Doug Noland writes…..

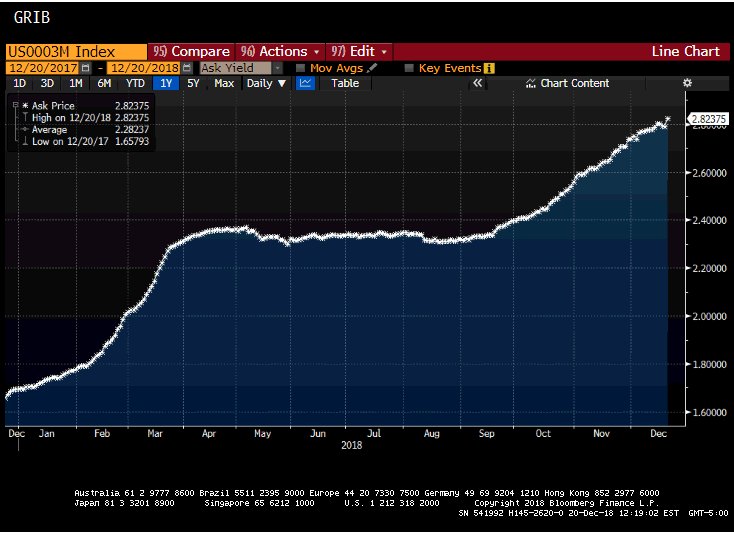

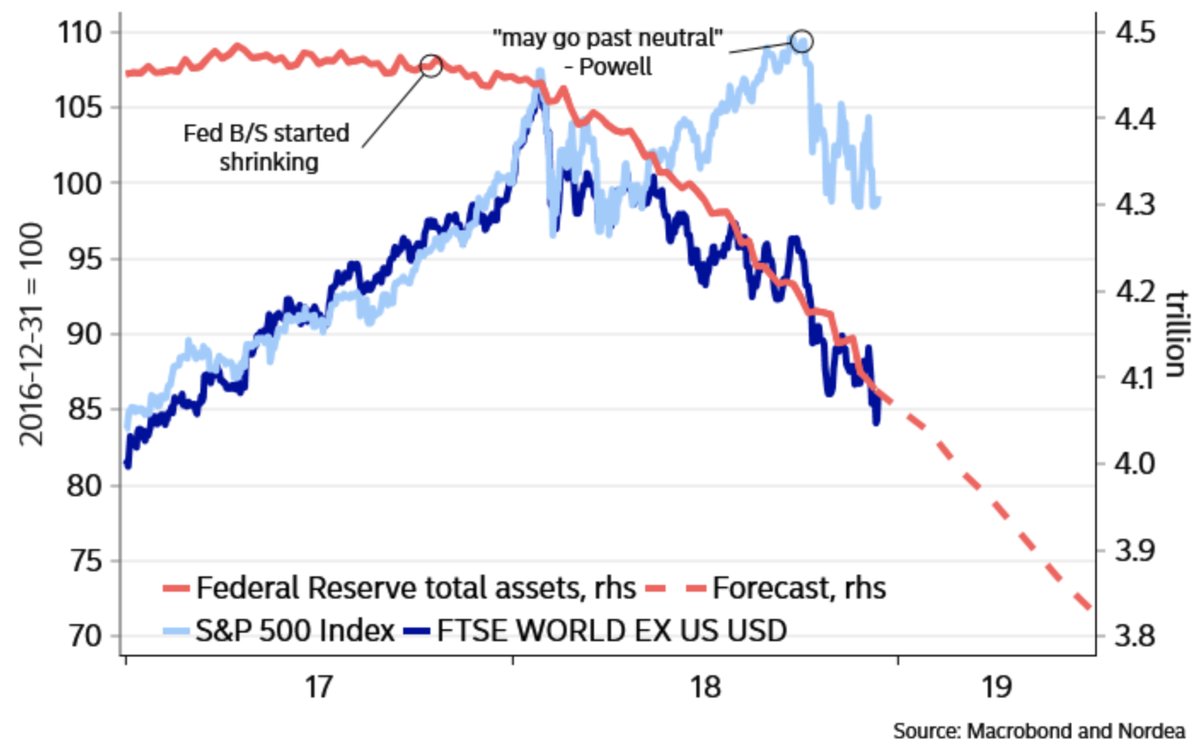

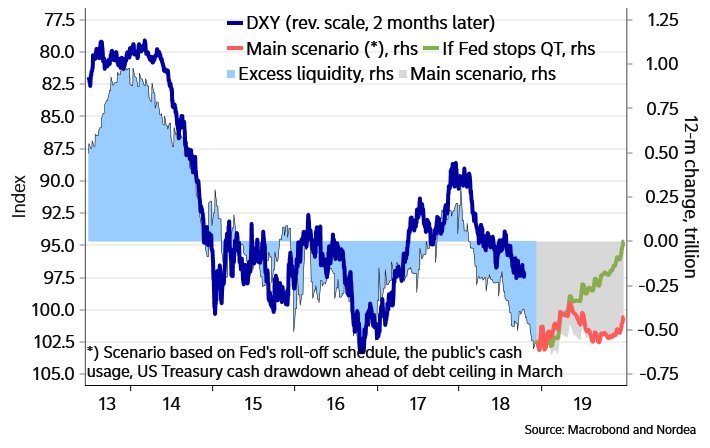

I have little confidence history will get this right. Today’s overwhelming consensus view holds that Powell this week committed a major policy blunder. After his early-October “we’re a long way from neutral” “rookie mistake”, he has followed with a rate increase right in the throes of a stock market sell-off, Credit market instability and mounting global and domestic economic risk. He stated the Fed’s balance sheet runoff was stuck on autopilot, even as stunned market participants fret illiquidity. Moreover, Powell disappointed skittish markets heading right into December quadruple-witch options expiration – in the face of an impending government shutdown. How times have changed.

There was irony in Alan Greenspan joining Bloomberg’s Tom Keene Wednesday for live coverage of the FOMC policy decision. It was, after all, the original “Greenspan put” that morphed over Bernanke’s and Yellen’s terms into the interminable “Fed put.” Markets this week were desperate for confirmation that the Powell Fed would uphold the tradition of pacifying the markets and, when needed, invoking the Federal Reserve backstop. Markets were prepared to begrudgingly tolerate a rate increase. But the marketplace demanded evidence – an explicit signal – that the FOMC recognized the gravity of market developments and was prepared to intervene. Chairman Powell didn’t share the markets’ agenda.

Our Federal Reserve Chairman should be commended. Under extraordinary pressure, Mr. Powell and the FOMC didn’t buckle.

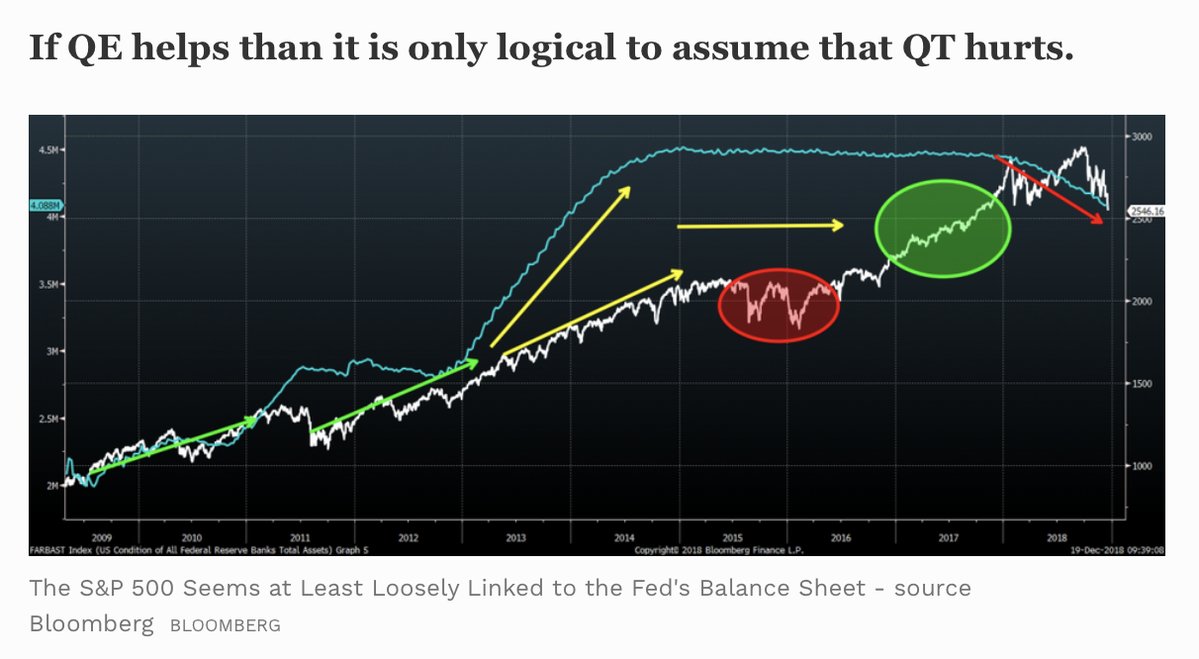

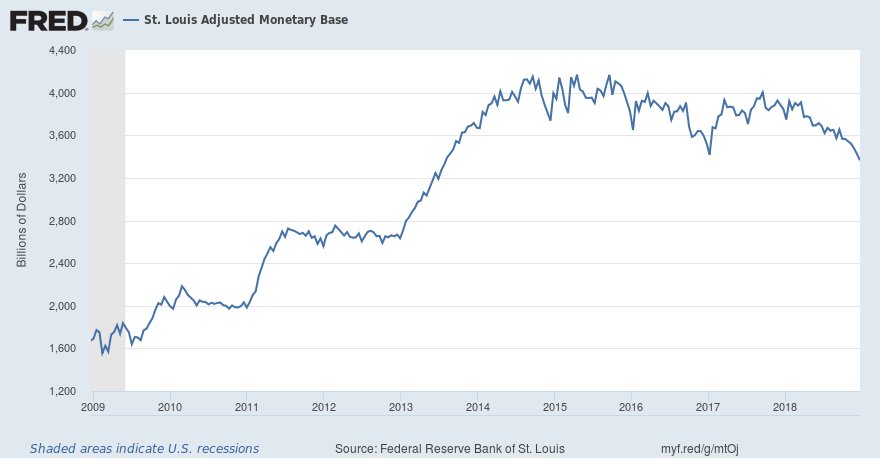

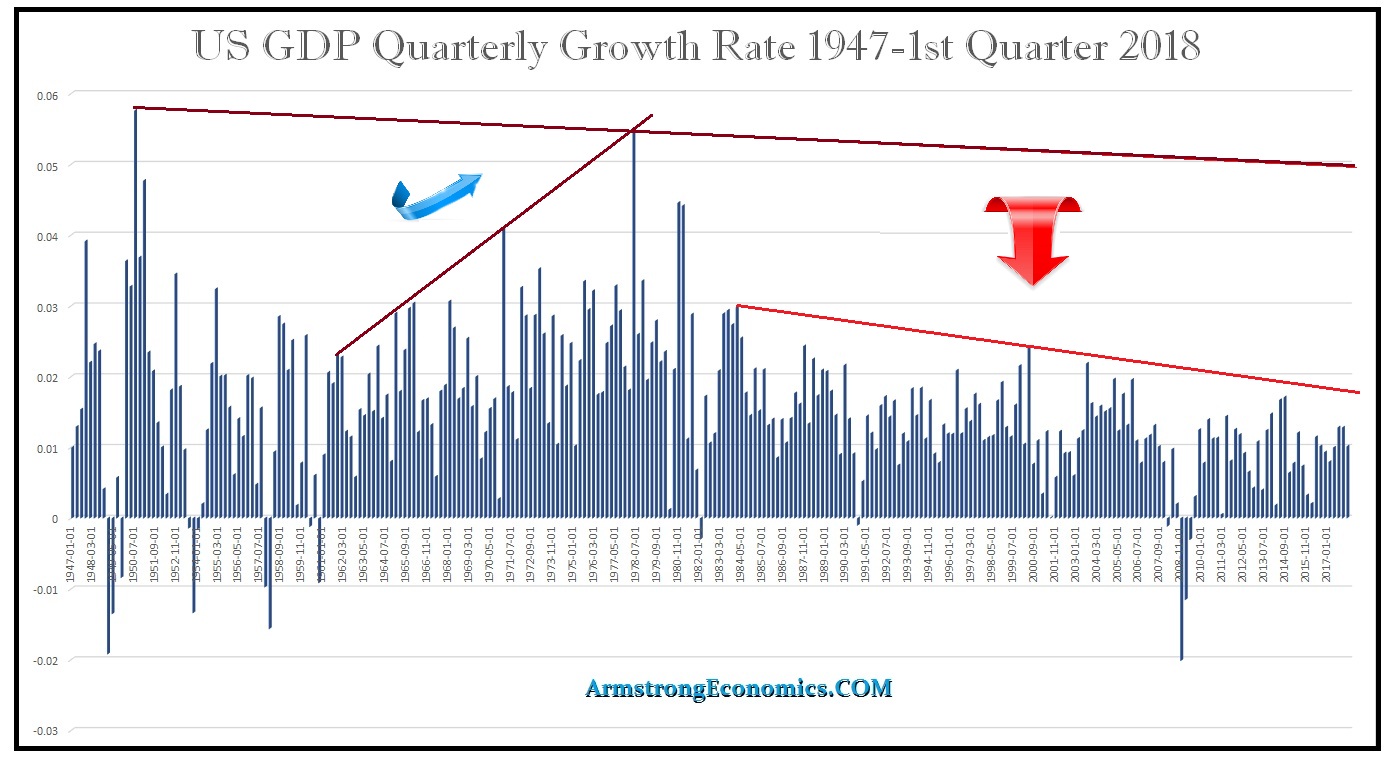

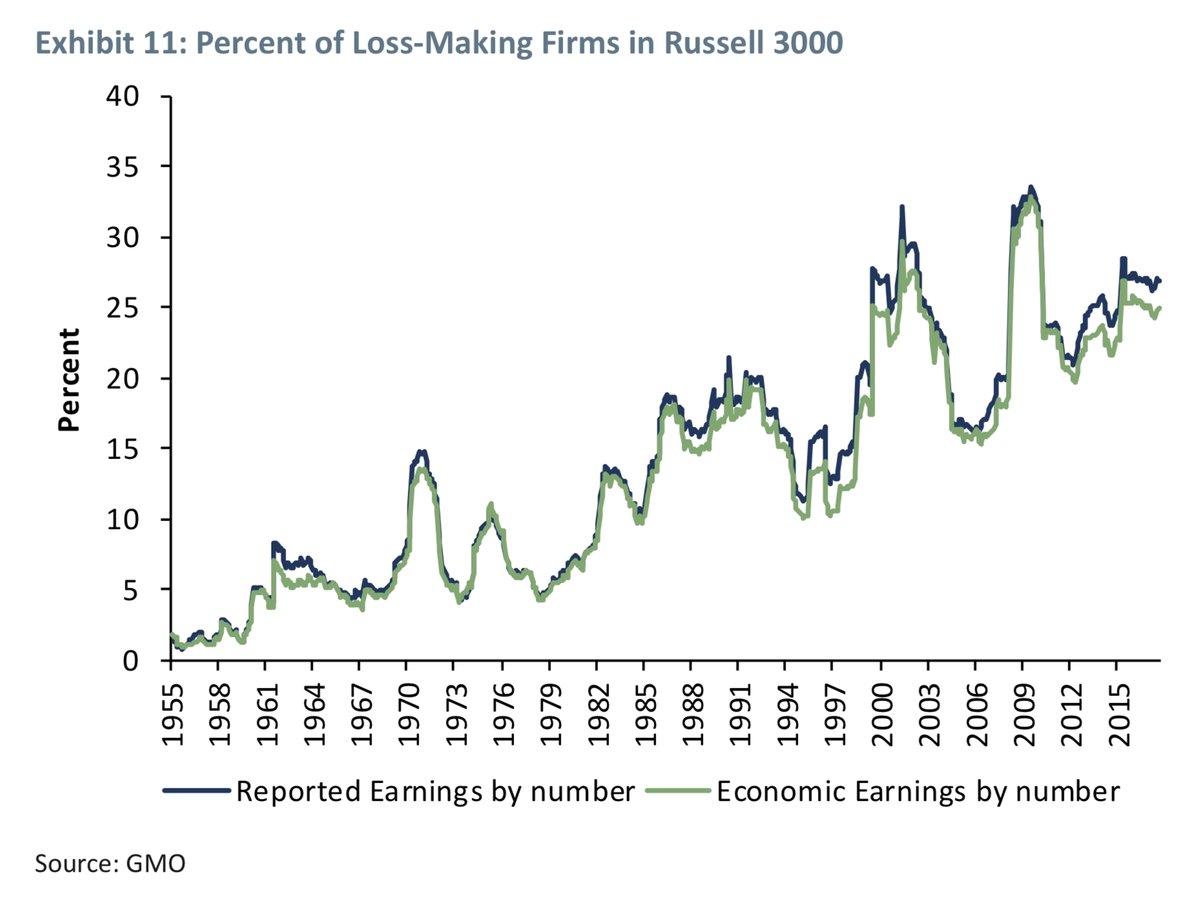

Expiration for the aged “Fed put” was long past due. For too long it has been integral to precarious Bubble Dynamics. It has promoted speculation and speculative leverage. It is indispensable to a derivatives complex that too often distorts, exacerbates and redirects risk. The “Fed put” has been integral to momentous market misperceptions, distortions and structural maladjustment. It has been fundamental to the precarious “moneyness of risk assets,” the momentous misconception key to Trillions flowing freely into ETFs and other passive “investment” products and strategies. The “Fed put” was central to a prolonged financial Bubble that over time imparted major structural impairment upon the U.S. Bubble Economy.

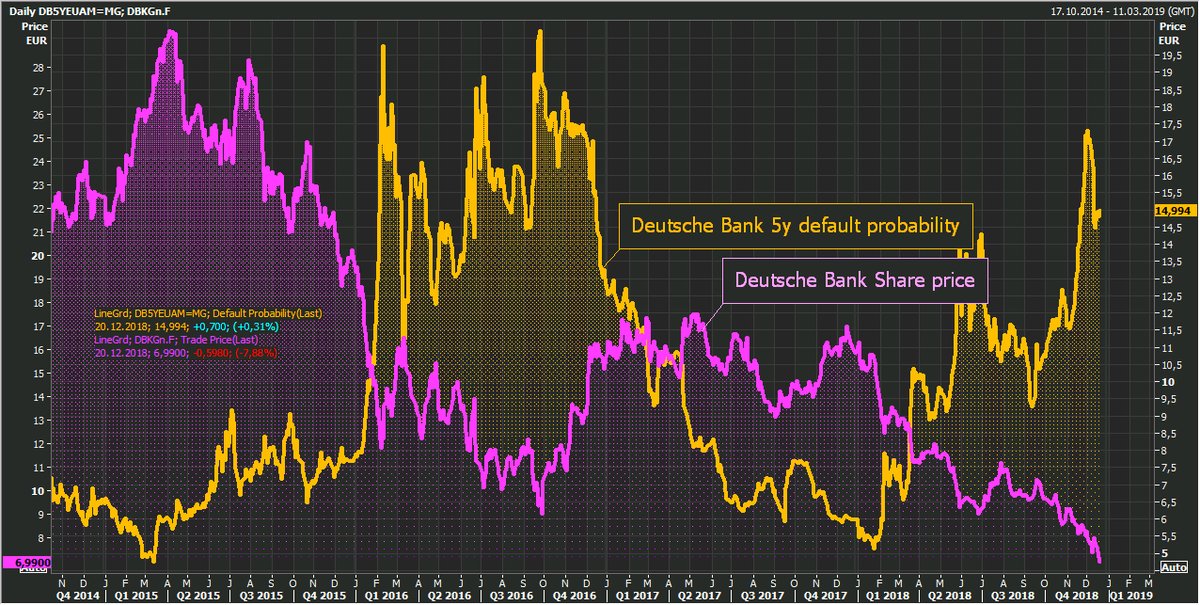

Moreover, prolonged U.S. financial and economic Bubbles were fundamental to Bubbles inflating on an unprecedented global scale. The “Fed put” morphed into a disastrous global “policymaker put” phenomenon. If not for the “Fed put,” never would there have been the audaciousness to set forth on “whatever it takes.” And the greater asset Bubbles inflated the more convinced everyone became that central banks and governments (certainly including Beijing!) had everything under control – and would in no terms tolerate a bust.

There is never a good time to pierce a Bubble. There definitely is no cure, so it’s a central banker and policymaker imperative to avoid supporting a backdrop conducive to Bubble Dynamics. There was never going to be a convenient time to end the “Fed put.” Implicit backstops and guarantees are problematic that way. Washington throughout the mortgage finance Bubble period was content with the markets’ view that the Treasury would backstop GSE obligations. No one was willing to rock the boat during the boom. Critical lesson not learned.

As for the Fed’s market “put”, it proved a challenge for Chairman Powell to distance the Federal Open Market Committee (FOMC) from an implicit backstop the Federal Reserve repeatedly employed starting all the way back with the 1987 stock market crash (evolving from liquidity assurances to Trillions of “whatever it takes” liquidity injections and zero rates in a non-crisis backdrop). The new Chairman intimated that he preferred the Fed move in a different direction, subtlety easily lost with the focus on communicating policy continuity. It was only when the markets were under acute pressure that participants would comprehend the seriousness of a subtle but momentous change in the Fed’s approach. That day came Wednesday.

December 21 – CNBC (Kate Rooney): “Federal Reserve Bank of New York President John Williams told CNBC on Friday the Fed is open to reconsidering its views on rate hikes next year. ‘We are listening, there are risks to that outlook that maybe the economy will slow further,’ Williams told Steve Liesman… Williams said despite this week’s forecasts, the central bank is not ‘sitting there saying we know for sure what’s going to happen’ in 2019. ‘What we’re going to be doing going into next year is reassessing our views on the economy, listening to not only markets but everybody that we talk to, looking at all the data and being ready to reassess and re-evaluate our views,’ he said.”

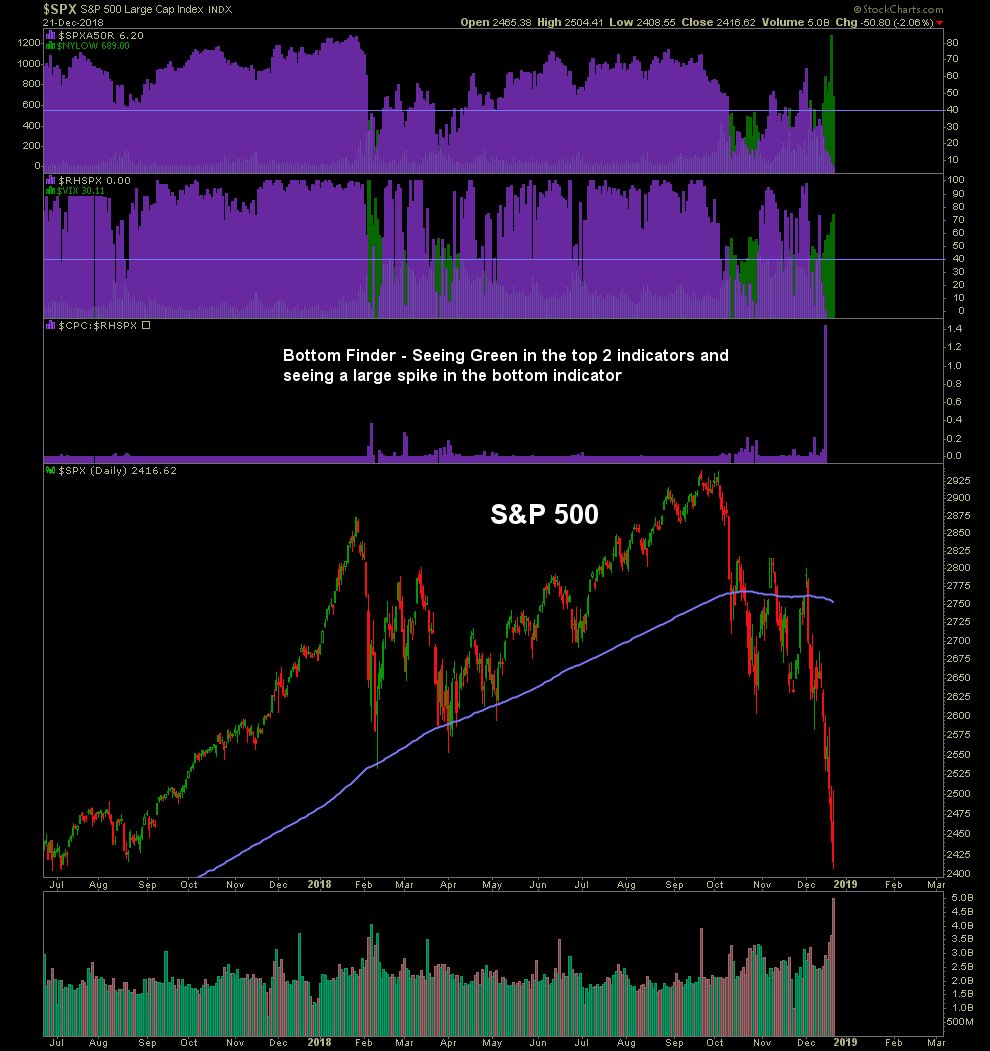

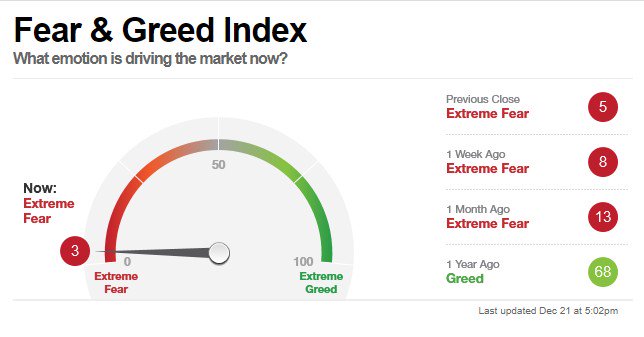

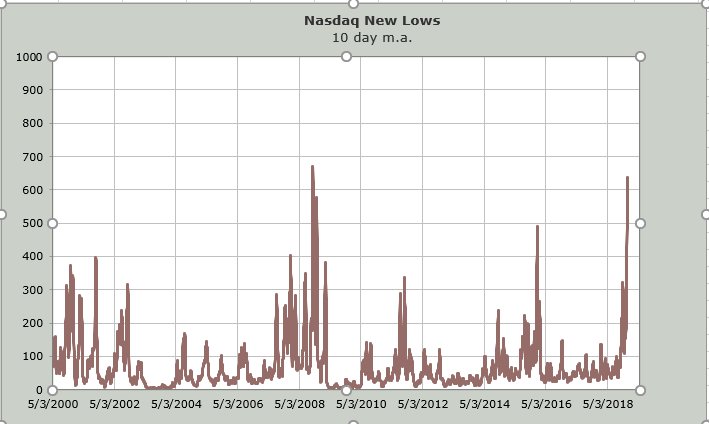

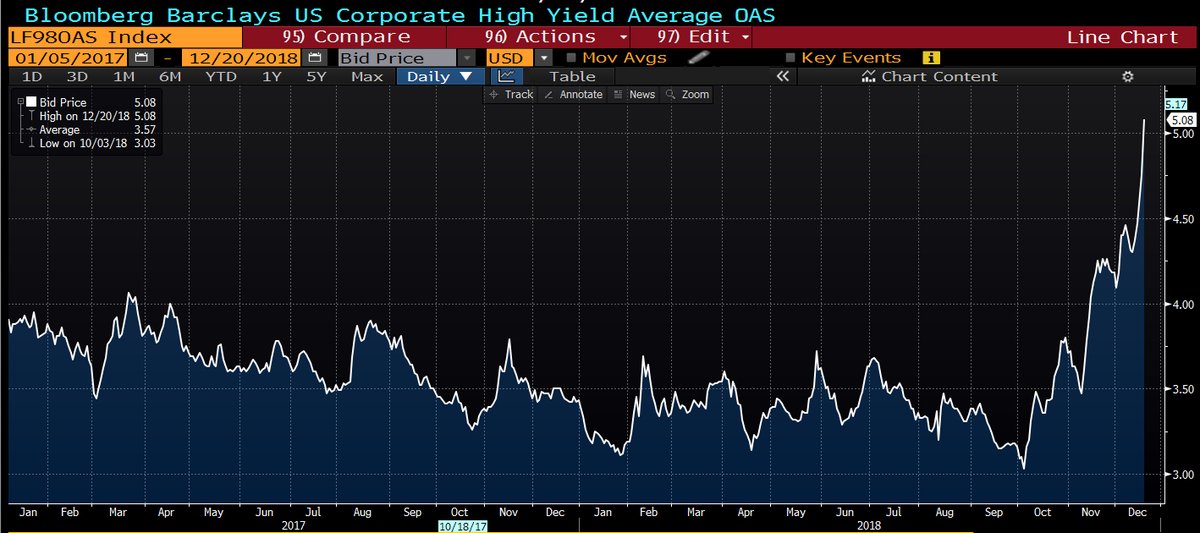

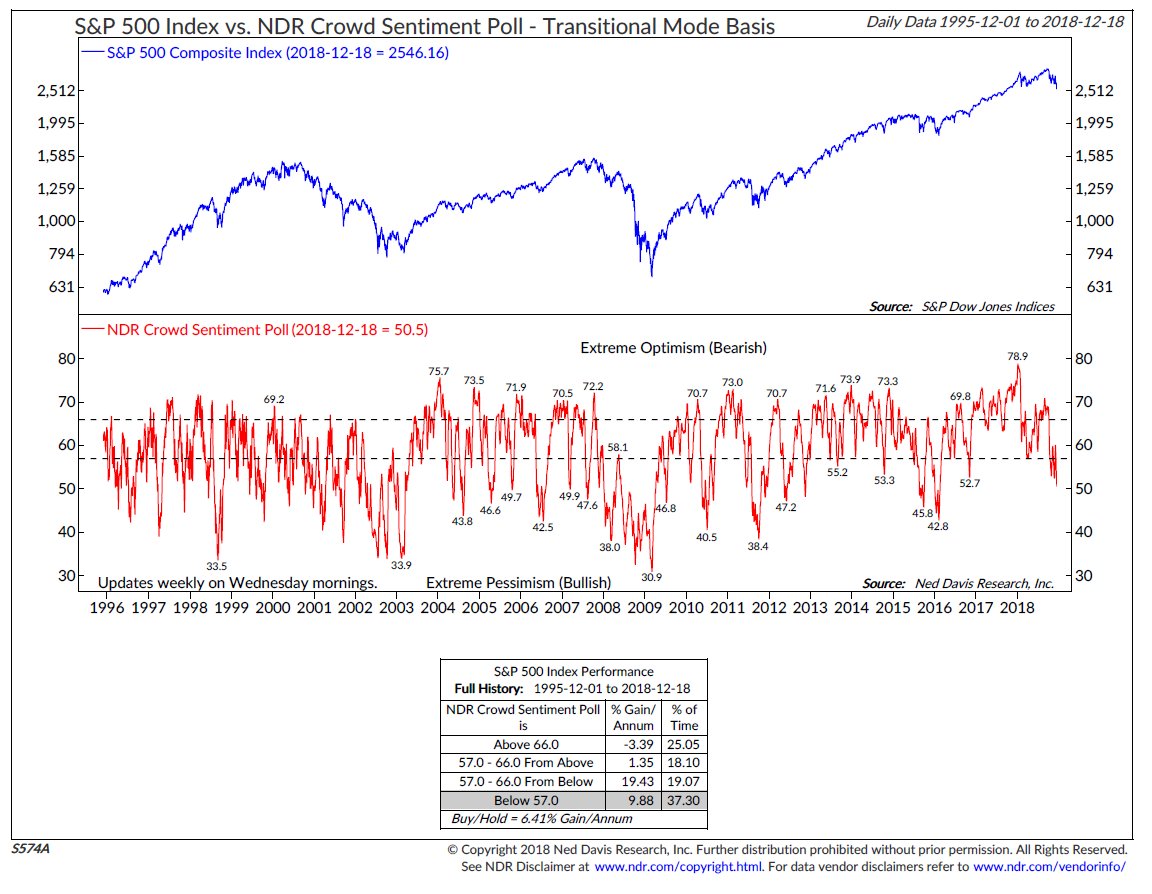

The Dow rallied 350 points in Friday morning trading on comments from (NY Fed President) John Williams. Yet another rally to evaporate. By that time, the damage had been done. Confidence had been shaken. Fear had completely supplanted Greed. And, to be sure, it’s not a market structure especially resistant to waning confidence. Indeed, acute fragilities are being laid bare. Bubbles don’t work in reverse. Crisis Dynamics have engulfed the “Core,” and I’ll leave it at that for this week.

I’ve always had serious issues with central banks promoting the perception that they would eagerly backstop market liquidity. Liquidity is a fundamental market risk – that can’t be permanently transformed, transferred or mitigated. It’s a precarious proposition to promote the belief that contemporary central banks – with unlimited capacity to create liquidity – will do “whatever it takes” to ensure highly liquid markets. Nevertheless, it’s extremely challenging to convey to market participants, central bankers, politicians and the general public why central banks aggressively underpinning the markets over the long-term promotes pernicious instability for the markets, real economies and humanity more generally.

The implicit “Fed put” seemed so innocuous when things looked good – so long as the Bubble was inflating. For going on a decade, Bubble Analysis has appeared a pathetic waste of time. Suddenly, cracks appear, confidence wanes, liquidity disappears, credit falters – and ramifications are anything but subtle: so much teeters on the markets’ perception of the efficacy of central bank market backstops. The world today hangs in the balance – markets, economies, politics and geopolitics. One of the greatest risks associated with the global government finance Bubble has been a crisis of confidence in policymaking.

It was inevitable the “Fed put” would turn problematic. The more explicit central backstops become, the more market distortions promote self-reinforcing speculative excess and Bubbles. The greater the scope of Bubbles, the more deeply manic markets become convinced that central bankers won’t allow the good times to end. Importantly, speculation and leverage will invariably expand beyond the expected capacity of liquidity backstops. This is why “whatever it takes” and “QE infinity” were so reckless. There became essentially no degree of excess that troubled the marketplace. It degenerated into a complete malfunctioning of the market mechanism.

I certainly don’t believe the “Fed put” is dead. The Powell Fed just meaningfully lowered the “strike price.” They’ll be forced to respond, but only after the market has suffered significant impairment. To the markets’ horror, the bursting Bubble will pass the point of no return before our central bank is compelled to aggressively defend the marketplace.

As painful as this process will become, and as deeply distressing it will be to see so many hopes, dreams and expectations crushed, the Powell Fed is taking the best approach. The Bubble would have inevitably burst. Indeed, the global Bubble has been deflating since earlier in the year. That the U.S. “Terminal Phase” of Bubble excess continued even as the global Bubble faltered created a perilous divergence that would end badly. It’s ending now – badly. The miserable downside would have only been worse had the Fed stepped in, bolstered the markets once again and extended the “Terminal Phase.”

It would have been the easy decision for Powell to just pull a Greenspan, Bernanke or Yellen. Just give the markets what they want and silence the temper tantrum. The three preceding Fed chairs invariably acted in the interest of sustaining or resuscitating Bubble Dynamics. In my view, at least two of the three seemed preoccupied with their own reputations and legacies.

In an age seemingly bereft of statesmen, Jay Powell is one. He will fall under only more intense pressure and criticism. This good man will be pilloried and blamed for a predicament decades in the making. Clearly, he’s the targeted presidential fall guy. History will surely be merciless, and it’s all unfair. I worry about a lot of things these days, including how our nation will attract talented and decent individuals into public service – especially now that they will be needed more than ever. We’re heading into challenging and unsettling times. Somehow our nation must to come together and support our institutions and responsible public servants.

http://creditbubblebulletin.blogspot.com/2018/12/weekly-commentary-powell-federal.html