Making sense out of Chaos

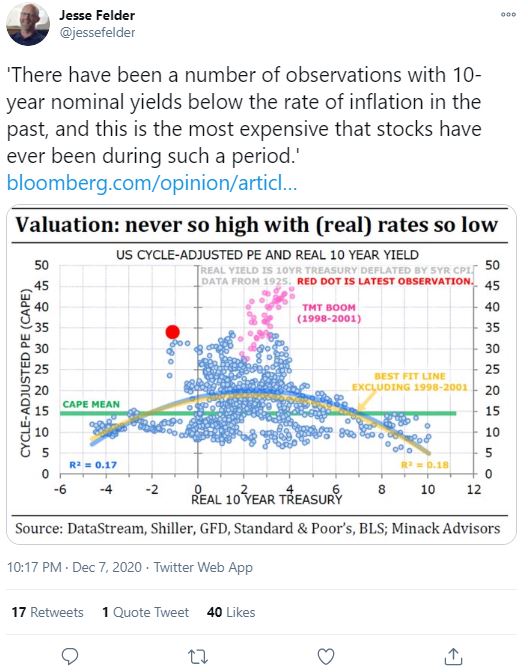

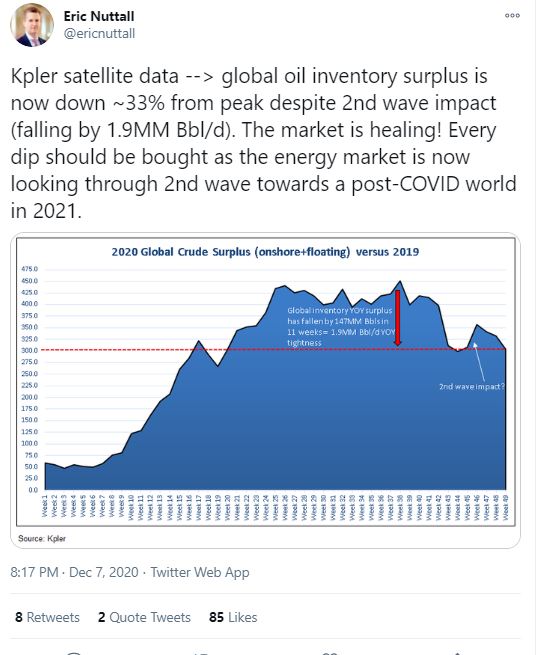

Luke Gromen of FFTT fame gives us a glimpse of some important charts that we need to understand and take into account as we head into 2021

First two charts

Next 2 charts

last 2 charts

December 04, 2020

By Bryce Coward, CFA via Knowledgeleaderscapital.com

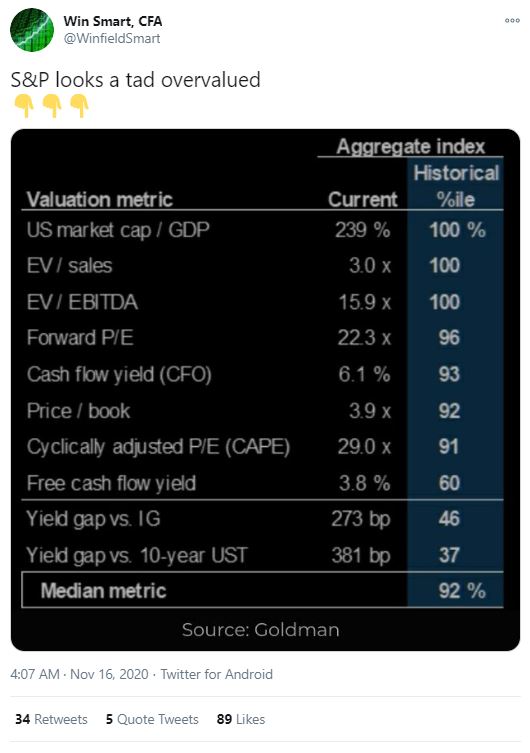

Inflation expectations as priced by the Treasury market are hitting 18 month highs just now. As the reader can see, inflation expectations across all treasury maturities are at cycle highs. This is happening coincident with growing expectations for the $908bn bipartisan stimulus deal and widespread expectations that the Fed will ease in some additional way at their next meeting 12 days from now. That these two events are anticipated by the market does pose some near-term downside risk for inflation expectations, since there is now room for disappointment. Even still, keeping the long game in mind is useful. Indeed, there exist multiple structural catalysts for inflationary pressure that haven’t existed in quite some time:

Within the equity market, there are clear implications to a structural change in inflation expectations. The clearest one may be the outperformance of cyclical vs defensive stocks. In the next chart below I compare the materials sector vs the consumer staples sector (red line) and overlay 10Y inflation expectations (blue line). The bottom panel displays the correlation between the two series in green. If breakevens continue to march higher, it’s clear one wants a more cyclical tilt towards their portfolio.

On the other hand, cyclicality does not equal value. This is apparent in the chart below in which I plot the relative performance of Pure Value vs Pure Growth stocks overlaid on inflation expectations. The correlation here is much, much less than the preceding chart. As I have argued multiple times in this blog, value as a style is highly dependent on the yield curve steepening. Because the Fed has telegraphed an inclination to push against back against higher long rates (yield curve control, forward guidance, etc.), a material and sustained steepening of the yield curve (i.e. one that lasts through the first half of 2021) doesn’t seem like a particularly high probability bet. At least, the bet on cyclical vs defensive is a higher probability and one that will grow if the inflationary catalysts above play out.

The events of 2020 have led to an uplift in a range of different searches people have been asking on Google, from how to bake soda bread to a variety of indoor workouts. However, there’s also been an increase in searches of an altogether more life-altering scale, as more and more people have considered their options for moving abroad. For example, there has been a 29% increase in global Google searches for ‘how to move abroad’ from January 2020 to October 2020 alone.

But where are the most popular destinations for people looking to live overseas? Are people looking for warm weather and sandy beaches, or is a solid health system, good economy and welcoming attitude more important?

Keen to find out more here at Remitly, we took a look at global search data to discover the most popular destinations for inhabitants of 101 countries around the world.* By analysing the average monthly search volume for phrases commonly associated with researching a move overseas and ranking them with the most searched-for location within each country, we were able to see which destinations came out top.

And this is what we learned…

Which are the most popular countries for moving abroad?

The most popular destination for people looking to move overseas was Canada, which topped the wish-lists of 29 other countries.

| The Top 10 Countries for Moving Abroad | Number of countries that want to move here the most |

|---|---|

| 1. Canada | 30 |

| 2. Japan | 13 |

| 3. Spain | 12 |

| 4. Germany | 8 |

| 5. Qatar | 6 |

| 6. Australia | 5 |

| 7. Switzerland | 4 |

| 8. Portugal | 3 |

| 9. USA | 2 |

| 10. United Kingdom | 2 |

Featuring prominently in the Global Peace Index as one of the safest places to live, and boasting low unemployment rates alongside a high amount of immigration options, it’s arguably no surprise that Canada is head and shoulders above the rest of the world. Add to that its friendly locals and beautiful scenery and it’s little surprise that the country is so appealing.

However, Canadians themselves were found to be angling for a move to second placed Japan, yet another country known for its stunning scenery, safety and vast array of job opportunities. Other popular options included Spain and Germany within Europe and Qatar in Asia.

We’ve created a colour-coded map below to provide an at-a-glance view of which countries are most popular in different parts of the world.

https://www.remitly.com/gb/en/landing/where-the-world-wants-to-live

via themarket.ch

Larry McDonald, founder of the investment research service The Bear Traps Report, is betting on a global synchronized boom in the economy. He predicts rising inflation and a strong bull market in the commodity sector, particularly in energy stocks.

Investors look back on a number of turbulent years. With Brexit, the trade wars and, most recently, the global pandemic cyclical stocks had a hard time. On the opposite side, large tech names such as Apple, Microsoft and Amazon dominated the stock market.

«The last ten years were all about austerity and Tea Parties. Now, we’re going to have no trade war, no Brexit, no Covid and a far more global fiscal receptivity framework,» says Larry McDonald. «This is going to be a massive commodity boom. We’re at the beginning of a commodity super cycle,» adds the internationally renowned investment strategist.

As Mr. McDonald points out, signs of a revival of the global economy are already evident in the shipping industry, where freight rates for containers are skyrocketing. A similar trend is going to be emerging in the energy sector, where serious capacity shortages could boost fossil fuel prices as early as next summer.

In this in-depth interview with The Market/NZZ, the former senior distressed debt trader at Lehman Brothers reveals which investment strategies are most promising for the coming commodity upturn, which individual stocks he favors, and which leading indicators investors should pay particular attention to in the coming months.

Mr. McDonald, after a strong surge in the first half of November, stocks have lost momentum. What’s going to happen next?

Near term, we are going to have some problems: In the US, the contested election risk is still there, and it’s going to get ugly. Also, we’re not going to get enough fiscal stimulus for now, and that’s another big problem: Every day a new Covid-19 relief bill doesn’t come in, it increases the credit risk in the commercial real estate space where rising Covid cases are showing up.

How serious is this situation?

There is a huge problem in commercial real estate. Many big cities need to soften the blow from the pandemic. All these mayors and governors are taking measures to close down parts of the economy to try to slow the spread. But they’re not doing the math. Just last week, New York City announced that they’re going to lay off close to ten thousand people that work in the subway system, planning a 40% reduction across all subway lines. This whole de-organization is going to create massive defaults in commercial real estate.

How will this affect the financial markets?

There are some real weaknesses that are percolating. Take Vornado, a realty trust that’s heavily concentrated in New York City. Despite the large rally in high yield credit since March, Vornado’s CDS spread is just below its March peak. You see it also with some CMBS tranches where the predictive default rate is spiking in the fastest pace since the financial crisis.

How big is the risk that the stress in the commercial mortgage space spills over into other areas of the financial system?

There is going to be a spectacular default cycle over the next year, but it’s going to be highly concentrated in sectors that have exposure to these cities. Also, the Fed is taking measures to try to contain the risk. Unlike in 2007-08, today the banking system is strong, and they don’t want this risk to contaminate the banking system. So it should get a little bit ugly first, but the Fed will be able to contain it. In terms of the CMBS market, they already can buy tranches of Triple-A rated securities. So all they have to do is to buy sub-investment-grade CMBS tranches. And of course, they’re already making mistakes. For instance, they’re buying bonds backed by the New York subway system. They get like a 1.9% coupon, but those bonds should be yielding around 10% right now.

So what is your investment outlook for the coming year?

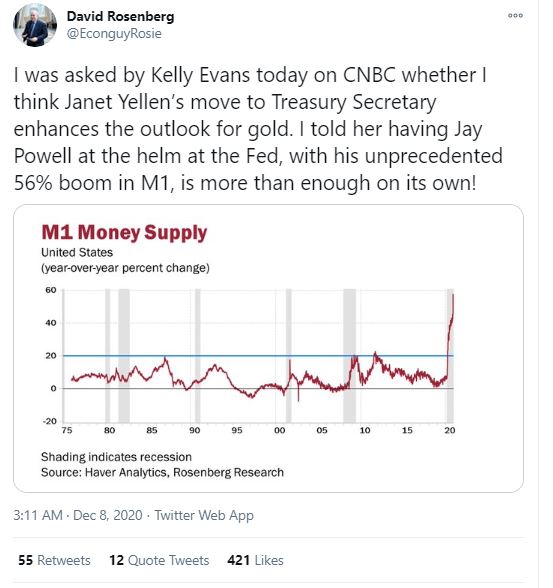

Over the past few years, we had Brexit, trade wars and now Covid. But most importantly, the Fed was extremely hawkish: In 2017-18, Congress did a trillion-dollar tax cut, and the Fed literally lit it on fire because they hiked interest rates five or six times in one year. Actually, when you add the shrinking of the Fed’s balance sheet, it was more like eight or nine hikes. So the Fed obliterated the tax cuts. Now, they have admitted that that was wrong. They won’t say that President Trump was right, but when you listen to all the Fed speeches, they’re basically saying: «We shouldn’t have done that.» Going forward, they are going to have a much more accommodative posture. They won’t hike rates until they see the whites of inflation’s eyes.

And what can be expected with regard to Washington? Are Republicans going to take a hard line on the budget once again, as they did during the Tea Party years of Barack Obama’s presidency?

President Obama was really unfortunate to deal with these people. At the start of his first term, he was running a $1.2 trillion deficit, and then they came up with the sequester. This was a forced mechanism that brought the deficit down to $500 billion over three years. Soon after that, the Fed started the taper, scaling back its monetary stimulus. So you had the sequester, the taper and thereafter you had Brexit and the trade war. You had all these growth inhibiting developments back to back, and they created a massive deflationary disaster. That is a bond buyers dream! When you buy bonds in a gridlock government situation, you do really well.

Will President-elect Joe Biden have to deal with a similar situation?

First of all, we have an active Covid-cycle. So Congress can’t go down that same fiscally conservative route now. In January and February, we’re going to have to spend at least $500 billion, maybe even a trillion. Also, it’s a different world. For Republicans, it’s very difficult to go from Trump’s expansive fiscal policy to austerity just because they don’t like Biden. In 2013, when Obama was coming into his second term, the political environment was totally different. At that time, it was a lot easier to sell yourself as a member of the Tea Party if you were a Republican. But make no mistake: This has nothing to do with Trump.

Why?

Trump was just lucky to be at the right place at the right time. This is a populist revolution in America, and it has a major impact on the financial markets because you’re seeing a big fiscal push. Against this backdrop, Trump just brought in tons of Democrats and independents into the Republican Party. Since 2016, the GOP has expanded by 12 million votes. And, he’s spending money. So it’s very difficult to go back to austerity from this kind of spending because you’re going to shrink the party. If Republicans want to take Congress seats in 2022, they are going to have to be more like Trump.

What does this mean for the stock market?

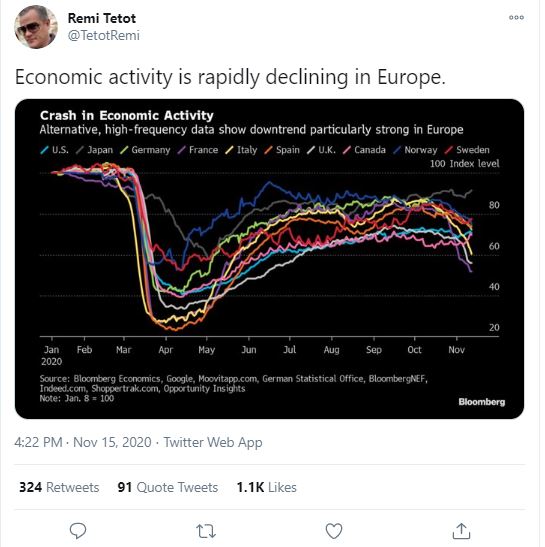

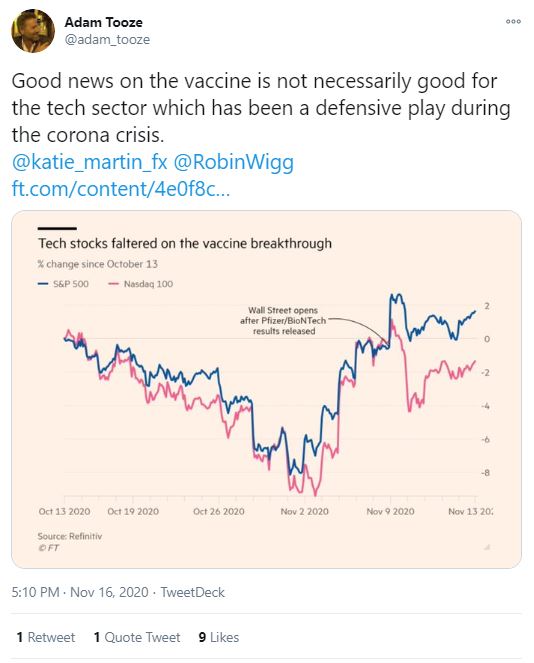

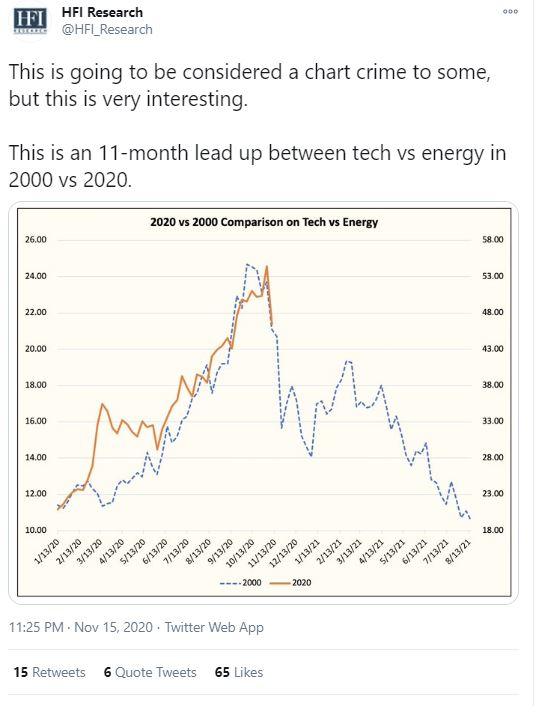

We’ve already pounded the table on this in March and April: The dollar should collapse, and we foresee a global synchronized economic boom once the pandemic is over. The multiplier effect of the stronger Yuan has an incredible impact on the global economy. We now have the vaccines, and a Biden administration that is globally friendly. As a result, we’re going to have a massive global synchronized growth trade. Just look at Microsoft’s stock price: It’s basically flat since June, whereas Caterpillar is up almost 40%. Tech stocks are in deep trouble, because everybody who was hiding in those FANG names, now wants to be in Caterpillar, Exxon Mobil, and all these industrials.

Cyclical sectors such as industrials and energy have seen impressive gains in recent weeks. How much upside potential is still in these stocks?

We have a risk of whether the vaccines are safe. So there is a little bit more testing that needs to be done, and maybe it’s going to be slowed down somewhat. But with these vaccines, which are 95% effective, a fair amount of testing and a weaker dollar, we will get a booming global economy that will feed demand for commodities and eventually result in true inflation. The good news about the vaccines are a home run for the inflation trade. Right now, we’re only at the end of the second inning, and our team just scored 15 runs in one inning. So yes, we already had one reflation/reopen trade in the middle of June. But look at where Exxon is trading today: In June, the stock was at $55, today it’s at $39. Same thing with Chevron.

What would be the consequences of a return of inflation?

Bonds are dead. The traditional 60/40 portfolio is going to be in a transformation to something like 50/30, and 20 into commodities. On planet earth, there are $110 trillion of bonds yielding less than 1.75%, and there is no protection. That means investors are going to be forced into commodities to protect their portfolio against inflation. The last ten years were all about austerity and Tea Parties. Now, we’re going to have no trade war, no Brexit, no Covid and a far more global fiscal receptivity framework. This is going to be a massive commodity boom. We’re at the beginning of a commodity super cycle.

What should investors pay attention to?

An important leading indicator in this cycle in comparison to the previous ones is that bonds in the energy sector have been dramatically outperforming the equities so far. This is a really big buy signal for energy equities which now are playing catch up. The energy sector went through hell in 2016 with the global slowdown, it went through hell in 2018 with the strong dollar, and it went through hell in 2020 with Covid. Now, what credit metrics in the energy space are telling you is a screaming buy. Many stocks will be up 100% over the next year.

What strategy do you recommend against this background?

We like commodities in general, also on the agricultural side where some of our favorites are Mosaic, a fertilizer manufacturer, and Teck Resources, Canada’s largest diversified resources company. You can also buy an ETF, for example the XOP. Another ETF is the FCG which is more on the natural gas side. We also like Royal Dutch Shell, Chevron and Exxon. Basically, any company that has exposure to oil.

What’s the specific bull case for energy stocks?

There was a lot of talk about a Green New Deal. We never got it, but every investor in the energy space had been listening to the Democratic party primaries debates about the Green New Deal for almost twelve months. So they are terrified when it comes to capital investment in the US commodity space. This Green New Deal is a wonderful thing, and I support it. But people forget to do the mathematics behind it. It wasn’t thought through. This is something that takes twenty years, but they want to do it over two years. As a result, the Green New Deal scared everybody in the energy space to death. Now, they start to realize that we’re just not getting rid of the energy sector and fossil fuels for quite some time.

What does this mean for the oil price?

We are going to have an energy crisis. With the US energy sector, it’s like turning around an aircraft carrier: If you talk to anybody in the Permian basin, where we have lots of contacts, they’ll tell you that with the amount of supply relative to demand, we are going to be three or four million barrels short a day by the summer. Look what’s happening with big shipping companies like Maersk. In some ways, shipping is like energy where they took so many big ships in a drydock because of Covid. When you have a snap back in demand, you can’t just switch the supply of these ships back on, so the price of shipping containers is exploding. The same thing goes for energy: If you have a snap back in demand, there isn’t enough production out of the US and the rest of the world. That’s why we are going to have a real crisis by probably August next year where the price shoots up to something like $100 per barrel.

And how do you see the prospects for metals?

In this market segment, we like commodity producing countries. Chile and Brazil are in a great position, and Mexico too. On the copper side, we like the XME ETF, and people who want to speculate can take a look at Freeport-McMoRan. But with commodities, it’s best to be in a wide basket. In the first part of this commodity cycle, which was from March to June, gold and silver outperformed, and energy was left behind. Then, we had a strong rally in copper, and the later part of the cycle is going to be oil, natural gas as well as agricultural goods.

The price of gold has weakened by around 10% since the record-high in August. Does that open up new opportunities for investors?

We’re long some gold, but gold is in a really nasty spot right now. It’s not a sweet spot, it’s a dark spot. Usually, gold does well in the early stage of a commodity cycle, which we just went through. Keep in mind: Gold likes negative real yields. Recently, nominal yields have gone up, but so far inflation expectations haven’t followed enough. Today, real yields on ten-year treasuries are at around minus 80 basis points. In August, that number was minus 110. That means you had 30 basis points of increase in real yields. So the market is starting to price in a global cyclical revival, but bonds don’t trust it yet. Here’s what will happen sometime next year: Yields will stop going up because the Fed will contain them, and inflation expectations will keep rising – and that’s when gold and silver are going to explode higher.

Where else do you spot opportunities?

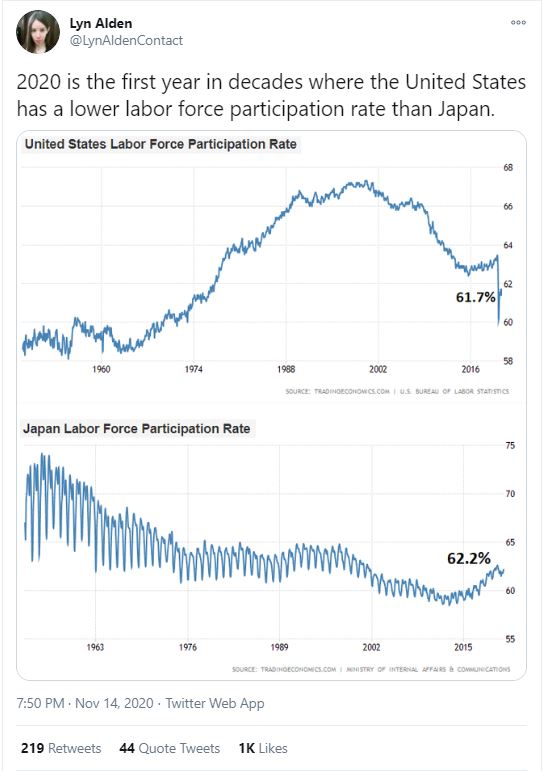

There is a colossal migration in the works. Both the GOP and the Democrats have been warming up to Japan in an attempt to move away from China which is a negative focal point in the US populist movement. Republicans and Democrats in the United States have sold out the hearth land of America. A whole group of people was disenfranchised. Five years ago, these people didn’t really know why they were suffering. They knew their taxes were going up, their cost of education was going up, and housing costs were going up because of the Fed. So the American Dream, the ability of the average American to succeed, had been impaired by globalization. As we look forward, that isn’t going away. It’s going to impact the US-China relationship, and it will force us right into Japan’s arms. Obviously, Warren Buffett sees something as well, as you can tell from his large investments in Japan.

Why exactly is Japan becoming more important for America?

Japan has a large manufacturing base; they have supply chains. In the past, we put way too many of our eggs into the China basket. There won’t be any new tariffs, but there are going to be some disincentives in terms of US-China trade relations. At the same time, there are going to be more incentives on reshoring, and on trade with countries like Japan. What’s more, Japan benefits from global synchronized growth. Reflation will help Japan dramatically. They have an aging population, so they can’t grow organically. They need the world to grow.

Are there any risks investors should pay special attention to in this regard?

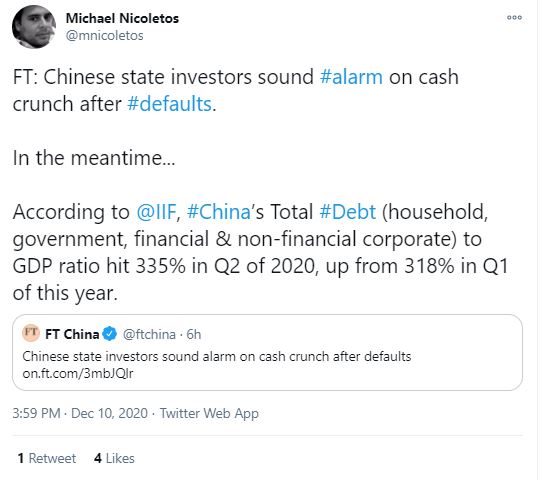

We’re seeing a spike in defaults in China. But so far, it’s contained in the onshore companies, and it hasn’t broken out. In some ways, it’s the same thing as with the credit risk in the US commercial real estate space: You have a spike in defaults that hasn’t broken out. A great leading indicator for China over the last ten years has been CDS spreads on Standard Chartered. For now, they’re tight, so credit risk isn’t leaking out of China yet. These are the two main risks, but other than that, all of our Lehman systemic risk indicators have come down. For example, one great leading indicator for global equities is that the yield on CCC-rated bonds tightens fast relative to BB-rated bonds. That’s a sign that good things are happening with cyclicals.

Lawrence McDonald is the founder and editor of The Bear Traps Report, an independent macro research platform focusing on global political and systemic risk with actionable trade ideas. As a former vice-president of distress debt and convertible securities trading at Lehman Brothers, he wrote a book on the fall of the investment bank, titled «A Colossal Failure of Common Sense». Published in 2009, the book hit the New York Times Best Seller’s list upon release and is now translated into 12 different languages. Prior to working at Lehman, he was the co-founder of Convertbond.com, a website that provided convertible securities information and was acquired by Morgan Stanley in 1999. From 2011 to 2016, he was Managing Director and Head of US Macro Strategy at Société Générale. Mr. McDonald grew up in the Cape Cod region. He attended The University of Massachusetts Dartmouth and received a degree in Economics in 1989.

Larry McDonald: «We’re at the Start of a Commodity Cycle» (themarket.ch)

via themarket.ch

We are dedicating this week’s “Big Picture” to a special topic: Bitcoin.Specifically, we want to investigate the question of whether the cryptocurrency deserves a place in a diversified portfolio.Bitcoin is stirring emotions in the financial markets. It has increased by around 132% since the beginning of the year, albeit with considerable fluctuations. On January 1st, a Bitcoin cost $ 7200, in the panic wave in March it sank (intraday) just below $ 4000, rose to over $ 10,000, shot up by 80% within six weeks from mid-October and is now correcting violent for two days:

But this should not be about the short-term fluctuations, nor about speculation about how long the current correction will last – but about the question of whether Bitcoin deserves a place in a diversified portfolio.The answer is likely to frustrate you. But read for yourself.We approach the question in five chapters:

display

Sponsored Content

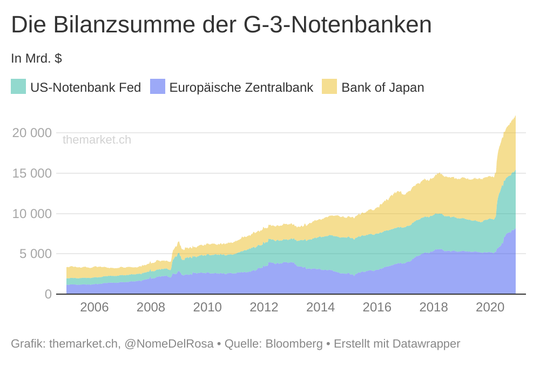

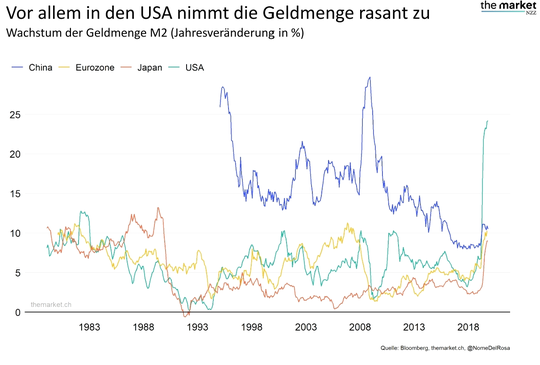

E-Sports & Gaming – the next professional sport? A market worth billions has emerged from the former niche market for gaming and e-sports. Learn more 1. The narrativeAt this point we refrain from spreading the history and the exact functionality of Bitcoin. For the purposes of this analysis, it is important that Bitcoin has existed for a little more than ten years and runs on a decentralized booking database – the blockchain. It is “money” (more on this later) that is neither controlled by a government nor a central bank.There are currently just over 18.5 million Bitcoins in circulation. The amount is limited to a maximum of 21 million bitcoins. Around 330,000 new Bitcoins are currently being added each year, with the number of existing Bitcoins rising in an asymptotic curve in the coming years until the last Bitcoin is “mined” in around 2140.Put simply, Bitcoin is a stateless currency whose money supply only grows according to strictly defined parameters and which has an upper limit. So it’s tight.That brings us to the narrative, which is why Bitcoin is coming into focus in 2020.According to calculations by Bank of America, states around the world have fiscal and monetary policy measures totaling 21 trillion to combat the economic consequences of the pandemic. $ decided. The three central banks alone, the Fed, the ECB and the Bank of Japan, have accumulated their total assets by more than 8 trillion since the beginning of 2020. $ expands.

The broad money supply, defined as M2, is increasing in all major currency areas, in the USA currently with an annual expansion rate of more than 24%:

The US budget deficit has risen to over 20% of gross domestic product, and the cumulative level of all debts worldwide should be 277 trillion at the end of the year. $ which is about 365% of world GDP.The list could be expanded at will, but the picture is clear: Debt is increasing, as is the amount of paper money. This feeds the fear of a devaluation of the paper currency.If the amount of money in monetary system A can be increased at will, while the amount of money in system B is fixed according to strict rules, it is obvious that the interest of investors and speculators in the currency of system B will increase.This explains the increased interest in Bitcoin and gold, the amount of which cannot be increased at will either.Another factor was added to the narrative for Bitcoin in 2020: Well-known “dinosaurs” from the hedge fund world, for example Paul Tudor Jones in May or Stanley Druckermiller in November , publicly said they had bought Bitcoin to protect against future inflation. Established financial institutions such as Fidelity and JPMorgan also expressed their confidence, and at the end of October the payment processor PayPal announced that its customers in the USA could now also trade Bitcoins.As Rino Borini puts it in this Fintool video , the cryptocurrency has “grown up”.2. Bitcoin an investment?We described Bitcoin above as “money” in quotation marks. Is Bitcoin money at all?Something is considered money if it fulfills the following three functions:

Bitcoin fulfills these functions, even if – given its high volatility – not too efficiently.Studies, for example here , have repeatedly shown that far more than 90% of all transactions with Bitcoin are not of a commercial nature, but are carried out by speculators. In the concrete application, Bitcoin is not used as money for economic exchange transactions, but as an investment for investment or speculation purposes.That leads to the next question: is Bitcoin an investment?(Inset: Bitcoin is only one of more than 7000 cryptocurrencies. With a market share of more than 60%, however, it is by far the most important, which is why we limit ourselves to Bitcoin.)In short: yes. There is a market for Bitcoin in which around 350,000 transactions currently take place every day. There are enough market participants who attach a value to Bitcoin, which enables observable pricing (although this does not mean that this pricing is rational).An aggravating factor in any form of analyzing the quality of Bitcoin as an investment is the fact that it has only been around for a little over a decade. The first bitcoins were created in January 2009, and a time series of fairly reliably observable prices has existed since around May 2010.This is far too short a time series to provide reliable information about the behavior of Bitcoin as an investment. For example, during those ten years in the United States there was:

The history of Bitcoin so far has taken place in a generally good-natured environment, in which pretty much every asset class has gained in value and there were only short phases of shock – for example in December 2018 or March 2020.This note is also important because ardent proponents of cryptocurrencies like to mention that Bitcoin is the “most successful asset class of the last ten years”.It would be more appropriate and correct to state that Bitcoin had a market capitalization of zero in January 2009 and that it has increased to just under $ 315 billion to date – i.e. all existing Bitcoins multiplied by the current value of $ 17,000 each.Bitcoin has therefore grown from a startup to a small cap and now a large cap, as Tesla, for example, succeeded in doing over a similar period of time. No more and no less.Of course, this statement is not intended to diminish the revolutionary character of Bitcoin as an alternative to paper currency or its success in global distribution. Bitcoin has prevailed among thousands of cryptocurrencies and has increased its market share from 48% to 66% in the last three years, according to Statista . The network effect works. As it becomes more widespread, the likelihood that Bitcoin will no longer disappear also increases.In summary: Bitcoin is now an accepted investment, the market capitalization of which is in the range of an American blue chip share. Everything we know about pricing and the behavior of participants in the Bitcoin market is based on an observation period of just ten years, which was characterized by a structural bull market in most asset classes.That brings us to the next question.3. What is the fair value of Bitcoin?An asset – a share, bond, property – usually generates an annual cash flow that can be used to determine an “intrinsic” value for the investment. This value is subject to uncertainties in the estimate – what are the future cash flows? With what interest should they be discounted? -, but at least a guideline can be established.With established currencies issued by central banks, things get more complicated because their value fluctuates in the form of exchange rates in relation to other currencies. With tools such as interest or purchasing power parity, however, it is at least possible to determine approximately “fair” valuations of a currency.Bitcoin does not have such an anchor. Because Bitcoin is stateless, parity calculations are not an option, and because Bitcoin does not generate any income, no intrinsic value can be determined.This is also gold’s dilemma, but gold has a history of several thousand years as an accepted store of value.To put it in the extreme: A Bitcoin is only ever as much as the next buyer is willing to pay for it. This is one of the reasons why speculative excesses repeatedly occur in the Bitcoin price (more on this in Chapter 5).Speculating in an investment with no intrinsic value always contains an element of the “greater fool” theory: I buy the investment assuming that I can later sell it to a bigger idiot at a higher price.However, it would be wrong to say that Bitcoin is worthless. First, the observation applies that the value of all Bitcoins in circulation is currently around $ 315 billion. Second, like for gold, the marginal production costs can be used to define a kind of minimum value: It currently costs, depending on the estimate, $ 4,000 to $ 7,500 in hardware and energy to “mine” a new Bitcoin. If the market price falls below this, it is no longer worthwhile for the provider to mine more Bitcoins.Thirdly, a possible value can be approximated: As the investment strategist Lyn Alden calculates , the total value of all investments worldwide (stocks, bonds, real estate, etc.) is around 400 trillion. $. The total value of the around 200,000 tonnes of gold that has already been mined in the world is a little less than 10 trillion. $.Gold’s share of total world wealth is 2.5%, Bitcoin’s share ($ 315 billion) is less than 0.08%. The value of Bitcoin can therefore be viewed as a function of the question of what proportion of their wealth the world’s population would like to invest in Bitcoin. If no one wants to hold Bitcoin, the value is zero. If the Bitcoin share rises to a third of the gold allocation (i.e. 0.8%), then the value should rise to ten times its current level.Of course, all of this is of no use in answering the question of whether the current Bitcoin price of $ 17,000 is “fair”. No, it’s not him. Or: It’s just as fair as $ 7,000 or $ 70,000.This is important for the next question: What role can Bitcoin play in the portfolio? Sponsored Content

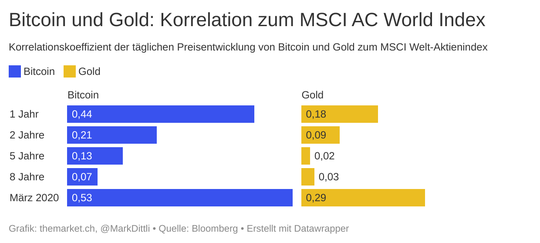

Three myths about responsible investing sports & gaming – the next professional sport? For most long-term investors, future capital growth is a top priority.Learn more 4. Bitcoin in the portfolioThe purpose of portfolio diversification is to combine different assets, the price development of which correlates differently with one another. In a portfolio with, say, 60% international stocks, it is therefore particularly interesting to add assets that do not correlate – or even negatively – with stocks.So how does the price development of Bitcoin relate to the price development of stocks?Here, of course, the problem arises again that the time series for Bitcoin with ten years is too short for a reasonable statistical statement.With this reservation, we carried out a correlation analysis of Bitcoin and gold to the MSCI All Country World Index based on Bloomberg data. The following graphic shows the result:

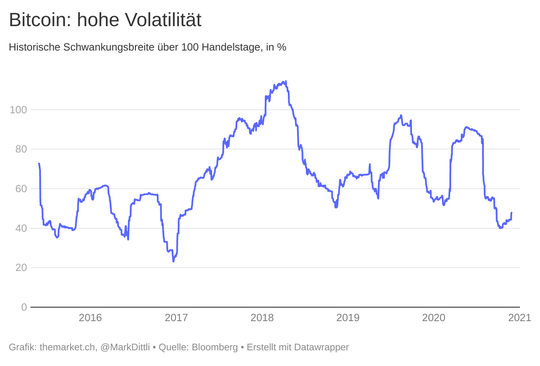

Bitcoin shows a weak positive correlation to the stock market over the period of two, five and eight years, comparable to gold. Viewed over the short period of one year, the correlation is significantly higher. In March 2020, when a wave of panic swept the markets and the exchanges crashed, the correlation between Bitcoin and the MSCI AC World skyrocketed.From this – very rudimentary – analysis it can be concluded that Bitcoin plays a similar role in the portfolio context as gold and only has a slightly positive correlation to stocks. However, Bitcoin clearly did not show anti-fragile qualities under stress conditions (March 2020).The volatility of Bitcoin is also significantly higher: the gold price fluctuated between 10 and 20% around its average over the past six years in a 100-day perspective.

The fluctuation range of Bitcoin in the same observation was meanwhile between 50 and 100%.

In a direct comparison to gold, Bitcoin cannot score points in the context of a portfolio. The diversification effect, measured in terms of the correlation to the stock market, is slightly worse, the stress resistance is lower and the volatility is about a factor of 5 higher.But that doesn’t mean that Bitcoin has no place in the portfolio. Sponsored Content

Sustainable

investing in credits This framework gives credit investors access to the best of both worlds. Our SDG credit strategies 5. The investment case –

or: the meaning of jewelry insuranceBitcoin is a scarce asset in a world in which the amount of paper money is expected to continue to grow strongly over the years. Bitcoin has also clearly come out on top among a variety of other cryptocurrencies and is gaining popularity. This leads to a network effect in which the market leader becomes stronger and stronger.Bitcoin cannot be controlled by governments or central banks, and Bitcoin allows its owner to easily move wealth across national borders. It is therefore no coincidence that the demand for Bitcoin has increased in recent months, especially in countries such as Turkey and Argentina, as Dylan Grice from the London-based asset manager Calderwood Capital wrote in a customer letter.Now an important additional factor comes into play: The amount of new Bitcoins that are created every year halves roughly every four years. The supply of new Bitcoins that come onto the market is therefore constantly decreasing, which is expressed in the asymptotic quantity curve mentioned at the beginning.In jargon, one speaks of “halving” in this context. In the first halving cycle, from 2009 to the end of November 2012, the miners received 50 bitcoins for each new block on the blockchain. In the second cycle, from November 2012 to July 2016, there were 25 bitcoins. In the third cycle, from July 2016 to May 2020, the “prospect’s wage” halved to 12.5, and since May 11, 2020, when the fourth cycle began, there are still 6.25 bitcoins.This will continue in the next few years with further halvings.It is now interesting how the Bitcoin price has moved in each case. Here you can see the course graphs for each of the four cycles:

It is noticeable that in each cycle the Bitcoin price experienced a spectacular speculative bubble within 12 to 18 months of being halved before settling down at a higher level.Each cycle ended at a price level that was around 15 (3rd cycle) to 150 (1st cycle) times higher than at the beginning of the cycle.Here, too, the following applies: four observation periods are far too few to extract reliable findings. But the pattern of the first three cycles repeats itself in the current fourth cycle, then the Bitcoin price is currently only at the beginning of a speculative bubble formation. And in 2024, when the next halving is due, the price – again based on the last three cycles – would have to be many times higher than today.And that brings us to the core question: Should a “normal investor” buy Bitcoin?We cannot emphasize it enough: Ten years of history do not allow any reliable statements about the price behavior of Bitcoin. We just don’t know enough. Short-term statements are useless anyway in view of the volatility.Maybe the Bitcoin price will crash again. But there is also the possibility that it will follow its previous pattern and rise significantly higher in the coming years – as a scarce commodity in an inflationary environment. We do not know it.Therefore comes the train to what we at this point already once as jewelry Insurance have called ( “idiot insurance”): you buy for a reasonable amount, for example 2% of the total portfolio, Bitcoin. This can also be done using tracker certificates – in Switzerland for example from Leonteq, Vontobel or Seba.Then you are there with a small investment and don’t have to feel like jewelry when the price goes up. But the stake has to be small enough that it doesn’t hurt if it is halved or quartered. And please: don’t let the volatility drive you crazy.

The world is awash in LIQUIDITY and till now there is no reason to reduce risk from portfolio.

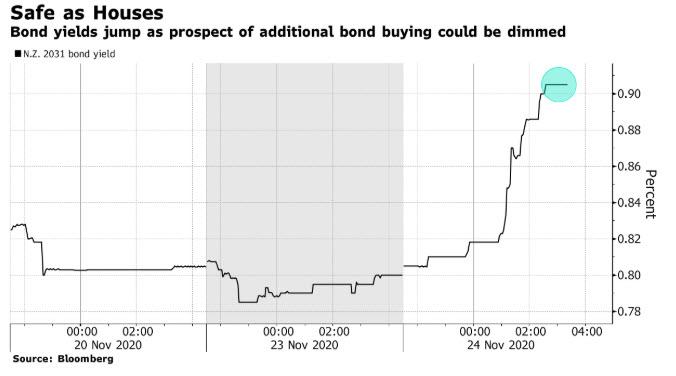

The article below published in Zerohedge is a good indication of what happens if policy makers starts getting cold feet on keeping system awash in LIQUIDITY

by Tyler Durden Tue, 11/24/2020

The New Zealand dollar soared overnight, reaching a two year high, bid up by shocked FX traders who learned that Finance Minister Grant Robertson sent a letter to the central bank expressing concerns over how low rates have stoked home prices.

In a stunning development, Robertson asked the Reserve Bank of New Zealand to add home prices to its monetary policy remit, a proposal which would crash any prospects for further rate cuts or additional bond-buying programs.

Remarkably, just two weeks ago traders had been pricing in over a 50% chance of a rate hike implying negative rates by the end of 2021; however then the central bank projected a more upbeat view of the economic recovery and added a lending program that led traders to price out the chance for negative rates. Following the Robertson letter, the odds of a rate cut tumbled to less than 25%.

“Today’s announcement just reinforces the notion that negative rates are less likely in New Zealand,” said Prashant Newnaha, senior rates strategist at TD Securities in Singapore. “The economy has held up remarkably well.”

In kneejerk response, the kiwi surged as much as 1.1%, briefly topping 70 U.S. cents, the highest level since June 2018. The currency has risen almost 6% this quarter, leading gains among the Group-of-10 peers against the dollar.

“We were already positive on the New Zealand dollar, largely reflecting a bearish U.S. dollar view, but more confirmation of the end of the easing cycle in New Zealand supports that prevailing view,” Jason Wong, strategist at Bank of New Zealand, told Bloomberg.

The dramatic reversal meant that while at the start of the month, the OIS market priced more than 40 bps of cuts by end of 2021, after the finance minister’s statement this tumbled to just 5bps. And as rates markets traded out the likelihood of rate cuts, New Zealand’s 10-year bond yields jumped over 10 basis points to 0.905%, more than double a low in September.

The turnaround in expectations has come swiftly, and surprised most traders. Consider that it was just one month ago, on Oct. 14, when Assistant Governor Christian Hawkesby said that the RBNZ wasn’t bluffing on the prospect of negative rates. The central bank’s ownership of the nation’s outstanding nominal sovereign bonds has also surged from 6% to just just under 40% in the seven months since it introduced an aggressive quantitative easing program.

The problem is that just like in the US, this has translated into runaway house inflation. Home prices, which were expected to drop in the pandemic, have jumped with a record low policy rate of 0.25%. Average prices gained an annual 8% in October, spurring Robertson to urge the RBNZ to consider how it may contribute to a stable housing market.

In short, at least one central bank is starting to realize that keeping rates lower for ever may not work in an economy where the housing market is already overheating. We wonder how far US home prices will rise before Powell (and Brainard after) decide that it’s time to do similar damage control in the US…

Over the weekend I gave interview to ventura securities.

The link is below