By Will Matthews

- Asian countries have used currency manipulation to significantly undervalue their currencies relative to the US$

- Conferred a massive competitive advantage to Asian manufacturers by artificially reducing their labour and real estate costs which US employers were not able to match or offset with productivity

- A floating exchange rate would otherwise absorb / ameliorate these advantages

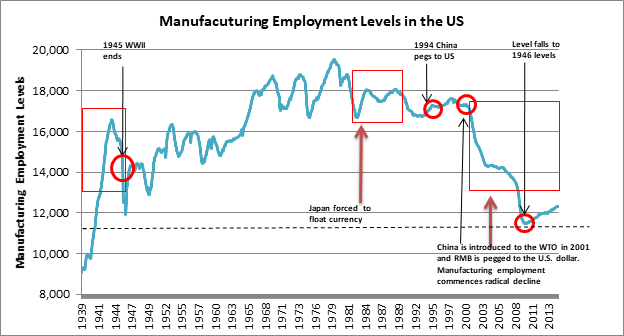

- Resulted in massive job transfers from the US to Asian countries which led to stagnant real incomes in the US, all time lows in US manufacturing employment levels – in 2010, there were fewer manufacturing jobs than after demobilization from World War II and the population was 2.2 times greater – and wealth disparities – companies could lock in super normal profits by maintaining price and shifting to lower cost jurisdictions

- This currency manipulation conveyed a huge growth boost to those Asian countries at the expense of the American worker

- Japan grew at 5% to 7% per year from the 1960s through the late 1980s until Japan’s currency was forced to trade freely

- China miracle growth since 1990

- Asian growth of over 5% per year

- Started with Japan in the late 1960s and was felt strongly through the 1970s and early 1980s until Japan was forced to let its currency trade freely in 1987

- Japan currency peg led to stagnant job growth in the US manufacturing sector in the 1970s and 80s. Following the currency becoming freely tradable in the late 1980s there is a slight rebound

- Taiwan, South Korea, Hong Kong, Singapore and Thailand used currency manipulation to undervalue their currencies. These countries still manipulate their currencies versus the US$ and are highly dependent on exports

- Once China pegged in the late 1990s and was given access to US markets, a precipitous decline in manufacturing jobs commenced

- This transfer of wealth from America workers to Asia has not, and will not, offer any return to the US via new markets. No Asian country is a net importer. Their growth and current size is dependent on currency manipulation

- Once Japan’s currency was forced to trade at market rates, it appreciated approximately 250% versus the US$. Since the revaluation, growth has collapsed- Japan has grown has grown 6% in 25 years

- After 45 years, Japan remains a net exporter – there still is no net export opportunity for US producers

- It was thought that once countries reached developed world status, they would switch from net exporters to net importers. Like Japan, Singapore, Hong Kong, South Korea and Taiwan have reached developed country standards, have not become net importers and remain highly dependent on exports

- Over the long term, if one country sells/exports (“Seller”) more to the another country (“Buyer”), Seller’s currency will appreciate relative to Buyer’s

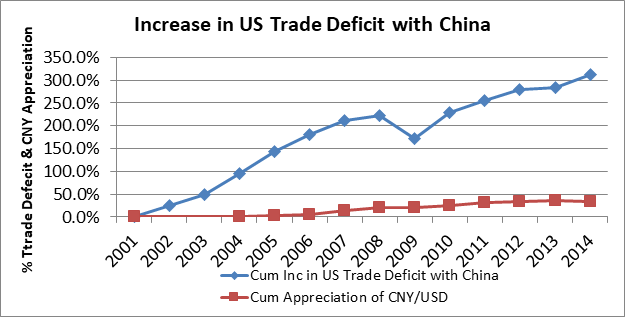

- It is clear that China is manipulating its currency as the trade deficit with the US is up by 300% and the currency is up less than 35%.

- To be clear, free trade should always be supported but free trade only occurs when both sides play by the same rules:

- Freely traded currencies

- Same employment and environmental rules

- No unequal government subsidies

- To get the US middle class going again, force all Asian currencies to be freely traded and use access to US markets as a way to normalize employment and environmental laws