There is a presumption that faster economic growth in emerging markets drive up corporate earnings as well. This statement isn’t new. Many “supply-side” models of stock market returns are based on macroeconomic performance.

Supply side models assume that the GDP growth of underlying economy flows to shareholders in three steps:

- It transforms into corporate profit growth

- The aggregate earnings growth translates into EPS growth

- EPS growth translates into stock price increases

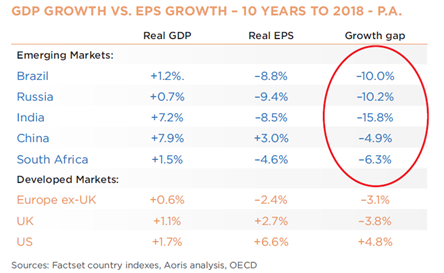

The thought of high GDP growth in EM’s lead to faster EPS now seems intuitive but in practice research shows contradictory results. See the chart below,EPS has grown at a slower pace than GDP.

In reality, firstly, we need to expand our view to global markets than local markets. With globalisation operations is distributed throughout the world and production processes for these MNC’s is not reflected in country’s GDP. Company’s revenue and share price largely depend on global GDP growth as increasing proportion of products is sold abroad.

Secondly, a significant part of economic growth comes from new enterprises and not by faster growth of existing ones.

In EM’s the finance and resources sectors account for a far larger portion of the stock exchange them they do of domestic corporate sector. Dilution from equity issuance has been far greater in EM’s than in developed ones. Research by Schroders over 10 years to 2017 estimates the dilution across all EM’s at 3.8% p.a. on average, significantly larger than 0.5% p.a. dilution for DM’s.

Rather than dilution, across portfolio most companies have reduced shares on issue, so EPS has risen faster than profits. EPS dilution arising from growth in issued shares is greater than the lower the return on capital. This causes discrepancy between corporate earnings and earnings per share. If companies issue new shares and dilute existing shareholders or if young companies go public, capital increases and the economy grows, but shareholders are not receiving any increase in EPS. In such case, the market capitalization grow much more than shareholders’ returns.

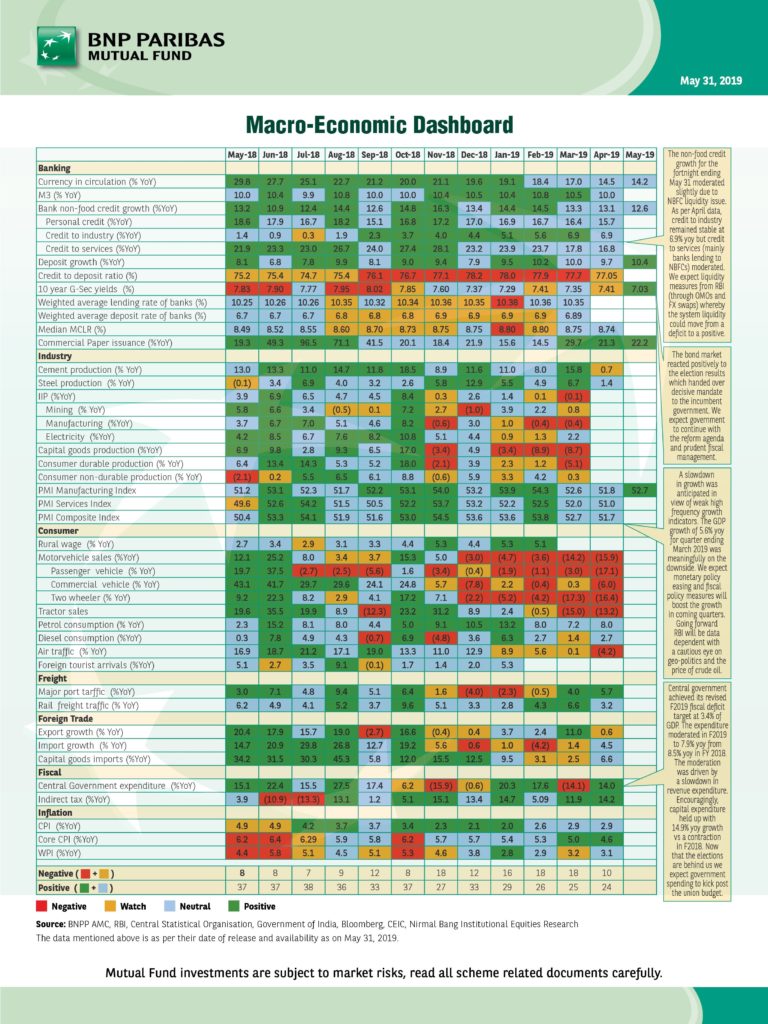

India for example, shows divergence in corporate earnings and GDP growth. As per Aoris Investment Management report on Emerging Market Fallacy, “The profits of all listed and unlisted companies relative to GDP in India declined from a peak of 7.8% in 2008 to 3% in 2018. Over that period, India’s nominal GDP (including inflation) grew at a rate of 12.90% while earnings of Indian companies grew by just 2.6% p.a.”

In few analysis, it is evident that long term equity performance was similar to GDP growth. However, this parallel growth was due to increasing valuations offsetting the dilution effect. Expected economic growth is built into current prices, thus reducing future realized returns. As an example, when Japan’s Nikkei 225 soared to almost 39,000 in late December 1989, investors were bullish about the growth of Japanese economy. When the expected growth did not happen, the stock markets collapsed.

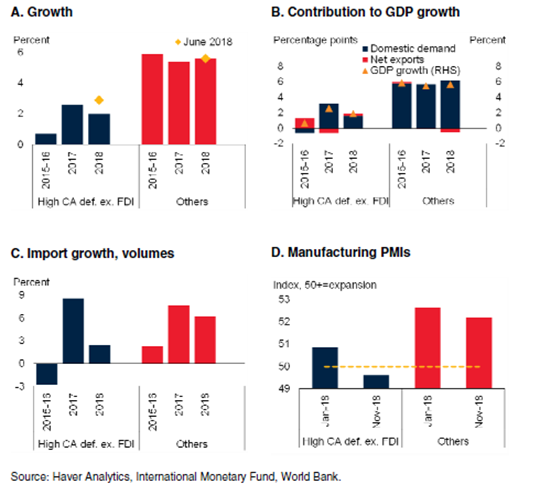

Mobilizing domestic resources is not simply a matter of taxing more, it’s also about taxing better, by expanding the tax base, ensuring an appropriate distribution of the tax burden among taxpayers, simplifying and improving the efficiency of tax administration, bringing tax laws up to date, and making sure that tax administrators know how to audit local and multinational companies alike. The citizenry must see the tax system as being equitable. There is a concern that the trend toward lower taxation of capital (to encourage growth) is making it harder to counter the growing inequality of income and wealth. The growing income and wealth gaps can undermine social cohesion, and ultimately undermine economic growth as well. World Bank flagship report states, “EMDE activity has stalled, in part reflecting the effect of financial stress in some large economies with sizable current account deficits and high exposure to volatile capital flows. Domestic demand across EMDEs has generally moderated and trade flows have softened. High – frequency indicators suggest that the weakness continues, particularly in vulnerable economies.”

Country – specific sectors influence a country’s ability to attract long term financing. Development of domestic capital markets to act as a long term source of financing will support the goal of strong, sustainable and balanced growth. This calls for greater attention to policies and instruments that can lower the risk and strengthen the confidence of investors over a long term horizon. Domestic resource mobilization is always going to be a main source of funding for development purposes.

Gaps between investment needs and the availability of appropriate financing often arise not only from the supply side of financing, but also as a result of a weak underlying investment climate, lack of planning and institutional capacity, and the absence of strong regulatory frameworks.

As per FSD report, “GDP growth is expected to remain steady at 3.0% in 2019 and 2020. Most growth forecasts have been revised downwards due in part to the negative effects of trade uncertainty and weakening financial market sentiment.

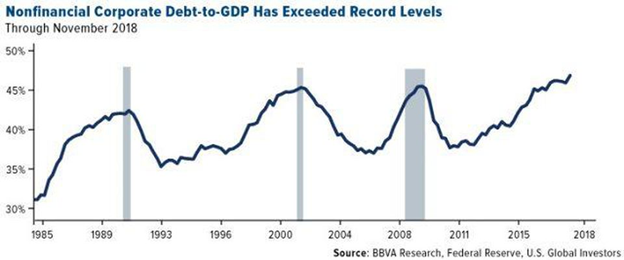

In current uncertain environment, financial markets are highly susceptible to a sudden shift in investors’ perception of market risk which could result in a sharp and disorderly tightening of global financial conditions. A faster than expected pace of increasing interest rates in systemically important developed economies could have significant spillover effects on the rest of the world, including sharp reversal of capital flows from developing countries. This would likely have a larger impact on countries with weak macroeconomic fundamentals, large external imbalances, high indebtedness and a high share of short term liabilities among capital inflows and low policy buffers. Currency depreciation can also dampen capital investment through balance sheet effects.”

In Conclusion “EPS growth in EM’s has fallen significantly short of GDP growth over the last decade. You may feel bullish on the Chinese economy or the recovery prospects in Brazil. However, counterintuitive though this may feel, your view on an economy should have no bearing on your expectation for EPS growth from that particular country.”

file:///C:/Users/rites/Desktop/The%20Emerging%20Market%20fallacy.pdf