Key highlights of the fortnight:

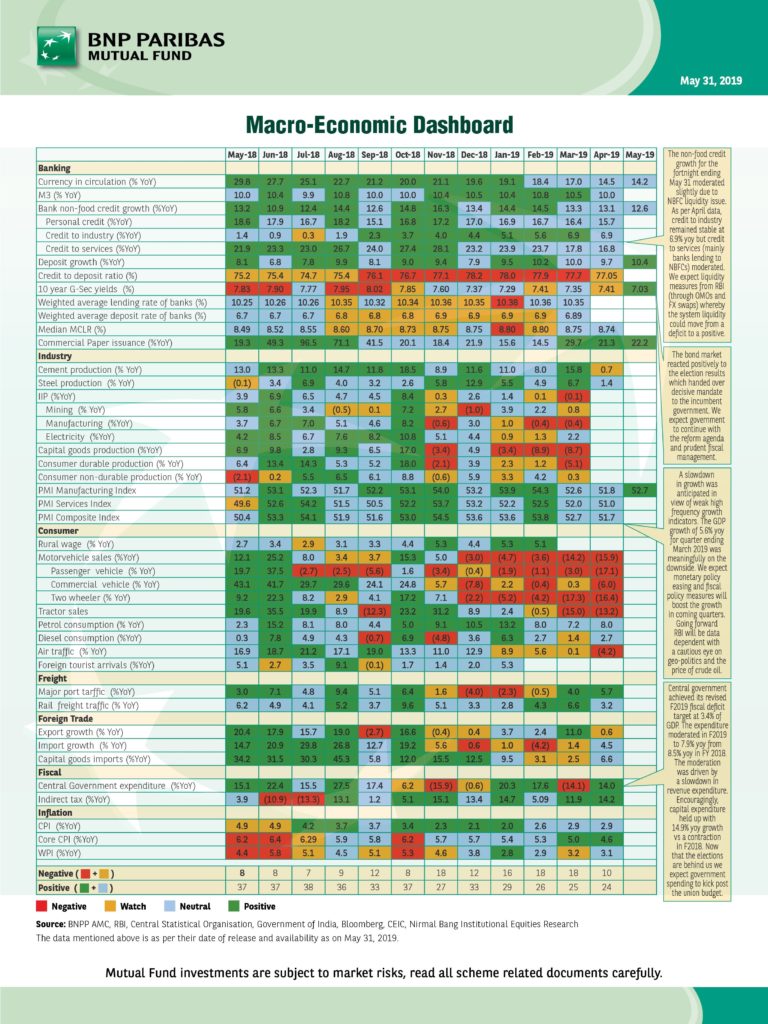

The non-food credit growth for the fortnight ending May 31 moderated slightly due to NBFC liquidity issue. As per April data, credit to industry remained stable at 6.9% yoy but credit to services (mainly banks lending to NBFCs) moderated. We expect liquidity measures from RBI (through OMOs and FX swaps) whereby the system liquidity could move from a deficit to a positive

The bond market reacted positively to the election results which handed over decisive mandate to the incumbent government. We expect government to continue with the reform agenda and prudent fiscal management.A slowdown in growth was anticipated in view of weak high frequency growth indicators. The GDP growth of 5.6% yoy for quarter ending March 2019 was meaningfully on the downside. We expect monetary policy easing and fiscal policy measures will boost the growth in coming quarters. Going forward RBI will be data dependent with a cautious eye on geo-politics and the price of crude oil

Central government achieved its revised F2019 fiscal deficit target at 3.4% of GDP. The expenditure moderated in F2019 to 7.9% yoy from 8.5% yoy in FY 2018. The moderation was driven by a slowdown in revenue expenditure.Encouragingly, capital expenditure held up with 14.9% yoy growth vs a contraction in F2018. Now that the elections are behind us we expect government spending to kick start post the union budget.