Rathin Roy explains the problem of India’s slowdown and I agree with his prognosis that India is facing structural headwinds. I have observed over the years that India’s Growth benefitted only a small portion of the population.

Making sense out of Chaos

Rathin Roy explains the problem of India’s slowdown and I agree with his prognosis that India is facing structural headwinds. I have observed over the years that India’s Growth benefitted only a small portion of the population.

Martin Armstrong writes….

The answer is YES!!!!! His little nitch was good from the ’80s for the market was UNDERVALUED and as such being a “value investor” was appropriate for that time period. The markets have shifted to capital preservation, which has also inspired the corporate buy-backs. Value Investing is now fading. Capital is shifting because of currency, risk in other countries, and none of this has to do with simplistic earnings.

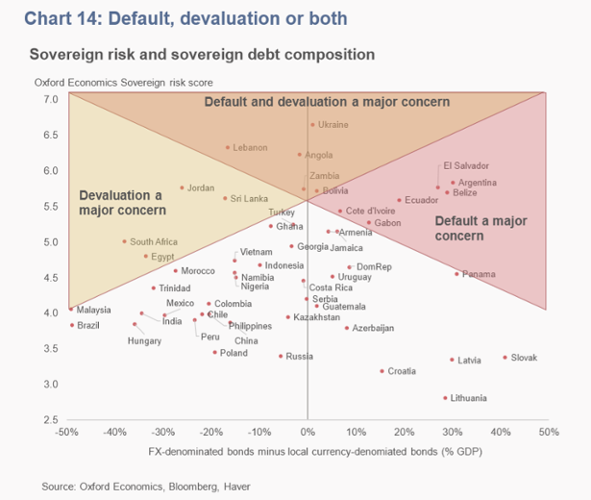

Welcome to the new trend of Country Risk. You have to now keep your eye on all the balls flying around. This is not a game of baseball with a single pitcher.

Read Full article below

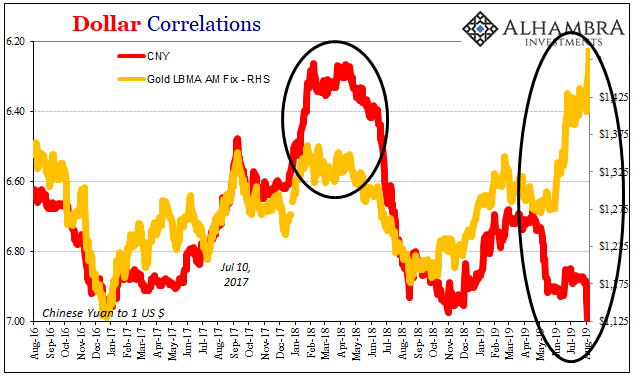

Whenever CNY has depreciated it always means deflation in the world because weak Chinese currency makes Chinese exports cheaper and hence falling CNY means falling GOLD prices….

More important than “currency wars”, file this one away in the something-big-changed-recently drawer

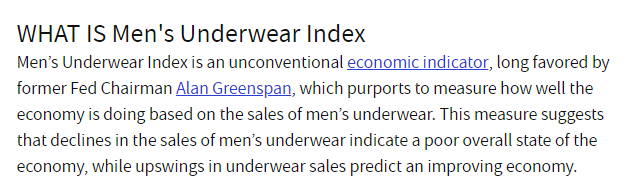

Page Industries (India franchise of Jockey’s brand)historical Revenue

CAGR 10 Yrs:27%

5 Yrs:19%

3 Yrs:17%

Last 2 Qtrs – Page Ind Revenue Growth

Q4FY19 -0.1%

Q1FY20 +2.4%

Reminds me of ‘MEN’S UNDERWEAR INDEX’ followed by Alan Greenspan (link: https://www.investopedia.com/terms/m/mens-underwear-index.asp) investopedia.com/terms/m/mens-u…

(Mangalam Maloo)

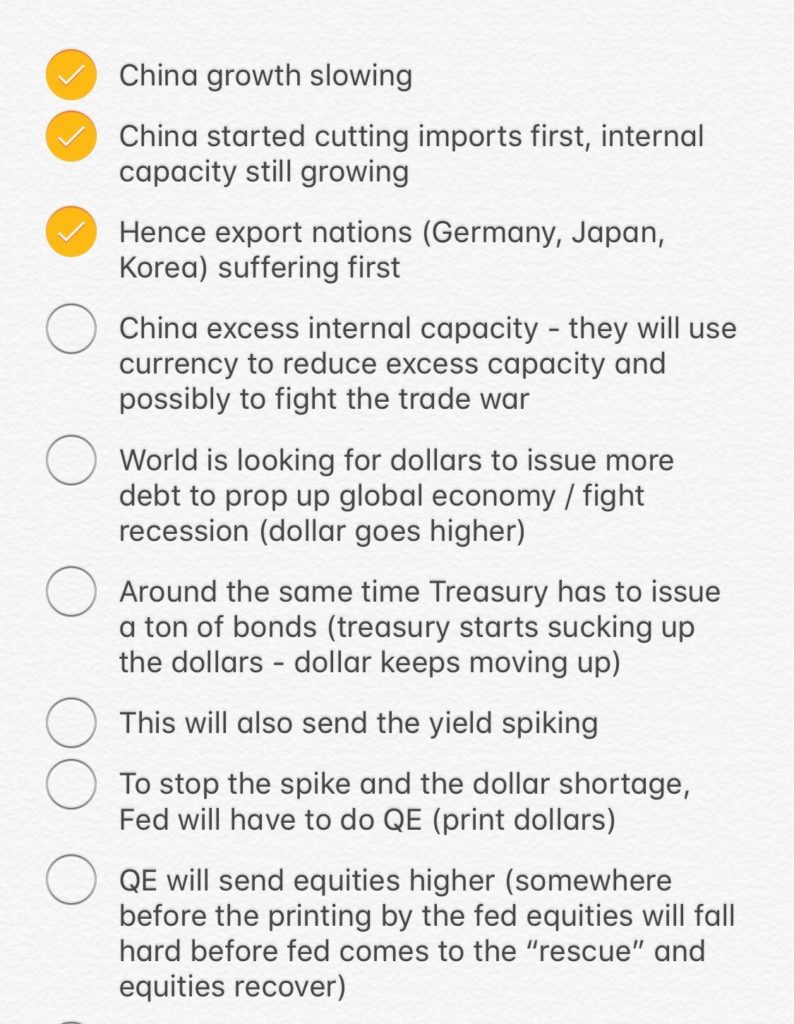

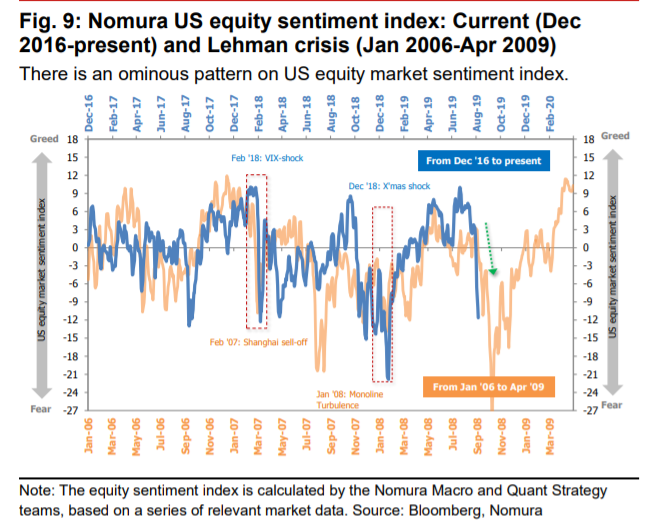

I know it is difficult to predict the markets.….so not making any bold claims with this graph but why don’t you paste it next to your screen and we will compare the notes in couple of years

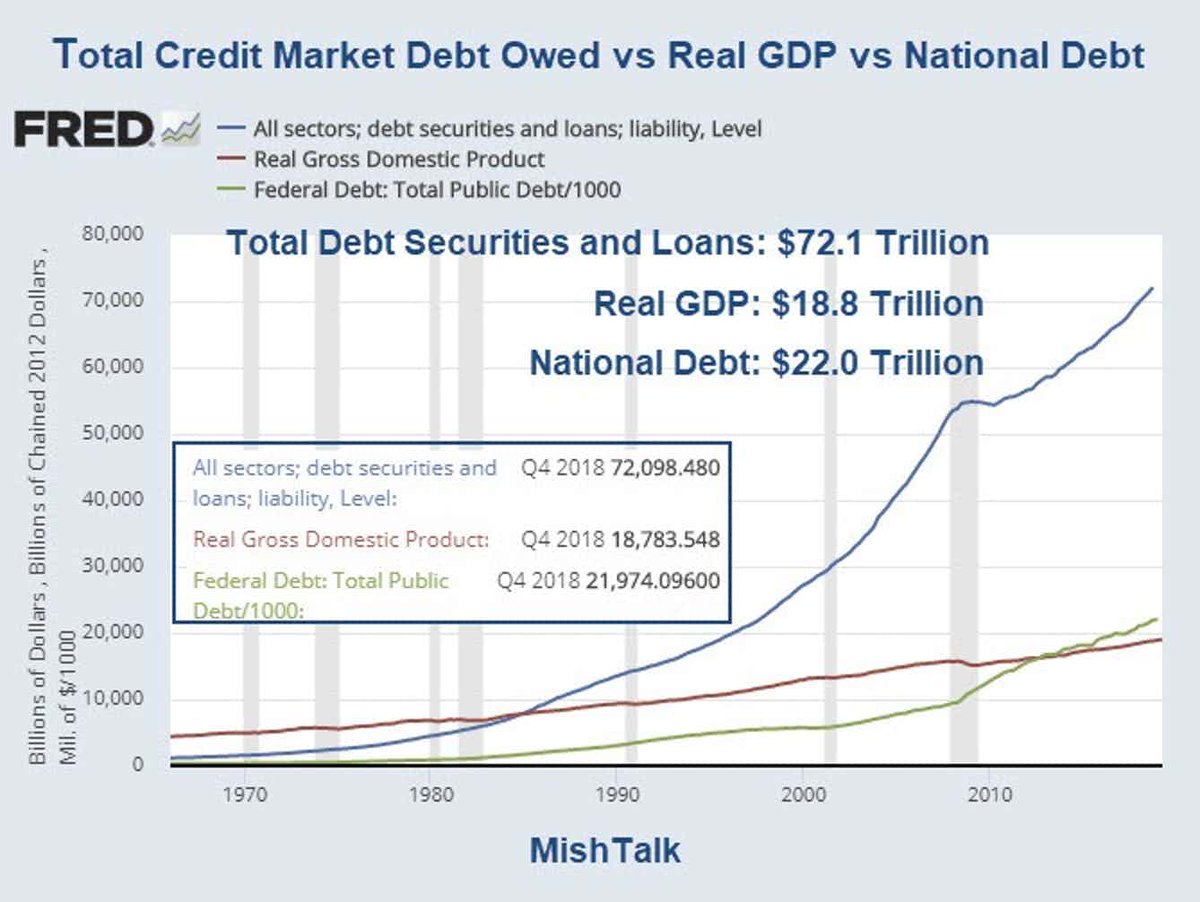

Fed Trapped in a Rate-Cutting Box: It’s the Debt Stupid

By Vikram Mansharamani, PhD, Founder, Kelan Capital, LLC [Edited Excerpt FROM BOOMBUSTOLOGY, 2nd EDITION]

As part of his high-profile efforts to promote an ambitious development program labeled “Make in India,” Indian Prime Minister Narendra Modi met with politicians and local executives at a showcase in Germany in 2016. The “Make in India” campaign is his signature undertaking to make India a global manufacturing hub, and it has received disproportionate attention from Modi and his team since his election. It’s one of the hallmarks of his economic reform program, one in which he expects to create 100 million new manufacturing jobs by 2020, six years after he first announced it. These jobs are critical to his effort to develop a middle class that will power the Indian economy for the foreseeable future.

This 2016 event was notable for one particular attendee Modi met there. It was not the CEO of a powerful multinational, the prime minister of a major European country, or even an accomplished development economist. It was a robot.

Modi met YuMi, “a collaborative, dual arm, small parts assembly robot solution that includes flexible hands, parts feeding systems, camera-based part location and state-of-the-art robot control.” Robots like YuMi are the future of manufacturing and, in an ironic twist of fate, may prevent Modi from achieving his “Make in India” objectives.

Of course, robots of a sort have been in manufacturing for more than a century. Consider the story of Henry Ford II, who, on a tour of a partially automated factory with United Auto Workers chief Walter Reuther, smugly asked, “How are you going to get these robots to pay your dues?” Without missing a beat, the story goes, the UAW boss responded, “How are you going to get them to buy your cars?”

The story is telling because of the essential need for workers to have incomes adequate to buy the very goods their efforts create. It also makes clear the sometimes-conflicting dynamic between production and labor: labor costs to a manufacturer aren’t just costs, they are the very source of future revenues as workers spend their money on goods they make. And when you’re trying to create a million jobs per month, a productivity boost may be precisely the opposite of what is useful. Strictly speaking, productivity is the ability to produce more with the same or fewer inputs. In this sense, productivity and technological substitution of labor are the exact opposite of what India needs.

Modi’s vision of India as a manufacturing powerhouse producing goods that global markets seek is inspirational. It has motivated lots of bullish articles and strong investor interest in the country. By taking farmers to the factories, the theory goes, Modi will drive exponential growth in the middle class that will make Indian consumers a globally powerful force, driving economic activity. His aspiration is to replicate the Chinese success story.

I’m not convinced. Robots like YuMi are the main reason. It may very well be that technological advancements like YuMi have now made it impossible to create a middle class through manufacturing methods. China may have been the last country to do so through a manufacturing-based approach. The window to modernize through industrialization is rapidly closing; India has likely missed its chance.

There’s a joke that India’s prospects look brighter the farther away you are. Certainly, from the perspective of a Westerner, India appears a more logical candidate for a sustained boom than China. It’s a democracy in which most Indians seem to have a good under- standing of Western institutions. The former British colony has lots of educated English speakers. It’s also younger and has a cosmopolitan leader in Modi, a reform- and markets-minded head of state who has been actively encouraging foreign nations to invest in India (in direct contrast to India’s historical preference as inward looking).

The Boombustology framework paints a different picture, one in which the chance that India emerges to be the next great growth market is extremely low, and the lofty expectations of it being the next economic superpower are misguided… Expectations of a booming middle class are likely to be left unfulfilled, and many an investor will be disappointed.

India is not the next China.

Many argue that India won’t be the next China because India is going to be bigger than China as an investment story—India’s population is younger than China’s, India has a desperate need for infrastructure and doesn’t risk over- capacity, and India’s democracy makes it more vibrant than China’s one-party state. Let’s consider some evidence…

Starbucks is often seen as an informal economic indicator, given its ubiquity and the “affordable luxury” nature of its product. The better the economy is performing for the middle class, the more Starbucks locations are opened, and the more venti coffees it sells. The opposite is true, as well: during the financial meltdown of 2008, Starbucks shut more than 900 stores in the United States.

The coffee purveyor has been heavily focused on international markets as the source of its future growth. The company opened its first shop in China in 1999, expanding its operations in India 13 years later. It’s not a fair comparison, therefore, to look at store count; but looking at Starbucks’s growth metrics in each nation shows that India’s economy continues to lack a jolt. According to an internal 2014 Starbucks story on its India and China operations, in early 2014, Starbucks had 40 locations in India and planned to double that number in a year. At the same time, Starbucks planned to have 1,500 stores in China in 2015. In China, Starbucks ended up overshooting that estimate by a third, with 2,000 locations by the end of 2015. Efforts in India fell short, how- ever, with just 74 outlets a year later.

Even as we would expect the pace of store openings to slow in China, they have in fact accelerated. In 2018, Starbucks stepped up its pace of openings in China to one store every 15

hours! That will give the Seattle company 6,000 stores in China by the end of 2022. In contrast, Starbucks’s rate of openings in India has gotten slower. The company just opened the doors of its 100th India store in autumn 2017 and opened three more stores through mid-2018, all in Kolkata. Over the course of Starbucks’s presence in India, that’s a pace of one store every 23 days. “We believe that one day India will be one of the top five markets. I won’t put a time frame to it. It’s over the long haul,” Starbucks International President John Culver told BloombergQuint in 2017. At the present pace, it wouldn’t surpass current number five, South Korea, for more than 63 years. Given current trajectories, that means the champagne for Starbucks India passing Starbucks Korea won’t be popped until 2081.

So much for a booming middle class

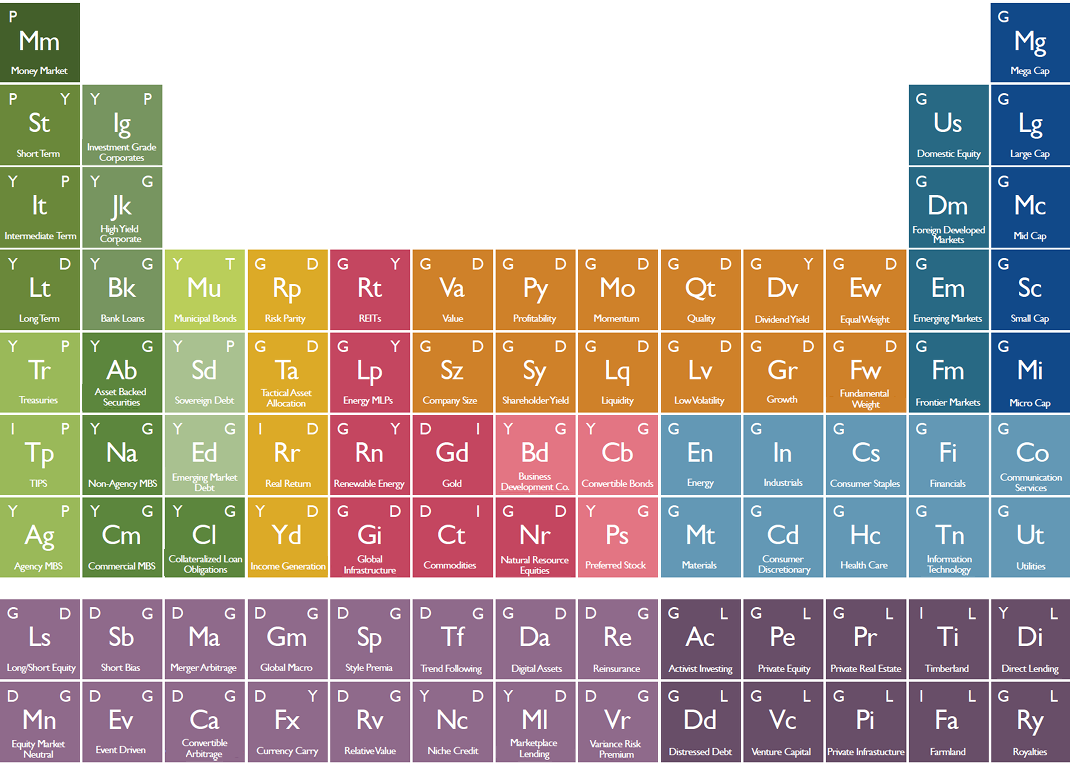

Periodic Table of Investments

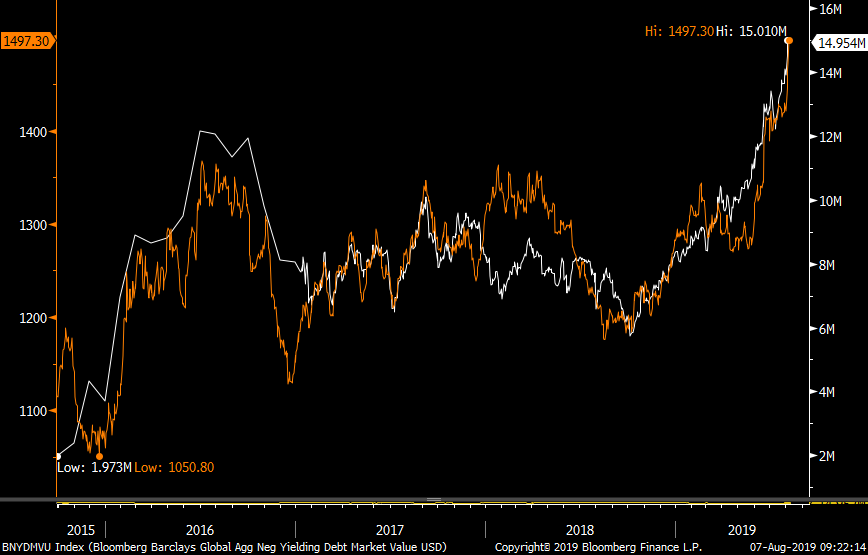

Now you know what is driving Gold prices

An updated overlay of gold (generic contract) in orange and $ amount of negative yielding securities in white.

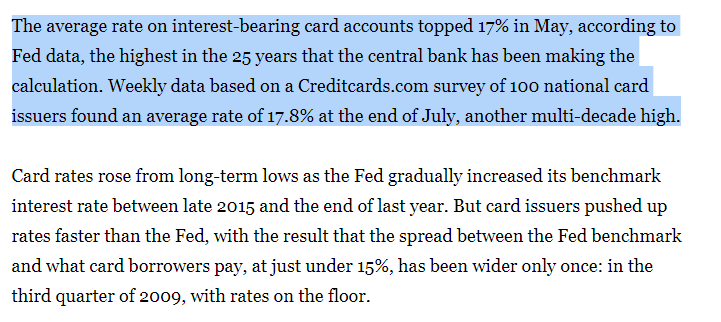

Interest rates around the globe are negative or on their way there but credit card rates just hit their highest avg level in 25 years One way or another, banks figure out how to get paid (link: https://www.latimes.com/business/story/2019-08-06/fed-rate-cut-credit-card-interest-rates-rise) latimes.com/business/story…

This chart will come handy once Dollar index (DXY) breaks out of 100

Martin Armstrong writes….The way the Fed was originally designed allowed it to stimulate the economy by purchasing corporate paper directly, which placed it in a better management position. Buying only government paper from banks who in turn hoard the money fails. As Larry Summers admitted, they have NEVER been able to predict a recession even once.

The Fed lowered rates during every recession to no avail just as the ECB has moved to negative rates without success. The central banks are trapped and they are quietly asking for help from the politicians which will never happen.

read Full post below

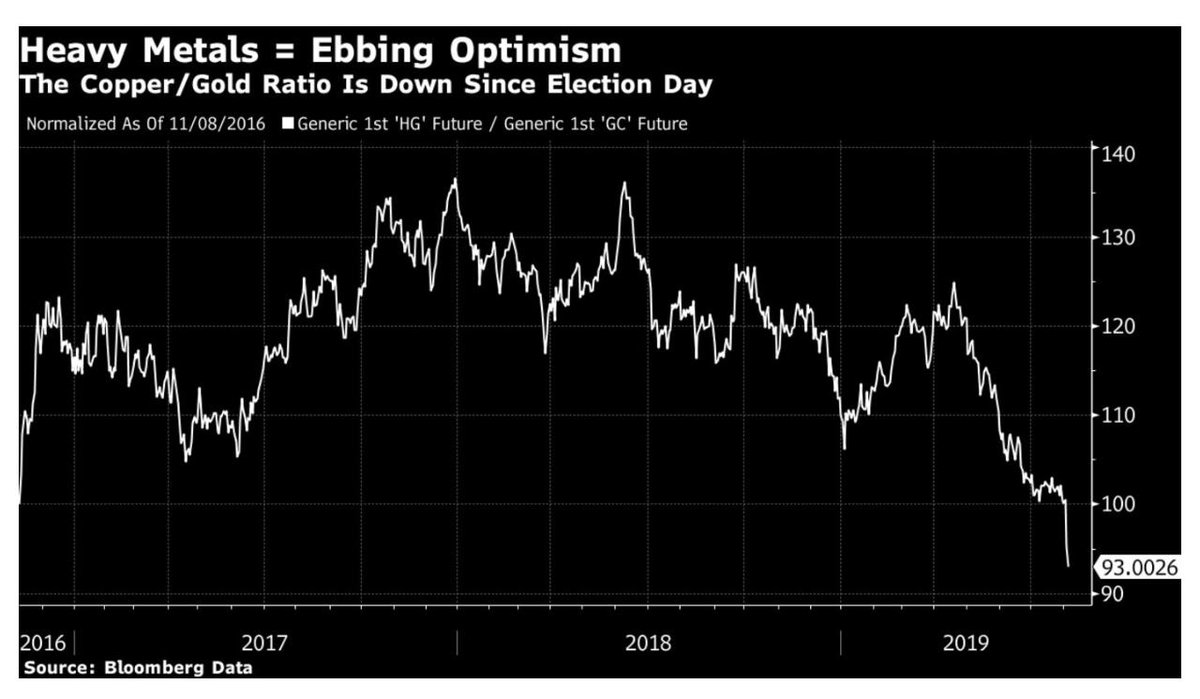

Alchemy of confidence: according to John Authers the markets read the copper/gold ratio as a measure of confidence. Presumably copper is real economy v gold = safe haven … this week, for 1st time since Nov 2016, gold has outperformed copper (link: https://www.bloomberg.com/opinion/articles/2019-08-06/good-will-is-a-thing-of-the-past-in-the-trade-war-jyzaqk0v?srnd=premium) bloomberg.com/opinion/articl…

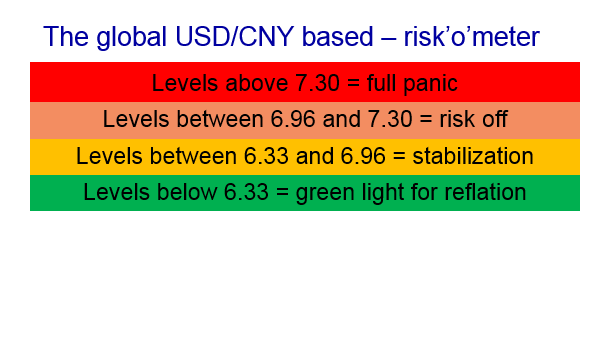

The USD/CNY risk’o’meter

Between 6.96 and 7.30 = risk off

>7.30 = full panic

This inversion is getting serious. I don’t envy the Fed’s choice right now: Live with an inverted yield curve or defend rate cuts with inflation near 2% and unemployment at historic low.

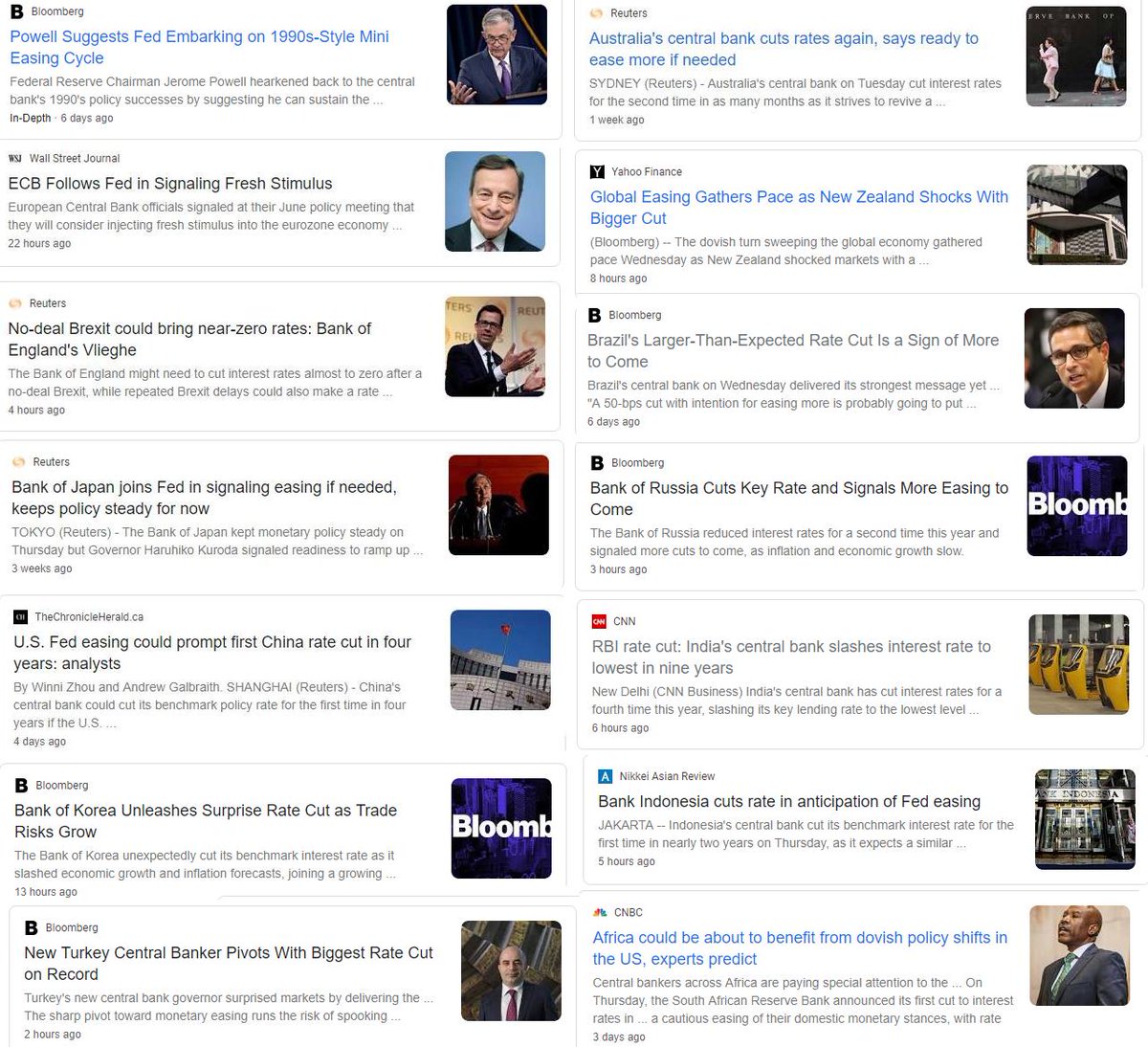

Global coordinated easing… Fed: easing. ECB: easing. BOE: easing. BOJ: easing. Australia: easing. New Zealand: easing. Brazil: easing. Russia: easing. India: easing. China: easing. Hong Kong: easing. Korea: easing. Indonesia: easing. South Africa: easing. Turkey: easing.

Chris writes for Capitalist exploits

This isn’t meant to be a history lesson on Hong Kong, so let’s make it as short as possible.

Hong Kong was an illegitimate child of the British Empire, and as their grip on global dominance ebbed, old Maggie “Iron Lady” Thatcher saw what was inevitable (losing the territory) and began speeding up preparations so as to ensure a more peaceful transition.

Hong Kongers then had no say as to who their parent would be, and today, 22 years after the official handover, they’ve no say either.

Sure, like a child that’s grown up a bit and felt the lure of independence they want it to be the case, but this is never going to happen, and here’s why.

What you have is an autonomous state that enjoys the some of the widest forms of self expression and democracy in the world sitting on the lap of one of the world’s most totalitarian regimes in existence.

The Chinese call it “one Nation, two systems.” I call it bonkers.

Old Maggie was a sharp cookie, and one of the most adept negotiators our tea drinking, sun starved friends have ever managed to birth (incidentally, the Brits could well do with that right now, because let’s face, it Boris ain’t half a Maggie).

Anyhow, Maggie knew that they had to let Hong Kong go. It was an expiring option, and with China was growing stronger each year while Britain was sinking, she knew the option still had value to them. But with each passing year the cost of the option began to outweigh the benefits.

It had to go… and so it did.

But when the old Iron bird negotiated the transfer of Hong Kong back to Mainland China she put a spanner into the spokes, namely a 50-year treaty essentially saying, “Here, it’s yours, but for half a century you can’t really touch it.”

The problem with this agreement is that no agreement is worth a jelly donut if it can’t be enforced. Look around you and tell me who’s going to enforce the democracy of Hong Kong?

The Brits can’t. They’re balls deep in the real life comedy that is Brexit, and to be fair, there’s enough knife crime on London’s streets now that Hong Kong looks positively peaceful. So no, that dog won’t hunt.

What about NATO? Pffft! I said once, actually twice before that NATO is coming to and end.

That leaves just one: America.

If America intervenes with military, then we’re screwed. Really screwed. If they don’t, well… Hong Kong is screwed.

read full article below

SUMMARY:

Nomura on US equities

“We would expect any near-term rally to be no more than a head fake, and think that any such rally would be best treated as an opportunity to sell in preparation for the second wave of volatility that we expect will arrive in late Aug or early Sept”

Government Bond- Negative yielding crosses $15 trillion

We will either look back at this period as the new normal or an insane period of irrationally low inflation expectations.

Junk Bond

Spreads on US junk bonds widened yesterday by the most since 2011. Important to watch, since it highlights how quickly the credit risk in high-yield bonds can re-price amid a deteriorating backdrop (On an absolute basis the most since Aug. 2011; percentage basis most since 2007.) Lisa Abramowicz

“Midcycle adjustment” seems off the table. Markets expect another four Fed rate cuts in the coming 12mths