In the following interview, Vanguard Chief Investment Officer Greg Davis addresses investment and economic conditions, investor expectations, and some of the ways technology is improving financial market efficiency and transparency.

The bull market in stocks that began in many parts of the world in early 2009 is nearly a decade old. Should investors adjust their expectations?

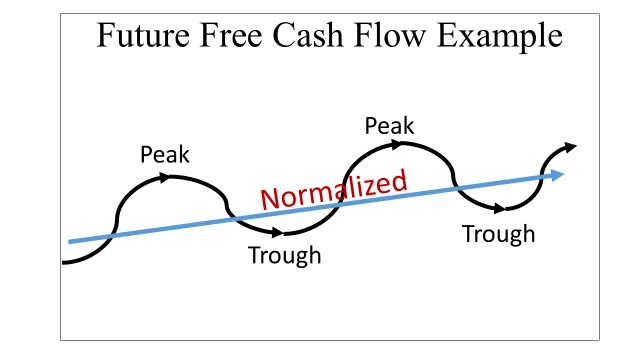

Based on our fair-valuation metrics, we expect globally diversified stock portfolios to deliver annualized returns in the 4.5%–6.5% range over the next ten years.1 That’s roughly half of their long-term historical average return. And it’s roughly a third of their annualized gains since the depths of the financial crisis a decade ago. So, yes, some investors probably are expecting too much from stocks.

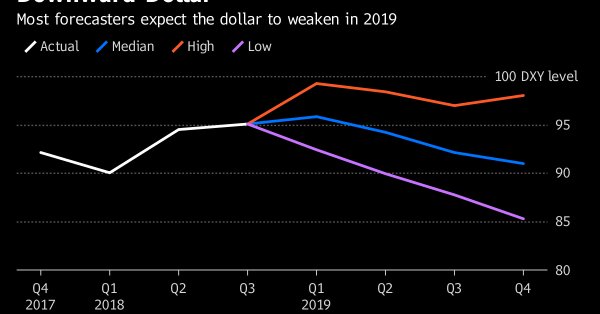

Below our headline expectations for global stock portfolios, which assume dollar-denominated investments, are somewhat higher forecasts for non-U.S. markets and somewhat lower forecasts for the U.S. market. We’re a little more optimistic about stocks outside the U.S. because their valuations are lower.

The U.S. Federal Reserve, the nation’s central bank, has raised its target for short-term interest rates eight times in the last three years. What’s changed in the U.S. fixed income markets as the Fed has worked to normalize monetary policy?

Longer-term bond yields began to rise in the middle of 2016, about six months after the Fed started its current cycle of rate hikes. But the curve has flattened a lot since then, as longer-term yields have climbed less than shorter-term yields. We believe one reason the increases in longer-term yields have been relatively muted is investor skepticism that the rate of U.S. inflation is going to spend much time above the Fed’s 2% target. One thing that rising yields, particularly short-term yields, have done is to make cash and U.S. Treasuries more compelling investments—a real competing force relative to equities in certain cases.

How many more Federal Reserve rate hikes are likely?

We’re expecting one more rate hike this year, when the Fed meets on December 18–19. It’s almost certain to be another quarter-percentage-point increase, as all of the Fed’s moves in the current cycle have been. If so, the target rate would rise from a range of 2.00%–2.25% to 2.25%–2.50%. We expect two more increases next year. By the time we get to the second half of 2019, we’re likely to be in neutral policy territory, with a target rate of 2.75%–3.00%.

Central bankers in other countries are only beginning to lift their target interest rates from global financial crisis lows. How do you expect them to proceed?

We expect the European Central Bank to leave rates alone until the fall of 2019, at which point it will begin to gradually normalize policy. The Bank of Japan seems unlikely to raise rates in 2019. Many of the emerging markets banks will be forced to tighten along with the Fed, although China is skirting the trend through further capital controls and modest yuan depreciation.

Your Fixed Income Group manages more than $1.2 trillion in bond and money market assets. What portfolio-construction approach is the team emphasizing?

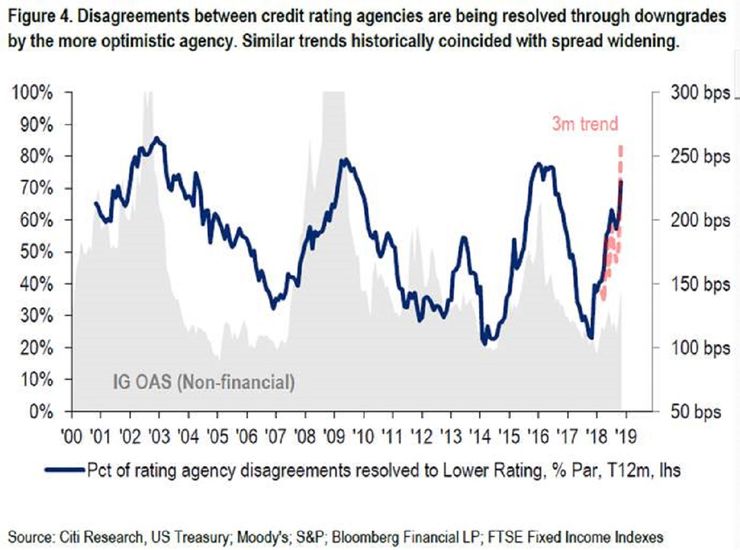

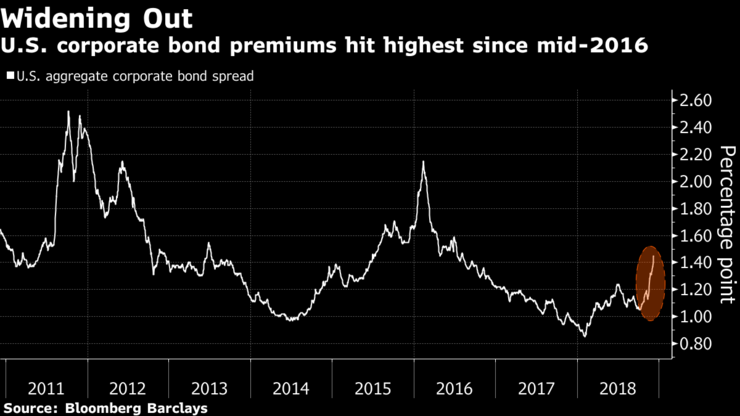

When we think about our active fixed income portfolios, we’ve been trying to be a bit more defensive. Valuations for U.S. investment-grade and high-yield bonds aren’t as attractive as they have been over the last ten years. There’s been a lot of spread compression—the differences between yields of lower-risk and higher-risk securities are not as large as they have been.Given the late phase of the economic cycle and the risk of more restrictive Fed policy, U.S. investment-grade and high-yield bonds could be negatively affected by rising corporate borrowing costs. So could emerging markets bonds, since many are issued in U.S.-dollar denominations or from countries with currencies pegged to the dollar. Of course, this doesn’t mean investors should necessarily avoid these segments. We believe diversification is crucial to long-term investing success. I like a quote from investment researcher Peter Bernstein, who said that if you’re not invested in something that makes you uncomfortable, you’re not really diversified.

You mentioned expected stock returns over the coming decade. How are global bond markets apt to perform?

In his 2019 economic and market outlook, Vanguard Global Chief Economist Joe Davis forecasted annualized global fixed income returns in the 2.2%–4.2% range in U.S. dollar terms, driven mostly by rising central bank policy rates and higher yields. Our estimates are notably higher than they were a year ago, when we anticipated 1.5%–3.5% returns. However, they remain muted compared to a long-term historical return of 4.7%.

If our new forecast proves accurate, globally diversified bond investors in many parts of the world should, over time, earn real returns—that is, returns above the rate of inflation. This assumes that central banks succeed in keeping inflation in the range of 2%, which is more or less the goal in the U.S., Canada, Australia, Japan, the U.K., and the euro area.

There have been some recent signs of modestly slower economic growth around the world. How might slower growth affect the financial markets?

The market effects of an economic slowdown, whenever the next one occurs, probably will depend on two factors—the speed and depth of the slowdown and the extent to which investors accurately anticipate those changes. Our Investment Strategy Group recently completed some interesting research on economic surprises and the returns of various asset classes. It found some correlation in the short term; the connection varied with the phase of the economic cycle. In the long term, on the other hand, it found that economic surprises don’t really matter.2

What are the chances of a U.S. recession in the next year or two?

We don’t see a U.S. recession as our base case, but we believe the possibility has risen as the yield curve has flattened. At this point, the probability might be 20%–30% in 2019. Looking at 2020, the risk might rise to 30%–40%. The primary drivers of rising recession risk are higher interest rates and concerns about slowing global growth. Our estimates reflect a pair of models: a single-factor model based on the slope of the yield curve, and a multifactor model that incorporates other leading indicators as well, such as credit spreads, stock market returns, and economic growth signals. The yield curve is sometimes dismissed as a recession warning signal, but our research suggests that it should not be ignored.3

The growth of indexing has been grabbing attention lately, with some speculating that its rise will lead to the next stock market downturn. Do you think there’s any there, there?

I don’t know what will cause the next market correction, but it won’t be indexing. I’m confident about that for several reasons. First, there’s been no historical correlation between indexing and market downturns. The percentage of fund assets in index funds has grown steadily, while the market has fluctuated more or less randomly. Second, index mutual funds and ETFs, which mostly follow index strategies, are a small part of the overall markets. Among U.S. stocks—easily the most heavily indexed asset class—index fund management accounts for less than 5% of the daily exchange-traded volume. And almost all of the trading in ETFs simply transfers ETF share ownership from one investor to another. Only about 10% of ETF trades cause buying and selling in the underlying securities that make up the funds. Finally, while some claim that index fund investors will rush to sell in the next downturn, exacerbating it, the opposite happened in 2000–2002 and 2008–2009. Investors sought out index funds, adding significantly to their holdings. It’s not clear to me why the next downturn would see them behave much differently.

What do you think about crypto currencies like bitcoin?

We’re not fans of bitcoin and see it as a speculative bubble. We are very interested in blockchain, the technology that underlies the electronic currency, and what it can do to increase our efficiency and that of the financial markets. For example, we’ve partnered with benchmark provider CRSP and Symbiont, a blockchain firm, to automate intraday index data transmission through a blockchain network. That will increase transparency and decrease the risk of disruptions sometimes caused by manual processes. In turn, this will make capital markets cheaper, faster, and more accurate for investors.

You’ve been Vanguard’s CIO for about 18 months. If there were only one message you could share with clients and prospective clients, what would it be?

That we’re more than an indexing and low-cost leader. We’ve historically delivered outperforming actively managed funds as well. During the ten years ended September 30, 2018, for example, 92% of our U.S.-domiciled actively managed funds topped the average returns of competing funds.4 We’re also determined to help investors everywhere—whether they’re investing for themselves, their families, or institutions, directly or through financial advisors or consultants—make the best possible decisions. That’s why we’ve invested heavily in our ability to provide financial advice. Our ability to do much more than index and deliver low costs is a natural outgrowth of our corporate stability and our client focus. Ultimately it reflects our mission—to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success. We’re serious about it.

1 Ten-year period is 2019–2028. See: Vanguard economic and market outlook for 2019.https://advisors.vanguard.com/VGApp/iip/site/advisor/researchcommentary/article/IWE_InvResGlblOtlkDnBtNtOt