Doug Noland writes….

This week’s FOMC meeting will be debated for years – perhaps even decades. The Fed essentially pre-committed to no rate hike in 2019. The committee downgraded both its growth and inflation forecasts. Having all at once turned of little consequence, we can now dismiss the 3.8% unemployment rate and the strongest wage growth in a decade. Moreover, the Fed announced it would be scaling back and then winding down balance sheet “normalization” by September. This put an impressive exclamation point on a historic policy shift since the December 19th meeting. At least for me, it hearkened back to a Rick Santelli moment: “What’s the Fed afraid of?”

Markets came into the meeting fully anticipating a dovish Fed. Our central bank returned to the old playbook of beating expectations. In the process, the Federal Reserve doused an already flaming fixed-income marketplace with additional fuel.

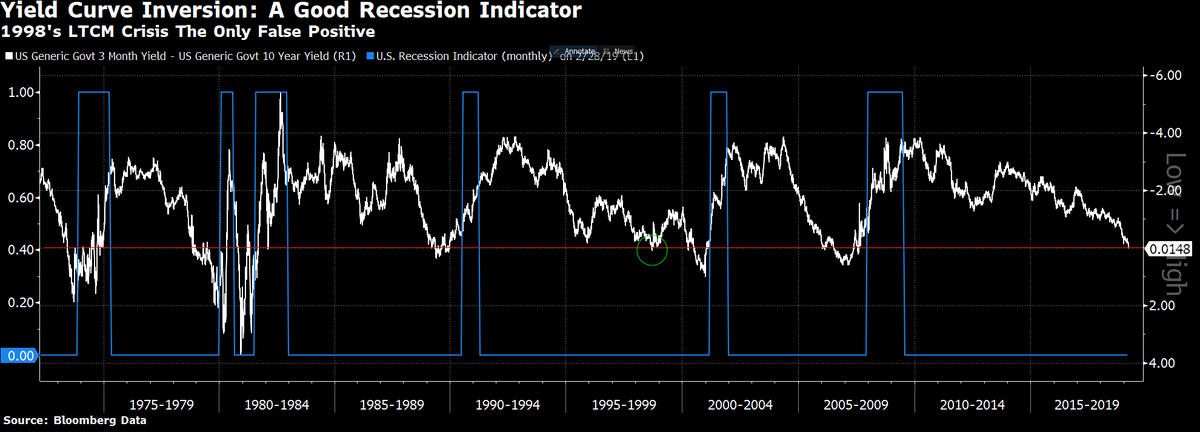

After trading to 3.34% during November 8th trading, ten-year Treasury yields ended this week a full 90 bps lower at 2.44%, trading Friday at the lowest yields since December 2017. Yields were down 15 bps this week – 17 bps from Tuesday’s (pre-Fed day) close – and 28 bps so far in March. And with three-month T-bill rates at 2.40%, the three-month/10-year Treasury curve flattened to the narrowest spread since 2007 (briefly inverting Friday). Five-year Treasury yields ended the week inverted 16 bps to three-month T-bills – and two-year Treasuries were inverted about eight bps.

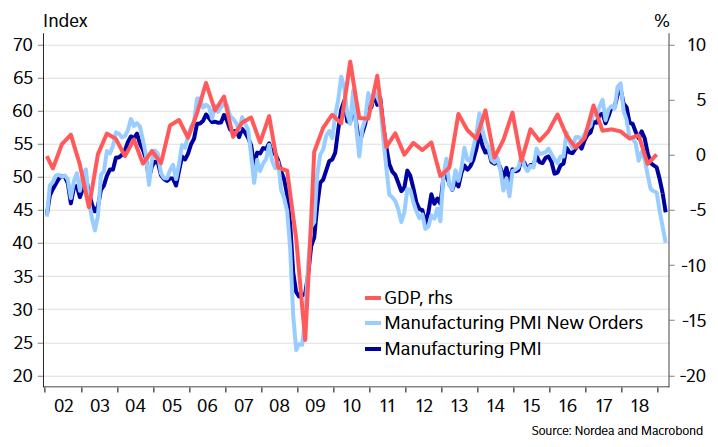

Collapsing sovereign yields were a global phenomenon. Japan’s 10-year JGB yields declined four bps Friday to negative eight bps (-0.08%), the lowest yields since September 2016. With Germany’s Markit Manufacturing index sinking to the lowest level since 2012 (44.7), bund yields dropped seven bps to negative 0.015% – also lows going back to September 2016. Swiss 10-year yields sank 12 bps this week to negative 0.45%. Two-year German yields closed out the week at negative 0.57%. UK 10-year yields dropped 20 bps (1.01%), Spain 12 bps (1.07%) and France 11 bps (0.35%).

The destabilizing impact of the Fed’s shift back to an Uber-Dovish posture was more conspicuous by week’s end. The S&P500 dropped 1.9% in Friday trading, with financial stocks coming under heavy pressure. In three sessions, the KBW Bank Index was slammed 8.2% and the Broker/Dealers (NYSE Arca) lost 5.6%.

It wasn’t only the banks’ shares under pressure. Bank Credit default swap (CDS) prices reversed sharply higher this week, with European bank debt in the spotlight. Deutsche Bank 5yr CDS surged 24 bps this week to 168 bps, the largest weekly gain since late-November. UniCredit CDS jumped 22 bps (150bps), Intesa Sanpaulo 21 bps (159bps) and Credit Suisse 16 bps (84bps). An index of European subordinated bank debt surged 31 bps this week (to 177bps), the largest weekly gain since October 2014. Pressure on European bank CDS spilled over into European corporates. After trading to one-year lows in Tuesday’s session, a popular European high-yield CDS (iTraxx Crossover) reversed 22 bps higher in three sessions (to 281bps) – posting its worst week since mid-December.

Friday trading saw European CDS instability jump the Atlantic. Late-week losses saw most major U.S. bank CDS rise modestly for the week. After closing Tuesday near one-year lows, U.S. investment-grade corporate CDS jumped 10 bps in three sessions to end the week about 10 bps higher. This index suffered its largest weekly gain (higher protection costs) since the week of December 21 (reducing y-t-d decline to 20bps). The week saw junk bonds notably underperform. Sinking financial stocks, widening spreads and rising CDS prices fed into equities volatility. After ending last week at the lows (12.88) since early-October, the VIX popped to 16.48 (also the largest weekly gain since the week of December 21).

It’s now commonly accepted that the Federal Reserve erred in raising rates 25 bps in December. I hold the view that Chairman Powell had hoped to lower the “Fed put” strike price. The Fed was willing to disregard some market instability, hoping to begin the process of the markets standing on their own. The Fed just didn’t appreciate the degree of latent market fragility that had been accumulating over the years. I don’t fault them for trying.

In the name of promoting financial stability after a decade of extraordinary stimulus measures, it was prudent for the Fed to adhere to a course of gradual rate normalization even in the face of some market weakness. GDP expanded at a 3.4% rate in Q3 and slowed somewhat to 2.6% during Q4. After a decade-long expansion, periods of economic moderation should be expected (and welcomed).

Some analysts see this week’s dovish posture as part of a FOMC effort to rectify its December misdeeds. Markets now see about a 60% probability of a 2019 rate cut – with zero likelihood of a hike through January 2020. The Fed’s dot plot – still with one additional rate increase in 2020 – has lost all market credibility.

March 22 – Bloomberg (Matthew Boesler and Jeanna Smialek): “Federal Reserve policy makers have concluded that when in doubt, do no harm. Welcome to the new abnormal. Six months ago, U.S. central bankers thought they’d soon be returning to the days of on-target inflation, full employment and interest rates that, while lower than in decades past, would still need to rise into growth-restricting territory to keep things on track. But in a watershed moment, the Federal Reserve surprised investors… by slashing rate projections to show no hike this year. Officials signaled expectations for a slowdown in the economy… and they no longer expect inflation to rise above their 2% target. The move was a serious about-face. Since September 2017, they had signaled they would probably need to eventually raise rates above their estimate of the so-called neutral level for the economy… to slow the expansion and protect against the possibility of higher inflation. That was based on a longstanding view in the economics profession about how the economy works: If central bankers allow the unemployment rate to fall too far below its lowest sustainable level by keeping rates too low, then inflation will rise.”

There’s been a bevy of interesting analysis the past few days. The “New Abnormal” from the above Bloomberg article headline caught my attention. Responding to “New Normal” (Pimco) pontification, I titled an October 2009 CBB “The Newest Abnormal.” My argument almost a decade ago was that “activist” central banks were just doing what they had done repeatedly – only more aggressively: responding to bursting Bubbles with reflationary policymaking that would ensure the inflation of only bigger and more precarious Bubbles.

I didn’t back then believe it possible for central banks to orchestrate a successful inflation. I have great conviction in this analysis today. The popular notion of inflating out of debt problems is way too simplistic. Just inflate the general price level and reduce real debt burdens, as the thinking goes. The problem is that debt levels have expanded greatly, right along with securities and asset prices – and speculative excess. Aggregate measures of consumer prices, meanwhile, were left in the dust. The Great Credit Bubble has ballooned uncontrollably; asset price Bubbles have significantly worsened; and speculative Bubbles have become only more deeply embedded throughout global finance.

Bond markets were anything but oblivious to Bubble Dynamics back in 2007 – and have become only more keenly fixated here in 2019. I strongly argue that dysfunctional global markets are in a more precarious position today than in 2007, a view anything but diminished by this week’s developments. Wednesday’s statement and Powell press conference were viewed as confirming that the Fed is preparing to reinstitute aggressive policy stimulus.

With acute fragilities revealed in December, the Fed and global central bankers are on edge and scrambling. Markets see the Fed’s aggressive dovish push suggesting that the Fed – after December’s missteps – is now poised to err on the side of being early and aggressive with stimulus measures. In safe haven bond land, the Fed has evoked vivid images of monetary “shock and awe.”

Analysts are focusing on sovereign yields and an inverted Treasury curve as foreshadowing recession. I would counter with the view that bond markets appreciate global Bubble fragilities and are now pricing in the inevitability of rate cuts and new QE programs. Yield curves (at home and abroad) are more about market dynamics and prospective monetary policy than the real economy. As such, the strong correlations between safe haven and risk assets are no confounding mystery. Safe haven assets these days have no fear of “risk on.” After all, surging global risk markets only exacerbate systemic risk, ensuring more problematic Bubbles, central bankers operating with hair triggers, and the near certainty of aggressive future monetary stimulus.

Friday’s market instability had market participants searching for an explanation. Is there a significant development moving markets? Negative news coming from the China/U.S. trade front?

There could be something out there spooking the markets. Or perhaps the big story of the week was that Fed Uber-Dovishness pushed global bond markets and fixed-income derivatives toward dislocation. From the above Bloomberg article: “Federal Reserve policy makers have concluded that when in doubt, do no harm.” Maybe the Fed, trying too hard to compensate for December, is Doing Harm to market stability.

DoubleLine Capital’s Jeffrey Gundlach (from Reuters): “This U-Turn – on nothing fundamentally changing – is unprecedented. Three months ago, we were on ‘autopilot’ with the balance sheet – and now the bond market is priced for a rate cut this year. The reversal in their stance is stunning.”

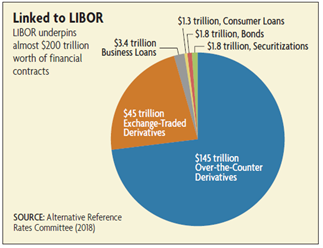

Perhaps the disorderly drop in safe haven yields has led to a problematic widening of Credit spreads. The easy returns being made long higher-yielding Credit instruments versus a short in Treasuries have come to an abrupt conclusion. Could serious problems be unfolding in the derivatives markets, along with major losses for levered players caught on the wrong side of illiquid and rapidly moving markets. Is the Fed’s stunning “U-turn” market destabilizing – with great irony, fomenting “risk off” deleveraging?

What is the Federal Reserve’s reaction function? What factors will be driving policy decisions going forward? The Fed set rates at about zero (0 to 25bps) in January 2009 and left them unchanged for six years. The Fed then raised rates 25 bps in December 2015, 25 bps in December 2016 – and then cautiously increased rates six more times spaced over the next three years. The Fed’s balance sheet was roughly stable from Q4 2014 through Q4 2017 and has since been in gradual/predictable runoff for the past five quarters. For years now, Fed policy has been usually certain. Rate and balance sheet “normalization” were to proceed at an extraordinarily measured pace. No surprises. Bypassing a tightening of financial conditions, the “autopilot” Fed was conducive to aggressive market positioning/speculation (and leveraging).

An unusual era of monetary policy stability/predictability formally ended Wednesday. Balance sheet “normalization” is being brought to an early conclusion. Markets now assume the next rate move is lower. And with the Fed apparently turning its focus to persistently undershooting consumer price inflation, it is reasonable to assume it’s only a matter of time until the Fed resorts once again to QE. But when and at what quantity?

Especially as three years of rate “normalization” ends with Fed funds at only 2.25% to 2.50%, markets well-recognize there’s meager stimulus potential available in rate policy. Will the Fed even bother with rate cuts – or be compelled to move directly to QE? Suddenly, the future of monetary policy appears awfully murky.

Come the next serious stimulus push, it will be the Fed’s balance sheet called upon to do the heavy lifting. And, for those pondering a likely catalyst, I’d say look no further than a global market accident – omen December. As such, it now matters greatly that QE has evolved from an extreme policy response necessary to counter the “worst crisis since the Great Depression” – to a prominent tool in the Fed’s (and global central banking) toolkit readily available to counter risks of economic weakness and stock market instability.

Throw in the concept of late-cycle “Terminal Excess” – appreciating that policymakers, from Beijing to Tokyo to Frankfurt, London, Canberra, Toronto, Washington and beyond, are prolonging a most precarious cycle – and one can build a solid case for big trouble and big QE brewing. With this in mind, it’s not difficult to get quite concerned for the stability of global bond markets, along with securities, derivatives and asset markets more generally. And with markets unsettled, it probably didn’t help to have the largest ever monthly federal deficit ($234bn), with the y-t-d deficit after five months ($544bn) running 40% ahead of fiscal 2018 – or that President Trump announced the nomination of Stephen Moore to the Federal Reserve.

read full article

http://creditbubblebulletin.blogspot.com/2019/03/weekly-commentary-doing-harm-with-uber.html