Recall the time when David Einhorn came up with a devious idea of iPrefs to distribute the massive cash that Apple was chewing among its shareholders in 2013. Instead of Apple bowing to this idea, announced one of the biggest share buyback program and planned to increase their dividend multifold to pacify investors demanding return of their invested cash. Lesser known fact is that Apple had more than $130 billion in cash not in US but in Ireland and deploying a buyback would have required them to bring that cash back in the States and pay huge taxes. Quick – witted Apple did not disturb its cash sitting overseas but instead funded the buyback through debt issuance and repaid the shareholders dividends through that loan. It also committed itself to distribute over $100 billion to shareholders by the end of 2015.

Since then, Apple have being repurchasing shares frequently which has increased its share price and ROE and kept their investors elated. The new normal for young companies and big technological companies is to keep huge amount of cash in their war chest and argue its necessity in future technological advancements projects or acquisitions or a million other reasons. Yet, these companies have kept their shareholders content by distributing dividends or repurchasing shares and made their EPS look good.

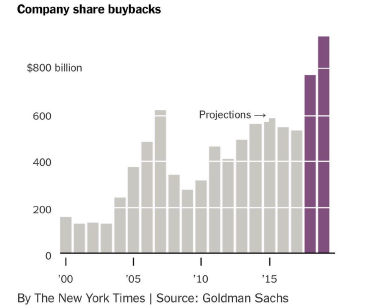

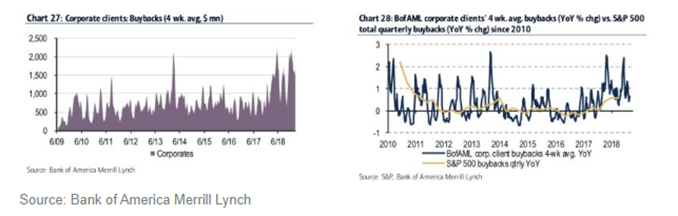

Flushed with savings from lower tax rates and profits from a growing economy, big US companies collectively spent a record amount of $1 trillion buying back their own stock in 2018. Many argued that this led to further income inequality and these companies should have invested the excess cash internally on projects or by paying more wages to workers than distributing it to public. Some countered by standing strong on theory that buybacks indicate a positive turn in a company where these companies believe they are being undervalued by the market and wish improve their valuation. Ed Yardeni of Yardeni Research points different motivation for share repurchases and says, “S&P data suggest the aim of buyback is to reduce dilution from stock compensation rather than to boost EPS.”

However, JPM estimates $400B of cash was repatriated between Q1 and Q3 while $190B was used for buybacks, $90B for corporate bond withdrawals and only $75B for Capex.

Buybacks funded by debt issuance rose from 8% in 2010 to 32% in 2016 and the opulent brands like Apple, Oracle, Microsoft, Cisco and many others announced big buyback programs in 2018. Few argue that these companies have exposed themselves to risk where if Fed goes in complete QT mode, it would threaten these equity stocks.

Right now, major shareholders like Mark Zuckerberg who owns stock in companies that use repurchases exclusively can defer their own tax and their heirs can avoid taxes altogether thanks to a loophole in tax code known as step – up in basis. Sen. Marco Rubio proposed a fix for this as opposed to proposals by Sen. Bernie Sanders and Sen. Chuck Schumer who suggested blocking the buybacks altogether.

When tax cuts increased budget deficit, Republicans believed that tax cuts would boost business investments. That didn’t happen and Rubio’s proposal tries to solve this mystery.

Essentially, Rubio proposed that buybacks should be subject to same tax code as dividends i.e. would get taxed immediately instead of waiting for shareholders to sell the stock and also allowing these companies to immediately and fully deduct the cost of new investments, thereby making it more attractive.

The debate between two mind-sets in which one supports huge buybacks of 2018 emphasizing that it kept the money in circulation in the economy and boosted consumer confidence, other set effectively are of belief that excess buybacks could lead to stagnation of wages, increased inequality by enriching shareholders and executives. Corporations funded the buybacks from tax cuts instead of investing cash in internal growth. Rubio’s proposal implicitly aimed at making corporates think twice before repurchasing the shares and explore other value propositions rather than solely focusing on boosting EPS and be always in pursuit of higher ROE. Investing for long term and efficient use of cash could also keep fundamentals aligned as well.

(with inputs from Apra Sharma)