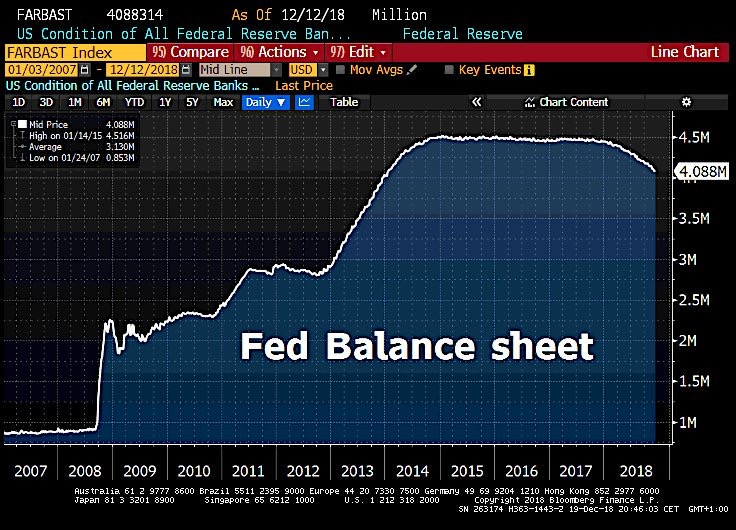

So a lot of focus today was on the Fed’s shrinking balance sheet! Powell dented any hopes of relief there…

The hawkish tone did what was expected: The yield curves flattened in response to the failure to present a dovish tone going into the New Year. The DOLLAR turned and rallied and the early strength in GOLD gave way as the flattening yield curves put a bid to the DOLLAR.

Powell is to be commended by being tone-deaf to the stock market, but going into 2019 the issue of a growing deficit in a full employment economy will be a harbinger of increased market volatility. Be prepared for Wall street to assail Powell at every turn. But at this juncture, Powell is doing a Maggie Thatcher: He is not for turning.

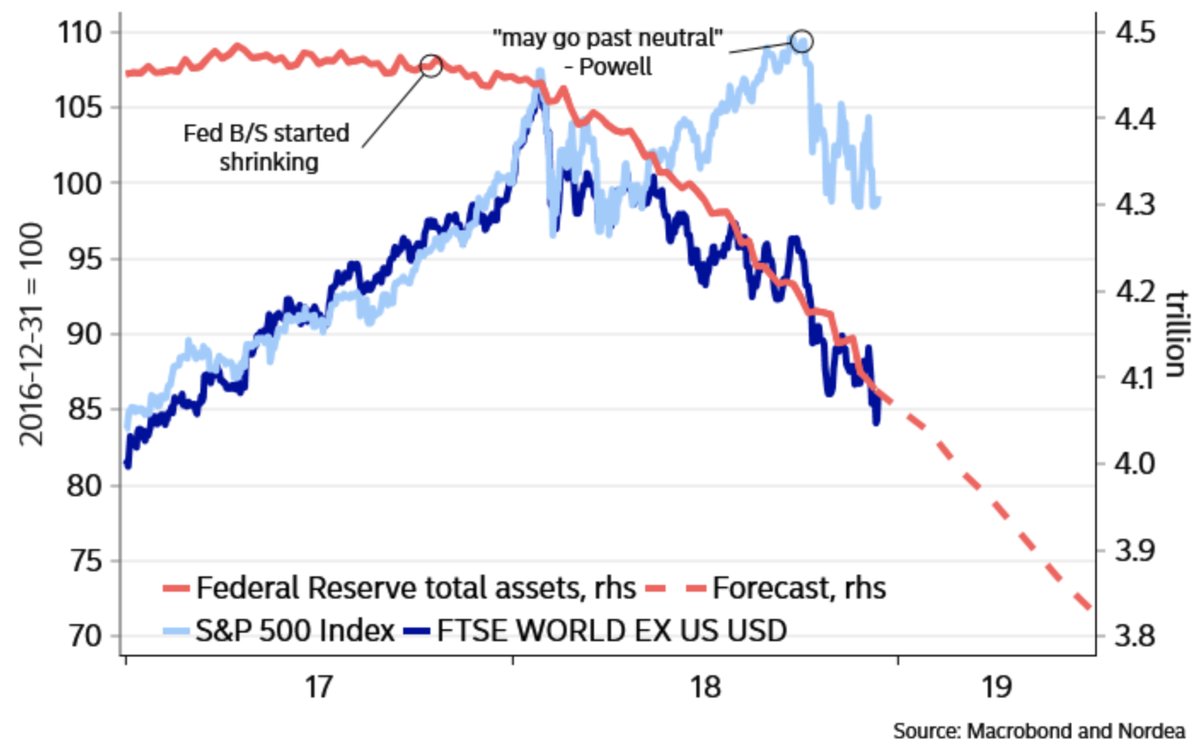

Here’s Fed’s shrinking balance sheet vs equities outside of the US (in USD)… Bad news for returns in the rest of the world.

The most important statement in my view was ” Some years ago, we took away the lesson that markets were very sensitive to news about balance sheet, so we thought carefully about how to normalize it and thought to have it on automatic pilot. That has been a good decision, I don’t see us changing that”

(They don’t give a shit about the markets)

Central Bankers have never admitted ,but they are the ones responsible for this inequality created through rising asset prices. Nobody after Paul Walker was willing to correct this anomaly by taking away this punchbowl until today,when Jerome Powell showed that he gives two hoots about asset prices.

This in my view will lead to a much stronger Dollar and breather for Emerging Markets is over. Commodities including Precious metals will come under renewed pressure and non investment grade bonds (including EM bonds) could see further widening of spreads.

tread cautiously… the terrain is going to get ROCKY

For India – FIIs contribute around 33% of the turnover/investment according to a recent report in a leading newspaper.

Crude down, Rupee strengthening, flows into SIP schemes of hapless investors continuing to be strong, what could be the impact on the Indian markets?

look there are other technical reason that our markets can hold of for more time than other markets simply because of extra money getting pumped into the system which is completely contrary to happening in rest of the world. lower oil prices help in short term but the more oil prices remain low the lower is our inward remittance and lower is our state taxes on crude.