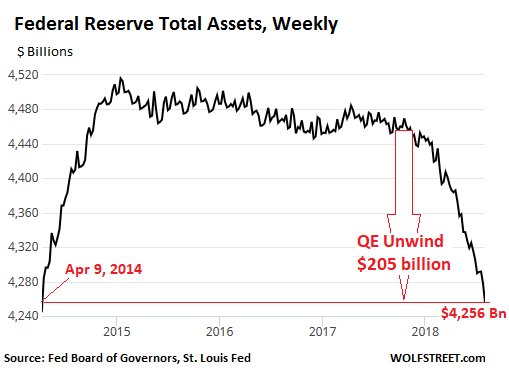

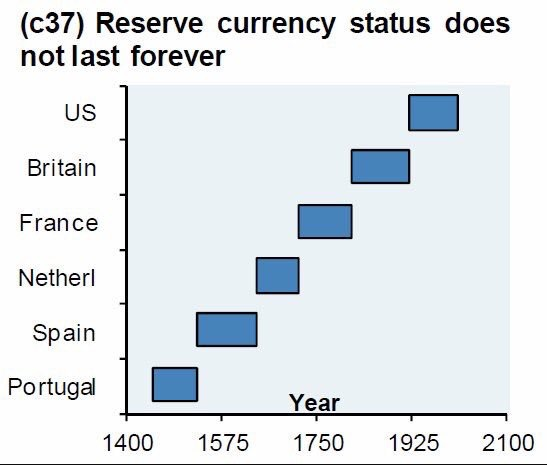

We are in the most exciting part of a generational cycle for markets where the country having reserve currency status (US) is now trying to absolve itself of the responsibilities which comes with reserve currency.

There are four conditions which needs to be fulfilled to become reserve currency

- Strongest Military

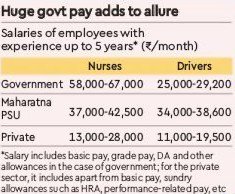

- Running high current account deficit

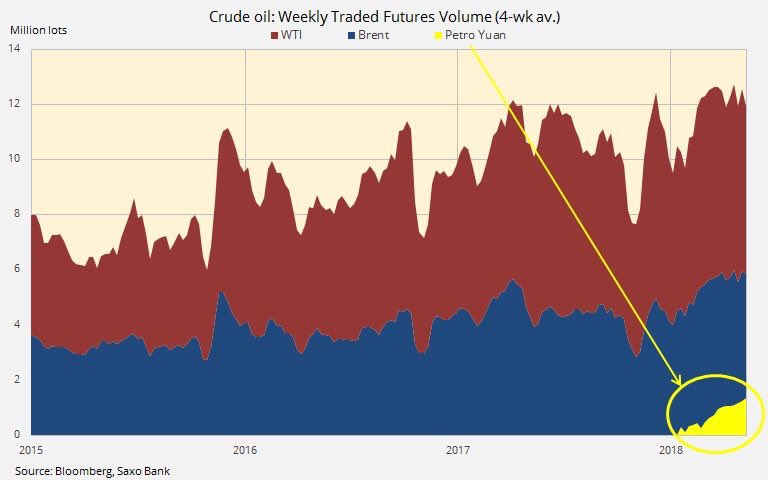

- Global Confidence in using the Reserve currency for Global Trade transaction like buying OIL

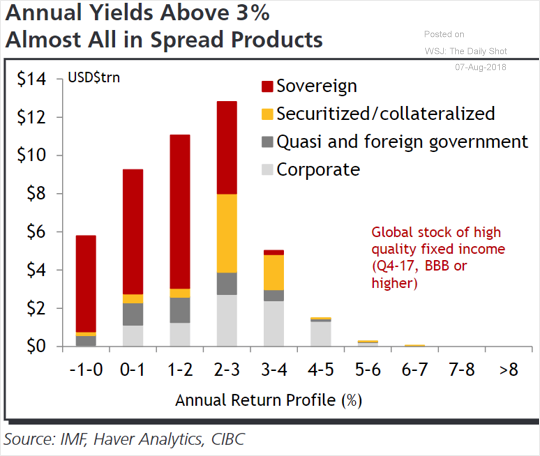

- Deep and Liquid Markets so that the surplus created out of selling goods and services to the country having reserve currency status can be invested back into that reserve currency.

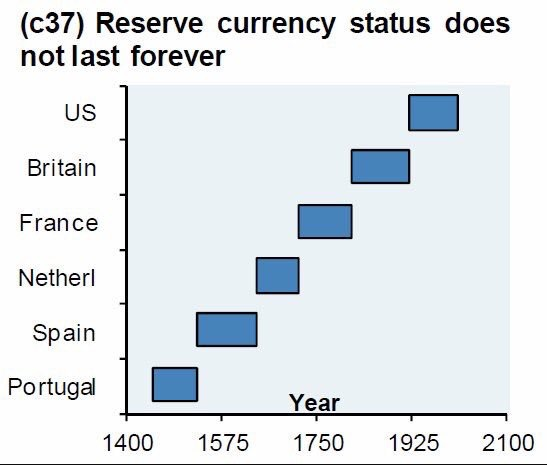

US fulfilled all these conditions and the world monetary order was set .But the life of reserve currency does not last for ever as can be seen in the chart below

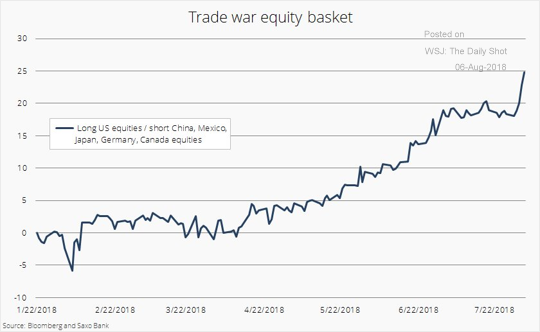

The actions of US today like closing of border,putting restrictions on trade, not allowing countries having dollars to invest in US economy, bringing down NFTA,diluting the military umbrella like whats happening with NATO and even GCC countries.These actions do not resemble that of a country which wants to continue with reserve currency status.

US is no more willing to overlook the minor trade friction,a tariff barrier against its exports to other countries or stealing of technologies from its corporations . The reason is OIL independence. US is not only getting self sufficient in oil production but also exporting oil and hence it does not want to keep its military umbrella to keep world safe and sound so that it can secure its oil supplies. On the contrary,a conflct ridden world bereft of US military umbrella will allow US to export Weaponary to the world in which it is already technologically advanced and a world leader.

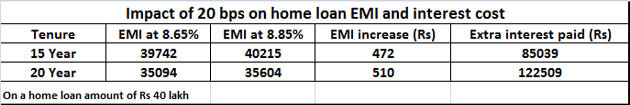

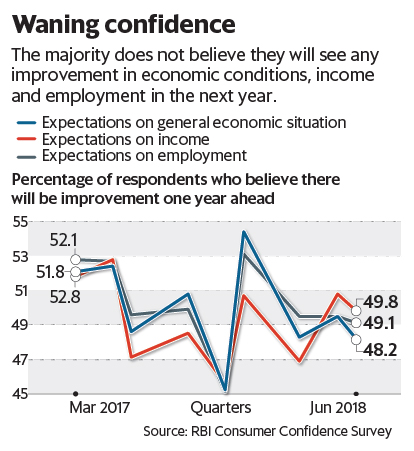

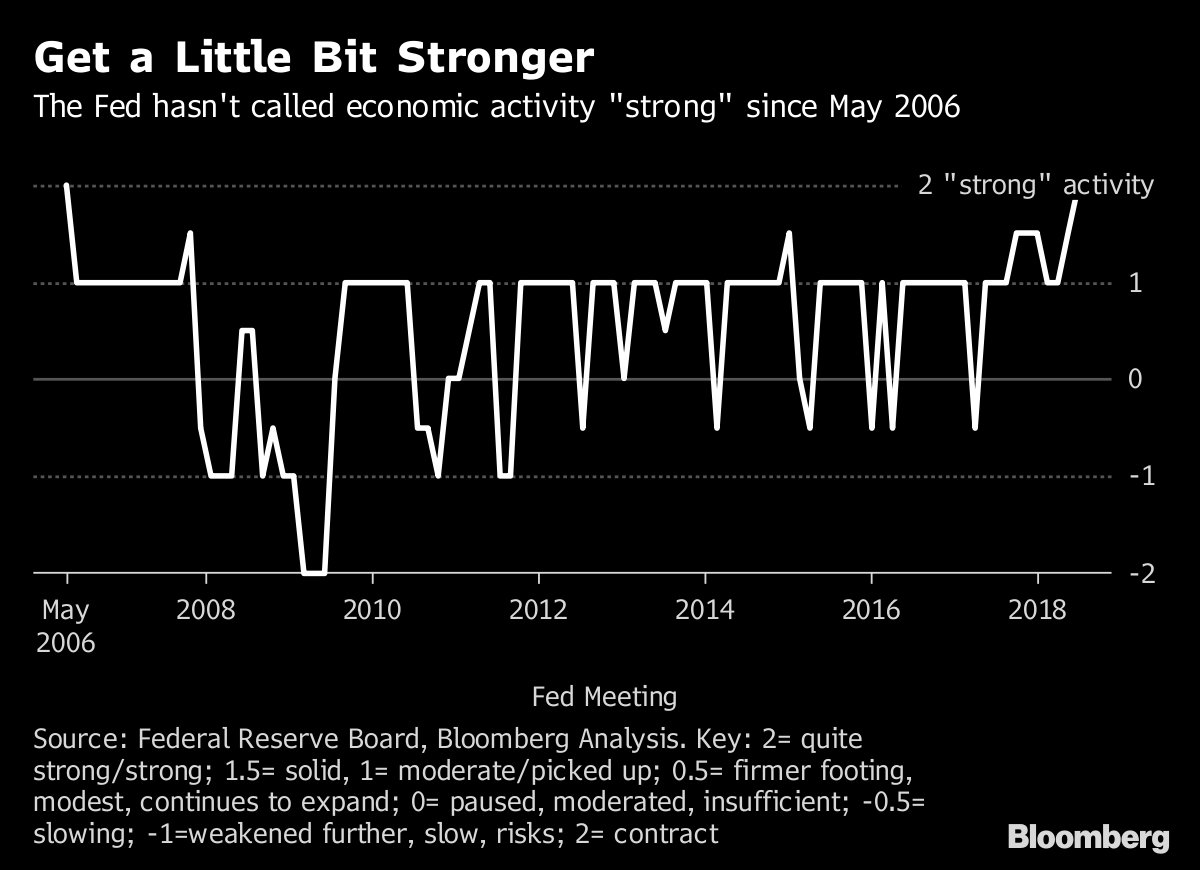

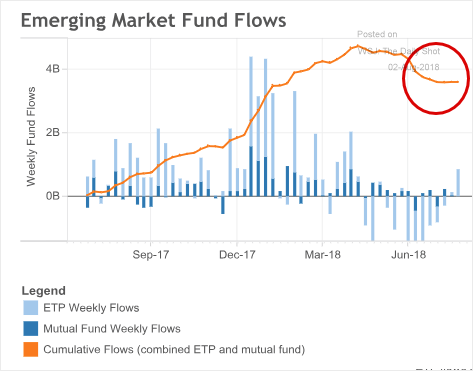

It does not mean that US dollar will cease to be the reserve currency tommorow , but we have started on that path. Although,I believe in the short term any reduction in US current account deficit coupled with rising FED rate will actually lead to stregthening of Dollar which will be like rubbing salt to the wounds of Emerging Markets.

The bigger issue is, there is no other country which is ready to take on the mantle of reserve currency. Although China has this month, fulfilled one condition which is running current account deficit.

As Saxo Bank writes China is growing up – meaning… current account deficit, more dependence on foreign funding, more open capital account, weaker CNY & deeper capital market but also less “ability” to massage economy – in 2007/08 China ran big C/A surplus but not now.

China will take long time to fulfill other conditions but it is reaching closer in military capabilities, using investment under OBOR like US used under Marshall Plan.

This period of vacuum created out of no clear anchor to the world will be the most disruptive period for our generation and will have very few winners who will know how to play with new set of rules.