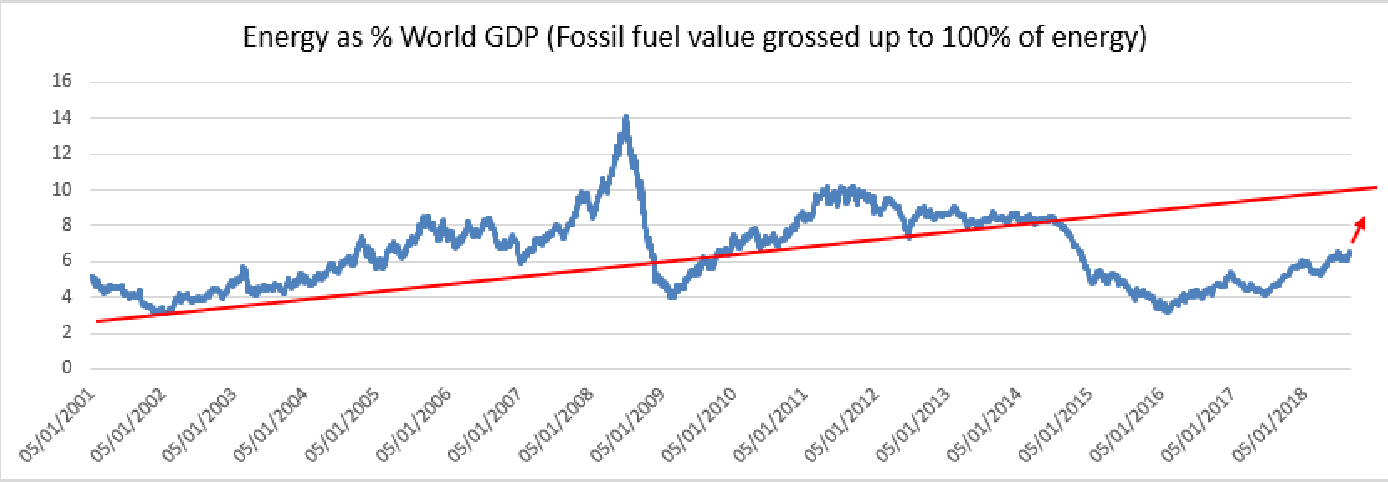

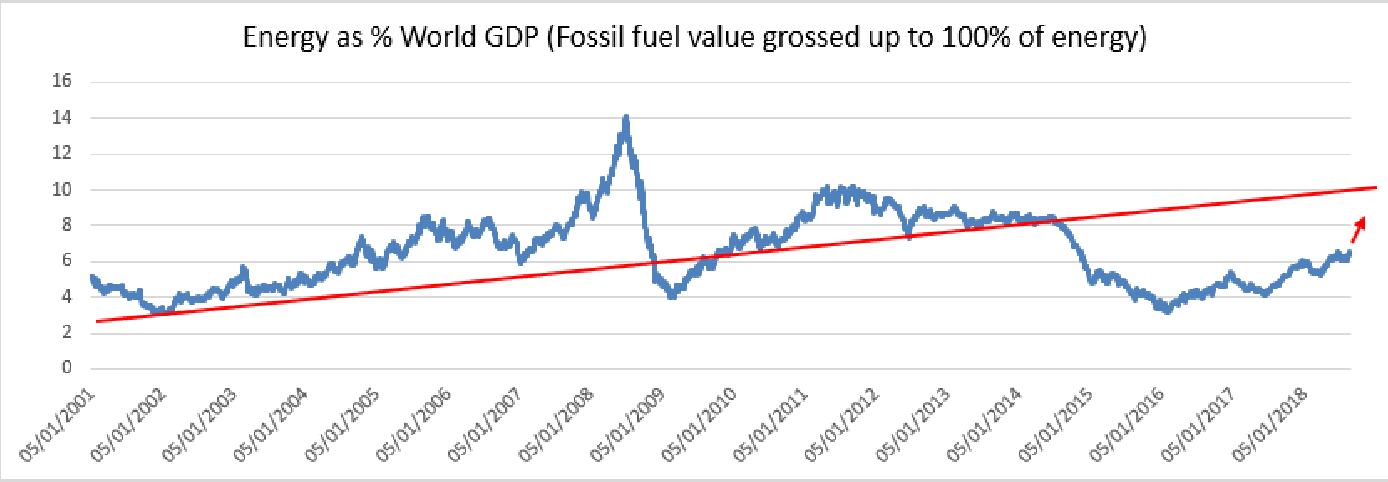

Macrostrategy Partnership Writes……”Energy rose to 6.52% of world GDP, the highest percentage since 2014, driven by new highs in Asian LNG prices which reached USD11.635mBTU. Inventories were depleted during the summer and have to be rebuilt ahead of the winter. Deliveries of term cargoes have also been affected by project delays and production line problems. In terms of oil, Reuters reports that the floating storage that had built around northwest Europe, the Mediterranean and West Africa over July and August was rapidly draining, down from 30 cargoes just a week ago to no more than a handful now as Iran’s exports fall. In emerging market currency terms, oil is just 5% short of its 2008 high”.

Conclusion

The LNG prices are rising, Oil at sea is rapidly disappearing, and shale gas companies are either cutting down capex or buying back their shares when they should be putting more money into exploration. Higher energy prices in rapidly depreciating falling local currencies could add to EM woes.

Fantastic graph. Thanks