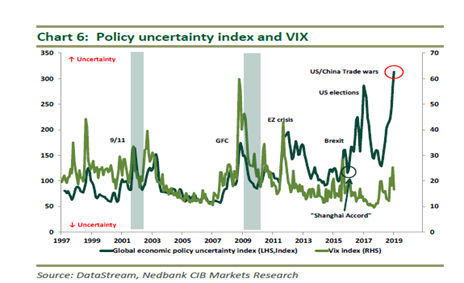

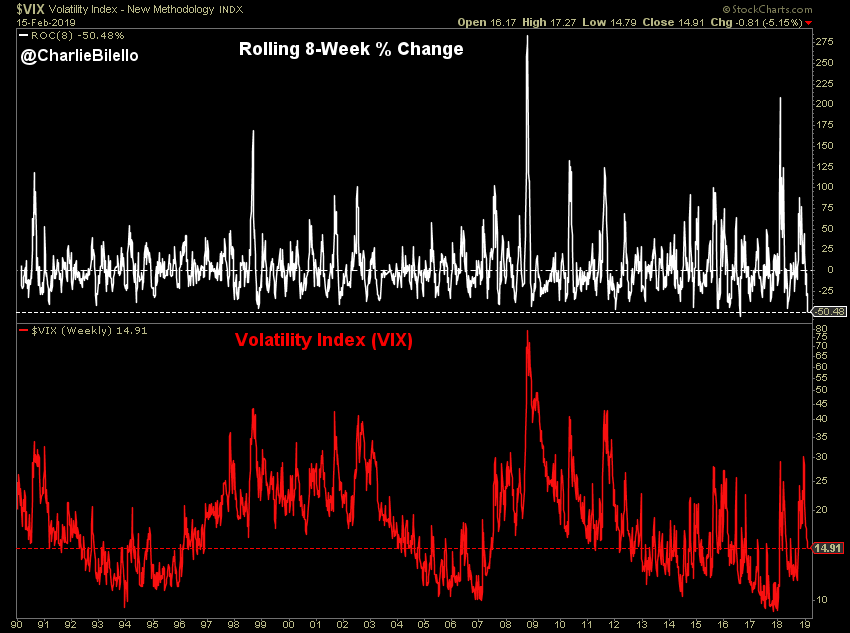

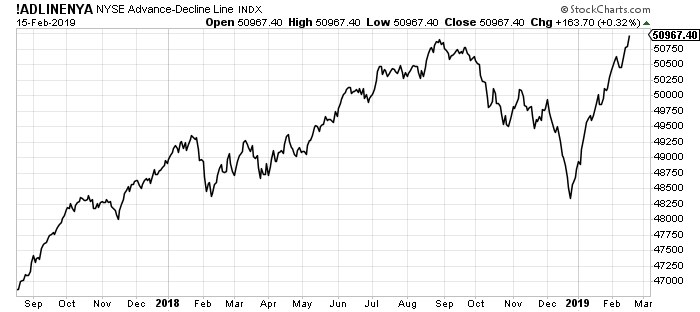

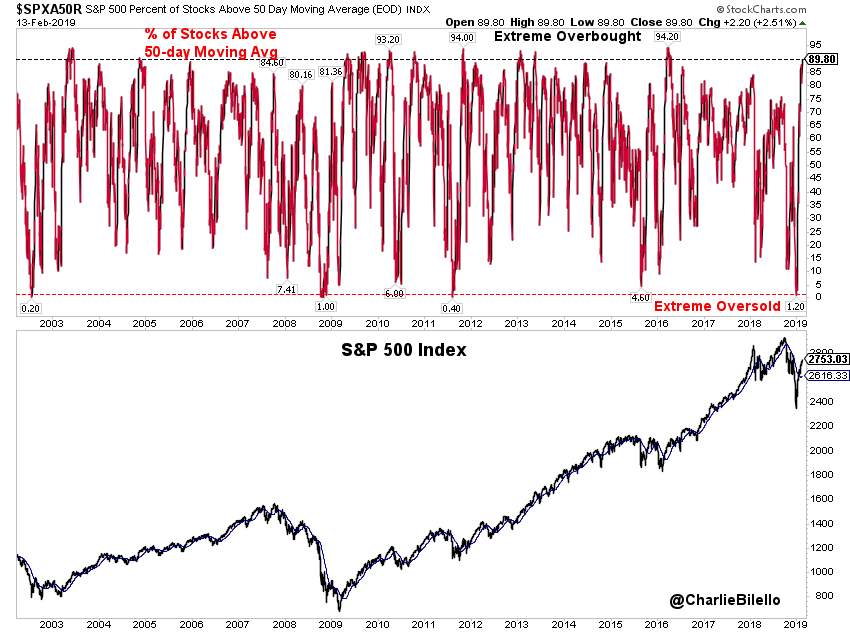

Doug Noland writes……The world is now fully embroiled in a most precarious period. I wonder if the Fed is comfortable seeing the markets dash skyward – the small caps up 16.4% y-t-d, Banks 15.9%, Transports 15.2%, Biotechs 18.5% and the Semiconductors 17.0%. Or, perhaps, they’re quickly coming to recognize that they are now fully held hostage by market Bubbles.

Similarly, I ponder how Beijing feels about January’s booming Credit data – Aggregate Financing up $685 billion in a month. Do officials appreciate that they are completely held captive by history’s greatest Credit Bubble? I have argued that Bubbles have become a fundamental geopolitical device – a stratagem. Things have regressed to a veritable global Financial Arms Race. As China/U.S. trade negotiations seemingly head down the homestretch, each side must believe that rallying domestic markets beget negotiating power. Meanwhile, emboldened global markets behave as if they have attained power surpassing mighty militaries and even nuclear arsenals.

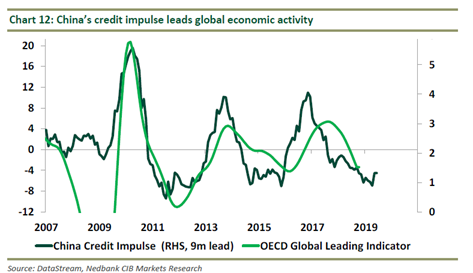

February 15 – Reuters (Kevin Yao and Judy Hua): “China’s banks made the most new loans on record in January – totaling 3.23 trillion yuan ($477bn) – as policymakers try to jumpstart sluggish investment and prevent a sharper slowdown in the world’s second-largest economy. Chinese banks tend to front-load loans early in the year to get higher-quality customers and win market share. But they have also faced months of pressure from regulators to step up lending, particularly to cash-starved smaller firms. Net new yuan lending last month was far more than expected and eclipsed the last high of 2.9 trillion yuan in January 2018. Analysts… had predicted new loans of 2.8 trillion yuan, more than double the level seen in December.”

January’s record China new bank loans were 11.4% higher than the previous record from January 2018 – and 15% above estimates. Bank Loans expanded an imprudent $821 billion over the past three months alone, a full 20% above the comparable period from one year ago. Total Bank Loans expanded 13.4% over the past year; 28% in two years; 45% in three years; 91% in five years; and an incredible 323% over the past decade.

Led by bubbling bank lending, China’s Aggregate Financing expanded a record $685 billion during January. Flood gates wide open. While typically a big month for Chinese lending, January’s growth in Aggregate Financing was 50% above January 2018. It’s worth noting that the growth in Aggregate Financing over the past six months ran 7% above the comparable year ago period (and equates to an annualized pace of $3.7 TN). Consumer (largely mortgage) Loans expanded a record $146 billion for the month, 10% greater than the previous record from January 2018. Consumer loans expanded 18% over the past year; 43% in two years; 77% in three; and 140% in five years.

It’s too fitting: as the long-standing global superpower and ascending superpower are locked in tortuous negotiations, their respective financial power centers – securities markets in the U.S. and state-directed bank lending in China – rage. No Holds Barred.

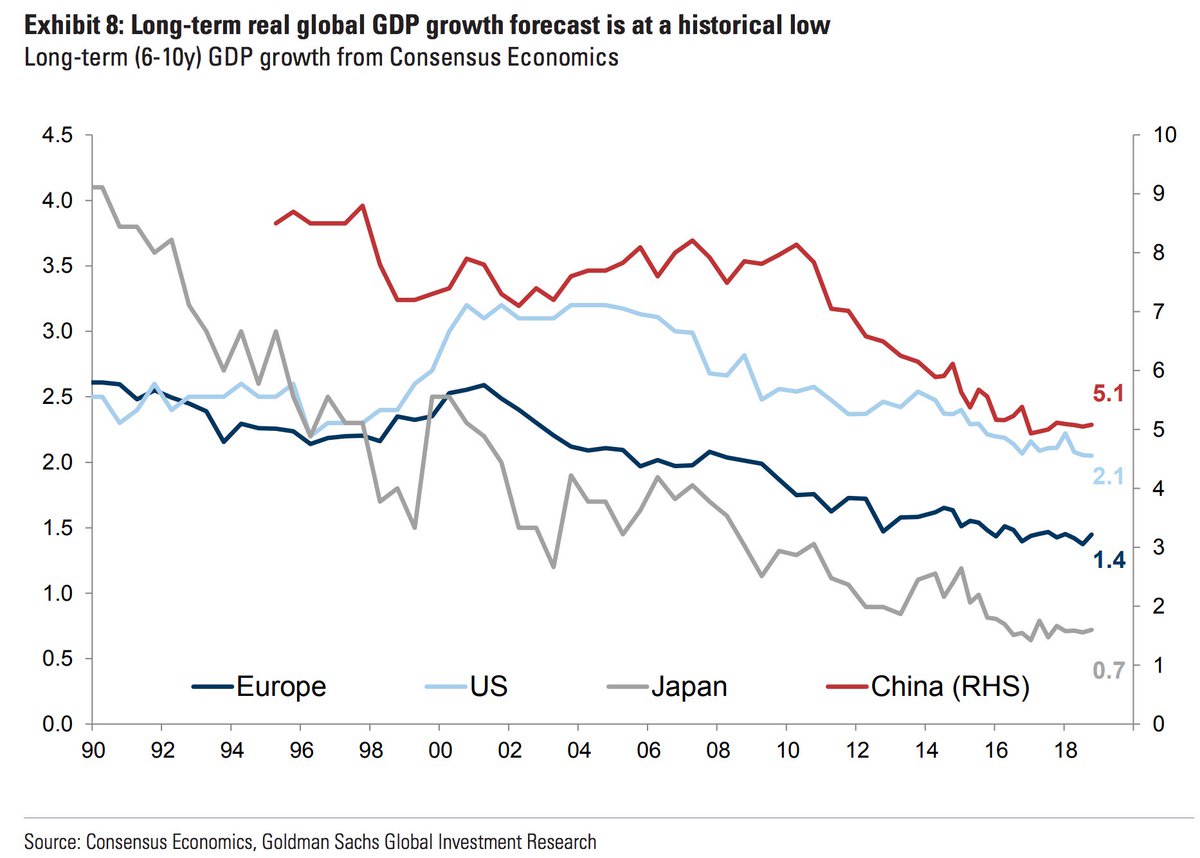

“The reason I’m giving the central bank an “F” is look at what’s happening in China and Asia… Look at what’s happening in Europe from the economic perspective. The U.S. stimulated at full employment with our tax cuts. That stimulus is about to wear off. What I worry about is the last three recessions we’ve had in the U.S. we’ve cut rates 500 bps. Now we can only cut them 225 or 250. And a week or two ago the San Francisco Fed put out a white paper about the benefits of negative interest rates. I hope that’s not where we’re going, but we can only cut rates about 225/250 bps to be at zero. So, this point of normalization should have happened long ago – not now. They were really late in the cycle in raising rates and now they’re stuck. So when we get into even a small recession, I don’t think we have the arrows in the quiver. And so let’s hope that we learned something from Japan and Europe about negative interest rates. They destroy the banking sectors and they have not helped their economies whatsoever…” Kyle Bass, Hayman Capital Management, appearing on Bloomberg Television, February 11, 2019

Seeing eye-to-eye with Kyle Bass, it has become difficult not to be thinking ahead to the next recession. And while Chinese Credit and ongoing aggressive global monetary stimulus can no doubt prolong the “Terminal Phase” of this most prolonged worldwide boom, this comes at a steep price.

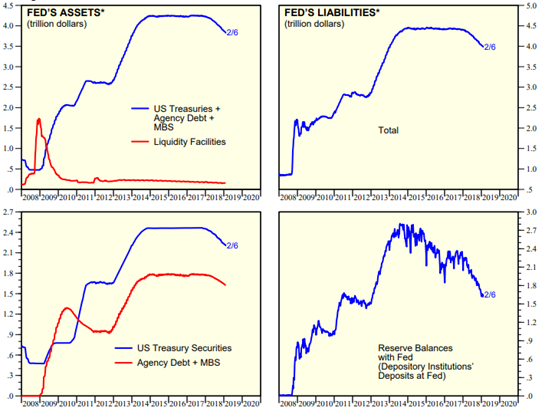

Between July 2007 and December 2008, the Fed collapsed fed funds 500 bps. At least as important, 10-year Treasury yields sank about 300 bps during this period (520bps to 213bps). After ending June 2007 at 6.26%, benchmark Fannie Mae MBS yields closed out 2008 at 3.89%.

The Fed retained significant firepower to counter the bursting of the mortgage finance Bubble. Between August 2007 and March 2009, benchmark 30-year mortgage rates sank from about 6.70% to 4.85%. Importantly, by collapsing rates and purchasing large quantities of mortgage-backed securities, the Fed orchestrated a major mortgage refinancing boom. This, along with scores of government-assistance programs, allowed tens of millions of indebted homeowners to significantly reduce monthly mortgage payments. In particular, millions of higher-risk borrowers were able to replace old high-rate subprime mortgages for prime mortgages with dramatically lower payments.

At 4.37%, 30-year conventional mortgage rates are today already below the lowest levels from 2009. And with the vast majority of borrows over recent years having refinanced at historically low mortgage rates, there’s limited prospects for reduced monthly payments to dampen financial burdens during the next recession.

Worse yet, student loan debt has more than doubled since the crisis. And when the next recession hits, there will be record amounts of auto and Credit card debt.

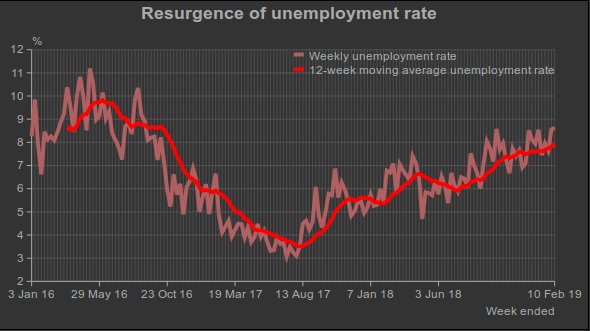

February 12 – Reuters (Jonathan Spicer): “Some red flags emerged for the U.S. economy late last year as credit card inquiries fell, student-loan delinquencies remained high and riskier borrowers drove home automobiles, according to a report that could signal a downturn is on the horizon. The U.S. household debt and credit report… by the Federal Reserve Bank of New York, showed that the overall debt shouldered by Americans edged up to a record $13.5 trillion in the fourth quarter of 2018. It has risen consistently since 2013, when debt bottomed out after the last recession. While mortgage debt, by far the largest slice, slipped for the first time in two years, other forms of borrowing rose including that of credit cards, which at $870 billion matched its pre-crisis peak in 2008.”

Auto lending, in particular, has gone through a protracted – arguably unprecedented – period of loose lending.

February 12 – Washington Post (Heather Long): “A record 7 million Americans are 90 days or more behind on their auto loan payments, the Federal Reserve Bank of New York reported…, even more than during the wake of the financial crisis era. Economists warn this is a red flag. Despite the strong economy and low unemployment rate, many Americans are struggling to pay their bills. ‘The substantial and growing number of distressed borrowers suggests that not all Americans have benefited from the strong labor market,’ economists at the New York Fed wrote… A car loan is typically the first payment people make because a vehicle is critical to getting to work, and someone can live in a car if all else fails. When car loan delinquencies rise, it is a sign of significant duress among low-income and working-class Americans.”

February 13 – CNBC (Sarah O’Brien): “As Americans’ appetite for new cars continues unabated, an advocacy group is sounding the alarm over the growing level of auto debt carried by U.S. consumers. In a report…, U.S. PIRG warns that the continuing rise in auto debt is putting many consumers in a financially vulnerable position, which could worsen during an economic downturn… ‘More and more people are buying too much car for what they can afford,’ said Ed Mierzwinski, senior director of U.S. PIRG’s federal consumer program. The group’s new report delves into the financial implications and policy-related aspects of Americans’ reliance on cars. It shows that the aggregate amount of auto debt that consumers carry — roughly $1.27 trillion — is 75% more than the amount owed at the end of 2009… Overall, auto debt accounts for about 9% of total U.S. consumer debt, up from 6% in late 2011… Among subprime borrowers — those with credit scores below 620— the delinquency rate was 16.3% in mid-2018. In 2015, that figure was 12.4%… The average price of a new vehicle is now about $37,100, compared with $27,573 five years ago… As of January, the average amount financed was $31,707 and the average loan length had reached 69.1 months, up from 61 in 2010…”

And from the PIRG report: “The rise in automobile debt since the Great Recession leaves millions of Americans financially vulnerable — especially in the event of an economic downturn… Of all auto loans issued in the first two quarters of 2017, 42% carried a term of six years or longer, compared to just 26% in 2009… Many car buyers ‘roll over’ the unpaid portion of a car loan into a loan on a new vehicle, increasing their financial vulnerability… At the end of 2017, almost a third of all traded-in vehicles carried negative equity, with these vehicles being underwater by an average of $5,100… The increase in higher-cost ‘subprime’ loans has extended auto ownership to many households with low credit scores… In 2016, lending to borrowers with subprime and deep subprime credit scores made up as much as 26% of all auto loans originated.”

When it comes to Bubbles, the more conspicuous they are the less likely they are to be deeply systemic. The “tech” Bubble was obvious, yet the most egregious excess was contained within the technology sector. The mortgage finance Bubble was much more systemic, with excesses spread about and not as apparent. I believe today’s Super “Tech” Bubble is much more systemic than back in 2000. And while subprime is not the key issue it was for previous Bubble, I would argue that excess in many key housing markets is comparable. Commercial real estate on a national basis is likely more vulnerable today than in 2007, and the same could be said for some regional housing markets (i.e. greater “Silicon Valley”, Los Angeles, Seattle, Portland, Atlanta). Today’s Bubble in leveraged lending and M&A is greater than 2006/2007. The Bubble in corporate Credit dwarfs that from the mortgage finance Bubble period. Excesses throughout the securities markets phenomenally exceed those from the prior Bubble period. Moreover, I suspect the current level of derivatives-related speculative leverage could be multiples of 2007.

February 13 – Associated Press (Martin Crutsinger): “The government surpassed a dubious milestone this week: Its debt topped $22 trillion — that’s trillion, with a ‘t’ — for the first time. Piles of federal debt have been growing ever higher for years, fueled by accumulating annual deficits, which themselves have been driven by tax cuts, government spending increases and the mounting costs of Medicare and Social Security and interest on the debt itself.”

Thinking Ahead to the Next Recession, we should de deeply concerned about our nation’s tenuous fiscal position. To see deficits approaching 5% of GDP – with unemployment and interest rates at such historically low levels – should have us all fearful. Of course deficits matter. After ending 2007 at $8.056 TN, federal Liabilities (from Fed’s Z.1) surged $11.86 TN, or 147%, to end Q3 2018 at $19.918 TN. Over this period, outstanding Treasury Securities jumped $11.367 TN, or 188%, to $17.418 TN. And after ending 2007 at $7.40 TN, Agency Securities increased $1.62 TN, or 22%, to $9.02 TN. Over this period, combined Treasury and Agency securities almost doubled to $26.44 TN, expanding from 92% to 128% of GDP.

During the last crisis, the collapse in rates and market yields significantly mitigated the Treasury debt service burden. This ensured an outsized percentage of huge deficit spending went to bolster the real economy, with relatively less to debt holders. Come the next recession, already huge deficits will expand much larger, likely with only meager benefits from lower borrowing costs. Worse yet, there’s a scenario where fiscal recklessness finally leads to some market backlash. At some point, out of control deficits could be compounded by rising market yields – central bank stimulus notwithstanding.

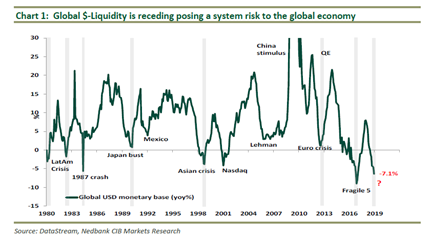

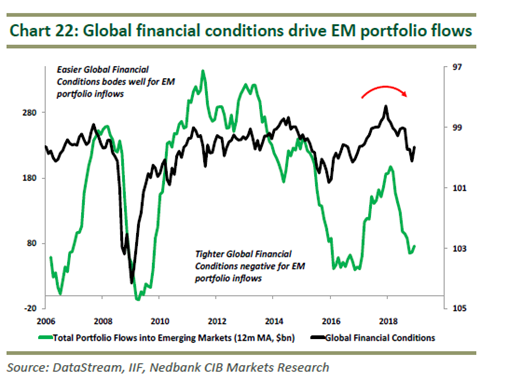

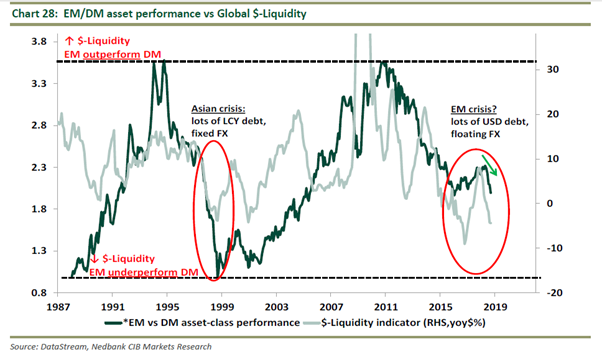

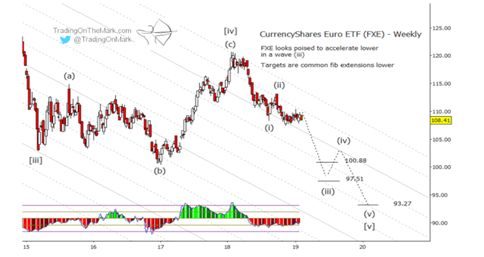

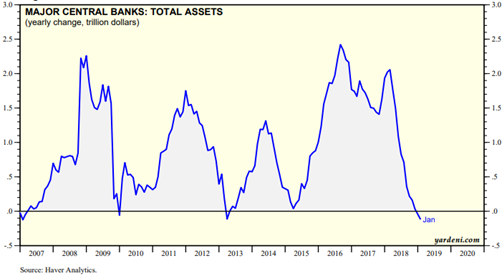

And we definitely cannot ponder the next recession without taking a global view. Since the last crisis, global Credit Bubbles have become highly synchronized, securities markets atypically synchronized, and economies uncommonly synchronized. Synchronization also applies within the markets – equities, investment-grade and “junk” corporate Credit, sovereign debt, M&A – “developed” and “developing.” Global asset prices – certainly including real estate – notably synchronized. When it comes to a synchronized global policy response, keep in mind that ECB and BOJ policy rates are basically at zero – with little evidence of benefits from negative rates. The ECB just ended QE, while the BOJ just keeps printing. With little effective ammo, policymakers exploit what they can to sustain the Bubble and hold fragilities at bay.

To be sure, today’s backdrop overshadows the world’s predicament heading into 2008/09. China and EM, in particular, were in the midst of powerful expansions in 2008 – burgeoning Bubbles readily resuscitated post-U.S. crisis. Fueled by China’s massive stimulus, the emerging markets became the “growth locomotive” pulling the entire global economy away from a downward spiral. Pondering the future, it is not at all clear how a vigorous downward spiral is repelled come the next crisis.

Policymakers continue to throw enormous stimulus at global markets and economies. Instead of stabilization, we’ve witnessed ongoing Bubble inflation and intensifying Monetary Disorder. And the more Bubbles inflate, the greater the underlying financial and economic fragilities – and the quicker the Fed was to conclude “normalization” and China was to, once again, aggressively spur lending.

What worries me most is that underlying instability and vulnerabilities have policymakers resolved to abrogate bear markets and recessions. Extraordinary measures continue to be taken to nullify business and market cycles, with apparently no appreciation for how vital adjustments and corrections are to sound financial and economic systems. Worst of all, structurally maladjusted and highly speculative global markets are emboldened as never before. Party like it’s twenty nineteen – with global financial, economic and geopolitical backdrops uncomfortably reminiscent of ninety years ago.

http://creditbubblebulletin.blogspot.com/2019/02/weekly-commentary-no-holds-barred.html