Transcript: The Kiril Sokoloff Interviews: Stanley Druckenmiller

Featuring: Stanley Druckenmiller

Published Date: September 28th, 2018

Length: 01:24:27

Synopsis: Investment visionary Kiril Sokoloff is embarking on a series of exceptional interviews from his personal contacts for Real Vision. In the second episode of his series, he sits down with a revered titan of the investment world: Stanley Druckenmiller. Druckenmiller has an unrivaled track record that spans many decades. But what might be most incredible is that even whilst becoming one of the world’s most successful money managers, Druckenmiller has also managed to maintain an incredibly balanced and happy life. This interview provides a unique opportunity to learn the previously unheard secrets of an investment legend. Filmed on September 6, 2018 in New York.

Kiril Sokoloff is the chairman & founder of 13D Global Strategy & Research. To find out more about 13D Publications, visit 13d.com.

Topics: Career, Macro, Monetary Policy

Tags: Dusquene 13D Global Research & Strategy

Video Link: https://www.realvision.com/rv/channel/realvision/videos/aa7160fd4db64065a02399e0666b5378 The content and use of this transcription is intended for the use of registered users only. The transcription represents the contributor’s personal views and is for general information only. It is not intended to amount to specific investment advice on which you should rely. We will not be liable to any user for any loss or damage arising under or in connection with the use or reliance of the transcription.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

Raoul Pal: Hi. I’m Raoul Pal. I’m the CEO of Real Vision. And it’s my pleasure to personally introduce one of most incredible conversations that I’ve ever seen or we’ve ever had on Real Vision, and it’s led by my good friend Kiril Sokoloff. Kiril is one of the most legendary people in the investment research business. You can see by the quality of the guests that he brings to Real Vision that his contacts in the finance industry and the wider world are completely unparalleled. And this time, Kiril is going to do something extraordinary for us.

In this episode, he’s going to interview one of the greatest investors of all time, Stanley Druckenmiller. Stan has perhaps the best 30-year track record in money management history.

He’s compounded over 30% returns, and he’s never had a down year. Over 120 quarters, he’s only lost money in five. I mean, how is this even possible? How has he managed to make money day after day, year after year, decade after decade? That’s a question that nobody’s ever been able to answer. That is, until now. You see, Stanley Druckenmiller has never given an interview like this before. And in this incredible conversation, Stan tells Kiril how he was able to build that track record, how he’s operating in this new world of distorted price signals, and the opportunities and risks that he says lie ahead. It’s a truly extraordinary conversation that every investor will want to watch and then return to time and time again. There’s so much learning in this. So now, in the second episode of our Kiril Sokoloff series, please enjoy the full conversation with Stanley Druckenmiller.

Kiril Sokoloff: Stan, it’s a great pleasure to have you here.

Stanley Druckenmiller: Great to be here, Kiril. I’ve enjoyed your work for many, many years, so I’m excited about the opportunity.

KS: Thank you. Well, we are too. We’ve been friends for 25 years. Both of us are very low profile people. We avoid publicity. And thank you for trusting me to do this.

What I really want to drill down on is that incredible brain of yours that’s created this phenomenal track record that is, really, the best in history– 30 years performance managing outside money, never had a down year; 120 quarters, only five were down; 30% compounded over 30 years– how did you do it, and to try to understand the mindset approach to intelligence that enabled you to do that.

And secondly, to take that and bring it forward to today’s complexity– how you look at the world, what challenges, what opportunities, how are you operating differently given the fact that algos are running the markets, free money has destroyed price signals.

And third, to discuss Stan Druckenmiller’s other passions– your family, your extracurricular activities, and your philanthropy, which you do in a very low key way, which, of course, is the best way to do it.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

So let me start off by asking you a question on your balanced life. People in our business tend to be very focused and very driven, but I wouldn’t say that not that many of them are happy. And you’re a happy man. You’ve got a balanced life. You’re one of the great philanthropists in America. You’ve got a beautiful, evolved, spiritual wife who you love. You’ve got three lovely daughters who are all successful. And you have this balanced life with this incredible performance, and you’re a happy man. How do you do it?

SD: That’s kind of you to say. The balanced life is the key. And in my case, Fiona and I are both very private people, so we don’t really go out on the social scene in New York at all. We might go to three events a year, whereas I think most of my peers might go to three a week. And that frees up a lot of time.

I had the benefit of a very highly intelligent, creative wife who’s now had four different careers– she repots herself about every 10 years– who, after my children were born, she gave up everything to raise those children. And she did it in a very intense creative ways. She used to have this thing called special time, where each child, one day a week, for two or three hours after school, could go anywhere in New York and any activity with her, because she thought it was important with sibling rivalry to have individual time with each.

So it all sort of starts with her. And then I would really weigh in on the weekends. And maybe because I married a little late with her, which was when I was 35, I was successful enough at the time and had acquired enough knowledge that I was able to spend most of my time with the kids on the weekends. If it had been my 20s, I think it would have been a disaster.

That’s been a very, very important part of the balance. It’s interesting where– someone asked me– oh, Fiona and I talked about the difference between men and women and their response to their children. And you have to understand our children are 28, 27, and 25. And even today, when she has full time job, she’s running a business, she says the first hour of her day is spent thinking of all the things she’s going to do for the children that day, through texts and email she’s gotten– and arranging it– it’s the first thing she thinks about.

Of course, the first thing I think about is the euro and the yen. And I love my children, but it’s just it’s a whole different mindset. And I’ve been a huge beneficiary of that.

And one of my early mentors said, with children, if you get the first five years right, you’re rewarded the rest of your life. And if you got them wrong, you’re tortured the rest of your life.

KS: That’s very true. Very true.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

SD: Fiona extended the five to about 20 years, but having a happy family provides a whole lot of happiness and a whole lot of balance. So I think that’s pretty much been the key. And that’s freed up the extra time to do some physical activities as well as the philanthropy you mentioned.

KS: We’re all worried about entitlement for our kids. And we’re always struggling with that. How did you deal with it?

SD: You know, that is such a fascinating question. Fiona and I had a totally different philosophy on that. She felt no holds bar in giving the kids material stuff, and there was no reason to hide our wealth from them. I thought she was crazy, and this was going to be a disaster. But it was her area, and I deferred to her.

I’ve never heard her say no to those kids on anything except video games. It’s the only thing that was really heavily discouraged and she said no to. And I guess through osmosis or observing the parents’ values, or whatever, somehow strangely they all ended up being high achievers. We never, ever talked to them about philanthropy or charity or giving back, and yet they’ve all done stuff very actively to help the disadvantaged. I’m not sure how or why it all happened, but I guess it starts, again, with the mother that was with them so much time and taught them values.

But it’s bizarre, because I’ll never forget in the third grade, we had a teacher review with our oldest child. She wasn’t there. And the teacher wanted to know what Fiona had done, because the other wealthy kids were all bragging how they had country houses and this and that. And she said that Sarah, our oldest daughter, would never, ever talk about any of that, and wanted to know how we get schooled her in that. But it was never, ever brought up.

KS: Interesting.

SD: We’ve never hid their wealth from them. So Fiona kind of broke every rule in the book that you would read about in dealing with this subject, but things have worked out extremely well.

KS: Congratulations. Nothing like a happy man and a happy family.

So moving on to the world that we’re living in, this has been an especially volatile year. We’ve got a new Fed chair, we have possible contagion in emerging markets, we have a huge new fiscal stimulus in the US, which is distorting things, and we have a very aggressive foreign policy and trade policy on the part of the United States. So taking all that and whatever else you’re focused on, what are you really thinking about? Where is your focus right now?

SD: Yeah, well, since free money was instituted, I have really struggled. I haven’t had any down years since I started the family office, but thank you for quoting the 30-year record. I don’t even know how I did that when I look back and I look at today. But I probably made about 70% of my money during that time in currencies and bonds, and that’s been pretty much squished and become a very challenging area, both of them, as a profit center.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

So while I started in equities, and that was my bread and butter on my first three or four years in the business, I evolved in other areas. And it’s a little bit of back to the future, the last eight or nine years, where I’ve had to refocus on the equity market. And I also have bear-itis, because I made– my highest absolute returns were all in bear markets. I think my average return in bear markets was well over 50%. So I’ve had a bearish bias, and I’ve been way too cautious the last, say, five or six years. And this year is no exception.

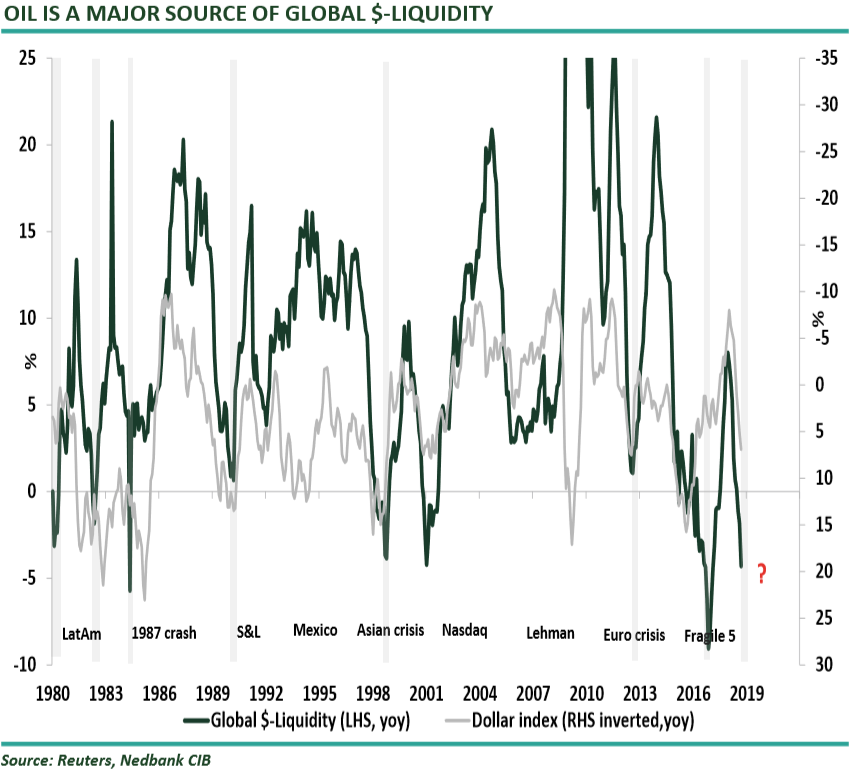

I came into the year with a very, very challenging puzzle, which is rates are too low worldwide.

You have negative real rates. And yet you have balance sheets being expanded by central banks, at the time, of a trillion dollars a year, which I knew by the end of this year was going to go to zero because the US was obviously going to go from printing money and QE to letting $50 billion a month, starting actually this month, run off on the balance sheet. I figured Europe, which is doing $30 billion euros a month, would go to zero.

So the question to me was, if you go from $1 trillion in central bank buying a year to zero, and you get that rate of change all happening within a 12-month period, does that not matter if global rates are still what I would call inappropriate for the circumstances? And those circumstances you have outlined perfectly. You pretty much have had robust global growth, with massive fiscal stimulus in the United States, where the unemployment rate is below 4. If you came down from Mars, you would probably guess the Fed funds rate would be 4 or 5/ and you have a president screaming because it’s at 175.

I, maybe because I have a bearish bias, kind of had this scenario that the first half would be fine, but then by July, August, you’d start to discount the shrinking of the balance sheet. I just didn’t see how that rate of change would not be a challenge for equities, other than PEs, and that’s because margins are at an all time record. We’re at the top of the valuation on any measures you look, except against interest rates. And at least for two or three months, I’ve been dead wrong.

So that was sort of the overwhelming macro view. Interestingly, some of the things that tend to happen early in a monetary tightening are responding to the QE shrinkage. And that’s obviously, as you’ve cited, emerging markets.

So the cocktail I mixed up for here was to continue– and this has been going on for three or four years– my firm to continue on the disruptors– that would be the cloud-based companies, the internet companies– to be short, the disrupted, which would be things like retail, staples, that kind of stuff; and with regard to China, to continued on who I thought would be the winners in the Chinese internet.

It’s been a below average year, mainly because the Chinese internets, which were very, very good to me the last two or three years, have been pretty much a disaster this year. I gave an interview at Sun Valley not this year but last year and said that I thought the Chinese internets were at less risk of government regulation than the US internet, and everyone in the audience howled with laughter. And I said, no, I’m serious because they’re partnering with the government

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

because they have all this information that they hand over to the government. The internet has been the greatest friend the Communist Party could ever imagine. Whereas 15 years ago, I would have told you the internet was going to destroy them. Well, at least on the gaming side with Tencent, I’ve been dead wrong, and it’s tended to drag that whole group down.

The other thing that happened two or three months ago, mysteriously, my retail and staple shorts, that have just been fantastic relative to my tech longs, just have had this miraculous recovery. And I’ve also struggled mightily– and this is really concerning to me. It’s about the most trouble I’ve been about my future as a money manager maybe ever is what you mentioned– the canceling of price signals.

But it’s not just the central banks. If it was just the central banks, I could deal with that. But one of my strengths over the years was having deep respect for the markets and using the markets to predict the economy, and particularly using internal groups within the market to make predictions. And I think I was always open minded enough and had enough humility that if those signals challenged my opinion, I went back to the drawing board and made sure things weren’t changing.

These algos have taken all the rhythm out of the market and have become extremely confusing to me. And when you take away price action versus news from someone who’s used price action news as their major disciplinary tool for 35 years, it’s tough, and it’s become very tough. I don’t know where this is all going. If it continues, I’m not going to return to 30% a year any time soon, not that I think I might not anyway, but one can always dream when the free money ends, we’ll go back to a normal macro trading environment.

KS: Well, let’s talk about the algos. We haven’t seen the algos sell. We’ve seen the algos buy. We saw a little bit of it in February, and there was some concentrated selling. We saw it in China in 2015, which was really scary. Most people weren’t focused on that, but I was, like you were too.

And they’re programmed to sell if the market’s down 2%. Machines are running, can’t be stopped. A huge amount of trading and money is being managed that way. And we’ve been operating in a bull market and a strong economy. What happens when it’s a bear market and a bad economy? And will things get out of hand?

So knowing that, and knowing the risk of that any moment unfolding, January-February just came like this. How are you protecting yourself and insulating– what are you watching for that that might happen?

SD: It’s a little bit like after 9/11 waiting for the next terrorist act, in which case you would have missed are a roaring bull market for the next six years, because you’re sitting there because Dick Cheney told your neighbor you’re supposed to move out of New York. I’m just going to trust my instincts and technical analysis to pick up the stuff.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

But I will say that– and I proved it to my own detriment the last three or four years– the minute the risk reward gets a little dodgy, I get more cautious than I probably would have been without this in the background. But I want to be clear that the major challenge for the algos, for me, is not some horrible market event. I can actually see myself getting caught in that, but I could also see myself, perhaps, taking advantage of it.

The challenge for me is these groups that used to send me signals, it doesn’t mean anything anymore. I gave one example this year. So the pharmaceuticals, which you would think are the most predictable earning streams out there– so there shouldn’t be a lot of movement one way or the other– from January to May, they were massive underperformers. In the old days, I’d look at that relative strength and I’ll go, this group is a disaster. OK. Trump’s making some noises about drug price in the background.

But they clearly had chart patterns and relative patterns that suggest this group’s a real problem. They were the worst group of any I follow from January to May, and with no change in news and with no change in Trump’s narrative, and, if anything, an acceleration in the US economy, which should put them more toward the back of the bus than the front of the bus because they don’t need a strong economy.

They have now been about the best group from May until now. And I could give you 15 other examples. And that’s the kind of stuff that didn’t used to happen. And that’s the major challenge of the algos for me, not what you’re talking about.

Now, that might be a challenge for society and the investing public in general. And yes, I can get caught like anybody else in that. But yeah, there’s probably some degree of having one foot out the door that I otherwise might not have, because I do know this is in the background.

You do know, though– I read– I skimmed the article, but there was something in the paper about how we’re taking more measures to put in circuit breakers, whatever they call those things, to stop the phenomena you’re talking about. It doesn’t mean they’ll be effective, but—

KS: So how are the algos operating? Why are they distorting the price signals?

SD: Well, I’ll just, again, tell you why it’s so challenging for me. A lot of my style is you build a thesis, hopefully that no one else has built; you sort of put some positions on; and then when the thesis starts to evolve, and people get on and you see the momentum start to change in your favor, then you really go for it. You pile into the trade. It’s what my former partner George Soros was so good at. We call it– if you follow baseball, it’s a slugging percentage, as opposed to batting average.

Well, a lot of these algos apparently are based on standard deviation models. So just when you would think you’re supposed to pile on and lift off, their models must tell them, because you’re three standard deviations from where you’re supposed to be, they come in with these massive programs that go against the beginning of the trend. And if you really believe in yourself, it’s an

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

opportunity. But if you’re a guy that uses price signals and price action versus news, it makes you question your scenario.

So they all have many, many different schemes they use, and different factors that go in. And if there’s one thing I’ve learned, currencies probably being the most obvious, every 15 or 20 years, there is regime change. So currency is traded on current account until Reagan came in and then they traded on interest differentials. And about five years, 10 years ago, they started trading on risk-on, risk-off. And a lot of these algos are built on historical models. And I think a lot of their factors are inappropriate because they’re missing– they’re in an old regime as opposed to a new regime, and the world keeps changing. But they’re very disruptive if price action versus news is a big part of your process, like it is for me.

KS: So how does that play out? Is this going to get worse, or does it blow up? How do you see it?

SD: I pray it blows up, but I don’t see that happening because money managers are so bad, I assume they’re going to outperform 90% to 95% of the money managers. I think the– I don’t know whether you read Kasparov’s book, but he thinks like the ultimate chess player. It’s not the machine, it’s the machine with the man and his intuition using the machine heavily.

I think there’s always going to be five or 10– maybe not a lot more– humans who the best machine in the world, the AlphaGo type thing, will never beat that human as long as he’s using the machine. And they need to be used, and they need to be understood.

I can’t see me passing my money onto a machine, but I think I’d be an idiot not to know the effect these machines are having. And frankly, using them is just one more input that I didn’t have 20 or 30 years ago. But you’ve got to understand when the signals are real and when they’re driven by them, and you got to understand the time frames.

KS: Are you using machines yourself?

SD: I have money with a couple of machines. It’s a very small amount of money. It’s just enough money so they send me signals when they think something dramatic is happening. And I’m early enough on the process that I don’t know my conclusion, but I assume that a lot of these machines are on the same factors. And if the machines start saying something is going to happen, they send me a notice. And that’s– to use a football term– that’s under review. I’m going to watch this for a year or two and see if they’re on to something or if they aren’t.

KS: And there seems to be correlations that make no sense.

SD: Yes.

KS: For example, the RMB and gold are trading very closely. It makes no sense.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

SD: Yeah.

KS: And that’s very dangerous.

SD: And even day to day, there’s correlations that make no sense. It’s all messed up. My great hope is, A, we get out of this ridiculous monetary regime. And when we do, things start to make sense again. I’ve always, as you know, maybe to a fault, have been a critic of the new monetary regime, which is very academically run.

And I’ve always thought part of capitalism was you got to have a hurdle rate to investment. You can’t just go on these silly inflation this and that– that if you’re going to make an investment, it should have some hurdle rate. And I think taking the hurdle rate away from investments and all this stuff is causing a lot of this stuff we’re talking about. I don’t know that, but that’s my intuition. And I’m hoping that, A, we go back to some sort of normal regime sometime in the next 20 years.

And then I’m hoping that the stuff you’re talking about at least diminishes greatly. But I don’t know, Kiril. I just don’t know. Like everything else, I’m open minded on it.

KS: So summer of 2017, there was a hope that Kevin Warsh might run the Fed. He worked for you for seven years. I met him. He was against QE too, as you were, as I was. And unfortunately, that didn’t happen. He worked for you for seven years.

SD: He still works for me.

KS: He still works there. What a fantastic opportunity to have a Fed chair grounded in the real world for once.

So if you were running the Fed now, what would you do? And I give the two challenges which you obviously know, but for the audience– if you don’t raise rates, asset prices continue to build, and one of your major points in the past has been the way you cause a deflation is to deflate an asset bubble that went too high. That’s been a major concern of yours and mine. On the other hand, because of the enormous rise in debt– $247 trillion, up 11% in the last year, three times global GDP– a lot of companies and countries would be bankrupt if interest rates go too high. Plus, all the malinvestment that took place as funds were forced to lend money at ridiculous rates. So how do we regularize?

SD: This is really a problem. You said on low key or under the radar or wherever it is– but in every private talk I’ve given for the last five years, I’ve answered this question the same way. But it’s a much, much, much more challenging situation than five years ago for the reasons you cite.

One of the more incredibly revealing things Trump said when he went after the central bank is, we shouldn’t be raising rates. Don’t they know we have all this debt to issue coming up? But it’s the chicken and the egg. The reason the debt has exploded– again, there’s no hurdle rate for investment. And when you can borrow money at zero, of course, debt is going to explode.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

So you’re exactly right. We have this massive debt problem. If we don’t normalize, it’s going to accelerate and cause a bigger problem down the road. If we do normalize, we’re going to have a problem. And unfortunately, we’re going to have a much bigger problem than we would have if we had normalized four or five years ago.

So I’m going to give you the same answer I gave at a dinner four or five years ago. I would raise rates every meeting as long as I could. And the minute you got substantial disruption, I would back off. And the sad thing is, since I made that statement, oh, my god, we’ve had these just rip roaring markets. And what I was saying is, just sneak one in every time you can. Just sneak one in. And they’ve passed up on so many golden opportunities.

But the problem now– and you articulated it beautifully– is, now, the debt is so much higher, particularly in emerging markets, than it was five years ago. You’re not going to be able to raise that much more, and we’re already starting to see the consequences. But somehow, if I’m reading them correctly, which is not easy, they seem to have stumbled into, with Chairman Powell, pretty much the formula I would be doing now, although I wouldn’t be on this quarterly path. It’s way too predictable, which is, as I’m reading them– by the way, other people with just as big brains are reading in the opposite. They’re going to go every opportunity they have until you have a dramatic tightening in financial conditions.

And because of the data out there, that’s how I would play it right now. You can’t just say, OK, I’m going to 3 and 1/2 or 4. No, you just sneak one in, see if they handle it– and when I say they handle it, I’m not talking about 5% or 10% correction. I’m talking about all the various measures out there that we need to look at. That’s what I would do.

But it’s just kind of ridiculous with the unemployment rate at 3.8 here, and conditions where they were are everywhere, to have rates at this level. And probably the most egregious has been the ECB. And one can’t even imagine the rot that must be in those banks from malinvestment.

KS: Well, I remember back in ’96– I think we were both in the same place at the contagion in emerging Asia, and I was arguing it was going to spread to all emerging countries and then come back to the United States, which it did. But it fueled– all that money came into the US and fueled the US bubble much worse than it would have been. So the question is, if we keep raising rates, is that same scenario going to happen, putting our market more at risk of higher valuations?

SD: I don’t think that last blast off in NASDAQ was because of higher rates. I think it was because– if you remember, we cut in September of ’98, then we did the intermeeting cut in midOctober, and then with the market on a new high, Greenspan did one final cut at the end of October. And I remember having been bearish that summer and then doing an about face, thinking we don’t need to be easing, there’s nothing at all wrong with the American economy.

And this money is probably going to flow into the US. So I think the phenomena you described has already been happening. So I think we’re somewhat well on the way.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

It’s interesting you bring up that period, because one of the more disturbing things that Powell said in Jackson Hole was his praising of Greenspan in the late ’90s. In my opinion– and by the way, it’s all over the media what a genius he was for not hiking and letting the thing run. In my opinion, that was the original sin when the NASDAQ went to 125 times earnings, hit a dot-com bust, and then because of the dot-com bust, we offset that with the housing thing. So that started the whole thing.

So I have a very– you hate to have a different opinion with the central bank consensus, because you’re not in charge of the central bank, they are, but– so no, I think the phenomena you’re talking about is already happening– that money is flowing in here.

On a practitioner’s basis, we have a lottery ticket in Brazil and in South Africa, because, as we’ve seen, back in the ’90s and again now, these things can move 50%, 60%, and your risk is probably not much more than the carry. I don’t know whether I’m going to get paid, but with the monetary tightening, we’re kind of at that stage of the cycle where bombs are going off. And until the bombs go off in the developed markets, you would think the tightening will continue.

And if the tightening continues, the bombs will keep going off, I would think, in emerging markets, because there was no more egregious recipient of free money than emerging markets, because you had the double whammy. A, all the vanilla money managers poured money into the place. B, you had no market constraints on the political actors. I mean, the stuff that was going on even a year or two ago– and can you imagine that Argentina issues a 100-year debt? 100 years at 7%– I can’t even remember a government surviving for five or 10 years, much less 100 years.

KS: So you’ve been in tech, big tech. You’ve been right for the right reasons. How do you navigate the phenomenal oligopolies that they are, profit machines they are, with what looks like a regulatory tidal wave coming at them? And how do you decide when to get off that investment?

SD: Perhaps I should have gotten off of a few weeks ago, and I missed my window. Kiril, it’s hard to figure out. I guess, let’s just take Google, OK, which is the new bad boy, and they’re really a bad boy because they didn’t show up at the hearing. They had an empty chair because they only wanted to send their lawyer.

But it’s 20 times earnings. It’s probably 15 times earnings after cash, but let’s just say it’s 20 times. Let’s forget all that other stuff. And they’re under earning in all these areas, and losing money they could turn it off. And then I look at Campbell’s Soup and this stuff selling at 20 times earnings.

And they’re the leaders in AI– unquestioned leaders in AI. There’s no one close. They look like they’re the leaders in driverless car. And then they just have this unbelievable search machine.

And one gets emotional when they own stocks, when they keep hearing about how horrible they are for consumers. I wish everyone that says that would have to use a Yahoo search engine. I’m

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

65, and I’m not too clever, and every once in a while, I hit the wrong button and my PC moves me into Yahoo. And Jerry Yang’s a close friend so I hate to say this, but these things are so bad.

And to hear the woman from Denmark say that the proof that Google is a monopoly and that iPhones don’t compete with Android is that everyone uses the Google search engine is just nonsense. You’re one click away from any other search engine. I just I wish that woman would have to use a non-Google search engine for a year– just, OK, fine, you hate Google? Don’t use their product, because it’s a wonderful product.

But clearly, they are monopolies. Clearly, there should be some regulation. But at 20 times earnings and a lot of bright prospects, I can’t make myself sell them yet.

KS: Right.

SD: Now, one thing the Chinese internets are proving, outside of Tencent, they’re just reminding us if and when we get in the bear market, it doesn’t matter what your fundamental earnings are. You could argue Tencent, OK, there’s an air pocket in games, and we all know what’s going on there, but Alibaba has beat every estimate just nonstop. And the stock’s gone from 210 to 165. It’s just a reminder that all these estimates where they project out earnings three or four years from now, and then they price of sales based on today’s price of sales, some of these cloud companies are selling at 10 times sales. If they’re selling at six times sales, which is not crazy in a normal market– by the way, I own these things– in three or four years, I’ll have lost money.

So it’s a challenge. It’s a challenge. I completely missed Apple, because I’m not really a value investor and I just looked at that enterprise. I don’t even think the phone is going to be the medium in 5 or 10 years. I don’t know if it’s going to be in your contact lens or some hologram, but– so I completely missed that one.

KS: When you worked with Soros for 12 years, one of the things that you said you learned was to focus on capital preservation and taking a really big bet, and that many money managers make all their money on two or three ideas and they have 40 stocks or 40 assets in their portfolio.

And it’s that concentration that has worked. Maybe you could go into that a bit more, how that works, how many of those concentrated bets did work, when you decided to get out if it didn’t work, do you add when the momentum goes up assuming the algos don’t interfere with it?

SD: As the disclaimer, if you’re going to make a bet like that, it has to be in a very liquid market, even better if it’s a liquid market that trades 24 hours a day. So most of those bets, for me, invariably would end up being in the bond and currency markets because I could change my mind. But I’ve seen guys like Buffett and Carl Icahn do it in the equity markets. I’ve just never had the trust in my own analytical ability to go in an illiquid instrument, which in equity is if you’re going to bet that kind of size on– you just have to be right.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

And for all the hoopla around Mr. Buffett, from ’98 to 2008– that’s a 10 year period– Berkshire Hathaway was down 40%. Nobody talks about that. If you had a hedge fund, you couldn’t have a hedge fund down for 10 years, 40%. They would have gone out of business in year 3, 4, somewhere in there.

But to answer your question, I’ll get a thesis. And I don’t really– I like to buy not in the zero inning and maybe not in the first inning, but no later than the second inning. And I don’t really want to pile on in the third or fourth or fifth inning.

So I guess examples are the best. One bet I made, which was the gift that kept on giving– it was after a funny incident with Soros. I had been there six months, wasn’t clear who was running the fund. Well, it was clear it was him, but he was trading very badly. And I was trading very badly. And I had come from a environment at immodestly where people thought I was some kind of superstar, and no one had ever questioned me.

And I flew to Pittsburgh because I had Duquesne at the same time. And he blew out my bond position while I was on the plane. I’d had total autonomy anywhere I’d been my whole career. So I basically call him up on a pay phone– that’s what we used back then– and resigned.

When I came back, he told me he was going to go to Eastern Europe for five months, and that he wouldn’t be trading. And maybe we were just in each other’s hair, and he couldn’t have two cooks in the kitchen. And let’s see whether that was a problem, or if I was really was inept– his words, not mine.

So while he was in Eastern Europe, the wall came down. And I had a very, very strong belief that Germans were obsessed with inflation. I know that most of them thought Hitler would have never happened if the Weimar Republic thing hadn’t happened. And when the wall came down, and it looked like they’re going to merge with East Germany, the world’s thesis was, this is going to be terrible for the Deutschmark.

My thesis was, the Bundesbank is the most powerful institution in Germany. The public is obsessed with inflation, and they will do whatever it takes on the rate side to keep their currency strong. And there’s no way that Deutschmark is going down. In fact, the place is going to grow like a weed with all this labor from Eastern Germany.

So while he was gone, this happened, and the Deutschmark gets killed the first two days. Now, here we are in zero inning. And I went in very, very big right away because the market gave me an opportunity. And I can’t remember what it was down. It was down 3% or 4%, and I thought it should be up 10%.

And then that, of course, led to this recurring devaluation. It started with Italy, but obviously the pound. Let’s not go over that. That’s been beat to death– Sweden– all these things we kept playing, and they’re going on and on.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

But there is a case where we never really averaged up. And in fact, we couldn’t, because we were dealing, in those instances, with fixed currencies. So there’s no price momentum. You’re betting that something is going to break.

But even against the dollar, it’s all-in right away. Normally, I’ll wait for– I’ll go in with, say, a third of a position and then wait for price confirmation. And when I get that, when I get a technical signal, I go.

I had another very close experience with the success of the Deutschmark, which was the euro. I can’t remember– I think it was 2014 when the thing was at 140, and they went to negative interest rates. It was very clear they were going to trash that currency, and the whole world was long the euro. And it would go on for years. I’d like to say I did it all at 139, and I did a whole lot, but I got a lot more brave when it went through to 135. And that’s a more normal pattern for me.

Then there would be this strange case of 2000, which is kind of my favorite, and involves some kind of luck. I had quit Quantum, and Duquesne was down 15%. And I had given up on the year and I went away for four months, and I didn’t see a financial newspaper. I didn’t see anything.

So I come back, and to my astonishment, the NASDAQ has rallied back almost to the high, but some other things have happened– the price of oil is going up, the dollar is going way up, and interest rates were going up– since I was on my sabbatical. And I knew that, normally, this particular cocktail had always been negative for earnings in the US economy. So I then went about calling 50 of my clients– they stayed with me during my sabbatical– who are all small businessmen. I didn’t really have institutional clients. I had all these little businessmen. And every one of them said their business was terrible.

So I’m thinking, this is interesting. And the two-year is yielding 604, not that I would remember, and Fed funds were 6 and 1/2. So I start buying very large positions in two and five-year US treasuries. Then, I explained my thesis to Ed Hyman, and I thought that was the end of it. And three days later, he’s run regression analysis– with the dollar interest rates and oil, what happens to S&P earnings? And it spit out, a year later, S&P earnings should be down 25%, and the street had them up 18.

So I keep buying these treasuries, and Greenspan keeps giving these hawkish speeches, and they have a bias to tighten. And I’m almost getting angry. And every time, he gives a speech, I keep buying more and more and more. And that turned out to be one of the best bets I ever made. And again, there was no price movement, I just had such a fundamental belief. So sometimes it’s price, sometimes it’s just such a belief in the fundamentals.

But for me, I’ve never trusted myself to go put 30% or 40% of my fund in an equity. I mean, I did it when I was managing $800,000, which is what I started with, but not in an illiquid position.

KS: One of the great things I understand you do is when you’ve had a down year, normally a fund manager would want to get aggressive to win it back. And what you’ve told me you do, you

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

take a lot of little bets that won’t hurt you until you get back to breakeven. It makes a tremendous amount of sense. Maybe you could just explore that a little bit with me.

SD: Yeah, one of the lucky things was the way my industry prices is you price– at the end of the year, you take a percentage of whatever profit you made for that year. So at the end of the year, psychologically and financially, you reset to zero. Last year’s profits are yesterday’s news.

So I would always be a crazy person when I was down end of the year, but I know, because I like to gamble, that in Las Vegas, 90% of the people that go there lose. And the odds are only 33 to 32 against you in most of the big games, so how can 90% lose? It’s because they want to go home and brag that they won money. So when they’re winning and they’re hot, they’re very, very cautious. And when they’re cold and losing money, they’re betting big because they want to go home and tell their wife or their friends they made money, which is completely irrational.

And this is important, because I don’t think anyone has ever said it before. One of my most important jobs as a money manager was to understand whether I was hot or cold. Life goes in streaks. And like a hitter in baseball, sometimes a money manager is seeing the ball, and sometimes they’re not.

And if you’re managing money, you must know whether you’re cold or hot. And in my opinion, when you’re cold, you should be trying for bunts. You shouldn’t be swinging for the fences. You’ve got to get back into a rhythm.

So that’s pretty much how I operated. If I was down, I had not earned the right to play big. And the little bets you’re talking about were simply on to tell me, had I re-established the rhythm and was I starting to make hits again? The example I gave you of the Treasury bet in 2000 is a total violation of that, which shows you how much conviction I had. So this dominates my thinking, but if a once-in-a-lifetime opportunity comes along, you can’t sit there and go, oh well, I have not earned the right.

Now, I will also say that was after a four-month break. My mind was fresh. My mind was clean. And I will go to my grave believing if I hadn’t taken that sabbatical, I would have never seen that in September, and I would have never made that bet. It’s because I had been freed up and I didn’t need to be hitting singles because I came back, and it was clear, and I was fresh, and so it was like the beginning of the season. So I wasn’t hitting bad yet. I had flushed that all out. But it is really, really important if you’re a money manager to know when you’re seeing the ball. It’s a huge function of success or failure. Huge.

KS: So when you made that trade you just described, there was a huge amount of conviction and historical proof that this had always worked. So today, as we look at the US equity market, that’s gone up for almost 10 straight years, and our performance has been dramatic, what would you need to see to give you the conviction to want to go short?

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

SD: Well, unfortunately, I have gone short several times this year. And at least I’m alive, but I regret having to do so. I looked at the seasonals in July-August. And I looked at the background of the– I had no precedent for a balance sheet rate of change going down a trillion dollars from where it had been, but that gave me the conviction to go short, on top of the fact that, seasonally, I had a trustee period that also sort of rhymed with right when the slope of the curve of the QE was shrinking.

It didn’t work. I got a bloody nose. I’m now recontemplating my future. But everything for me has never been about earnings. It’s never been about politics. It’s always about liquidity.

KS: Liquidity, right.

SD: And my assumption is one of these hikes– I don’t know which one– is going to trigger this thing. And I am on triple red alert because we’re not only in the time frame, we’re in the part, and maybe markets don’t anticipate the way they used to. I thought markets would anticipate. There’s no more euro ECB money spilling over into the US equity market at the end of the year, so this is a good time to take a shot. Clearly, it wasn’t.

If we get a blow off in the fourth quarter, which seasonally tends to happen, particularly in NASDAQ-type markets, particularly if these bombs keep going off in emerging markets, I could see myself taking a big shot somewhere around year end. But that’s a long way off, and I’ll cross that bridge when I come to it. Right now, I’m just licking my wounds from the last shot I took.

KS: Well, we have JGBs, which has been the most amazing vehicle. I remember back in the late ’90s, everybody’s favorite short was JGBs. And I think I finally jumped on the bandwagon at one point. But the thought was that the JGB was the outlier, but the JGB was really the leader.

SD: Absolutely.

KS: That was what we all missed, but then I figured that out. So we got to minus 30, I think, on a 10-year on the JGB, which I thought had to be a short. But it would have been– if it was a year or two ago, it would have been dead money.

Now, it looks like yields are breaking out of the JGB. I don’t know if you agree with that. It looks like something is going on. Kuroda’s accepting, perhaps, that it’s not working, and they need to change. And them having been the most egregious of all the central banks, is that a really important change?

SD: For the world, it’s part of the puzzle I’m talking about. In and of itself, I don’t know. But since it looks like it could be happening by the end of the year, if not sooner, and it looks like, at the same time, the ECB will stop buying bonds; it looks like, at the same time, we’ll be shrinking our balance sheet $50 billion a month; it’s an important– all these pieces fit together for reckoning.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

I’m not in the business of making a fortune if something goes from 10 basis points to 20 basis points. That’s not something I’m going to make a big bet on. I might have a short on to amuse myself for something like that.

But I do think it’s very important in terms of this overall narrative. It’s also instructive why they’re doing it, because it looks like, to my view, they’re not doing it for economic reasons. They finally understand that it’s killing their banks, which is the blood and the oxygen you need to run the economic body. And that’s causing a political problem.

I sure hope we don’t need 25 years of that kind of evidence before we normalize, but, Kiril, I think it’s very important but only as a piece in an overall puzzle. They’re all going the same direction, which is why I made the bet short in July and why it was wrong, at least on a trading basis. But psychologically, I’m still there. It’s going to be the shrinkage of liquidity that triggers this thing. And frankly, it’s already triggered it in emerging markets. And that’s kind of where it always starts.

Where I haven’t seen it yet, and where I think should happen for the equity– and God knows, talk about a crazy price market is the credit market. And it’s amazing that, probably since the 1880s, 1890s, this is the most disruptive economic period in history. There’s hardly any bankruptcies. So whatever that Buffett line about swimming naked with the tide, there’s probably so many zombies swimming out there and there’s going to be some level of liquidity that triggers it. Who knows? It might start with Tesla. I don’t know.

Could this Tesla thing have happened in any other environment in history? I don’t think so. It’s just ridiculous what’s going on there in the last few weeks. But I don’t look at it so much as Tesla. It just describes the environment to me. It’s nuts.

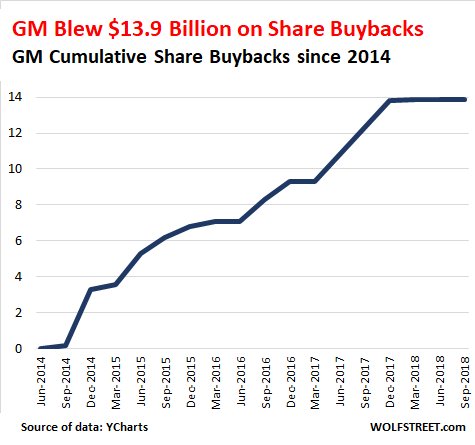

KS: Right. And all the malinvestment and the trillions of dollars that were spent without a cash return. And you just can’t imagine how many zombies there really are out there. And the corporation is buying back the stock to the tune of $5 trillion, running down their balance sheets. And then you go to the high yield market, where it’s covenant light, and huge amount of issuance. What happens when interest rates start to reflect credit risk?

SD: You know, intuitively, you can make a case that we’re going to have a financial crisis bigger than the last one, because all they did was triple down on what, in my opinion, caused it. Bernanke and I have a big disagreement over what caused that crisis. But to me, the seeds of it were born in ’03 when we had 9% nominal growth in the fourth quarter and we had 1% rates, which wasn’t even enough. He had that stupid considerable period thing attached to it.

And you had serious, serious malinvestment for three or four years. Subprime was pretty easy to identify if you had the right people showing you, which I was lucky enough to have had them come in. I don’t know who the boogeyman is this time. I do know that there are zombies out there. Are they going to infect the banking system the way they did last time? I don’t know.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

What I do know is we seem to learn something from every crisis, and this one we didn’t learn anything. And in my opinion, we tripled down on what caused the crisis. And we tripled down on it globally.

KS: Tried to solve the problem of debt with more debt.

SD: Exactly.

KS: Which is what we did in the ’20s, and that didn’t work out.

SD: With Wall Street just cheering them on, cheering them on.

KS: Well, we’ve got this huge entitlement issue, which you’ve written a lot about– 100 trillion unfunded liabilities, Medicare, Medicaid, Social Security, five times US GDP, just as bad in the rest of the world; worst demographics in 500 years; dependency ratios are rising. You’re going to have a battle between creditors and debtors at some point. Up to now, the creditors have been winning, but they’re starting to lose a couple. And when that plays out, we’re going to have some really tough times, which brings me to this whole idea of populism. And I want to kind of bring them all together.

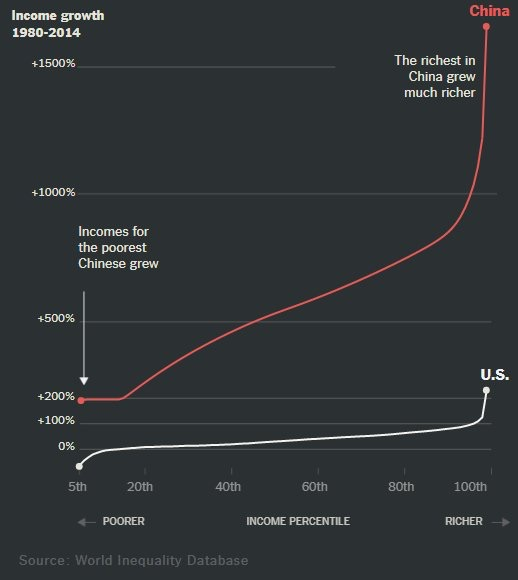

So I started following populism back in 2011. That’s when I felt it was coming. Then we had Brazil. I came back from Beijing in October 2012. It was clear to me that the new leadership– we didn’t know about Xi, if he’d be appointed, but we knew what they were planning to do, which was to clamp down on the corruption to save the Communist Party. And the word that we used to describe it is give a little bit now, rather than a lot later, having studied French and Russian revolutions. Unfortunately, in America, that didn’t happen. So it’s just gotten more wealth disparity.

So populism, some people think, is represented by Trump. And other people have different theories. My feeling is populism is really about wealth divide and unequal sharing in the economy. So for 30 years, the worker didn’t get a real wage increase. Now, he’s starting to get some of it, but it’s being taken away through higher cost of living.

So when you look at this whole debt situation, we also have to look at it in the context of populist sentiment and creditor versus debtor. And I may be ahead of myself here, but how do you see all of that working out?

SD: First of all, I think you nailed the cause of it because the previous populist periods we have required much worse aggregate economic statistics to set them off. But when I was running Soros, at year end for the first few years, we had a fixed system as a percentage of the profits. And the rage where the high performers felt about the low performers, even though they were all ridiculously overpaid, taught me that envy is one of the strongest human emotions.

KS: Yes, yes.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

SD: And when you look at the wealth disparity today, which by the way, in my opinion, the biggest success accelerant of has been QE, it’s not even like debatable.

KS: Absolutely.

SD: And then you have the internet broadcasting this disparity through millions of bits of information on an ongoing basis. I personally think Jeff Bezos deserves every penny he has. I think it’s one of the great companies ever. But there have been 20 articles in the last 48 hours, I promise you, on that he’s worth more than $150 billion. I mean, how does a normal citizen look at that and even contemplate it? KS: Exactly.

SD: So I think that is the seed of it. It’s not some economic malaise. It’s the disparity. The disparity has never been worse.

And probably one of the most disturbing books I’ve ever read was Charles Murray’s Coming Apart. And I read that, and I said, oh, my god, this is going to get worse, and it can’t stop. It’s just built into the system. The irony being, what really set it off is when these universities became meritocracies instead of an old boy network, and then you started to have inbreeding between the men and the women going to Harvard, and they all live in the same zip codes. And I’m looking at this and going, oh, my god, this is my family. And it comes home.

So I don’t see what stops this until you end up with some major, major dislocations politically and economically because of it. The Trump comment is interesting because had Bernie Sanders won the nomination, every poll that spring had Hillary running about even with Trump, just no one believed it. They all had Bernie Sanders 18 points ahead of Trump. And Bernie Sanders was not losing Michigan and Pennsylvania and all those states. And Bernie Sanders was also a populist. So I agree with you, it’s not about Trump. Trump is clearly a populist. Don’t get me wrong. But it’s too global, and it’s happening everywhere.

And Macron was probably a short-term response to Trump, but other than Macron, there’s just been surprise after surprise after surprise to the elites on these elections. And you wonder why they’re surprised anymore.

KS: Well, my theory on Bernie Sanders is that he was– they used sort of internal politics to deny him the nomination that he should have won. And had he won the nomination, he would have beaten Trump, so we would have had that shift already.

This leads me to what’s going on now, and that is America’s shift towards nationalism, at least under Trump. The rest of the world is focusing on maintaining multilateral alignments. Japan has just signed the biggest free trade deal with the EU. Mexico has– TPP is powering ahead. We have

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

the China’s One Belt. There’s a lot of controversy about it, but I think it’s a tremendous vision. I think it’s real, and I understand why they’re doing it. Which is destined to win in the end?

SD: The answer is, I don’t know. Probably the most destructive thing Trump has done in the global trading system is and once he figured out how powerful a weapon the US banking system was, and how powerful sanctions are– but he doesn’t understand that that weapon was created and is so powerful because, from the Marshall Plan on, we have been the only country that all the others, no matter how they might badmouth us or that trusted to do the right thing were, we’re the only nation in history that handled success the way we did.

And yes, you should use this weapon once in a while. But when you start just shooting it all over the place, and you’re now shooting it at Canada, at Europe, here or there, that’s a lot different than shooting at Iran or Russia.

KS: Exactly.

SD: And he’s like a little kid that found this water gun, and he’s just running around going all over the place with it. And the biggest danger I see is we lose that trust that America is good, and in the end they’re going to do the right thing. I don’t think it can be lost in four years. I really don’t. But if Trump is re-elected, or maybe even worse, if another populist on the very hard left is reelected, and they use the weapon the same way, I think by ’24, which, by the way, is exactly when the entitlement thing will start to get crazy, this thing could be very bad.

I’m quite open minded. Let’s see who the Democrats put up. Let’s see if Trump’s in office. But I don’t think the world will give up on us in four years. I think– I’m open minded to Trump having been a one-off and the trade system can survive this.

But it’s not like that’s an 80% probability. It’s probably somewhere between 40 and 55 that it works out. It’s sad.

KS: For sure. The whole supply chain issue is phenomenally interesting and complicated. And I’m concerned that the administration doesn’t understand the complexities of it, and by trying to pull out all the sensitive components from China and relocate them to the US or to Vietnam or wherever else is so immensely disruptive and dangerous. And then you start a process.

So during the worst part of the first meetings between the Chinese and the Americans, I was in Beijing. I was also in South Korea, and I met with Samsung. And already, China was moving very aggressively to create its own semiconductor industry. It was investing $150 billion, which of course has ramped up 10 times faster.

And I asked Samsung, what are you going to do? If the Americans forbade you to sell semiconductors, would you continue to do so? And I was told that they would, but they would also help China build its own industry, even though it was going to cannibalize them.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

So I see these trends that are taking place that won’t be reversed. And Europe, which would normally be an ally of America to try to hold back China’s advances, is now being forced more towards China. And these aren’t things that are going to shift back, because once you start to take these positions, you’re not going to reverse yourself.

SD: I agree with you on the semiconductors. And again, it emphasizes what you talked about earlier, which is sort of now policies. Even if they worked– and I can make an argument that it won’t even work because if you disrupt supply chains, everything is going to blow up– but now you’ve absolutely put in force the creation of a Chinese semiconductor industry that didn’t need to happen in the time frame that’s going to happen. I think there’s been enough frustration with the Chinese that the Europeans could look at this as a one off and be right back with our allies, as our allies again.

But no, you’re right. There are a lot of other things that are said in force that we’re not going back to. And I think you can make a good argument that some of the aspects of the China situation are a fight worth fighting. You can also make an argument they’re not. But they’re not a fight worth fighting without Europe and Canada and all of these allies we would have had. If you want to take on China– and again, fair people can debate on whether that should be done. If you want to take on China, you can do it with a united front. You don’t do it by alienating all your partners as the process gets underway.

KS: Especially when the US is a net debtor to the tune of $8 trillion, is running fiscal deficits that are close to what they were in 2009. I think we—

SD: At full employment.

KS: At full employment.

SD: I mean, I– if we’re in a recession, that thing could go to $2 trillion in a heartbeat. That’s when deficits explode. Sorry to interrupt.

KS: If we have a recession, yeah. I think we’re rolling over, if I remember correctly, something like $10 trillion of nominal new each year. We sold $130 billion in July, which is a record since 2008 or ’09. And so the holders of our debt are the very people that we’re having a trade war against. It seems a little ironic to me.

SD: It is what it is.

KS: So let’s move over to your philanthropy and your passions there, and what you’re most interested in, and what’s happening that’s exciting in your neuroscience and the stem cell work. SD: In general, Fiona and I didn’t want to give to the arts. We don’t have anything against the arts. We think they’re wonderful, but they seem to be extremely well supported relative to the

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

utility society gets out of them. So our big areas– and I’ll get to your question specifically– were atrisk youth, education, the environment, and health.

And the neuroscience and the stem cell are both Fiona’s original idea, not mine. We both think that the brain is sort of the last frontier in terms of rapid advances with the body. And it’s been extremely frustrating so far with autism and Alzheimer’s and Parkinson’s. And we’re both convinced– me by Fiona, Fiona by a lot of research– that this problem, with the right funding, can be solved over the next, say, 20 years, and great advances are going to be made, not dissimilar with what started going on with cancer, seven or 10 years ago.

So that’s pretty much the thought on neuroscience and stem cells. Non-anonymously, we’ve funded the neuroscience center at, obviously, NYU and a lot of the basic research. And we’ve also funded anonymously some of the more applied research at other institutions. But we find them both very exciting.

NYU seemed like the perfect place because they have a great aggressive leader in Bob Grossman. That’s sort of a necessary requirement of anything we invest in. I mean, I don’t think it’s an accident that that place has gone from like 40th to third in medical school rankings since Langone got involved and Bob Grossman. It’s just ridiculous. I mean, the only people ahead of them now are Harvard and Johns Hopkins. And I think they were considered average as late as 15 years ago.

And then, of course, stem cells are another great hope in all these areas. And I know Fiona was very enthralled with Susan Solomon and what they were creating, and the bang for their buck. So in both cases, we went for an area that we thought showed great potential in terms of progress, and we picked institutions which we thought, with very strong innovative leaders, who could execute on that proposition. Frankly, if some other institution solves the problem, I’ll be thrilled. I don’t really care.

I’m sure you saw what NYU did with the medical school. I would also be– while it wouldn’t be the greatest outcome for NYU, I think even the people who run NYU, our dream would be that starts an arms race, because the brain drain going out of medicine into less productive things, like my business and the tech world, social media, and things, has been horrendous, because by the time these kids go through four years of pre-med, medical school, residency, and then fellowships, they usually don’t start earning money until their mid-30s, and they’ve got $500,000 in debt. And you can be making $2 or $3 million a year in my business with a lot less preparation at the age of 27 or 28. So I really hope Harvard, with their $40 billion endowment or whatever it is, and the others, decide that they can’t let NYU just grab all the great medical students.

KS: So in terms of defeating Alzheimer’s and dementia, have you gotten far enough along to know what the formula is to figure that in?

SD: I have not. There’s all sorts of theories out there– that some of the drugs right now that attack amyloid– I mean, I know how Biogen’s had a resurgence. And this company we actually own in

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

Switzerland caught on. Those drugs will be a bridge. The ultimate solution, I think, would have to be something different. And Fiona knows a lot more on the subject than me. And she’s pretty optimistic that they’re going to solve this thing in 20 years.

KS: More and more of our friends are showing up with dementia, even at young ages. And you watch how debilitating it is, and it’s incredibly depressing. SD: We’ve seen it. It didn’t happen before we started the neuroscience center, but we’ve seen it up close and personal. And it’s tragic, just tragic.

KS: Very, very, very painful.

SD: We’re really hoping– and even though you’re seeing it in younger ages, we’re all living longer. So it’s manifesting itself more and more just simply because humans are living to ages they didn’t use to. And every part of the body has seemed to have kept up with the progress except the brain. And we’re not going to doing brain transplants, so we’ve got to fix this directly.

KS: How would you like to be remembered? What’s the most important thing– when you look back in your life, this is how I want people to remember me.

SD: I don’t know how important that is to me, but since you asked the question, I just– I’ve been so blessed to be in an industry with just crazy financial remuneration relative to society’s benefits. And obviously, I was given a gift. I was a good student, but there were certainly smarter kids than me. I just have a gift of compounding money. I’d like to think that I made a difference with that.

And I guess if people are remembering things, I’d like to be remembered as not some loud, ostentatious, overly consumptive person in the meantime. But I thank god I married Fiona, because she wasn’t from a lot of money, but she had old money, and she taught me to behave in a way I probably wouldn’t have from the get go when I see some of my peers. And I’d like to avoid that stamp, if possible.

KS: For sure. For sure.

SD: And now we have a president who seems to have exceeded that culture. So I guess that would be it, just that I made a difference and lived at least a life with some humility.

KS: Well, you certainly have. And I think you’re going to help a lot of people with your insights today. Thank you very much for joining us here—

SD: Thank you, Kiril.

KS: –and giving us your time.

SD: Fun.

September 28th, 2018 – www.realvision.com

Kiril Sokoloff Interviews: Stanley Druckenmiller

KS: It was really a lot of fun.

SD: OK.

KS: OK. Thank you. Raoul Pal: Stan Druckenmiller is the most requested guest in the history of Real Vision. Myself included, we all wanted to see and learn how he does things because his track record is extraordinary. And the brilliance of the man is something that doesn’t come across enough in television because there’s never an in-depth interview. You just don’t know that much about him. But I’m so pleased that Kiril managed to flesh out what makes Stan, Stan, what makes him think and how he does things. There was so much learning for all of us in this, and it’s truly an honor for us to have had Kiril conduct an interview. And I really hope you enjoyed it as much as I did. And I cannot wait to see also who Kiril brings next to Real Vision. It’s going to be somebody legendary