maintain service levels of the past, unable to investigate an increasing proportion of low level crimes. If there is no budget to enforce the law, then effectively it becomes law; the identity to the loss of productive capital is this loss of legal capital.

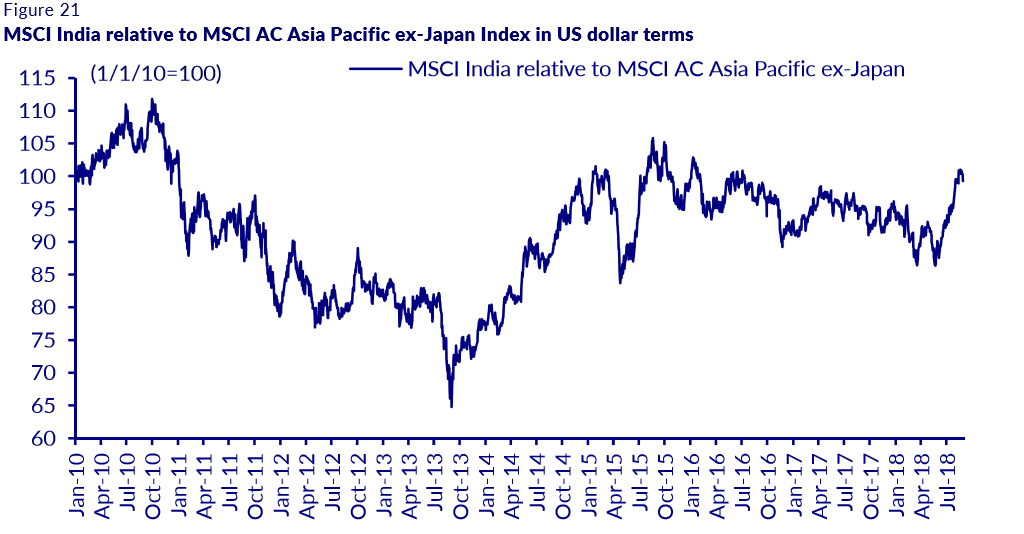

With global debt around 250% of GDP, the cost of letting the system clear is something no democratic government could possibly entertain, but with the cost of not letting the system clear now a real loss of capital rather than just an opportunity cost, political and social capital will be lost either way. This will likely to show up in increasing populism. If a democratic government cannot let the system clear, it is inevitable that the system must eventually move towards an undemocratic system that can. Whilst today’s “populism” is a long way short of such change, the loss of political capital will rapidly compound. In the meantime, individual countries and economies, and specific groups of society are likely to be sacrificed, with politicians hiding behind the narrative of defenders of democracy, when in fact, it is their policies that are undermining it. Beyond the obvious emerging market casualties, the European Union, in its present form, looks very vulnerable.

Rather than seeing this as ability of the Fed to respond to the next downturn, it is more suggestive that scale of monetary response to catch the falling knife and stop the inevitable clearing will have to be that much bigger. Whilst the markets and economy responded in 2008 to the stimulus, and I would expect a similar order of play to the next round of stimulus, I would also expect it to move the political needle further towards the extreme, with the slight cracks we’ve seen in the local and international economic and legal architecture, starting to spread and become much more substantial. The relatively weak institutions like the European Union, at least in its present form, are likely to be the early casualties.

Must Read Fullnote

file:///C:/Users/rites/AppData/Local/Packages/Microsoft.MicrosoftEdge_8wekyb3d8bbwe/TempState/Downloads/Populism%20and%20the%20loss%20of%20Political%20Capital%20(1).pdf